Wolverine Worldwide (WWW) President and CEO Chris Hufnagel reported that after the company delivered sequential improvement in top line trends throughout 2024 and inflected to growth in the fourth quarter, the momentum continued to build into 2025.

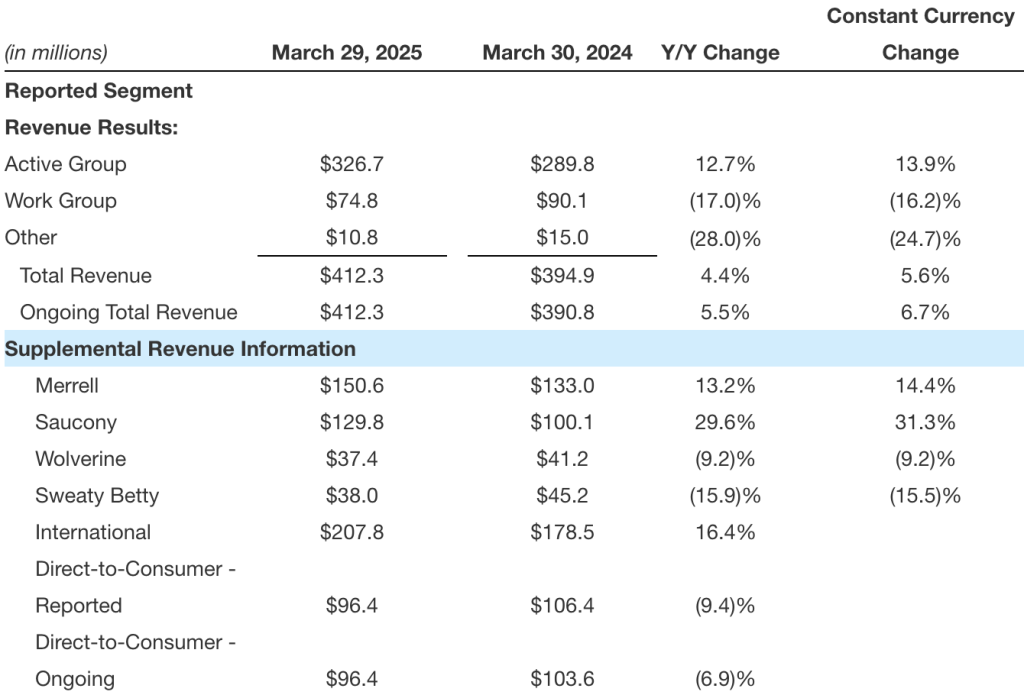

“First quarter revenue of $412 million was above our outlook of approximately $395 million,” added company CFO Taryn Miller. “The majority of the over-delivery was driven by increased demand in the Active Group and favorable foreign currency contributed $6 million. Constant-currency (cc) revenue growth for our ongoing business in the quarter was 6.7 percent versus the prior year and reflects increased demand for our brands and products as we execute our consumer-focused strategy.”

Miller said the year-over-year comparison includes $6 million of revenue in the first quarter of 2024 that did not repeat in Q1 2025 related to the Merrell Kids and Saucony Kids business model change.

“In the first quarter, we exceeded our expectations on just about every financial measure,” Hufnagel added. “Revenue grew by over 5 percent on an ongoing basis and nearly 7 percent on a constant-currency basis.” First quarter results were driven by the company’s two biggest brands: Saucony and Merrell.

“While we’ve made great strides in these [two] critical businesses, we have certain areas where we believe we can and should perform better, specifically the Wolverine brand and Sweaty Betty,” Hufnagel suggested.

Hufnagel said he was pleased with the progress the company made to inflect and now accelerate the growth of Merrell and Saucony through the fast and rigorous execution of WWW’s growth playbook.

“Our product pipelines are stronger. We’ve implemented a disciplined distribution strategy, while simultaneously cleaning up the marketplace. We’re beginning to build brand heat momentum through compelling new brand campaigns, key city activations, innovative collaborations and investments in retail marketing on the sales floor,” the CEO shared.

But he also cautioned that not everything was coming up roses for the company.

First Quarter 2025 Sales Summary

Active Group

Active Group revenue grew 13 percent year-over-year, which she said came in better than outlook for mid-single digit growth.

