Caleres, Inc. President and CEO Jay Schmidt told participants on an analyst conference call that the company’s first-quarter results fell short of expectations, with February sales “particularly weak.”

The parent of Famous Footwear and the Naturalizer, Vionic, Allen Edmonds, Blowfish Malibu, and Sam Edelman footwear brands saw sales trends improve in March and April despite the shift in the Easter holiday; however, the company reported overall performance below plan for the quarter.

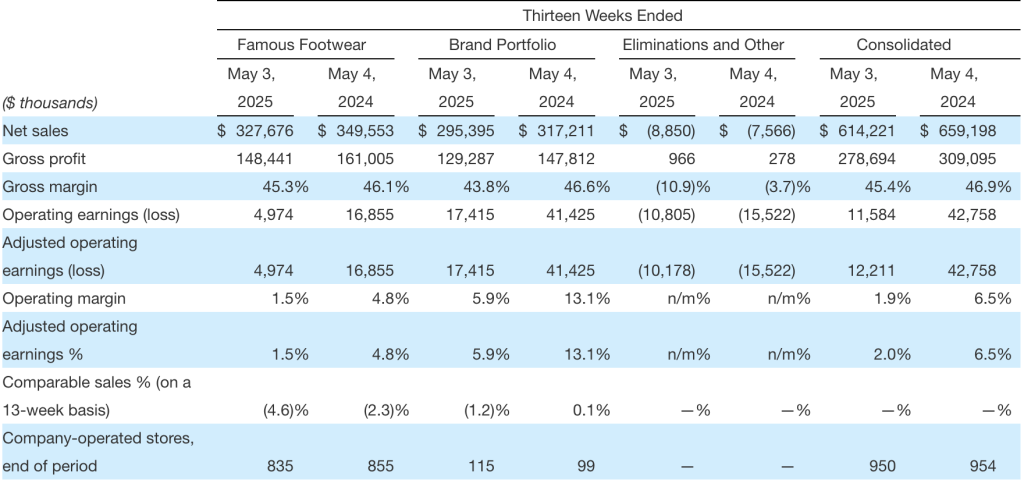

Consolidated net sales declined 6.8 percent year-over-year (y/y) to $614.2 million in the quarter ended April 3. Analysts were forecasting a 5.6 percent decline in net sales to $622 million.

Total company Direct-to-Consumer (DTC) sales represented approximately 70 percent of total net sales for the period.

Despite the weak quarter, Schmidt said the company did experience improving momentum at retail and growth in its “strategically important” international business.

Still, the CEO noted that “Our Q1 results include several larger-than-planned impacts related to tariff escalation and sourcing disruption, higher-than-planned inventories and worsening customer credit issues.”

First, on the sourcing front, Schmidt said that after the April 2 “Liberation Day” tariff proclamations from the Trump Administration, Caleres “acted quickly” to pause production in China.

“Depending on where items were in the production cycle, we either canceled, caused or relocated manufacturing,” Schmidt shared. “As you can imagine, each of these decisions had associated costs that impacted the quarter.”

The CEO stated that the company believes sourcing disruption had a minimal impact on sales but reduced gross margin profit by nearly $1.9 million during the quarter.

“As sales trends softened late last year and into the first quarter, our outlook shifted, and we could not adjust our inventory flow quickly enough to match the lower demand coming from some parts of the Brand Portfolio,” he explained further. “While the excess inventory is largely current and came in before April, thus avoiding the latest tariffs, these higher inventory levels required additional markdown reserves.”

Markdown reserves reportedly impacted the quarter by roughly $2.3 million versus the comparative quarter last year.

Lastly, Schmidt said the company saw expanding customer credit concerns in the quarter and added bad debt write-downs, which hit profit by almost $3.1 million compared to last year’s Q1 period.

“We are taking multiple actions to offset additional sourcing costs and improve our financial performance, including sourcing migration, price increases and expense reduction,” he wrapped.

