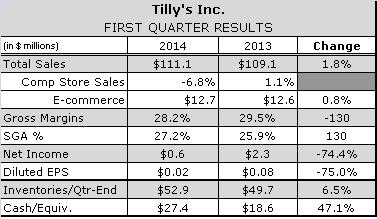

Action sports retailer Tilly’s Inc. said a lack of clearance inventory hurt traffic in the highly promotional teen market in the fiscal first quarter, causing comp store sales, including Internet sales, to fall 6.8 percent.

Action sports retailer Tilly’s Inc. said a lack of clearance inventory hurt traffic in the highly promotional teen market in the fiscal first quarter, causing comp store sales, including Internet sales, to fall 6.8 percent.

The comps decline reflected decreases in traffic and conversion as well as a tough comparison against the the first quarter of 2013 when the retailer had more clearance items in its inventory. Comps declined most in men’s, footwear and accessories and were nearly flat in juniors and kids. E-commerce sales, which grew just 1.2 percent during the quarter, were disproportionately affected by the lack of clearance items. The declines in traffic and sales were partially offset by increased average transaction value and higher product margins, resulting in gross margin of 29.1 percent, down 130 bps.

TLYS President and CEO Daniel Griesemer estimated fewer clearance sales accounted for about a third of the comps decline, but noted that tighter inventory management boosted merchandise margins 60 basis points. That helped offset the deleveraging of store occupancy costs and enabled the company to deliver on its 2 cents per share earnings target. The company ended the quarter with 4.5 percent less inventory per square foot of retail showroom in the expectation that volatile and weak traffic trends will continue to result in a highly promotional environment in teen retail.

“If these trends continue, we would expect second-quarter comparable store sales to decline in the high single digits, and net income per diluted share to be in the range of 3 to 7 cents,” said CFO Jennifer Ehrhardt. That compares with EPS of 15 cents in the second quarter of 2013.

Griesemer said TLYS will continue to navigate through a very challenging teen retail environment by offering exclusive, on-trend merchandise, managing inventory to preserve product margins and improving its digital marketing and store locations rather than matching competitors’ discounted prices.

“Those are the things we can control and those are the things we remain intensely focused on,” he said. “That's what sustains quality, long-term earnings and growth. I don't see another way to run it.”

In the fiscal first quarter, for instance, TLYS stores began selling vinyl records, introduced new brands such as Asphalt Yacht Club and brought in more exclusive products from Sector 9 skateboards. Griesemer attributed the relative strength of the juniors business during the quarter to TLYS deft use of its private label to respond quickly to trends in bottoms and fashion.

The retailer also emailed its first digital catalog to more than 1.4 million subscribers and boosted enrollment in its five-month-old Tilly’s Hookup loyalty program to 500,000. TLYS began operations at its new dedicated e-commerce fulfillment center in May. Going forward it will offer a broader assortment of Patrons of Peace and its own Full Tile activewear line for juniors, which have performed well.