New Era’s key manufacturing partner, Mainland Headwear Holdings Limited (Group), reported that the Group’s revenue for 2024 totaled HK$1.47 billion, compared to HK$1.42 billion in the prior year.

Gross profit was down 4.4 percent to HK$455.5 million in 2024, compared to HK$476.4 in 2023. Gross profit margin narrowed by 270 basis points to 30.9 percent of net sales for the year, compared to 33.6 percent in 2023.

Profit attributable to shareholders amounted to HK$57.1 million in 2024, down 51.6 percent from HK$117.9 million in 2023, due primarily to lower revenues and a wider operating loss in the Group’s Trading business.

Mainland Headwear Holdings, Ltd reports in the Hong Kong dollar (HK$) currency.

The Mainland Headwear Board recommended a final dividend of HK 5 cents per share for the year ended December 31, 2024, down from the HK 6 cents final dividend in 2023. Together with the interim dividend of HK 3 cents per share, the total dividend for the year amounted to HK 8 cents.

The Group reported maintaining a healthy financial position with stable operating cash flows. It also held cash on hand and unutilized banking facilities, amounting to approximately HK$191.8 million and HK$750.0 million, respectively, at year-end 2024.

Segment Summary

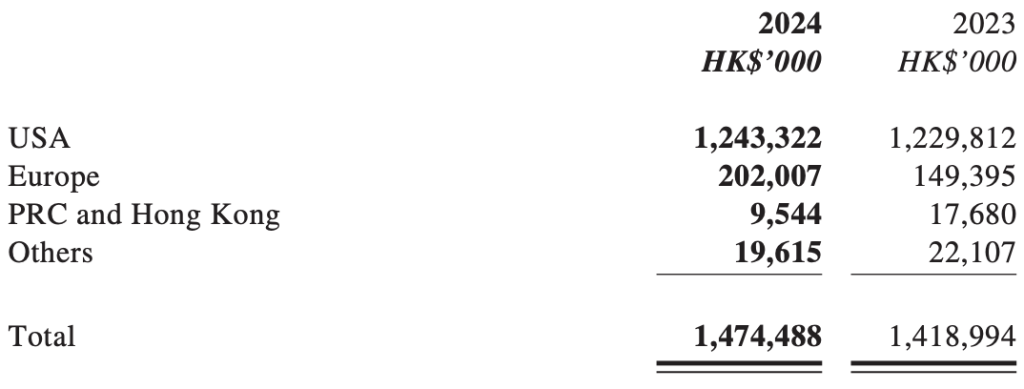

The Group’s revenue from external customers is divided into the following geographical areas based on the location of the customers.

Full-year 2024 revenue derived from the Group’s largest customer (who is a group of affiliated companies of a shareholder) amounted to HK$644.4 million or 43.7 percent of the Group’s revenue in 2024, compared to HK$598.7 million, or 42.2 percent, in 2023. These revenues were attributable to the Manufacturing Business.

Manufacturing Business

As one of the few manufacturers in the headwear market capable of quick production and delivery, the Group operates factories in Bangladesh, Mexico and Mainland China, with each plant complementing the strengths of the others. Leveraging advanced automated production equipment and many skilled workers, the Bangladesh factory can produce 6.5 million pieces of headwear and 300,000 pieces of accessories, such as belts, wallets, and backpacks, per month. The Mexican factory, completed at the end of 2023, boasts the geographical advantage of being close to the U.S. market and thus can quickly respond to North American customers. After months of training staff and adjusting production workflow, the plant is expected to produce up to 1,000,000 pieces of headwear products a month by the end of 2025. As for the Shenzhen factory, it focuses on design, product development and production support of the Group.

Although Europe and the U.S. face uncertainties, such as the continuing Russia-Ukraine war and slowing economic growth, the procurement market has shown signs of recovery during the year. With the inventory backlog accumulated in previous years nearly fully cleared, buyers have reportedly resumed placing large orders. The Group said it could secure substantial orders and its manufacturing business grew.