Famous Footwear

Famous Footwear segment net sales decreased 6.3 percent y/y to $327.7 million in Q1, with comparable sales down 4.6 percent y/y. February was said to be “significantly down,” but the family footwear channel retail brand saw sequential improvement in March and April.

Company CFO Jack Calandra said comparable sales declined in the low double-digits in February and improved to a low single-digit decline for the combined March/April period.

E-commerce sales were up 2.5 percent in the quarter while gross margins declined 80 basis points due to more promotional days, primarily concentrated in February, and higher freight costs.

“Men’s, kids and accessories outperformed the total, while women’s underperformed,” Schmidt shared. “By category, we saw relative strength in Athletics.”

Within the strategically important Kids’ category, Famous reportedly gained 0.5 points of market share in the Shoe Chains channel, while total Famous gained 0.2 points year-over-year. Kids’ penetration was 21 percent in the quarter, with sales trends exceeding the total chain for 16 of the last 17 quarters.

And finally, Caleres-owned brands outperformed at Famous Footwear in the quarter with notable increases from both our Blowfish and its Ryka brand.

“We continue to enhance the consumer experience at Famous. At the end of the first quarter, we had 44 flare locations in total. We saw an eight-point sales lift versus the rest of the chain for stores converted in the last year and a three-point lift for all Flair stores,” said Schmidt.

“Flair is helping to attract more elevated product and brands and our Famous consumer is responding,” Schmidt continued. “We’ve already added two Flair stores this quarter and expect to add seven more by July, bringing our total to 53 stores heading into back to school.”

Famous Footwear launched the Jordan brand in 147 stores in mid-May, supporting the launch with “bold exterior signage, branded fixtures, full family displays that are Flair locations and geo-targeted messaging.”

Schmidt said the company looks forward to rolling the brand out to all stores for back-to-school in men’s, women’s, kids’ and accessories.

“The [Jordan] brand is currently exclusive to Famous in the Shoe Chain channel,‘ Schmidt confirmed. “Early selling is very encouraging, and we look forward to even stronger results with our national marketing campaign during Back-to-School.”

The CEO said Famous is well-positioned for Back-to-School with expanded or new assortments from Nike, Adidas, Birkenstock, New Balance, Brooks, Timberland, and Sorel, as well as Pride, which arrives later in the fall.

“In summary, the strength of Athletic, Kids’, our Flair results, and the brand and product lineup make us feel cautiously optimistic,“ he expressed. “We believe Famous‘ inherent competitive advantages, namely its leadership position with the millennial family, especially kids, coupled with its clear avenues for growth and support from the Caleres structure, position the business to gain additional market share in food chains, generate robust levels of cash and increase profitability over the long term.”

Brand Portfolio

Brand Portfolio segment net sales declined 6.9 percent y/y to $295.4 million in the quarter, with similar softness across all channels. Schmidt said the Brand Portfolio gained market share in women’s fashion footwear during the period, according to data from Zirconia.

Calandra said tariff-related challenges and other discrete items adversely impacted the comparison to Q1 last year by about $7 million.

Schmidt said consumer demand remained solid in key categories, including fashion, flats, sandals and sneakers, while dress styles were more challenged. Lower product margins, costs relating to canceling or moving goods and higher inventory reserves pressured the Brand Portfolio gross margin and resulted in a 280-basis-point decline versus Q1 last year.

“Our four lead brands, which include Sam Edelman, Allen Edmonds, Naturalizer and Vionic, represented about 60 percent of sales and 80 percent of operating earnings in the quarter,“ the CEO shared. “While sales were down for lead brands in total, they outperformed the other brands in the portfolio.”

The Sam Edelman brand reportedly delivered a solid quarter “marked by sales growth domestically and double-digit growth internationally.”

Schmidt said the company saw improvement in the Sam Edelman China business, reportedly driven by strong response to the sneaker assortment. He also called out expansion in the brand’s global footprint through new marketplace partnerships and growth in the Middle East.

