Yue Yuen Industrial (Holdings) Limited, the manufacturer of athletic and outdoor footwear and components, still sees its business in a weaker position than it was two years ago. The company’s Footwear Manufacturing business continued to see year-over-year increases for the nine-month year-to-date period against a weak and declining business in 2023 but its China retail operation continues to be a source of pain as the China economy continues to weaken.

The U.S. continues to be the No. 1 destination for deliveries for Yue Yuen, but the region is also losing share to product shipped to Mainland China and Europe. The recent conversations about China tariffs will have less impact than ever going forward as the Hong Kong-based company continues to reduce its production base in Mainland China in favor of Indonesia and Other sourcing locations in Bangladesh, Cambodia and Myanmar, among others.

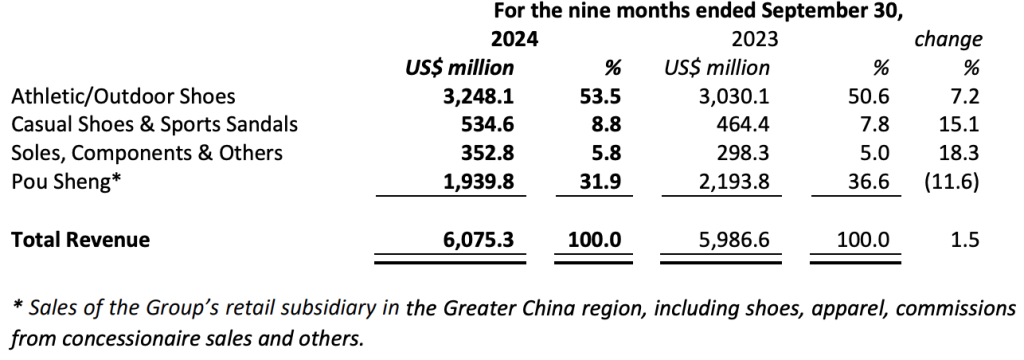

The company recorded revenue of $6.08 billion for the nine-month year-to-date (YTD) period, representing an increase of 1.5 percent compared to revenue of $5.99 billion in the corresponding YTD period last year. The YTD period was cycling against a 14.1 percent decline in the 2023 YTD period and failed to reach the ~$7 billion in revenues in the comparative 2022 nine-month YTD period.

The Hong Kong-based company reports in U.S. dollar ($) currency.

Footwear Manufacturing

Revenue attributed to Footwear Manufacturing activity (including athletic/outdoor shoes, casual shoes and sports sandals) increased by 8.2 percent to $3.78 billion for the YTD period, compared with the corresponding YTD period last year. The shoes order fulfillment reportedly strengthened quarter-over-quarter, driving an acceleration in footwear shipment volume growth during the YTD period, with a year-over-year increase of 16.2 percent to 186.9 million pairs.

The company’s athletic/outdoor shoes category accounted for 85.9 percent of footwear manufacturing revenue in the YTD period. Casual shoes and sports sandals accounted for 14.1 percent of footwear manufacturing revenue. When considering the Group’s consolidated revenue, athletic/outdoor shoes represented the company’s principal category, accounting for 53.5 percent of total revenue, followed by casual shoes and sports sandals, which accounted for 8.8 percent of total revenue.

The average selling price decreased by 6.8 percent to $20.24 per pair for the YTD period, said to be due to a high base effect and changes to the company’s product mix.

The company’s total revenue with respect to the Manufacturing business (including footwear, as well as soles, components and others) was $4.14 billion for the YTD period, representing an increase of 9.0 percent as compared to the corresponding period of last year.

The company’s total revenue with respect to the Manufacturing business (including footwear, as well as soles, components and others) was $4.14 billion for the YTD period, representing an increase of 9.0 percent as compared to the corresponding period of last year.

- U.S. market revenues represented 27.7 percent of shipments by value from the total global Manufacturing business, posting a 6.0 percent increase year-over-year. The U.S. represented 28.4 percent of shipments by value in the 2023 YTD period.

