Wilson Sport’s parent company, Amer Sports, reported that its Ball & Racquet Sports segment returned to growth in the second quarter, reportedly driven by improving sell-in to the retail channel. The Wilson business was busy in the quarter with preparations for the Olympics but found time to attach its brand to one of the biggest shooting stars in the sports world today by inking a sponsorship deal with WNBA rookie star Caitlin Clark.

The company is also bullish on the brand’s tennis business, especially in China, where there are a few superstars in the racquet sports world to complement Roger Federer, the brand’s core tennis athlete.

“While still in its early stages, our tennis 360 strategy is proving to be a key driver for the Wilson franchise led by apparel and footwear growth, accelerating expansion of Wilson tennis-360 shops in China, and key new product launches,” shared Amer Sports CEO James Zheng. “We are particularly excited that Roger Federer is back and active with the Wilson brand again. Roger will have his own line of premium performance racquets, bags and accessories at Wilson called the RF, which launched on his birthday, August 8. As you know, Roger is a living legend in tennis, and this new product line has been met with a very enthusiastic response from the market.”

Zheng said that Wilson is also launching the first tennis shoe designed for female tennis players, called the Intrigue. The shoe reportedly combines the comfort and support of modern foam technology without losing the lateral stability required to play the game. “Our 360 tennis athlete Marta Kostyuk will wear it for the first time in the U.S. Open later this month,” Zheng noted.

The CEO also said Wilson tennis and Wilson China had a big moment during the Summer Olympics when Qinwen Zheng won Gold playing with a Wilson racquet. “This feat did not go unnoticed in her home country, as sales of Wilson racquets rose 2,000 percent that day,” Zheng said, emphasizing that there are currently 19 million tennis participants in Greater China.

“Last but not least, Caitlin Clark is also elevating brand heat as the face of Wilson Basketball,” he added. “Her signature basketball collection, sold exclusively online, sold out in record time. And we expect our Caitlin Clark franchise to accelerate in H2 with the launch in select wholesale accounts.”

Ball & Racquet Sports revenue increased 1 percent to $283 million in the second quarter as Wilson returned to growth, as the company expected after a double-digit decline in Q1, driven by improving wholesale sell-in.

Golf also returned to growth driven by the Americas and EMEA, led by premium clubs,” shared Amer Sports CFO Andrew Page. The growth in sportswear, racquets and golf was partly offset by declines in baseball and inflatables.

The The Ball & Racquet Sports segment’s adjusted operating profit margin contracted 160 basis points to 1.1 percent of sales in Q2, compared to the second quarter of 2023.

“This margin compression was due to SG&A deleverage, which was driven by retail investments in the U.S., China and Korea, Footwear & apparel investments and timing of advertising and promotion spend,” Page offered. “Generating consistent margin performance is a key management priority for Ball & Racquet given its low-single-digit growth profile.”

Page said the company was pleased by its lean inventory position in Ball & Racquet Sports, which is down significantly compared to last year. He said it positions the segment well for improved profitability in the second half, especially in the fourth quarter when Wilson cycles against high discounts last year and faces its easiest comparison year-over-year, but also due to the strength of the new product pipeline.

Segment Outlook

Looking ahead, Ball & Racquet Sports segment revenue growth is seen in the low– to mid-single-digit range for the year, generating low- to mid-single-digit segment operating margin in 2024.