“Sam Edelman was well-positioned with key trends this season, including raffia, jellies, footbed sandals and slides, all while continuing to grow its sneaker business,“ he detailed.

Both Wholesale and Direct-to-Consumer (DTC) channels posted growth in the first quarter.

“At quarter end, we had 106 stores, 56 owned and 56 franchised, with 102 of them located internationally,“ Schmidt noted.

Allen Edmonds reportedly posted a softer quarter from a demand standpoint.

“The consumer here continues to respond to newness across all channels and newness in our owned retail stores outperformed total store performance by 10 points,“ Schmidt detailed. “Growth in rubber soled versus casuals and sneakers was offset by softness in leather sole dress shoes.”

Schmidt said that retail trends were meaningfully impacted in April by financial market volatility, but they have seen some rebound as markets stabilized.

Allen Edmonds opened three additional Port Washington studio stores in Q1, bringing the total to 15.

“These stores continue to outperform the fleet by 300 basis points to 400 basis points,“ said Schmidt. “We also opened a new outlet store in Charlotte, North Carolina. We plan to open a small number of Allen Edmonds outlets in the future to more effectively clear end-of-season goods. At the end of the quarter, we had a total of 57 stores.”

The Naturalizer brand reportedly had a down quarter but maintained its market share.

“Sneakers and casuals grew in penetration to the total, and sandals styles were up led by strong performance from new footbed styles,“ he noted. “While naturalizer.com saw lower sales in the quarter, conversion was up double digits.”

Schmidt added that the brand is also seeing growth with its largest Wholesale partners.

“As a reminder, Naturalizer invested in its first shop-in-shop at Macy’s Herald Square last October. This elevated modern shopping experience drove over a 50 percent sales increase in the first quarter and is on track to be the number one Naturalizer location globally,“ he added.

The Vionic brand reportedly declined year-over-year, reportedly due primarily to timing issues, but was still said to be slightly better than expectations. The brand shifted its catalog drop from Q1 to Q2.

“Our walking category sales grew over 100 percent to last year, driven by a walking campaign in February and the launch of three new walking styles,“ Schmidt shared. “We also saw encouraging early results in sandals, supported by new styling and enhanced footbed technology.”

Schmidt also touched on the pending acquisition of Stuart Weitzman. “We love its premium positioning, and we have proven an ability to operate profitably in the accessible luxury lane with our Veronica Beard and Vince licensed businesses,“ he said.

“We see the higher-end consumer as more resilient long term, and we view Stuart’s strong direct-to-consumer presence and international footprint as important strategic advantages,“ Schmidt continued. “We continue to believe we are the right owners for this asset and we are excited about its future at Caleres. We are also engaging an external firm to ensure we integrate the business well and capture all the synergies.”

Profit & Loss by Segment

Profitability & Expenses

Consolidated gross margin was 45.4 percent of net sales in the first quarter, down 150 basis points y/y, reportedly driven by lower margins in both segments.

Brand Portfolio gross margin was 43.8 percent of net sales in Q1, down 280 points y/y as a result of lower initial margins, costs associated with canceling, and moving production out of China and higher reserves for inventory markdowns.

Famous Footwear gross margin was 45.3 percent of net sales in Q1, down 80 basis points to last year due to additional days on promotion and higher shipping costs, partially offset by lower clearance sales and a higher clearance margin.

“We continue to utilize our BOGO promotion during key selling periods,” Calandra noted.

SG&A expense was said to be about flat y/y at $266.5 million in Q1. SG&A margin was 43.4 percent of net sales in the quarter, up 300 basis points versus last year’s Q1 period.

“On a dollar basis, continued investment in our international business and higher depreciation for store and IT investments was offset by lower marketing spending and incentive compensation expense,” Calandra shared.

Operating earnings were $12.2 million, and operating margin was 2 percent. Operating margin was 5.9 percent of net sales at Brand Portfolio and 1.5 percent at Famous Footwear.