Saucony was said to be the primary driver for the beat, boasting 29.6 percent (+31.1 percent cc) year-over-year sales growth due to strong demand in both Performance Run and Lifestyle. Miller said the Triumph 22, Ride 18 and Guide 18 models, as well as the Endorphin franchise led the way for the quarter driving higher replenishment orders from the wholesale channel and elevated consumer demand on Saucony.com.

Editor’s Note: See link at bottom for more detailed SGB Media coverage of Saucony’ first quarter results and go forward plans.

Merrell revenue grew 13.2 percent (+14.4 percent cc) in the quarter with growth in core product franchises including Moab 3, Agility Peak 5 and Moab Speed 2.

“In the U.S., Merrell continue to take market share in its primary category of hike,” Hufnagel noted, citing third party market share source. He said in was the ninth time in the last 10 quarters.

He said the brand also also took share in trail running and lifestyle in the first quarter.

The brand improved gross margin by more than 200 basis points versus Q1 last year, driven in part by an increase in average selling price at U.S. retail, a strong quarter now comprising three consecutive quarters of growth and another proof point for the company’s biggest brand.

“Merrell’s recent performance is a direct result of our focus on modernizing the trail as a leader in the category,” Hufnagel said. “The brand initiated strategy with faster and lighter product innovation in core outdoor performance categories a little over a year ago, introducing award-winning collections like the Moab Speed two and Hike and Agility Peak five and trail-running, both of which have become significant franchises and continue to grow rapidly in the first quarter.”

He said to push product innovation to an even greater level, Merrell launched the “visually disruptive” SpeedARC Surge Boa in January, built on the brand’s new spear platform for “a uniquely comfortable ride with exceptional energy return, Hufnagel noted.

“It sold through almost entirely in a matter of a few months at a nearly $300 price point,” the CEO said.

In March, Merrell followed up with the launch of the SpeedARC Matis, the next iteration of the SpeedARC family, which is said to be driving healthy sell-through in just a few weeks in the market.

“Merrell continues to make progress in its lifestyle business as well, driving very strong double-digit growth in both men’s and women’s at U.S. retail in the first quarter and even faster growth in influential Tier Zero accounts, albeit on a smaller base, Hufnagel said.

He said brand continues to test and earn placement with strategic accounts to reach younger consumers, particularly women.

During the analyst Q&A session, Hufnagel was asked about the promotional cadence for the Merrell brand.

“I continue to get lots of promotional e-mails from Merrell,” one analyst said. “And you had a nice margin increase there, and it sounds like, it’s gaining some momentum.” But the analyst was asking how the promo piece jives with the new distribution for the brand and asked why they were seeing so many promotional e-mails from the brand.

“We are working hard to become a less promotional business,” Hufnagel responded. “Certainly, the factors over the last handful of years led the company to a place where we had to clear more for a whole variety of reasons. We are much cleaner today. Our brands are in a much better place today and we’re working to become a less promotional business.”

The CEO said that does not happen overnight but there is a period of time which they have to make that transition and the market is going to see that.

“I would anticipate a material increase across our portfolio and dropping those – that promotional cadence of e-mails – [and] at the same time improving our gross margins. But there will be a shift that has to take place,” Hufnagel continued.

From a DTC standpoint, the CEO said that for Merrell specifically in the first quarter it probably lagged a little bit of the other brands on a full price mix largely due to one style that was a little bit late getting into the distribution centers so the company could roll it out.

“So specifically, you will see us become less promotional,” Hufnagel wrapped up the answer. “That’s very true in the facts and it’s something that we’re talking about more broadly as an organization. I’m pleased with the progress we’ve made but it’s not going to happen in a quarter. But certainly as we get into the back half of this year and begin to lap next year, you should certainly feel it.”

Sweaty Betty revenue declined 16 percent in the quarter which was said to be “in line with expectations.” At Sweaty Betty, Hufnagel said they have been largely focused on better integrating and improving the profitability of the business, “prerequisite to building a healthier branded business.”

“While affinity for the brand is strong with a unique and differentiated position in the desirable category, we believe we must further bolster our premium position,” he said. “Whether the products we build, the stories we tell or how we manage the business each day. We’re focused on driving a less promotional business here at the expense of top line growth in the near term.”

