August M&A Roundup: Implus Nets Sporting Goods Asset

The last full month of summer was again quiet on the M&A front, with only a handful of notable deals in the sporting goods, outdoor and active lifestyle industries. But August did get off to a strong start when Implus announced the company would acquire Pro Performance Sports LLC, dba SKLZ, a provider of multisport athletic performance and skill development training products.

Retail Reports Roundup

Studies arrived showing Nike and Lululemon ranking high among favorite retailers for millennial and Gen Z consumers; Outdoor Voices landing among LinkedIn’s top startups and research on visual search, online personalization, Walmart’s online share gains and voice assistant shopping.

Moosejaw’s CEO Addresses Walmart Concerns In Open Letter

On Linkedin, Eoin Comerford, Moosejaw’s CEO, wrote an open letter to the outdoor industry asserting that the development of the Premium Outdoor Store on Walmart was done in the spirit of “inclusivity” and he’s “surprised by the vehemence of the attacks by some of our industry’s leading retailers and the threats to drop brands that participated.”

Journeys Powers Genesco Ahead In Q2

Driven by huge gains in revenues and profitability at Journeys, Genesco Inc. reported the company’s first positive store comp in eight quarters while posting a surprise profit in the second quarter. Said Bob Dennis, Genesco’s CEO, “Despite lapping positive comparisons when Journeys successfully emerged from the fashion shift a year ago.”

Aisle Talk Week Of September 3

Top headlines from the active lifestyle industry you may have missed this week, including the tragic death of Jason Hairston, the founder of the KUIU hunting apparel brand.

Zumiez Q2 Gets Boost From Vans

Zumiez delivered the company’s “strongest second quarter in several years,” according to Rick Brooks, CEO, with a big boost from Vans.

G-III Apparel Q2 Boosted By Donna Karen And Tommy Hilfiger

Driven by sales more than doubling for Donna Karan/DKNY and 60 percent growth for Tommy Hilfiger, G-III Apparel Group Ltd. reported second-quarter results that came out well ahead of guidance.

Duluth Trading’s Revenues Accelerate In Q2

Helped by a pickup in sales in the company’s direct business, Duluth Holdings Inc., the parent of Duluth Trading Company, reported sales grew 28.3 percent in the second quarter, accelerating from the 19.7 percent gain seen in the first quarter. Both earnings and sales topped Wall Street guidance although the apparel company maintained guidance for the year.

Dick’s Touts Strong Vendor Relationships

Despite aggressive shifts by many vendors to pursue growth in direct-to-consumer (DTC) channels and the widely-covered challenges the chain is facing with Under Armour, Ed Stack, Dick’s Sporting Goods’ CEO, told attendees at Goldman Sachs’ Annual Global Retailing Conference that the chain’s vendor relationship have “never really been better.”

Caleres’s Shares Sink On Q2 Miss

Shares of Caleres Inc., the parent of Famous Footwear, fell 7.9 percent on Wednesday after the company reported earnings and sales that both grew but just missed Wall Street’s targets. The report comes as competitors, DSW and Shoe Carnival, both sharply raised their guidance following robust Q2 results.

SGB Exec Q&A: Decathlon USA’s COO Sophie O’Kelly De Gallagh

Sophie O’Kelly de Gallagh, COO of Decathlon USA, talked to SGB about Decathlon’s return to U.S.retailing with the company’s “lab” store in San Francisco, the retailer’s unique vertically-integrated model and expansion plans.

Retail Reports Roundup

Studies arrived on retailers’ omnichannel concerns, kids influence on BTS purchases, Gen-Z’s and millennials mobile phone purchases, Gen-Z’s non-digital interests, expanding retail app usage and more.

Auspicious Start For Lululemon’s New CEO

Things couldn’t have gone much better this week for new Lululemon Athletica Inc. CEO Calvin McDonald, whose first earnings call Thursday centered on the company’s stellar second quarter.

Aisle Talk Week of August 27

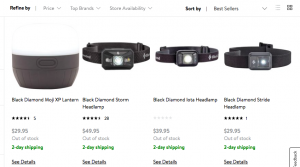

Top headlines from the active lifestyle industry you may have missed this week, including Black Diamond Equipment Ltd. sending Walmart a cease and desist notice in response to the launch of a new outdoor website on Walmart.com curated by Moosejaw.

Smith & Wesson’s Parent’s Shares Pop On Raised Outlook

Shares of American Outdoor Brands, the parent of Smith & Wesson, M&P, and Thompson/Center Arms, were trading up nearly a third in mid-day trading on Friday after the company exceeded guidance in the first quarter ended July 31 and aggressively lifted targets for the company’s full fiscal year. The firearms leader still cautioned that overall demand for firearms isn’t showing clear signs of a recovery.