Net interest expense was $3,800,000 – about flat to last year. Higher average borrowings were said to be offset by a lower weighted average borrowing rate.

Caleres had net earnings of $6.9 million, or 21 cents per diluted share, and Adjusted net earnings of $7.4 million, or 22 cents per diluted share, in Q1, compared to net earnings of $30.9 million, or 88 cents per diluted share, in the first quarter of 2024.

Adjusted earnings per diluted share were 22 cents versus 88 cents per diluted share in Q1 last year. Analysts were forecasting Adjusted net earnings at 37 cents per share.

Trailing twelve-month Adjusted EBITDA was $187.9 million and 7 percent of sales.

Balance Sheet and Cash Flow Summary

Caleres ended the first quarter with $258.5 million in borrowings, up $67.5 million to last year and no long-term debt. Debt to trailing 12-month EBITDA was 1.4x.

Inventory at quarter-end was $573.6 million, up $43 million, or 8.1 percent, to end of quarter last year.

- Famous Footwear inventory was said to be up slightly and included a build for the May 17 launch of the Jordan brand.

- Brand Portfolio inventory was up 20 percent, with the increase coming from fall 2024 carry-forward product and current spring styles.

“We’ve accrued markdown reserves as appropriate for slow-moving spring inventory that we expect will be needed to close that product at the end of the season,” Calandra noted.

Cash flow from operations was a negative $5.7 million as a result of lower net income and higher inventory levels.

Tariffs and China

“As previously discussed, the two original tranches of tariffs of 10 percent each imposed in February and March were managed through a combination of factory concessions, lower gross margin and to a lesser degree select price increases,” CFO Calandra outlined. “When the broader reciprocal tariffs and dramatically increased tariffs on China were announced on April 2, we paused all China production and took steps to move work in progress to other countries where it made financial sense to do so.”

He said when the tariff came down to 30 percent, they selectively released some goods where appropriate.

“We also took steps to further accelerate our move out of China and now expect about 10 percent of our dollars sourced to come from China in the back half,” the CFO noted. For goods sourced in other countries, the additional 10 percent tariff is being managed much like the initial China tariffs – through a combination of factory concessions, lower gross margin and select price increases.

The CDO said the situation remains fluid, with the 90-day pause on the incremental reciprocal China tariffs lapsing in August, and the 90-day pause on reciprocal tariffs for the rest of the world expiring in July. “We will remain nimble, and we are well-positioned to operate in a variety of different sourcing environments,” the CFO said.

Outlook

Caleres, Inc. reported that, “given the uncertainty in the environment,” the company is suspending guidance.

“The operating environment has become more challenging, and we must redouble our efforts to drive growth and profitability,” Schmidt noted. “In the near term, we are focused on controlling what we can control, including optimizing our sourcing strategy. Additionally, we expect to decrease SG&A by $15 million on an annualized basis through structural expense cuts. We are viewing this as an opportunity to strengthen Caleres and position our company for the future. Longer term, we are confident in our ability to get back on track, execute our strategic plan, invest to fuel our growth initiatives, and drive sustained value for our shareholders.”

Caleres, Inc. did provide the following information about Q2 quarter-to-date performance:

- Famous Footwear comparable sales are slightly better than the first quarter, posting a 4.6 percent decline to-date. The Jordan brand launched halfway through the period.

- For Brand Portfolio, the company has seen a modest increase versus last year in DTC sales, which represent about one-third of segment sales. Calandra said the the larger domestic Wholesale order book is fluid as the company rebalances the country sourcing mix and customers reconfirm orders at the new, higher prices.

“And finally, as Jay referenced, we are also executing a structural cost initiative that will result in $15 million of SG&A savings on an annualized basis and $7.5 million in the back half of 2025,” the CFO concluded.

“As we look ahead, we are confident in our ability to get back on track, execute our strategic plan, invest to fuel our growth initiatives and drive sustained value for our shareholders,” CEO Schmidt shared.

Image courtesy Famous Footwear