Caleres, Inc., the parent company of Famous Footwear and the Naturalizer, Vionic, Allen Edmonds, Blowfish Malibu, and Sam Edelman brands is the latest retailer to reduce its full-year guidance as Q3 sales and earnings came in under expectations. The company said it expects its season-to-date sales trend to continue into Q4 and anticipates pressure on gross margins as it takes actions to move through excess inventory and position itself well for 2025.

“The third quarter saw progress toward our strategy highlighted by the Brand Portfolio delivering growth, Famous Footwear delivering positive comparable store sales, and both segments increasing market share,” said Jay Schmidt, president and CEO, Caleres, Inc. “That said, performance was below our expectations reflecting softer seasonal demand in the boot category, late receipts of key athletic product at Famous Footwear, and a discrete customer credit issue that impacted shipments.” Schmidt added the company’s business in China was also weaker than planned.

Caleres shares were down in the high teens in pre-market trading on Thursday, November 5.

Consolidated net sales amounted $740.9 million for the third quarter, down 2.8 percent year-over-year (y/y) from the third quarter of 2023.

- Famous Footwear segment net sales decreased 4.8 percent y/y, with comparable store sales up 2.5 percent versus the year-ago Q3 period.

- Brand Portfolio segment net sales increased 0.7 percent y/y.

- Direct-to-consumer sales represented approximately 72 percent of total net sales in the third quarter.

Income Statement Summary

Consolidated gross profit was $327.0 million, while gross margin was 44.1 percent of net sales, down 55 basis points versus Q3 last year.

- Famous Footwear segment gross margin was 42.9 percent of net sales, down 130 basis points y/y.

- Brand Portfolio segment gross margin of 43.8 percent of net sales, up 15 basis points y/y.

SG&A as a percentage of net sales was 36.3 percent, up 30 basis points versus the prior-year third quarter, reflecting expense deleverage on the decline in sales.

Net earnings were $41.4 million, or $1.19 per diluted share, in the third quarter, compared to net earnings of $46.9 million, or $1.32 per diluted share, in the third quarter of 2023.

Adjusted net earnings amounted to $42.6 million, or $1.23 per diluted share, which excludes 4 cents related to charges associated with restructuring initiatives completed during the third quarter, compared to Adjusted net earnings of $48.6 million, or $1.37 per diluted share in the third quarter of 2023.

Balance Sheet Summary

Inventory was up 5.0 percent y/y at quarter-end, but increased 2.7 percent when accounting for the shift in the 53rd week in the 2023 retail calendar.

Borrowings under the asset-based revolving credit facility were $238.5 million at the end of the period, up $16.5 million from the third quarter of 2023.

Capital Allocation Update

During the quarter, Caleres continued to invest in value-driving growth opportunities while at the same time returning cash to shareholders through our dividend. In addition, the company repurchased approximately 1.5 million shares for a total of $50 million during the quarter. In the near term, the company expects to continue to focus on reducing debt and still expects borrowings under its asset-based revolving credit facility will be less than $100 million by the end of 2026. Caleres will continue to consider business performance and market conditions as it evaluates all opportunities for free cash flow for the remainder of the year.

Outlook

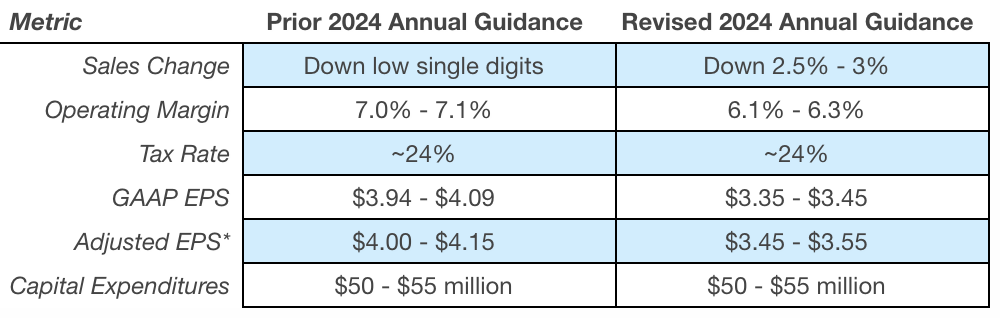

Caleres is revising its fiscal 2024 financial outlook. As previously noted, its fiscal 2024 is a 52-week year and compares to a 53-week year in fiscal 2023.

“As we begin the fourth quarter, our strategies are working to drive market share and we are aligning our expenses with expected sales, while appropriately investing behind areas of the business that are expected to deliver a strong ROI,” said Schmidt. “Longer term, we believe we are well-positioned to execute our strategic plan, invest to fuel our ambition, and drive sustained value for our shareholders.”

The company has adjusted its fiscal 2024 outlook for net sales to be down in a range of 2.5 percent to 3.0 percent versus previous guidance of down low-single-digits percent. Caleres revised fiscal 2024 outlook for earnings per diluted share to $3.35 to $3.45 versus prior guidance of $3.94 to $4.09, and Adjusted earnings per diluted share to a range of $3.45 to $3.55 versus prior guidance of $4.00 to $4.15, which excludes 10 cents per diluted share in restructuring costs.

* Adjusted EPS guidance excludes estimated restructuring charges incurred in the second half of 2024