Consolidated Amer Sports Results

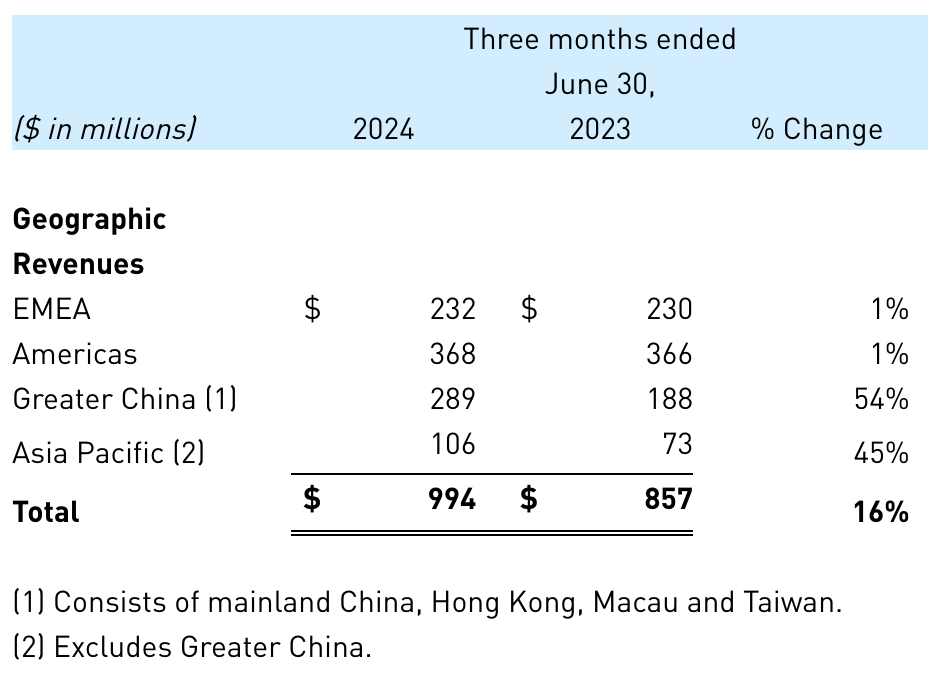

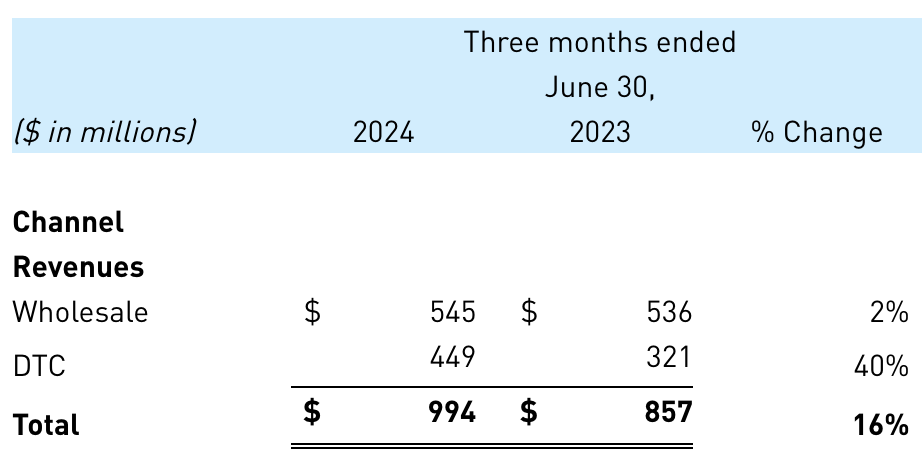

On a consolidated basis, Amer Sports, Inc. reported that second-quarter revenue increased 16 percent to $994 million and increased 18 percent year-over-year on a constant currency (cc) basis.

“We generated 16.0 percent sales growth in Q2, or plus-18 percent on a constant currency basis led by our flagship brand, Arc’teryx,” concluded CEO Zheng. “Although we benefited from a 2-point shift of wholesale shipments from 3Q into 2Q, our underlying growth momentum is clear. We achieved nearly a 3 percent adjusted operating margin, also well above our expectations, as we continue to enjoy strong gross margin expansion driven by the pricing power of our brands and a healthy mix-shift toward our highest-margin franchise, Arc’teryx.”

Region Summary

Segment Summary

Technical Apparel, which primarily includes the Arc’teryx brand business, increased 34 percent (+38 percent cc) to $407 million in the second quarter, reflecting an omni-comp growth of 26 percent on top of the 80 percent omni-comp growth in Q2 last year. Omni-comp trends reflect the year-over-year revenue growth from owned retail stores and e-commerce sites open for at least 13 months.

Go Here for more details on Q2 performance for Arc’teryx.

Outdoor Performance, which is primarily comprised of Salomon brand sales with 66 percent of total sales, increased 11 percent (+13 percent cc) to $304 million. Outdoor Performance operating margins increased 380 basis points to negative 2.1 percent of sales in the quarter.

Go Here for more details on Salomon’s second quarter.

Channel Summary

Income Statement Summary

Gross margin increased 220 basis points to 55.5 percent; Adjusted gross margin increased 200 basis points to 55.8 percent.

Selling, general and administrative (SG&A) expenses increased 26 percent to $560 million in Q2, with Adjusted SG&A expenses increased 21 percent to $526 million for the period.

Operating loss for the quarter was $9 million compared to operating profit of $8 million for the second quarter 2023. Adjusted operating profit increased 40 percent to $29 million for Q2.

Operating margin decreased 180 basis points to negative 0.9 percent, with expansion in the Arc’teryx business offsetting weakness in the Salomon and Wilson Sports businesses. Adjusted operating margin increased 50 basis points to 2.9 percent of sales for the quarter.

In the quarter, the company’s net loss decreased 98 percent to $4 million, or a loss of one cent per diluted share. Adjusted net income increased 129 percent to $25 million, or 5 cents diluted earnings per share, in Q2, compared to a net loss in Q2 2023.

