Fenix Outdoor International AG (Group) Chairman of the Board Martin Nordin was frank and to the point in his letter to investors on Monday, July 22. He indicated right up front that the second quarter did not come in as expected and proved “very challenging.”

Fenix Outdoor is the corporate parent to the Fjällräven, Tierra, Hanwag, and Royal Robbins wholesale brands and the Frilufts retail brand.

“The retailer market still faced a situation with higher-than-normal inventory, as well as volatile trading because of weather,” he noted. There are also indications that several retailers face some liquidity/financial problems limiting their ability to serve the market.”

Still, Nordin noted that, on the positive side, the Group made “great strides forward” in reducing inventory and increasing liquidity at the end of the quarter.

“Given that situation and the general economy, there is still a definitive price pressure in the market,” Nording said. “We do not know yet, but we might also see a paradigm shift in consumer behavior during strained times, meaning a shift into less expensive products. However, there is also a possibility that the COVID behavior gave the industry such a large boost that it is still adjusting.”

From a sales and financial perspective, Nordin reported that the company’s U.S. and Globetrotter operations were most affected in the quarter.

Regarding the company’s Brands and Global Sales business in the rest of the world, Nordin saw improved direct orders, but smaller than he had hoped. He said last year’s numbers included some customers who, instead of ordering direct, wanted early delivery of fall orders that were due to early deliveries last year and were then able to be fulfilled.

“We need to keep in mind that the second quarter, historically, is our most sales-sensitive quarter of the year,” Nordin noted.

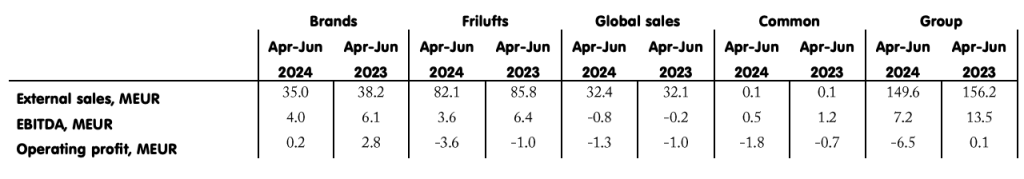

Net sales for the second declined 4.2 percent year-over-year to €149.6 million, compared to €156.2 million in the year-ago period. Nordin said the decline was primarily driven by the high inventory in the retail sector and lower reorders in Europe. He said the changes are relatively small regarding the split of consumer sales between digital and brick-and-mortar. “No conclusions can be drawn, but it seems that some kind of equilibrium between digital and brick-and-mortar sales might have occurred,” he offered.

Second Quarter Results by Segment (MEUR = Euro Million)

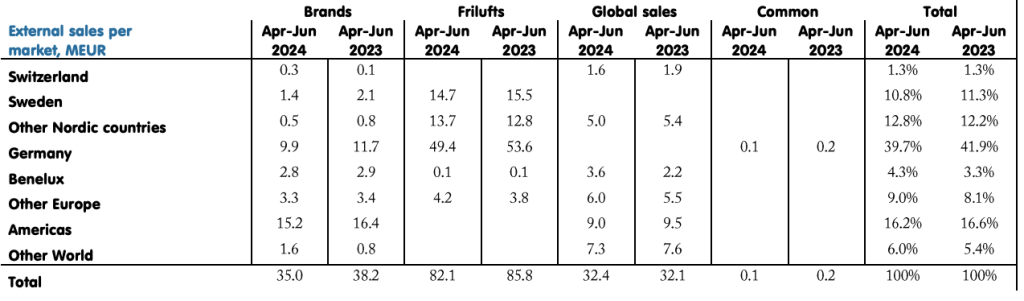

Second Quarter Regions by Segment (MEUR = Euro Million)

Segment Highlights

Brands

The Brands segment saw sales decrease 8.2 percent to €35.0 million. The company reported that the decrease was driven by a lack of reorders, predominantly in Europe. The company’s DTC business shows continued growth, but e-commerce sales decreased.

Nordin said the growth in DTC was driven by Fjällräven.

“Our direct-to-consumer business, a part of the Brands segment, grew 1.0 percent year-over-year, predominantly Fjällräven sales. Another interesting observation is that the sale of our internal brands, except Tierra, outperformed other brands within the period, Nordin added.

The North American business showed a slight decrease in DTC sales and wholesale, but it was also hit by lower Kånken sales, decreasing the marginal contribution.

Global Sales

Global Sales were reportedly stable overall, with net sales flat at €32.4 million in Q2 compared to €32.1 million in Q2 last year. The European part of Global Sales saw a 7 percent increase in sales. Asia was reportedly hit by slowdowns in South Korea and Taiwan, with both countries decreasing in local currency and euro terms, Nordin noted.

Frilufts

Sales in the Frilufts operation decreased 4.3 percent from €85.8 million in Q2 2023 to €82.1 million in the most recent quarter. This was reportedly driven by decreases predominantly in Germany and Sweden. The warm weather also created a very volatile situation, according to Nordin. In terms of results, this meant a substantial impact on profitability, he said. The Norwegian business continues to show reasonable improvement but has a way to go.

The Frilufts group, particularly Hanwag, grew 5 percent. Nordin said the company also saw it strengthening during the later weeks of the quarter.

Digital/Channel Development from a Group Perspective

The company’s brick-and-mortar sales decreased 3.1 percent to €74.1 million in the second quarter from €76.5 million in Q2 2023. Digital sales decreased 5.6 percent from €33.8 million to €32.0 million.

“As we also lost sales in wholesale, the proportion of its net sales was stable compared to last year. And knowing that most of our brands outperformed external brands in Frilufts, we believe there is a good chance that our brands are doing better than the market in general,” Nordin said

Balance Sheet and Cash Management

Inventory was reportedly down 18.5 percent, or 56.0 million, to 246.7 million at quarter-end, compared to 302.7 million last year. The company reported its net cash position was up from negative 41.7 million last year to positive 25.2 million at the end of the second quarter.

Third Quarter

In terms of expectations for Q3, Nordin said it looks “reasonable.”

“There is a solid order book in Brands and Global sales,” he shared. “However, given what we just experienced during Q2 as well as last year’s weather and the economy, I once again refrain from making any predictions.”

Moving Forward

“There are challenges,” Nordin admitted when attempting to provide a look ahead.

“We are back in another supply chain and transport problem, given new and slower routing, predominantly in Europe,” he said. “Given the Middle East unrest, we are facing a higher risk in our purchasing as well as higher costs. Internally, we have some minor delays in scaling up our operations in Ludwigslust. Due to that, we are also implementing a new ERP system. We still have to become more cost-aware in general. We are also implementing further savings and efficiency programs and have already seen improvements.”

Before closing his letter, Nordin also shared news on moves to improve the company’s production picture and provided the same movement on ESG goals.

“I am happy to share that we have already started a journey towards more production closer to our markets through our investment in the factories in Viomoda,” he shared. “This will help to further improve our CO2 profile and make us more flexible on one part of our production, decreasing transport-related emissions and improving our margin over time with less discounting in the end due to a more flexible production setup. We also see a great opportunity through this to improve our time to market as well as improve the hit rate of new products.”

Image courtesy Royal Robbins