The Footwear Distributors and Retailers of America (FDRA) has released the results of its Q1 2025 Shoe Executive Business Survey, which shows growing concerns among industry leaders over rising costs, weakening consumer demand and the ongoing impact of tariffs.

The survey, conducted among footwear executives, shows a significant decline in industry confidence, with 87 percent of respondents expecting a weaker U.S. economy over the next six months, marking the most pessimistic outlook in the survey’s history. Additionally, 85 percent of respondents forecast a weaker demand from consumers shopping for shoes, while 50 percent of respondents expect declining sales in the months ahead.

Tariffs Driving Costs Higher

FDRA noted that as uncertainty surrounding trade policy grows, footwear companies are reporting increasing financial strain:

- 97 percent of respondents expect their landed costs to rise in the next six months.

- 31 percent forecast cost increases of up to 10 percent, while 45 percent see a jump of 11 percent to 20 percent.

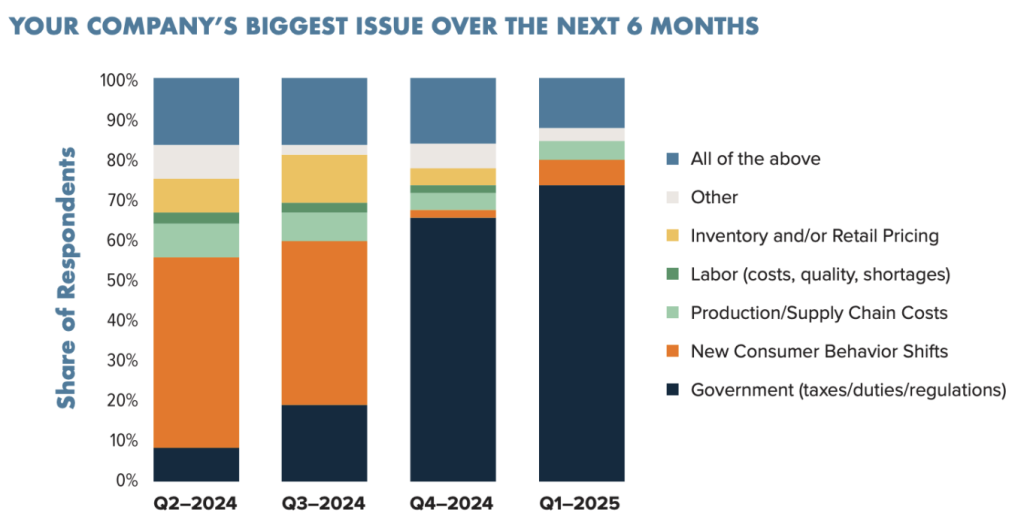

- Facing these pressures, nearly 75 percent of respondents cited government interference — primarily tariffs — as a top business concern.

“These results confirm what we’re hearing across the industry —consumer confidence has weakened significantly, and demand is slipping. Footwear is a necessity, but for many families, that extra pair of shoes is becoming a luxury they can’t justify,” commented FDRA President and CEO Matt Priest. “We must take surgical actions to ease these impacts, not only to help American families struggling with rising costs but also to support businesses that are vital to our economy.”

Retail Realities: Shoe Sales Slump Continues

FDRA said the survey results align with newly released U.S. government retail data, which shows January 2025 shoe store sales declining nearly 8 percent year-over-year. This marks the 21st decline in the last 23 months for footwear retail sales.

“Industry leaders warn that higher costs and weaker consumer demand could drive 2025 sales to their lowest levels in five years,” the trade association wrote.

“As family budgets continue to tighten, shoes continue to become a need- driven purchase, causing fewer visits to shoe stores and fewer buying occasions. Overall inflationary pressure especially hurts discretionary purchases, that extra pair of shoes in the closet is a luxury many families just cannot justify,” said one retail executive surveyed.

Data and chart courtesy Footwear Distributors and Retailers of America