In the second quarter, Amer Sports recognized an incremental tax benefit of $20 million related primarily to the resolution of uncertain tax positions, which benefited Q2 diluted EPS by approximately 4 cents per share. Additionally, approximately $20 million of wholesale orders shipped earlier than anticipated, which benefited Q2 sales growth by approximately 2 percent and diluted EPS by 1 cent per share. These timing shifts do not impact the full-year guidance.

Balance Sheet Summary

Inventories increased 2 percent year-over-year, below the 16 percent revenue growth for the quarter and are said to be in a healthy position.

“Our focus on inventory discipline is paying off as inventories finished Q2 in healthy condition, up only 2 percent year-over-year vs. 16 percent sales growth. Within our target to grow inventories in line with, or slower than, sales,” Page noted.

Net Debt was $1.820 billion at quarter-end, and Cash and equivalents totaled $256 million at June 30, 2024.

“Using the midpoint of our 2024 implied adjusted operating profit guidance, our net-debt-to-adjusted-non-IFRS-EBITDA ratio is already approximately 2.6x,” Page explained. “Deleveraging our balance sheet remains a priority, and our goal is to reduce our leverage ratio to 1.5x or better over the next few years through both EBITDA expansion AND debt pay down.”

Outlook

Digging into the outlook, CFO Page said, “Our strong financial performance in Q2 reinforces my confidence in our near- and long-term path forward. Organic revenue growth in the high-teens and significant gross- and operating-margin expansion reflect the combination of great brands, strong management execution, and a disciplined approach to expenses and working capital. These outstanding results give us the confidence to raise our full-year sales and earnings guidance.”

Zheng is confident in the company’s forecast in part because of its focus on China growth, a concern for some analysts that fear the slow-down in that market could have negative implications for Amer, and Arc’teryx in particular, due to its reliance on that market. But the CEO tackled that question head-on.

“While other consumer companies are having challenges in Greater China, we generated more than 50 percent growth there as we continue to well outperform the market. Importantly, we are seeing strong momentum across all of our Big 3 brands,” Zheng noted.

“A few reasons I would like to highlight why we are doing so well in China:

“Number one: Our brands compete in one of the healthiest and fastest-growing consumer segments in China: the premium sports and outdoor market. The outdoor trend in China is very strong. Even beyond the traditional male consumer, the outdoor category is attracting younger consumers and female consumers, and we also see more luxury shoppers spending in our categories.

“Second: The China consumer landscape today has evolved into a market of winners & losers, with some brands doing extremely well and others underperforming. Our still small, specialized brands with deep expertise and high quality and performance resonate strongly with Chinese shoppers.

“Thirdly and most importantly, We believe we have the best team in China. Our deep expertise and unique, scalable operating platform gives us a significant competitive advantage across the portfolio,” he concluded.

Full-Year 2024

For the full year, Amer Sports now expects revenue growth of 15 percent to 17 percent which incorporates greater than 30 percent growth in Technical Apparel, mid- to high-single-digit revenue growth in Outdoor Performance, and low- to mid-single-digit growth in Ball & Racquet Sports.

“We are increasing our adjusted gross profit margin guidance from approximately 54.0 percent to approximately 54.5 percent,” Page said. “We also are raising our guidance for our full-year operating margin and now expect adjusted operating margin toward the high-end of our previous 10.5 percent to 11.0 percent range.”

On an adjusted basis, Amer Sports sees Full Year 2024 as follows:

- Reported revenue growth: 15 percent to 17 percent

- Gross margin: approximately 54.5 percent

- Operating margin: toward the high end of 10.5 percent to 11.0 percent

- D&A: approximately $250 million, including roughly $110 million of ROU depreciation

- Net finance cost: $200 – $220 million, including approximately $15 million of finance costs in the first quarter 2024, that will not be recurring

- Effective tax rate: approximately 38 percent

- Fully diluted share count: 500 million

- Fully diluted EPS: 40 cents to 44 cents per share

Third Quarter 2024

Amer Sports expects third-quarter consolidated revenue to grow 12 percent to 13 percent, led by Technical Apparel.

“A reminder that in Q3, we will face our most challenging growth comparison of the year,” Page noted. “We expect Q3 adjusted gross margin to be approximately 54 percent driven primarily by the mix shift towards Technical Apparel, and an adjusted operating margin between 11.0 and 12.0 percent.”

On an adjusted basis, Amer Sports sees Third Quarter 2024 as follows:

- Reported revenue growth: 12 percent to 13 percent

- Gross margin: approximately 54.0 percent

- Operating margin: 11.0 percent to 12.0 percent

- Net finance cost: $45 million to $50 million

- Effective tax rate: 50 percent to 55 percent

- Fully diluted share count: 510 million

- Fully diluted EPS: 8 cents to 10 cents per share

Image courtesy Wilson Sports