He did note that Sweaty Betty’s first quarter gross margins were up nearly 1,000 basis points year-over-year, driven by improving the full price mix by approximately the same amount, with continued improvement in the first few weeks of the second quarter.

Hufnagel said they are encouraged by some of the early results they are seeing in acquiring new consumers under a more full-price strategy.

New consumer acquisition was said to be ahead of the internal plan in the first quarter, also noting that the lifetime value of the full-price consumer, on average, is 20 percent higher than consumers acquired through promotional tactics.

Sweaty Betty added a new talent to the brand over the past six months, most notably a new product chief and Hufnagel said they are chasing new products for the back half of this year targeting the holiday selling period.

“While not satisfied with our top line results, we have confidence in our strategy and we’re intently focused on building a stronger brand and business the right way,” Hufnagel summarized. “While the challenges and opportunities are different for Wolverine and Sweaty Betty, we believe they’ve been properly identified and we’re working at pace to get these businesses moving in a more positive direction.”

Work Group

Work Group revenue decreased 17 percent year-over-year in the quarter, which Miller said was somewhat below expectations. Approximately half of the decline was reportedly a result of a timing shift between the fourth quarter of 2024 and the first quarter of 2025.

“The other half of the decline relates to the non-repeat of significant discounting on certain styles from the prior year and challenges in our product offering which we are actively addressing. We expect Work Group performance to improve as new products go into market and inventory on key products is replenished,” Miller explained.

With the Wolverine brand, Hufnagel said they continue to work to find consistent footing.

While the brand’s Q4 results were reportedly strong, he reminded the call participants that he had cautioned on the Q4 call that the trends were still inconsistent in the business. He said the brand’s first quarter showed continued choppiness.

“Our efforts to strengthen soft spots in Western category and in Premium Work are gaining traction with new offerings like the Rancher Pro and Vantage,” the CEO offered. “However, the brand is comping against a period of significant discounting on certain styles last year, as we cleaned up our inventory position, a headwind which we anticipate will begin to dissipate as we move to the back half of the year.”

On a positive note, he said the brand’s year-over-year U.S. market share trend in the quarter “improved somewhat” and the DTC business was said to be “performing better.”

He noted that the company had initiated a search for new leadership for the Work Group, as Tom Kennedy is planning to retire later this year.

International

The total company International business increased 16.4 percent year-over-year.

Income Statement Summary

Hufnagel also noted that WWW achieved record Q1 gross margin, in part due to healthier brands and better inventory management, resulting in improved pricing power and a stronger full price business. He shared that it was the fourth time in the last five quarters that the company posted record gross margins.

“As a result, I’m pleased to report that earnings increased by more than 3x compared to last year. These results are another important proof point of our strategic direction and solid execution by our team,” he continued.

Adjusted gross margin amounted to 47.3 percent of net sales, an increase of 80 basis points compared to Q1 last year. Gross margins were said to come in above expectations and reflect a healthier sales mix lower promotional activity and the benefit of supply chain initiatives.

Adjusted operating margin of 6 percent increased 100 basis points compared to Q1 last year and exceeded the company’s outlook for the quarter driven by operating cost leverage on the stronger revenue performance.

As a result of the improvement in revenue and operating margin, adjusted diluted earnings per share improved from 5 cents in the first quarter of 2024 to 18 cents in 2025, beating the company’s outlook of 10 cents per share.

Net debt was $604 million down approximately $80 million year-over-year.

Outlook

“Confident in the progress we’ve made in transforming the company and informed by our stronger performance of the business, we exited the first quarter with an outlook, well on track to deliver our full year 2025 expectations, which called for solid revenue growth led by our biggest brands, meaningful profit improvement year-over-year and material investments in our brands and suite of new tools and capabilities,” Hufnagel shared.

“Unfortunately, significant uncertainty entered the equation on April 2, with the initial tariff proclamations, followed by the subsequent revisions,” he continued. “As we sit here today, it is difficult, if not impossible to predict the potential twist and turns in trade policies along with consumer sentiment and spending. Therefore, we were compelled to withdraw our full year guidance for 2025, a decision we did not take lightly but felt prudent given the dynamic situation. For what we can control I remain optimistic and bullish on our prospects.”

