Japan-based racquet sports and golf equipment manufacturer Yonex Company, Ltd. reported results for the nine-month year-to-date (YTD) period that ended December 31, 2024, suggesting that the sports market received a boost from the Summer Olympics in Paris and other international tournaments and from success of the athletes that competed in the event.

“We enhanced activities to expand the fanbase of sports by showcasing these sports events and leveraging the success of our sponsored athletes,” the company said in its fiscal Q3 YTD interim report. “Our marketing efforts and the attention garnered by the international tournaments also led to increased interest in our products.”

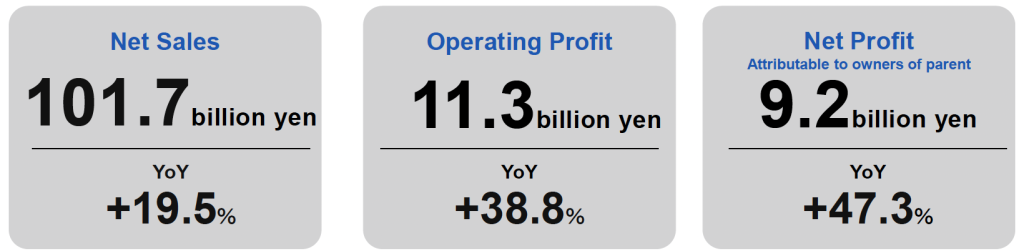

Fiscal Nine-Month Year-to-Date Summary

- In China, badminton sales continued to increase due to the success of the Chinese national team, driving higher consolidated net sales. Consolidated net sales reached a record high for the cumulative nine-month YTD period, helped in part by the positive effect of yen depreciation on overseas sales.’

- Advertising expenses increased, especially in Q3, due to enhanced marketing activities. In addition, system-related expenditures linked to the company’s global IT reinforcement, personnel expenses, and depreciation costs increased.

- Consolidated gross profit increased due to higher sales and improved gross profit margin. These gains more than offset the rise in SG&A, which included advertising costs from enhanced marketing efforts, system-related expenditures for global IT reinforcement, personnel expenses, and depreciation costs.

- Operating profit reached a record high for the cumulative YTD period.

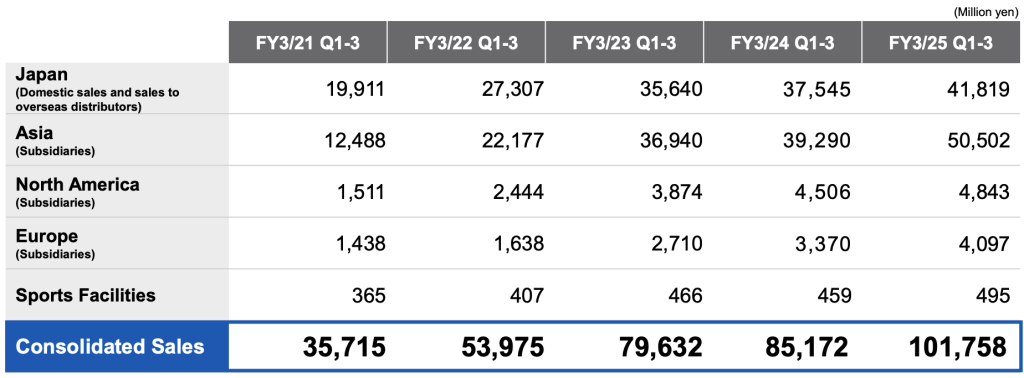

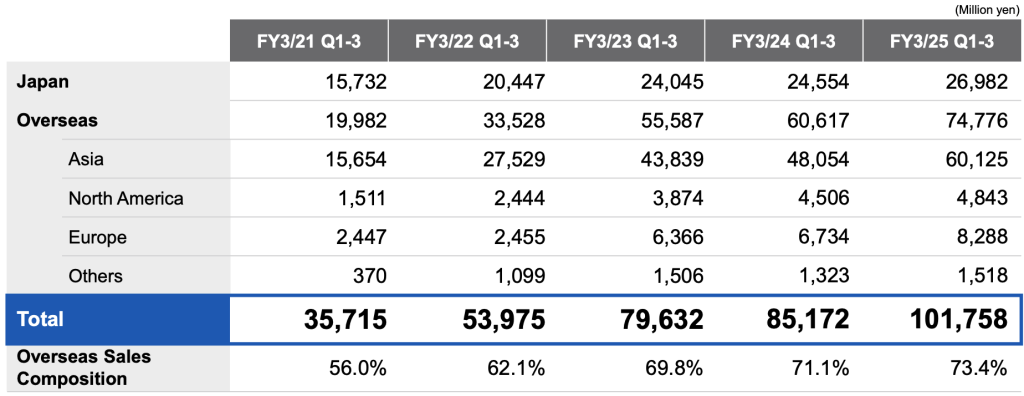

Japan Segment

Net sales in the domestic Japan market increased 11.4 percent year-over-year to ¥41,819 million in the YTD period. Operating income in the segment jumped 113 percent to ¥2,223 million for the nine-month year-to-date period.

