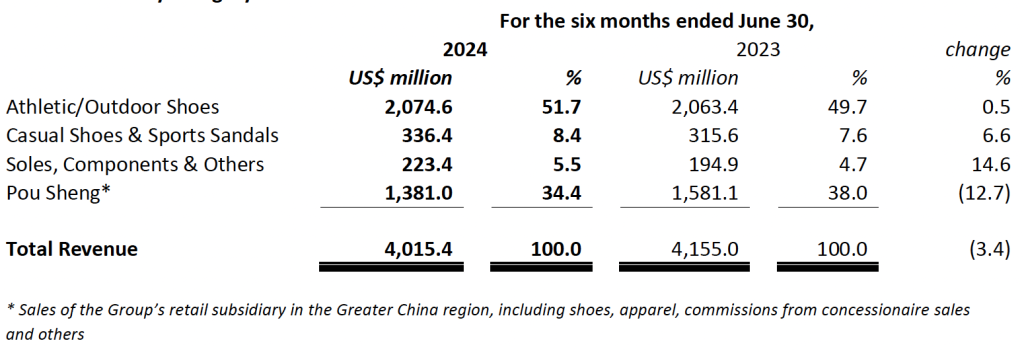

Yue Yuen Industrial (Holdings) Limited reported revenue of $4.02 billion in the six-month first half (H1) period ended June 30, a year-over-year decrease of 3.4 percent as compared with the corresponding H1 period last year.

Total Revenue by Category

Footwear Manufacturing

Revenue attributed to footwear Manufacturing activity (including athletic/outdoor shoes, casual shoes and sports sandals) increased 1.3 percent to $2.41 billion, compared with the corresponding H1 period last year. The volume of shoes shipped during the first half period increased by 9.9 percent to 120.7 million pairs amid a “decent recovery trend” and a further normalized order book.

The average selling price for footwear decreased by 7.8 percent to $19.98 per pair in the first half, reportedly due to a high base effect and changes to its product mix, partially offsetting the recovery of shipment volumes. The Group’s total revenue with respect to the Manufacturing business (including footwear, as well as soles, components and others) was $2.63 billion for the first half, an increase of 2.4 percent as compared to the H1 period last year.

Yue Yuen’s Manufacturing business and the consolidated company results reports in U.S. dollars ($).

Pou Sheng China Retail

Revenue attributed to Pou Sheng decreased by 12.7 percent to $1.38 billion for the first half, compared to $1.58 billion in the corresponding H1 period last year. In RMB terms (Pou Sheng’s reporting currency), revenue decreased 8.9 percent to RMB 9.98 billion, compared to RMB 10.96 billion in the 2023 H1 period, which was said to be mostly attributable to weak store traffic amid an increasingly dynamic retail environment in mainland China, despite the relatively resilient performance of its omni-channels.

As of June 30, 2024, Pou Sheng had 3,478 directly operated retail stores across the Greater China region, representing a net closure of 45 stores as compared with the 2023 year-end, with the contribution of quality larger-format stores (above 300 m2) to Pou Sheng’s directly-operated store count rose to 21.0 percent (H1 2023: 19.7 percent). Ensuring a holistic approach to new store openings and selectively rightsizing or upgrade of its stores is at the core of Pou Sheng’s retail refinement strategy, enabling it to focus on enhancing store-level efficiency.

Income Statement Summary

Gross Profit

During the first half, the Group’s gross profit dipped 0.3 percent to $975.1 million, while the overall gross profit margin increased by 80 basis points to 24.3 percent. The gross profit of the Manufacturing business increased 12.1 percent to $502.6 million, with the gross margin (GM) of the Manufacturing business increasing by 170 basis points year-over-year to 19.1 percent of sales as compared to the 2023 H1 period. The GM improvement was said to be mainly attributable to strong demand for footwear capacity which led to its improved overall capacity utilization rate, flexible production scheduling and orderly overtime arrangement, effective cost-reduction, as well as efficiency-improvement efforts.

Production leveling across the Group’s Manufacturing facilities was said to be uneven during the first half, with some factories experiencing higher utilization rates due to more overtime, alongside the ramp-up of new production capacity.

The Pou Sheng gross margin in the first half was 34.2 percent of sales, an increase of 70 basis points. The company said well managed discount controls, coupled with effective inventory management, helped offset an unfavorable channel mix.

Selling & Distribution Expenses, Administrative Expenses and Other Income/Expenses

The Group’s total selling and distribution expenses for the H1 Period decreased 10.4 percent to $424.2 million, equivalent to approximately 10.6 percent of revenue, compared to 11.4 percent of revenue in H1 2023.

Administrative expenses for the H1 period decreased by 3.8 percent to $275.3 million, or approximately 6.9 percent of revenue, compared to 6.9 percent of revenue in H1 2023.

Other income for the H1 period decreased by 4.7 percent to $63.4 million, or approximately 1.6 percent (H1 2023: 1.6 percent) of revenue.

Other expenses decreased by 38.8 percent to $79.7 million (H1 2023: $130.2 million), equivalent to approximately 2.0 percent (H1 2023: 3.1 percent) of revenue. Among which, there were no expenses for production capacity adjustments incurred during the H1 period, when compared to one-off expenses of approximately $20.5 million for production capacity adjustments during the corresponding period of 2023.

The Group’s net operating expenses for the H1 period decreased by $107.6 million, or 13.1 percent, year-over-year.

Recurring Profit Attributable to Owners of the Company

In the first half, the Group recognized a non-recurring profit attributable to owners of the company of $5.5 million, as compared to $3.7 million recognized in the corresponding period of last year. This included a one-off gain on the partial disposal of associates totaling $24.0 million, which was largely offset by a loss of $11.9 million due to fair value changes on financial instruments at fair value through profit or loss (“FVTPL”) and a combined impairment loss of $6.6 million on interests in a joint venture and an associate.

Excluding all items of non-recurring in nature, the recurring profit attributable to owners of the company for the first half was $178.9 million, representing an increase of 123.8 percent compared with $79.9 million for the corresponding period of last year.

Share of Results of Associates and Joint Ventures

For the first half, the share of results of associates and joint ventures was a combined profit of $32.9 million, compared to a combined profit of $29.1 million in the corresponding H1 period in 2023.

Profit Attributable to Owners of the Company

The profit attributable to owners of the company was $184.4 million in the first half, an increase of 120.6 percent compared to $83.6 million in the corresponding first half period last year.

The profit attributable to owners of the Manufacturing business increased by 177.5 percent to $155.4 million.

The profit attributable to owners of Pou Sheng increased by 9.9 percent to RMB 335.7 million.

The basic earnings per share for the first half of 2024 was 11.44 cents, compared to 5.19 cents for the corresponding H1 period last year.

Financial position

The company said the Group’s financial position remained solid in the first half. As at June 30, 2024, the Group had net cash of $65.8 million, down from $169.4 million at December 31, 2023. The Group’s gearing ratio (total bank borrowings to total equity) was reportedly 18.1 percent at June 30, compared to 20.7 percent at December 31, 2023.

Free cash inflow amounted to $79.9 million for the first half, compared to $279.1 million for H1 2023.

Dividend

The Board has resolved to declare an interim dividend of HK$0.40 per share (2023: HK$0.20 per share) for shareholders whose names appear on the register of members of the company on Wednesday, September 11, 2024. The interim dividend shall be paid on Friday, October 4, 2024. The Group said its commitment to “upholding a relatively steady dividend level” over the long-term remains intact.