Revenue from the Group’s Manufacturing business was HK$931.8 million for 2024, a 13.4 percent increase from the HK$821.8 million produced in 2023. Segment revenue accounted for 63.2 percent of the Group’s total revenue in 2024, compared to 57.9 percent in 2023.

The segment’s operating profit grew 2.0 percent year-over-year to HK$190.6 million, compared to HK$186.9 million in 2023.

During the year, the Group’s Bangladesh factory received a large number of orders for headwear products and began producing accessories such as wallets, belts and backpacks to be sold by the Trading business. As production expanded, so did the factory’s economies of scale and its gross profit margin. Bangladesh factory operating profit rose 15.2 percent year-over-year to HK$194.6 million in 2024, compared to HK$169.0 in 2023.

As for the Mexico factory, which was still in the early production stage, the Group increased investment in technical support, staff training and management and gradually worked on optimizing production processes to improve production efficiency.

The Shenzhen factory scaled down and incurred a one-off labor optimization cost from adjusting personnel deployment. During the year, the Mexico and Shenzhen factories recorded operating losses of HK$71.0 million, compared to an operating loss of HK$36.1 million in 2023.

At year-end, the Bangladesh factory had approximately 7,400 employees, and the Mexico and Shenzhen factories had approximately 490 employees and 120 employees, respectively.

Trading Business

The Group’s Trading business focuses on distributing headwear and accessories, including wallets, belts and backpacks, in the European and American markets. To expand its market coverage and enrich its product portfolio, the Group implemented several strategic initiatives during the year, including acquiring a property in Missouri as a warehouse, and 55 percent equity interests in a Dutch-licensed product development company with extensive experience in brand development and distribution of consumer products, to complement the operations of its other subsidiaries and create stronger synergies.

However, competition in the retail market intensified during the year, as many sportswear brands promoted their products in “U.S. hypermarkets,” putting pressure on the Group’s sales. In addition, some long-term retail customers suspended ordering, further affecting the Group’s sales performance. Despite adding in sales from the acquired Dutch company, revenue from the Trading business dropped 9.1 percent year-over-year to HK$542.7 million, compared to HK$597.2 million in 2023, constituting 36.8 percent of the Group’s total revenue.

The Trading business continued to actively manage its budget during the year, but with distribution costs remaining high, its gross profit margin shrank by 2.0 percentage points year-over-year. In addition, with the Group having to make provision for the inventory of its e-commerce business and assume an attributable operating loss from the acquired Dutch company, the Trading segment recorded an operating loss of HK$95.4 million, compared to an operating loss of HK$56.6 million in 2023.

Prospects

Looking ahead, the Group said international rivalry and challenges in the operating environment would continue.

“The United States frequently changing its tariff measures will also add uncertainties to global trade,” company Chairman Ngan Hei Keung noted. “Nevertheless, the Group remains cautiously optimistic about its prospects. With inventory near[ly] all digested in Europe and the United States, customers have increased procurement and are actively placing orders again. The Group will continue to optimize its business layout, promote synergistic development of its various businesses and grasp opportunities in the changing market.”

For the Manufacturing business, the Group said it will continue to improve its operations and production efficiency. After initial employee training and work process optimization at the Mexico factory, the production of basic style products has stabilized. A plan is in place to start “putting out high-end products in the second quarter of 2025.”

Based on production progress at the plant and existing orders, the Group expects to see a significant improvement in the operational efficiency of the factory in 2025.

Interestingly, there was no mention of U.S./Mexico tariffs in the company’s Annual Report or summary. With more production moving south of the border for Mainland and New Era (presumably), that push to increase shipments in the second quarter could eat into company margins as tariffs will hit in April after a 30-day delay.

Moreover, to mitigate geopolitical risks, the Group plans to expand its production footprint further and add production lines in Cambodia. It expects to lease a factory and start producing headwear products in Cambodia in the second half of 2025, putting out approximately 450,000 pieces of headwear a month. Leveraging the country’s relatively affordable labor costs and geographical advantage, the new production lines will handle orders from European and US customers who need to adjust and shift their supply chains to regions outside Mainland China; as such, it can enhance the Group’s overall competitiveness in the global manufacturing market.