- Europe was 25.3 percent of Manufacturing shipments by value in the 2024 YTD period, representing a 7.7 percent year-over-year increase. Europe delivered 25.7 percent of order volume in the 2023 YTD period.

- Mainland China comprised 18.5 percent of 9-month YTD Manufacturing dollars in 2024, a 19.1 percent year-over-year gain in volume and a 160 basis-point increase in share from 16.9 percent in the 2023 YTD period.

- Other regions, including Rest of Asia, South America, Canada, Australia, and others, grew 7.7 percent year-over-year to represent a 28.5 percent of shipments. Share was 29.0 percent in the 2023 9-month YTD period.

Country of Origin

As for location of manufacturing for the YTD period, it may come as surprise that Mainland China is now the second smallest country of origin for the Hong Kong-based manufacturing giant.

- Indonesia was the largest country of origin in the YTD period this year, representing 53 percent of total production. Indonesia production increased 27.4 percent year-over-year and increased its share from 48 percent in the 2023 YTD period and just 31 percent in full year 2013.

- Vietnam is still the second largest country of origin in the nine-month YTD period, increasing 2.9 percent in volume but losing 4 points of share of production from 35 percent in the 2023 YTD period and down 3 points from 34 percent share in full year 20i3.

- Mainland China grew 10.6 percent in the 9-month YTD period, but share of production shrank to 11 percent of the total volume, compared to 12 percent in the year-ago YTD period and down sharply from the 34 percent share level in full-year 2013.

- Other countries of origin, which include Bangladesh, Cambodia, Myanmar, and others, now represent 5 percent of production sourcing, an 11.3 percent increase in volume year-over-year.

Third Quarter Manufacturing Business Review

In the third quarter of 2024, the company saw a substantial rise in demand for its footwear products, driven by the further normalization of the global footwear market. Strong order fulfillment within its Manufacturing business led to a higher overall capacity utilization rate and improved production efficiency. In addition, brand customers prioritized strategic supply chain partners with strong development capabilities, further supporting this positive trend.

Operationally, the third quarter of the year was said to be “uncharacteristically solid” and not a low season for the company’s Manufacturing business. Demand for its production capacity continued to outstrip supply, with footwear shipment volumes growing strongly and the decline in average selling price narrowing quarter-on-quarter. The company continued to balance demand and its order pipeline. Uneven production leveling across its various Manufacturing plants improved sequentially, supported by flexible production scheduling and orderly overtime arrangement, alongside the steady ramp-up of new production capacity throughout this year.

Pou Sheng China Retail

For the YTD period, the revenue attributable to the Pou Sheng China retail business decreased by 11.6 percent to $1.94 billion, compared to $2.19 billion in the corresponding period of last year.

In RMB terms (Pou Sheng’s reporting currency), revenue decreased by 9.5 percent to RMB 13.98 billion, compared to RMB 15.44 billion in the corresponding period of last year, which was said to be mostly attributable to weak store traffic amid an increasingly dynamic retail environment in mainland China, despite the relatively resilient performance of its omni-channels.

Revenue Analysis

Income Statement Summary

Gross Profit

For the YTD period, the company’s gross profit increased by 4.5 percent to $1,472.3 million, with the overall gross profit margin increasing by 0.7 percentage points to 24.2 percent. The gross profit of the Manufacturing business increased by 18.8 percent to $812.3 million, with the gross profit margin of the Manufacturing business increasing by 1.6 percentage points to 19.6 percent as compared with the corresponding period of last year, which was mainly attributed to the strong demand for its Footwear Manufacturing orders that led to a substantial increase in its overall capacity utilization rate and production efficiency, as well as the steady ramp-up of new production capacity that is largely offsetting the negative impact from uneven production leveling.

The gross profit margin for Pou Sheng in the YTD period was 34.0 percent, an increase of 0.9 percentage points, with well-managed discount controls and effective inventory management.

