The Vista Outdoor, Inc. Board of Directors said in a new media statement that it has been conducting a thorough process with financial and legal advisors to evaluate all strategic alternatives for its businesses in response to stockholder feedback.

“We are pleased to report that the Board’s process has yielded significant value for our stockholders,” the Board said in the statement, stating that they take seriously their duty to maximize value for stockholders.

The Board said that, after extensive diligence, Czechoslovak Group a.s. (CSG) has agreed to make a significant investment in Vista’s Revelyst outdoor products segment, which the Board said will deliver increased cash consideration to stockholders. CSG had previously only considered acquiring Vista’s The Kinetic Group, the company’s ammunition-related segment.

On September 12, the company entered into an amendment to the merger agreement with CSG in which the Czech firearms and ammunition maker had agreed to purchase shares representing 7.5 percent of standalone Revelyst for $150 million at a price of approximately $31 per Revelyst share, valuing Revelyst at $2.0 billion.

Vista Outdoor noted that the company’s Gear Up transformation program delivers value that is aligned with prior guidance. The company also stated that Revelyst continues to gain market share in key categories and is on track to double Adjusted EBITDA sequentially for the quarter and for the full year.

Revelyst includes three sub-segments:

- The Adventure Sports platform includes the Fox Racing, Bell, Giro, CamelBak, QuietKat, and Blackburn brands;

- The Outdoor Performance platform includes the Simms, Bushnell, Blackhawk, Stone Glacier, Camp Chef, and Primos brands; and

- The Precision Sports and Technology platform includes the Foresight Sports, Bushnell Golf, and Pinseeker brands.

The $150 million of cash payable by CSG for the purchase of Revelyst shares plus additional cash from Vista Outdoor’s balance sheet will be returned to Vista Outdoor stockholders, increasing the cash consideration payable in the Revised CSG Transaction by $4 per share to $28 per share.

At the closing of the Revised CSG Transaction, Vista Outdoor stockholders will receive $28 in cash per share and one share of Revelyst common stock for each share of Vista Outdoor common stock.

After closing the CSG Transaction, Revelyst plans to establish an initial $50 million share repurchase program.

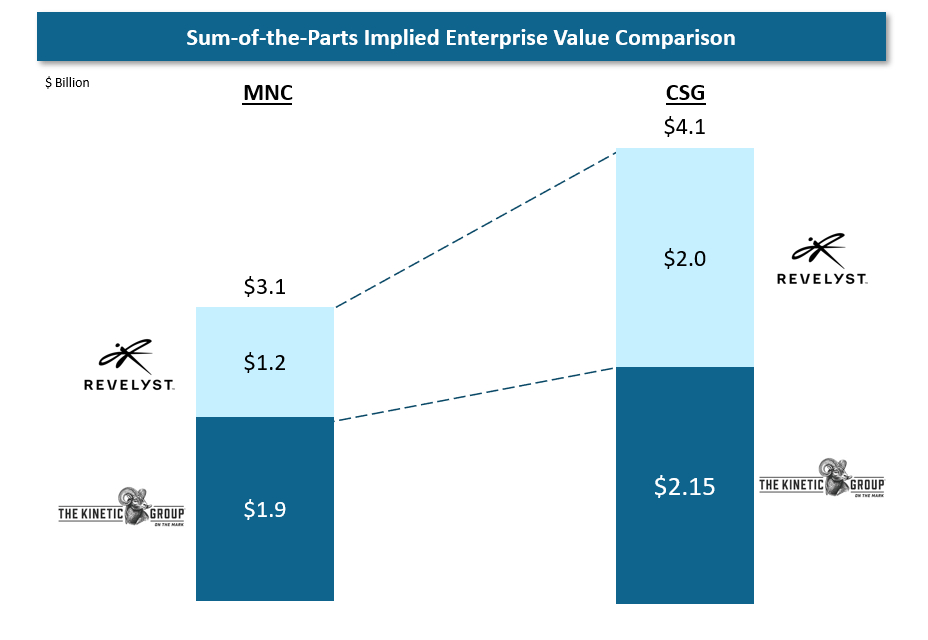

The Board noted that the MNC Revised Proposal received last weekend (see SGB Media coverage below) significantly undervalues The Kinetic Group and Revelyst compared to the Revised CSG Transaction.

“On September 6, we received a revised proposal from MNC to acquire the [total] company for $43 in cash per share (the “MNC Revised Proposal”). Documentation delivered to the Board in connection with the MNC Revised Proposal implies a value of ~$1.9 billion for The Kinetic Group and ~$1.2 billion for Revelyst. In comparison, the Revised CSG Transaction represents a value of $2.15 billion for The Kinetic Group and an investment in Revelyst at a value of $2.0 billion,” the Board stated on Friday, September 13.

“We have engaged extensively with MNC, accommodated MNC’s diligence requests, and provided access to management. MNC has publicly confirmed that it completed its diligence,” the Board continued.

The company noted that the MNC Revised Proposal does not increase enterprise value compared to MNC’s prior proposal when considering Vista Outdoor’s cash generated and lower net debt; however, the company said it would continue to engage constructively with MNC and urge MNC to deliver its best and final proposal as soon as possible.

Conflict of Interest?

The Board said that Gates Capital Management, Inc., the company’s second-largest stockholder, is a conflicted party. Vista’s Board recently learned that Gates Capital is included in MNC’s equity consortium.

“Given its involvement with MNC, Gates Capital’s public expression in favor of MNC’s proposal reflects a bias and conflict of interest,” The Board stated. “Consequently, Gates Capital’s interests are not aligned with those of other Vista Outdoor stockholders. We urge stockholders to make their own informed decision based on the valuation differential between the Revised CSG Transaction and the MNC Revised Proposal.”

The Board continued in its statement that it is, and has always been, “committed to maximizing value for all Vista Outdoor stockholders and remains open to opportunities that achieve this goal.” The Board said it continues to recommend that Vista Outdoor stockholders vote in favor of the proposal to adopt the merger agreement with CSG at the special meeting of stockholders, which will be held at 9:00 a.m. (CT) on September 27, 2024.

Morgan Stanley & Co. LLC is acting as Vista Outdoor’s sole financial adviser, and Cravath, Swaine & Moore LLP is acting as its legal adviser. Moelis & Company LLC is the sole financial adviser to the independent directors of Vista Outdoor, and Gibson, Dunn & Crutcher LLP is legal adviser to the independent directors of Vista Outdoor.

Image and graphic courtesy Vista Outdoor

***

See below for additional SGB Media coverage of the MNC Revised Proposal

EXEC: Vista Outdoor Confirms New $3.3M Bid; Adjourns Stockholder Meeting (Update)