Domestic sales in the Badminton category increased on the back of continued strong demand. Sales of racquets were said to be particularly strong in a wide price range. Within Tennis sales, racquets increased, but shoes declined, resulting in a slight decrease in overall tennis sales. Golf sales increased due to the increased attention to golf clubs, which resulted from Yonex athletes’ successes and new product launches.

In Overseas Distributors, sales of both Badminton and Tennis reportedly increased due to the positive effect of Yen depreciation. In Asian countries where badminton is popular, the market got a boost from the success of local athletes in international tournaments, with demand continuing to be strong.

Asia Segment

Net sales in the Asia segment grew 28.5 percent y/y to ¥50,502 million in the YTD period, and Operating Profit increased 32.4 percent yy/y to ¥7,955 million for the period.

In China, the Badminton market continues to be strong, and the success of the Chinese national team at the men’s and women’s national competitions (April/May) and the international sports events held in Paris afterward further energized the market. As a result, sales of badminton equipment, apparel, bags, etc., increased, leading to higher sales.

In Taiwan, the Badminton market continues to be solid. At the global quadrennial sports event in Paris, the Taiwanese men’s doubles pair claimed two consecutive gold medals, and the topic further energized the market.

North America Segment

Net sales in the North America segment improved 7.5 percent y/y to ¥4,843 million in the YTD period, and operating profit increased 48.4 percent y/y to ¥586 million, reportedly due to an increase in gross profit driven by higher sales and an improved gross profit margin, offsetting the rises in personnel and other SGA expenses.

Tennis sales in the segment reportedly grew due to improved market inventory levels and increased demand for our products, including favorable sales of our new racquets. In badminton, people continue to play actively, and sales increased in Q3, but sales decreased in the Q1-3 cumulative period from the impact of a sales decline in the H1. Overall, sales increased due to higher sales of tennis and the positive effect of yen depreciation.

Europe Segment

Net sales in the Europe segment increased 21.6 percent y/y to ¥4,097 million for the YTD period, driven by higher tennis sales and the Yen depreciation’s positive effect.

Yonex reported that its German and UK subsidiaries saw sales increase in tennis due to continued favorable demand for the company’s products. In badminton, participation level remained high, and sales increased mainly for racquets.

Gross profit increased due to higher sales; however, an increase in SG&A expenses, such as personnel expenses related to strengthening the organizational structure and advertising expenses to enhance marketing, exceeded the increase in gross profit, resulting in a decrease in operating profit.

Operating profit declined 5.3 percent y/y to ¥404 million for the period.

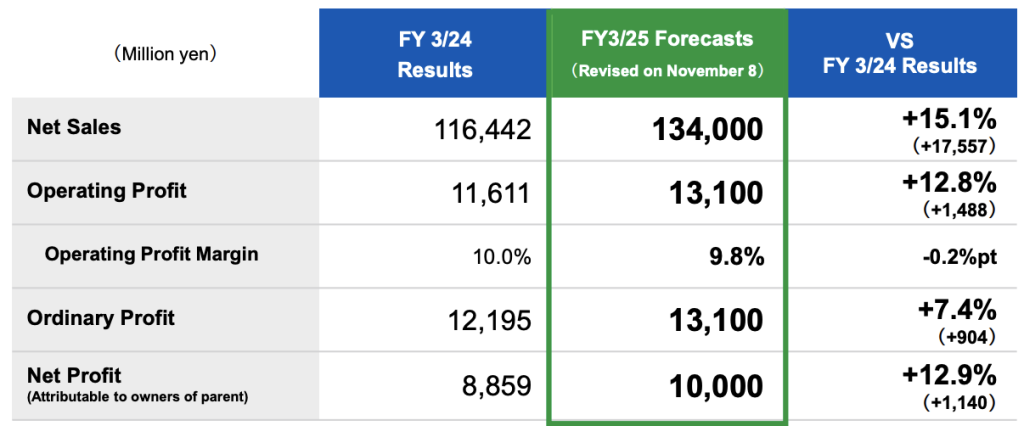

Fiscal Year Forecast

(12-month period ending March 31, 2025)

Image courtesy Yonex Company, Ltd.