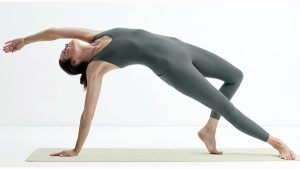

EXEC: Gap Sees Athleta’s Recovery Taking Longer Than Planned

Athleta’s sales declined 18 percent in the third quarter against “heavy discounting” a year ago and are expected to decline double-digits in the fourth quarter as the retailer’s recovery from recent fashion miscues has taken longer than expected.

EXEC: Hot Weather Chills Boot Sales at Shoe Carnival

Shoe Carnival reported it gained market share in the family footwear channel due to a robust back-to-school season with particular strength in kids on strength in athletic; however, annual guidance was lowered for the third straight quarter as hot and dry weather in September and October caused a decline in the twenties in the boot category.

Baird Sees Reawakened Investment Opportunity For Team Sports

In a recent analysis from Baird, the investment firm and financial services company forecasted that tech advances, improved player performance and safety features, elevated traditional and social media exposure, and other economic factors will accelerate the future of team sports participation, benefiting from both the sporting goods industry and its investors.

Bain: Luxury Seen Losing Pandemic Boost

Bain & Company’s Luxury Study forecasted the global personal luxury goods market will grow 4 percent on a currency-neutral basis to €362 billion ($393 bn) in 2023, below a forecast between 5 percent to 12 percent the consultancy published in June.

Fila Holdings’ Sales Slide On Fila Brand Weakness

Korea-based Fila Holdings Corp. reported sales fell 8.3 percent in the third quarter as a 35.1 percent decline at the Fila brand segment offset a gain of 3.3 percent at Acushnet (Titleist, Footjoy). Fila brand’s sales tumbled in the U.S. due to the impact of elevated inventories.

EXEC: On Delivers Record Quarterly Results, Elevated Inventories Concerning

Swiss running brand On delivered its seventh consecutive record quarter in revenues and achieved its highest gross margin since its August-2022 IPO. However, shares closed down slightly on Tuesday due to concerns over elevated inventory levels and its ability to deliver growth to match On’s stock’s high multiple.

EXEC: Samsonite Sees Gregory’s Q3 Sales Climb 23 Percent

Samsonite International S.A. reported sales from its Gregory backpack brand grew 23 percent in the third quarter while an overall recovery in travel led to similar gains for the overall company.

EXEC: Giant Group October Sales Fall One-Third, Adds to Negative YTD Trend

The Taiwanese bike brand said that although they saw strong growth from the China domestic market, the weak demand from the U.S. and Europe markets for entry to mid-level products and the high inventories in the channel resulted in a 12.4 percent decline in YTD sales.

EXEC: Dunlop Sports Sees Surging Q3 Profit Despite Moderate Sales Gain

For the third quarter, the Sports business was up 3 percent to ¥29.1 billion, after growing 19 percent in Q1 and 3 percent in Q2. Segment business profit was up 20 percent in the third quarter, to ¥2.5 billion.

EXEC: Study Finds Team Sports Participation Trails Pre-Pandemic Level

According to the Aspen Institute’s recently released State of Play 2023 report, kids are trying sports about as much as they did before COVID-19, but they’re not playing as frequently.

EXEC: Kamik CEO Talks 125 Years of Fighting Bad Weather

The Montreal-based boot maker is celebrating its 125th anniversary of protecting feet from wet, chilly, slushy, and icy conditions. CEO Gillian Meek talked with SGB Executive about the company’s roots, the benefits of Canadian manufacturing, the brand’s strength in kid’s boots, and more.

EXEC: YTD Footwear Shipments Fall Nearly 25 Percent at Yue Yuen

Year-to-date revenue attributable to footwear manufacturing activity, including athletic/outdoor shoes, casual shoes and sports sandals, decreased by 20.4 percent to US$3.50 billion as average selling prices rose in mid single digits.

Descente Sees Mid-Single-Digit Growth in Fiscal H1

Descente, Ltd. reported that revenues for the fiscal six months ended September 30 rose 4.9 percent to ¥59.9 billion ($396 mm) from ¥57.2 billion a year ago. Gains from the incorporation of Le Coq Sportif (Ningbo) Co. Ltd. (NLCS) into China’s consolidated results and growth in activewear overall offset decreased sales in golfwear.

EXEC: Yonex Fiscal H1 Sales Grow Double-Digits but Profits Fall

Fiscal 2024 first half net sales grew 15.2 percent ¥57.7 billion as demand for sports was said to have remained strong in all regions of the world. An increase in SG&A expenses offsetting a gross profit gain drove profits down more than 20 percent for the six-month period.

EXEC: Asics Lifts Outlook On Robust Third Quarter Results

Asics Corp. raised its outlook for the year after reporting strong earnings improvement in the third quarter and nine months ended September 30. Sales grew 14.5 percent in the third quarter and 23.4 percent in the nine months with healthy gains across regions.