Goldman Sachs upgraded its stock rating on VF Corp. to “Buy” from “Sell” as the investment firm believes strategic actions, including overhauling Vans’ management team, have improved VF’s outlook for profitability.

“VFC’s revenue and earnings trajectory has underperformed the market, but we believe the stock is nearing an inflection point with the balance of catalysts for the stock now weighted to the upside,” wrote Goldman analyst Brooke Roach on Friday. “Negative catalysts are increasingly in the rearview mirror, including well-appreciated Vans weakness and wholesale inventory rebalancing, a right-sized dividend, and unexpected CEO/management turnover.”

Roach noted that since Goldman placed its “Sell” rating on VF Corp. on July 14, 2021, the company’s shares fell 73 percent, significantly underperforming the 35 percent average decline in the analyst’s team’s overall stock coverage during the period as well as the 5 percent decline in the S&P 500.

Looking ahead, Roach noted confidence in VF’s strategic initiatives to improve execution and drive relative outperformance in the stock. She added, “In particular, we see potential upside from the following: (1)A sequentially stronger new product innovation pipeline at Vans, which, combined with better retail merchandising and wholesale distribution optimization, should help stem declines in North America revenues; (2) Enhanced operational focus, with better inventory management and cost control delivering stronger FCF [free cash flow] in FY24; (3) Strategic optionality from new management, where we highlight VFC is in talks to find a new permanent CEO and has recently appointed new leaders at Vans, Dickies, and emerging brands; (4) China reopening; and (5) Balance sheet deleveraging.”

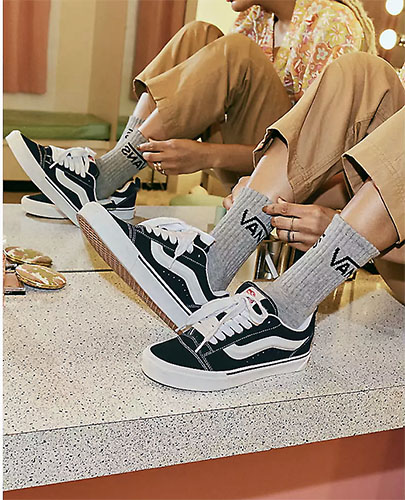

On Vans, Roach noted that new brand management, led by the return of Kevin Bailey as Vans president, chief product/merchandising officer and chief digital officer, had begun to influence product and merchandising, which “is likely to drive greenshoots in the brand in FY24 and help stabilize the business in North America. This is evidenced by Vans new product YTD, first observed with the Knu Skool Shoe, shown right,in March, which has quickly become a bestseller.”

On Vans, Roach noted that new brand management, led by the return of Kevin Bailey as Vans president, chief product/merchandising officer and chief digital officer, had begun to influence product and merchandising, which “is likely to drive greenshoots in the brand in FY24 and help stabilize the business in North America. This is evidenced by Vans new product YTD, first observed with the Knu Skool Shoe, shown right,in March, which has quickly become a bestseller.”

Roach also noted that VF Corp. had warned that Vans’ revenues would continue to decline through September 2023, and she believes the near-term weakness is reflected in VF’s stock.

Among VF’s other brands, Roach continues “to see momentum at TNF [The North Face], as an opportunity for improvements at Dickies (as they cycle wholesale rebalancing), and expect supply chain normalization and new store rollout to improve Supreme results.”

The analyst did note that the streetwear trend had weakened overall, and “emerging competitors have been taking some relative market share in this category in core markets.”

Roach also sees VF’s emerging brands providing “some valuation support for the business,” pointing to Altra‘s market share gains in trail running and Smartwool and Icebreaker‘s strong position in the merino wool category. Roach added, “We also see opportunity within management shifts taking place in the business (most recently Altra’s Brand President now leading Dickies) as leaders of strong performing brands have transitioned to those that have been more challenged.”

Roach also sees VF’s emerging brands providing “some valuation support for the business,” pointing to Altra‘s market share gains in trail running and Smartwool and Icebreaker‘s strong position in the merino wool category. Roach added, “We also see opportunity within management shifts taking place in the business (most recently Altra’s Brand President now leading Dickies) as leaders of strong performing brands have transitioned to those that have been more challenged.”

Overall sales recovery should benefit from the reopening of China, which accounted for 8 percent of VF’s sales in FY22.

From a profitability standpoint, tailwinds, including pricing, freight, mix, and international growth, are expected to drive a gross margin-led operating profit expansion through FY24. The gross margin improvement, combined with cost control, supply chain discipline, and gradual reductions in inventory balances, should help boost its free cash flow.

Finally, another factor in Goldman’s upgrade is the potential for an improving balance sheet with deleverage supported by VF’s recent announcement that it was exploring a sale of its Packs business (Kipling, Eastpak and JanSport), improving free cash flow in the base business and a possible favorable ruling from a tax case dating to VF’s 2011 Timberland acquisition.

The risks to Goldman Sachs’ updated rating include the “call may be early, as strategic initiatives can take time to take root” across the supply chain, innovation and execution. Roach added that Vans’ “stabilization of the brand may prove harder to achieve.”

Goldman slightly raised its 12-month price target on VF to $27 from $26. Share of VF closed Friday at $22.48, up 66 cents, or 3.0 percent. The stock’s 52-week trading range is between $20.03 and $58.88.

Photos courtesy Vans/Altra