Yonex Co., Ltd. reported that sports activity levels remained high in the company’s fiscal first half ended September 30 (H1, first half). To further stimulate market growth the company said it focused its efforts during the period on marketing campaigns that showcased international tournaments and leveraged the successes of Yonex athletes.

Badminton demand reportedly continued to trend solidly on the back of increased activity in China, the company’s biggest market, as well as in Japan, other Asian regions, and Europe.

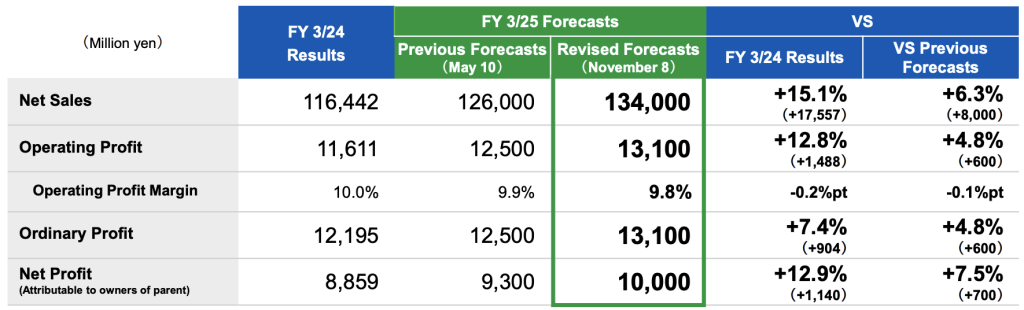

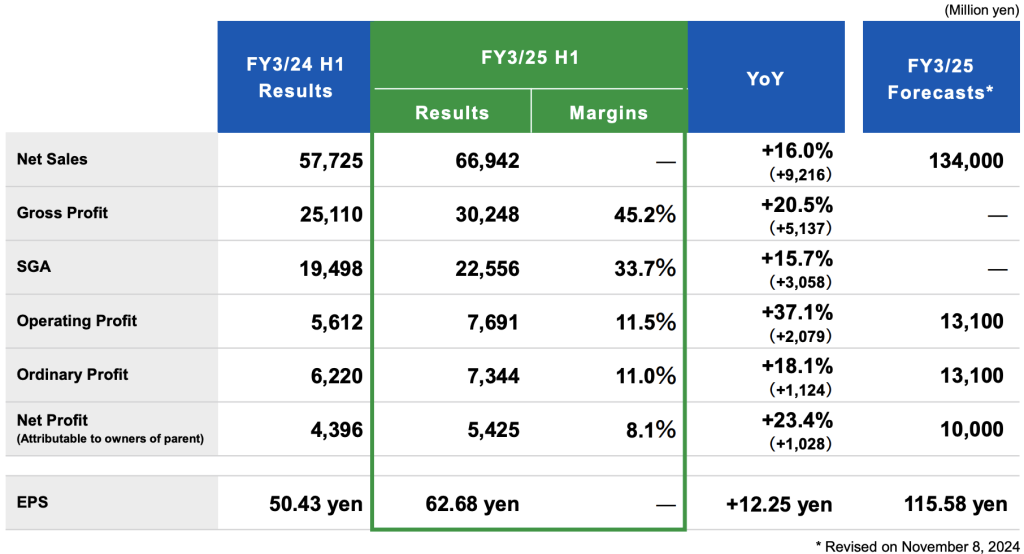

Consolidated net sales reportedly reached a record high for the cumulative H1 period, helped in part by the positive effect of yen

depreciation on overseas sales. Net sales increased 16.0 percent year-over-year for the first half to ¥66,942 million.

Gross profit increased due to a combination of higher sales and improved gross profit margin. These gains more than offset

the rise in SGA expenses, which included system-related expenditures for global IT reinforcement, depreciation costs, and

personnel expenses, as well as higher advertising costs from enhanced marketing efforts for international tournaments.

Operating profit amounted to ¥7.6 billion, a 37.1 percent year-over-year increase versus the fiscal H1 period last year.

In addition to increases in system-related expenditures linked to our global IT reinforcement efforts and advertising

expenses to fortify promotional activities for international tournaments, depreciation and personnel costs also increased.

Operating profit grew due to an increase in gross profit driven by higher sales and improvements in gross profit margin.

Operating profit reached a record high for the cumulative H1 period.

