Mergers & Acquisitions (M&A) activity in 2025 is expected to build on the gains in 2024, but has gotten off to a slow start to the year, according to recent data and reporting from EY and the EY-Parthenon Deal Barometer.

EY forecasted in November 2024 that M&A activity was expected to rise 10 percent in 2025, following an expected 13 percent growth in 2024. For private equity, EY’s M&A outlook predicted a 16 percent rise in 2025, and for corporate M&A, they saw 8 percent growth in 2025.

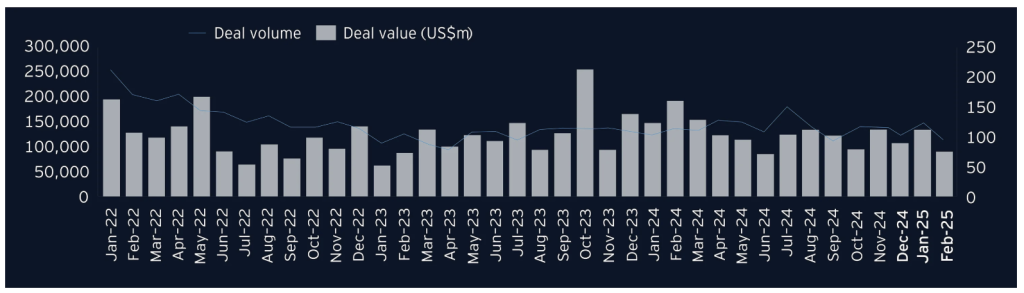

But the firm now believes the M&A market entered a watchful phase in February 2025, evidenced by a downturn in the number and total value of deals over $100 million. The volume of these deals fell by 5.9 percent year-over-year (YoY) and 19.5 percent from January 2025 MoM, while combined deal value dropped by 53 percent YoY and 34 percent MoM.

EY said businesses “were careful” with M&A activity over $1 billion, indicating that while while volume in deals this size rose 12 percent YoY, dollar value decreased by 59 percent and there were no large cap deals (those above $10 bn), compared with six such deals in February 2024. This combination of factors indicates selective activity in the mid-market.

Amid the current slowdown in activity, the Trump administration’s deregulation efforts and potential interest rate reductions later in the year may lift the M&A market, presenting chances for more affordable debt financing and avenues for growth.

“Companies are closely scrutinizing the effects of volatile trade policies and economic trends before engaging in substantial mergers or acquisitions,” EY wrote in their March 2025 M&A Activity Insights note published this week. “This approach has led to a preference for bolt-on acquisitions, allowing for strategic growth without the commitment to larger investments. Nonetheless, there is an optimistic expectation for a surge in M&A activity once the market conditions become more favorable.”

Monthly M&A trend (2022 onwards)

Deal Value ($100 mm+; Deal Volume ($100 mm+)

Through September 2024, volumes for both private equity (PE) and corporate M&A deals were up an impressive 17 percent year-to-date versus 2023, but settled back to a 13 percent increase by the end of the year

“We expect U.S. deal volume will rise 10 percent in 2025, building on a robust 13 percent advance in 2024, driven by sustained economic activity, decreasing interest rates, pent-up demand & reduced valuation gaps. Deregulation tailwinds represent an upside risk to our forecast,” EY Chief Economist Gregory Daco wrote in a LinkedIn post.

When developing the 2025 forecast, EY feedback in its CEO Outlook Survey, which indicates CEOs and institutional investors had a positive outlook for corporate M&A deals and PE activity in 2025.

“While there is a slight CEO preference for organic transformation compared to inorganic, there is a clear link between higher CEO confidence and a desire to transact,” the firm said in the EY-Parthenon Deal Barometer in the fourth quarter. “Nearly two-thirds (59 percent) of the most confident CEOs, as defined by their optimistic outlook for growth, talent, inflation and investment according to our CEO Confidence Index, are planning a transaction over the next 12 months compared with just 16 percent of the least confident CEOs.”

The firm said U.S. deal activity shows a continuing rebound after remarkable fluctuation seen in dealmaking over the last few years.

“In 2021 and early 2022, the M&A market surged to record levels thanks to low inflation, strong economies, high company profits and particularly low interest rates,” EY noted. But the firm also said with the Fed’s aggressive policy tightening to combat high inflation beginning in March 2022, the higher cost of capital, increased economic uncertainty, geopolitical strife and widening bid-ask spreads amid valuation uncertainty caused a sharp decline in deals in 2022 and 2023.

To put things in perspective, total deal volume surged 91 percent in 2021 and fell a cumulative 54 percent in 2022 and 2023. For corporate M&A, deal volume rose 92 percent in 2021 and fell a cumulative 49 percent in 2022 and 2023. For PE deals, the increase in 2021 was 88 percent, and the subsequent two-year decline was 64 percent.

Consumer and Businesses Enter a Phase of Prudent Spending

Data shows a strong U.S. economy with a likely soft landing, but with future economic activity likely more prudent amid high costs and rates.

Looking ahead, the EY Macroeconomics team’s U.S. economic outlook foresees consumers and businesses still spending but doing so more prudently amid still-elevated costs and rates.