The CEO said the current order book and DTC trends support the top end of the previous full-year revenue outlook, “not to mention improving market share gains across most brands in the portfolio.” He said that overall demand trends for the company’s brands appear to be holding at this point.

“Sell-through at U.S. retail, for example, has remained strong throughout April and we’re getting similar reports from our international regions,” Hufnagel noted.

“For what we can control, we believe that we are well positioned to navigate the current challenges, thanks to momentum we generated, a strong and gritty team in a variety of strategic and operational advantages along with many actions already taken or in motion to mitigate the risk,” he said.

“Once we have better visibility regarding the tariff rates and their potential impact on our business and our consumers, we’ll be in a better position to return to providing a current fiscal year outlook,” CFO Miller suggested. “We believe this approach provides a clear and strategic view of our progress and performance and allows us to navigate the complexities effectively.”

Miller continued, “Based on current trends in the business, we are seeing the momentum we’ve built over the past several quarters continued into the second quarter. We expect the impact of higher tariffs to be more significant in the second half of 2025 than in the second quarter.”

She said they expect second quarter revenue to be in the range of $440 million to $450 million, a year-over-year increase of approximately 5 percent at the midpoint, or 4.6 percent on a constant-currency basis at the midpoint. The year-over-year comparison reportedly includes $2 million of revenue in the second quarter of 2024 that will not repeat this year related to the Merrell and Saucony Kids business model change.

“Regarding foreign currency, spot rates have shifted significantly since the beginning of the year with the U.S. dollar weakening against most currencies,” Miller noted. “While the current rates are favorable to our original outlook, we are closely monitoring the situation and expect continued volatility especially as the tariff situation evolves.”

She said that at the midpoint of the range, WWW expects Active Group revenue for the second quarter to grow high-single digits percentage year-over-year. Work Group revenue is expected to decline by a low-single digit percentage, reflecting a sequential improvement compared to the first quarter.

“We expect improvements in operating margin and earnings with second quarter adjusted operating margins of approximately 7.2 percent and adjusted diluted earnings per share of 19 cents to 24 cents, the CFO said.

Hufnagel said the company’s sourcing footprint is strategically diversified due to a very intentional evolution over the past several years. He noted that in 2019, nearly 40 percent of products sold in the U.S. were sourced through China. This year WWW now expects that to be just high-single digits, primarily related to the Work Group brands.

“Our supply chain is also nimbler today, enabling optimization across a mix of suppliers and factories in some cases leveraging dual sourcing of franchises to maximize flexibility,” he shared “Importantly, we’ve invested in developing our relationship with our key supply chain partners over the last couple of years through annual summits and close strategic partnership and planning.”

He added the the company benefited greatly from appointing an industry veteran as our chief global supply chain officer a little over a year ago.

“On the commercial side, our business is truly global with our brands being sold in approximately 170 countries and territories around the world through an asset-light model powered largely through wholesale and distributor partnerships,” Hufnagel detailed. “As on the sourcing side, we focus considerable effort on continuing to strengthen these relationships over the past 18 months, engaging in top-to-top meetings, hosting our key partners here on campus and more regularly visiting important markets around the world.”

He said the business is strong and growing outside the U.S., up mid-teens year-over-year in the first quarter with a good outlook for the balance of the year.

Hufnagel said they have a solid plan to protect profitability, while also working to protect the momentum we generated across a range of model scenarios.

“Our approach consists of three components: mitigate, navigate and elevate,” he said. “To mitigate the impact of tariffs and deliver the products our consumers want at the best possible value, we’ve initiated a holistic balance set of actions across the entire value chain.”

He said they have taken the playbook from the turnaround stabilization efforts over the past 21 months and applied every learning to this new reality.

“This new muscle we built will serve us well in the days and weeks and months ahead,” the CEO said. “Despite the challenges, we are viewing that the shifting landscape [is] also as an opportunity to elevate and emerge a better and stronger company. We intend to proceed with our highest priority growth investments to accelerate share gains in certain areas and at the same time scrutinizes every expense. As in any difficult situation, there will inevitably be winners and losers. It’s our responsibility to be among the former.”

Image courtesy Sweaty Betty/ Wolverine Worldwide, Inc.