Segment Summary

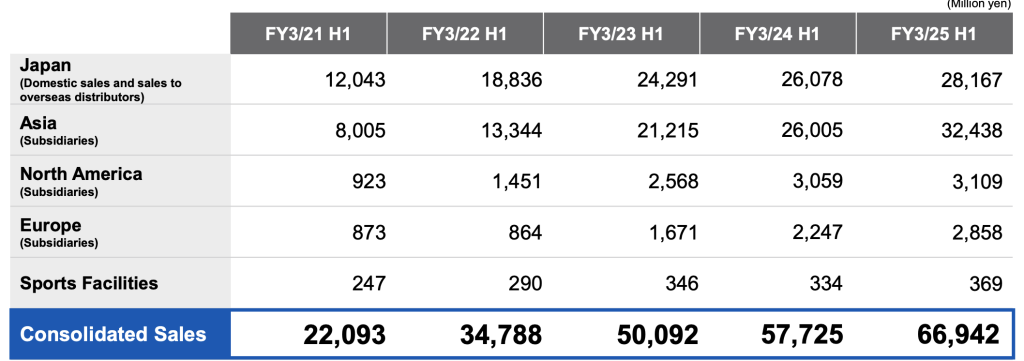

Japan Segment

Net sales in the Japan segment rose 8.0 percent year-over-year to ¥28,167 in the first half ended September 30.

On the Domestic Sales front, badminton category sales reportedly increased on the back of strong sales of racquets, supported by continued strong demand and the launch of a new model racquet in the second quarter. Although the company said tennis racquet sales also saw an uptick thanks to the favorable performance of a new model launched in September, overall tennis sales declined due to a slowdown in the robust demand observed in recent years.

At Overseas Distributors, badminton sales increased on the back of strong sales of racquets, supported by continued strong demand and the launch of a new model racquet in Q2. Although tennis racquet sales also saw an uptick thanks to the favorable performance of a new model launched in September, overall tennis sales reportedly declined due to a “slowdown in the robust demand observed in recent years.”

Japan segment operating profit jumped 91.4 percent year-over-year to ¥1,921 million yen in the first half. Gross profit increased, driven by higher sales and an improved gross profit margin resulting from revisions to international wholesale prices. Although SG&A expenses rose due to investments in IT systems, personnel, and global advertising and marketing activities, these increases were said to be offset by the increase in gross profit and allowed operating profit to rise.

Asia Segment

Net sales in the Asia segment increased 24.7 percent year-over-year to ¥32,438 million in the first half.

In China, Badminton demand remained solid, highlighted by strong sales from an online sales event in June, and strong sales of badminton equipment, apparel, and bags. The Chinese market was energized by the national badminton team’s double victories at the Thomas & Uber Cup held in April to May 2024.

In Taiwan, the badminton market continued to trend strongly, as demonstrated by the numerous open tournaments held throughout the season. Badminton equipment sales grew thanks to effective marketing campaigns that highlighted the successes of national athletes at international tournaments.

China segment operating profit increased 35.9 percent year-over-year to ¥5,070 million yen in the fiscal first half. The increase came despited increases in SG&A expenses due to higher advertising costs linked to marketing campaigns for international tournaments, and spending on both a new ERP system and personnel. However, these were more than offset by the increase in gross profit driven by higher sales, leading to an overall increase in operating profit.

North America Segment

Net sales in the North America segment inched up 1.6 percent to ¥3,109 million in the fiscal first half as tennis sales increased for both racquets and strings thanks to improving inventory levels and the successes of the brand’s grassroots activities. Badminton activities reportedly remained solid and racquet sales increased, but overall badminton equipment sales declined year-on-year, following the strong performance in the prior year, driven by post-COVID recovery demand. Overall sales increased due to the positive effect of yen depreciation.

Segment operating profit increased 13.2 percent to ¥329 million in the H1 period. The company said operating profit grew due to an increase in gross profit driven by higher sales and an improved gross profit margin resulting from a change in the sales mix, offsetting the rises in personnel and other SGA expenses.

Europe Segment

Net sales in the Europe segment rose 27.2 percent to ¥2,858 million in the first half.

In Germany, badminton sales increased, bolstered by the successes of international tournaments held in the first quarter. Tennis sales also saw an uptick, particularly in racquets, driven by effective initiatives to expand Yonex product demonstration opportunities.

In the UK, sales increased due to solid trends in both badminton and tennis markets, and UK due in part to the favorable effects of yen depreciation

Segment operating profit improved 11.6 percent year-over-year to ¥297 million as the rise in gross profit driven by higher sales and the favorable effect of yen depreciation offset the increase in personnel, advertising, and marketing expenses, resulting in higher operating profit.

Outlook

The company revised its earnings forecasts upward from those announced in May 2024 to reflect the solidly trending sports market and the increase in marketing investments aimed at expanding the Yonex fanbase.

Reasons for the Revision

During H1, both sales and profit exceeded the forecasts announced in May 2024, driven by robust demand for sports activities both in Japan and overseas, the stimulative effect of international tournaments on the market, and the favorable impact of yen depreciation on overseas sales.

The increase is based in part by the assumption that: 1) The sports market is expected to continue trending solidly; and 2) Yonex will increase marketing investments, leveraging the achievements of our athletes in international tournaments to broaden our fanbase.