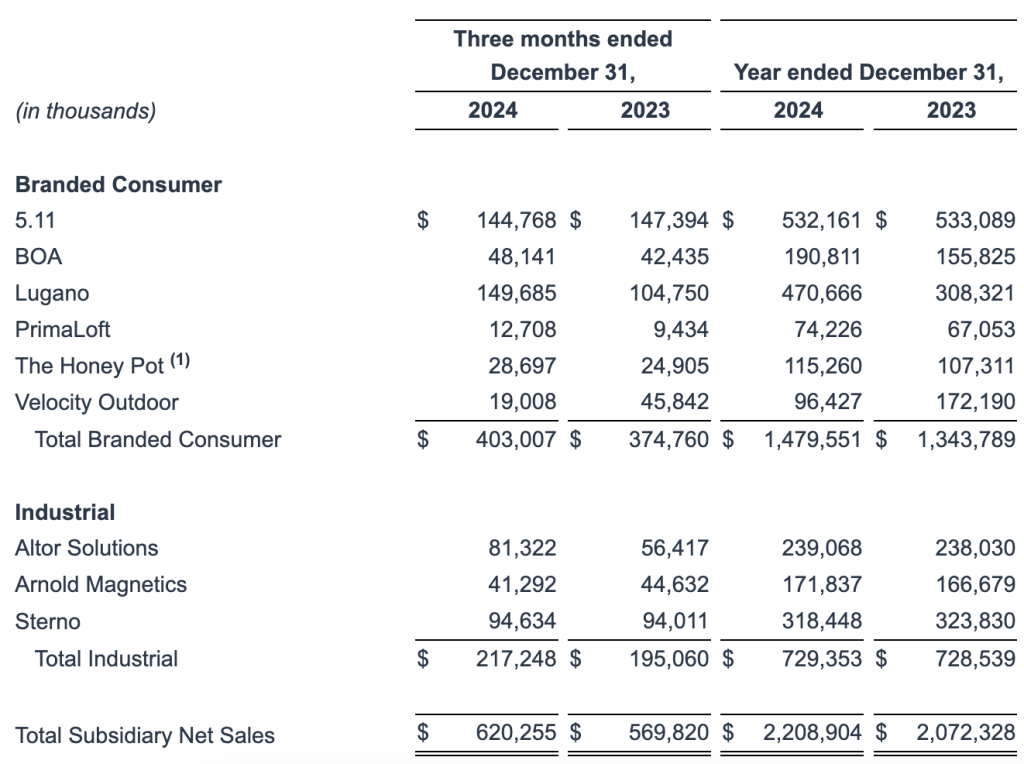

Compass Diversified (CODI) Branded Consumer net sales, which includes 5.11 Tactical, Boa, The Honey Pot, Lugano, Primaloft, and Velocity Outdoor, increased 8 percent in the 2024 fourth quarter to $403.0 million year-over-year. On a pro forma basis, Branded Consumer net sales increased 10 percent to $1.5 billion in the full year 2024.

“For the full year 2024, our consumer vertical saw pro forma revenues grow double-digits, and pro forma adjusted EBITDA increased by greater than 27 percent versus the prior year,” offered Patrick Maciariello, partner and COO at Compass Diversified, on a conference call with analysts. “This is despite the one-time impact of an approximately $12 million write-down of inventory at 5.11 related to PFAs regulations. Excluding this impact, our pro forma adjusted EBITDA on the consumer segment grew over 30 percent and our adjusted EBITDA margin was greater than 27 percent, representing a more than 400 basis point improvement over 2023.”

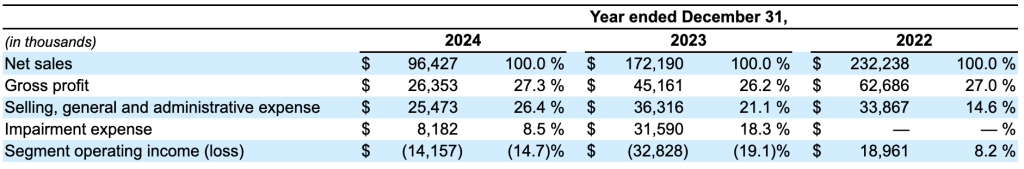

Velocity Outdoor

Velocity Outdoor, which includes the Ravin, CenterPoint, King’s Camo outdoor brands, experienced an impact on full-year sales due to the sale of the CODI subsidiary’s Crosman airgun product division in April 2024.