“We continue to expect a bifurcated consumer spending outlook with lower-income households with larger debt burdens exercising more spending restraint, while families at the higher end of the income spectrum still spend, albeit with more discretion,” the firm wrote. The forecasted real GDP growth easing to 2.0 percent in 2025 but note the unusually elevated level of policy uncertainty.

“Given robust but gently decelerating economic activity, strong productivity growth and softening inflation, we continue to anticipate measured monetary policy easing,” EY said. “As policymakers more carefully feel their way to a neutral policy stance, the Fed may decide to slow the recalibration process.”

EY Macroeconomics team was anticipating a rate cut at every other meeting in 2025, for a total of 100 bps of easing. It now looks like the market may see two cuts later this year.

The Federal Reserve’s decision to maintain interest rates at 4.25 percent to 4.50 percent was said to support debt financing, allowing companies to pursue mid-cap deals despite a cautious economic backdrop.

“However, the high cost of capital continues to weigh on some CEOs’ decision-making, leading to a cautious approach in certain industries,” EY noted in the March report.

Corporate M&A Outlook

EY’s baseline scenario shows a rise of 8 percent in M&A deals in 2025.

“Over the pre-pandemic decade, annual corporate M&A deal volumes averaged between 800 and 1,000 deals. But the low inflation and low-interest rate environment in 2020-21 resulted in a large boost for deal volume, registering an impressive jump of more than 90 percent in 2021 to around 1,900 deals, the firm noted in the last EY-Parthenon Deal Barometer.

The Deal Barometer anticipated around 1,080 deals in 2024 and around 1,170 deals in 2025.

“However, in our optimistic macroeconomic scenario – where GDP growth and corporate profits are stronger, inflation cooler and interest rates lower – our Deal Barometer anticipates more rapid recovery for 2024 with the total number of M&A deals increasing 11 percent in 2025,” they said. “In our pessimistic scenario – where GDP growth and corporate profits are weaker, inflation hotter and interest rates higher – deal volume is expected to show a muted recovery with 5 percent growth in 2025.”

PE Deal Outlook

EY’s baseline scenario shows a rise of 16 percent in PE deal volumes in 2025.

The Deal Barometer estimates PE deal volume will gradually pick up, rising 16 percent in 2025 after a 20 percent increase in 2024.

“Over the pre-pandemic decade, PE deal volumes averaged between 375 and 500 deals over $100 million per annum. But the low inflation and low-interest rate environment in 2020-21 resulted in a large boost for deal volume, registering an impressive jump of just under 90 percent in 2021 to nearly 890 deals,” the firm noted in the Deal Barometer report

The Deal Barometer expected approximately 380 deals closed in 2024 and is forecasting around 440 deals in 2025. This would still leave deal volumes 6 percent below the 2018-19 average.

“In our optimistic macroeconomic scenario – where GDP growth and corporate profits are stronger, inflation cooler and interest rates lower – PE deal volumes would rise faster in 2025, up 32 percent year over year (y/y). This would put deal volume 13 percent above the 2018-19 average,” the firm said. “In our pessimistic macroeconomic scenario – where GDP growth and corporate profits are weaker, inflation hotter and interest rates higher – PE deal volume would decline slightly in 2025, down 3 percent.”

Private equity continued to be a key contributor of deals in February 2025, making up 43 percent of the month’s deal value.

“With significant capital on hand, PE firms are expected to maintain active dealmaking, particularly in seeking exits, EY wrote in the March M&A Activity Insights note. “Shifting away from leveraged buyouts, these firms are now prioritizing strategic partnerships, minority investments and smaller, easily integrated acquisitions, reducing the need for borrowing. The strategic adjustments can be attributed to an evolving market landscape that demands greater risk management and operational efficiency.”

EY said that By targeting smaller, focused investments, PE players are better positioned to preserve capital and limit exposure to high leverage, facilitating quicker integration and operational synergies and also strengthening exit strategies by concentrating on long-term value creation.

“Such recalibration underscores a cautious yet adaptable investment climate, balancing growth ambitions with the shifting economic environment,” the firm said.

Dealmakers Seeking Clarity

Looking ahead, EY said the U.S .M&A market is adopting a wait-and-see approach amid uncertainties surrounding the Trump administration’s economic policies, including implementing significant tariffs. Companies are focusing on cost management and supply chain optimization, preparing for more robust deal activity once clarity returns.

“While the U.S. economy began the year with strong momentum, increasing uncertainty around trade and fiscal policies is straining the outlook,” the firm noted. “The latest EY economic report suggests that economic growth may moderate to a 2 percent trend rate in the coming quarters, with GDP projected to expand by 2.3 percent in 2025 and slow to an average of 1.7 percent in 2026.”

However, the firm also said the anticipated moderation in consumer spending and business growth is being met with strategic workforce planning and a focus on productivity, positioning businesses to effectively manage cost pressures and maintain momentum.

The latest EY US economic outlook highlighted a gradual moderation in spending trends with consumption momentum likely to ease from 3.2 percent YoY in Q4 2024 toward 2 percent YoY in Q4 2025.

Image courtesy EY-Parthenon