Selling & Distribution Expenses, Administrative Expenses and Other Income/Expenses

For the YTD period, the company’s total selling and distribution expenses decreased by 8.3 percent to $624.2 million (2023: $680.4 million), equivalent to approximately 10.3 percent (2023: 11.4 percent) of revenue.

Administrative expenses decreased by 1.2 percent to $416.1 million from $421.2 million in the 2023 period, equivalent to approximately 6.8 percent of revenue (2023: 7.0 percent) .

Other income decreased by 10.6 percent to $88.6 million (2023: $99.1 million), equivalent to approximately 1.5 percent (2023: 1.7 percent) of revenue. Other expenses decreased by 32.2 percent to $118.8 million (2023: $175.1 million), equivalent to approximately 2.0 percent (2023: 2.9 percent) of revenue, within which no expenses for production capacity adjustments were incurred for the Period, compared to one-off expenses of approximately $30.5 million for production capacity adjustments during the corresponding period of 2023. As a result, the company’s net operating expenses for the Period decreased by $107.1 million or 9.1 percent.

The company said it maintained its sustained focus on cost streamlining initiatives. Together with expense controls in both of its Manufacturing business and Pou Sheng, this supported improved operational efficiency and solid growth in profitability at the company level.

Share of Results of Associates and Joint Ventures

For the YTD period, the share of results of associates and joint ventures was a combined profit of $58.4 million, compared to a combined profit of $47.4 million recorded in the corresponding period of last year.

Profit Attributable to Owners of the Company

For the YTD period, the profit attributable to owners of the company amounted to $331.7 million, representing an increase of 140.9 percent as compared with that of $137.7 million recorded in the corresponding period of last year.

For the YTD period, the company recognized a non-recurring profit attributable to owners of the company of $26.4 million, including a one-off gain of $24.1 million on the partial disposal of associates, as compared to $3.6 million recognized in the corresponding period of last year. As a result, excluding all items non-recurring in nature, the recurring profit attributable to owners of the company for the YTD period was $305.2 million, representing an increase of 127.8 percent as compared with $134.0 million for the corresponding period of last year.

Outlook

The company said it firmly believes in the solid demand for preferred high-quality suppliers in the global footwear industry, amid a further normalized order book. However, the overall business environment will remain unsettled in the short-term due to uncertainties stemming from global macroeconomic conditions, including uneven consumer confidence amid the start of a global interest rate easing cycle, as well as regional conflicts and its impact on shipping lanes

Yue Yuen will further strengthen its operational resilience through its highly flexible and agile Manufacturing excellence strategies. It will monitor the dynamic business environment and adopt a comprehensive capacity expansion plan, aiming to balance strong short-term demand with its production scheduling, while reducing the potential impact from its up-front investments in new production plants and the capacity ramp-up cycle for the expanded production lines in the existing facilities. This approach will enhance its overall production efficiency. Meanwhile, the company will leverage its core competitive edges and superior adaptability, supported by cost and expense controls, to safeguard its profitability while focusing on maintaining a healthy cash flow and a solid financial position.

The company remains optimistic about the long-term prospects of the sports industry and remains committed to its mid to long-term capacity allocation strategy. This includes diversifying its manufacturing capacity in regions such as Indonesia and India where labor supply and infrastructure are supportive of sustainable growth.

For Pou Sheng, it will continue to enhance its operational efficiency by dynamically managing its brick and mortar and omni-channel footprint, broadening its category offerings, maximizing its strategic partnerships with business associates, and maintaining dynamic inventory controls.

The company will continue to exploit its strategy of prioritizing value growth by leveraging its integrated product development capabilities, which combine automation technology and research and development strength, to safeguard its core competitiveness as an industry leader, continue providing its brand partners with the best possible end-to-end solutions, and deliver quality returns to shareholders.

Image courtesy Yue Yuen Industrial (Holdings) Limited