As for the Trading business, the Group said it will capitalize on the licensed product development strengths of the Dutch company it acquired to expand its market coverage from existing regions in Europe and the United States to the Middle East and Africa, aiming to obtain more brand licenses to broaden its revenue sources.

“Although the Group still needs to bear the loss attributable to the Dutch company in 2025, it believes, by integrating the resources of this new company and other subsidiaries of the trading segment, it will be able to unearth the potential demand in cross-regional markets, and the trading segment will realize sales and profit growth in the medium to long term. The Group will continue to refine its marketing strategies and strengthen cooperation and communication with retail customers to consolidate its leadership in the trading industry,” the company said in its report summary.

The Group said it is also conducting a comprehensive assessment regarding building a duty-free zone in the Mexican industrial park, analyzing the changes in political and economic situations and the synergies a cross-border supply chain may bring. It has already filed related applications with the local government.

At the same time, the Group said it will continue to implement various cost control measures and streamline its operating structure to reduce expenses. The Missouri warehouse in the U.S., which has been in use since the first quarter of 2025, has not only helped the Group save rental expenses for office and warehouse space but also provided room for it to improve operational efficiency and meet the needs of the trading business to develop.

Liquidity and Financial Resources

The Group had cash and cash equivalents, short-term deposits and a portfolio of liquid investments totaling HK$196.0 million (2023: HK$331.0 million) at year-end 2024. About 44.8 percent, 16.9 percent, and 12.7 percent of these liquid funds were denominated in U.S. dollars, Renminbi and Hong Kong dollars, respectively, and the remaining were mainly in Mexican Peso, Bangladesh Taka and Pound Sterling.

As at December 31, 2024, the Group had banking facilities of HK$905.4 million (2023: HK$842.7 million), of which HK$750.6 million (2023: HK$733.7 million) was not utilized.

The borrowings over equity ratio of the Group was 16.9 percent (2023: 13.8 percent). Given the strong financial and liquidity position, the Group has sufficient financial resources to meet its commitments and working capital requirements.

Capital Expenditures

During the year, the Group reportedly incurred approximately HK$33.4 million to add plant and equipment to upgrade its manufacturing capability and expand in the Mexico and Bangladesh factories. The Group invested HK$145.4 million in 2023. The Group incurred HK$134.1 million on acquiring and renovating a warehouse in Missouri in the U.S. The Group also incurred HK$4.3 million (2023: HK$2.3 million) on equipment and systems of the Trading business.

The Group budgeted HK$152.6 million for capital expenditures in 2025, of which HK$145.8 million is estimated to be used to construct a warehouse and dormitory in Mexico and expand in Bangladesh and Cambodia under the Manufacturing business. The Group also authorized a capital commitment of HK$6.8 million for the equipment upgrades for the Trading business.

The above capital expenditure is expected to be financed by the internal resources of the Group and its banking facilities.

Acquisition of Subsidiary

Pursuant to an agreement signed between Sharp Assets Limited, a wholly-owned subsidiary of the company, and the sole shareholder of Difuzed B.V., Sharp Assets acquired 55 percent of the issued share capital of Difuzed at a cash consideration of €5 million, or about HK$43.1 million.

Upon completion of the acquisition on August 23, 2024, Difuzed became a 55 percent-owned subsidiary of the Group.

Exchange Risk

Most of the Group’s assets and liabilities are denominated in Hong Kong dollars, U.S. dollars, Renminbi, Bangladesh Taka, or Mexican pesos. The Group estimates that any 1 percent appreciation of the Bangladesh Taka would reduce the gross margin of the Manufacturing business by roughly 0.25 percent. Any 1 percent appreciation of other currencies would have an insignificant impact on the gross margin of the Manufacturing business.

Image courtesy New Era