The company included the operation results for Crosman through the date of sale.

Net sales for the year ended December 31, 2024, were $96.4 million compared to net sales of $172.2 million for the year ended December 31, 2023, a decrease of $75.8 million, or 44.0 percent year-over-year. The decline in net sales was driven by the divestiture of Crosman, which the company sold on April 30, 2024. The remaining product categories, which consist of the archery and hunting apparel product categories, decreased by roughly $3.5 million compared to the full year 2023, reportedly due to softness in the overall Hunt and Fish market and retailers reducing inventory-on-hand levels.

Gross margin was 27.3 percent of net sales for the year, compared to 26.2 percent in year on December 31, 2023. The 110 basis-point increase in gross margin was said to be primarily attributable to customer and product mix, as the Crosman product line had lower gross margins compared to the remaining archery and hunting apparel product categories post-divestiture of the airgun product category.

Selling, general and administrative (SG&A) expense 2024 were $25.5 million, or 26.4 percent of net sales, compared to $36.3 million, or 21.1 percent of net sales, for 2023. The decrease in SG&A expense was said to be primarily due to the divestiture of Crosman, while the increase as a percentage of net sales as compared to the prior year was due to the decrease in revenue.

CODI’s Velocity Outdoor reporting unit was tested quantitatively in March 2024 in connection with the company’s annual goodwill impairment. The impairment test resulted in Velocity recording an impairment expense of $8.2 million in the year ended December 31, 2024, after the fair value of the reporting unit did not exceed the carrying value.

In the prior year, Velocity performed an interim impairment test of its goodwill during the quarter ended September 30, 2023 due to operating results that were below forecast amounts used in quantitative impairment testing performed in March 2023. The impairment test resulted in Velocity recording impairment expense of $31.6 million in the year ended December 31, 2023.

The operating loss for the year ended December 31, 2024 was $14.2 million, a decreased loss of $18.7 million compared to an operating loss of $32.8 million in 2023.

Compass Diversified

Compass Diversified (CODI), parent of the 5.11 Tactical, Boa, Primaloft, and Velocity Outdoor consumer brands, posted net sales of $620.3 million in the 2024 fourth quarter, up 13.8 percent compared to $544.9 million in the fourth quarter of 2023.

For the full year 2024, CODI’s consolidated net sales were $2.2 billion, up 11.9 percent compared to $2.0 billion in 2023.

For the full year 2024, CODI’s operating income increased 170 percent to $230.1 million compared to $85.2 million a year ago. The increase was reportedly due to an increase in net sales year-over-year and non-cash impairment charges taken in 2023 of $89.4 million.

For the full year 2024, CODI’s net income was $47.4 million compared to $262.4 million in 2023. The decreases in net income were due primarily to the $179.5 million gain on the sale of Marucci Sports in November 2023 and the $98.0 million gain on selling Advanced Circuits in February 2023.

For the full year 2024, CODI’s income from continuing operations was $42.3 million, compared to a loss from continuing operations of $44.8 million in 2023. The net income increases from continuing operations primarily due to the non-cash impairment expenses associated with PrimaLoft and Velocity Outdoor in 2023.

For the full year 2024, CODI’s Adjusted Earnings were $161.6 million compared to $101.2 million a year ago.

For the full year 2024, CODI’s Adjusted EBITDA was $424.8 million, up 30 percent compared to $326.5 million a year ago. The increases were primarily due to strong results at Lugano. Management fees incurred during the fourth quarter and full year were $19.5 million and $74.8 million, respectively.

Image courtesy King’s Camo/Velocity Outdoor