Thule Group President and CEO Mattias Ankarberg used adjectives like “tough” and “weak” in describing the current market in a quarterly statement to investors and the media. He said the company’s 16 percent currency-neutral growth in the second quarter was driven by new products and categories, providing clear confirmation to him that the company’s high launch pace during the year has paid off.

“Despite substantial investments in product development, which impact short-term profitability, operating income was unchanged compared to last year. We are continuing on our chosen path toward a larger, more profitable Thule,” the CEO proclaimed.

“Market conditions in the second quarter remained challenging,” Ankarberg said, “particularly in North America, where consumer behavior was restrained and retailers were cautious about building up inventory levels.”

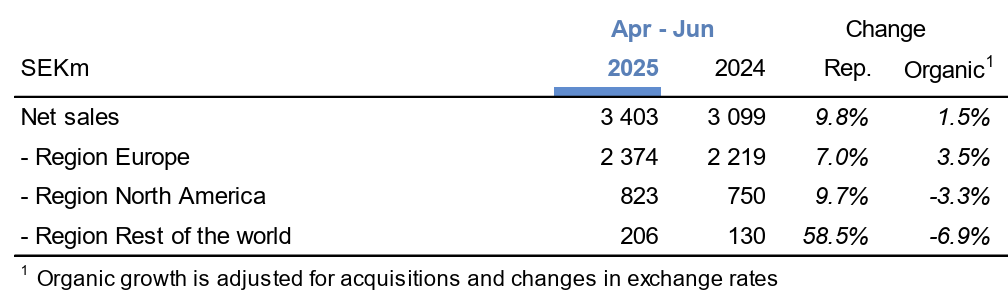

Consolidated sales in the second quarter increased 16 percent year-over-year (y/y) on a currency-neutral basis. The company saw a 14.2 percent y/y lift from the acquisition of Quad Lock while being negatively impacted 5.9 percent from currency effects. Organic growth was pegged at 1.5 percent year-over-year.

Thule’s reported net sales for the 2025 second quarter amounted to SEK 3.40 billion, corresponding to an increase of 9.8 percent from SEK 3.10 billion in the 2024 second quarter.

Thule Group reports to the Swedish krona (SEK) currency.

Second Quarter Region Results

Europe

In Region Europe, net sales totaled SEK 2.37 billion in the second quarter, up 7.0 percent from SEK 2.22 billion in the year-ago Q2 period. Organic growth was 3.5 percent for the quarter.

In RV Products, where sales are mainly in Europe, Ankarberg said Thule countered the headwinds in the RV market and posted organic growth of 4 percent.

North America

Net sales in Region North America amounted to SEK 823 million, up 9.7 percent from SEK 750 million in Q2 last year. Organically, sales declined 3.3 percent year-over-year.

The region’s first quarter sales trend was said to be “very weak” and Ankarberg suggested that the measures the company has implemented have reportedly started to pay off as organic sales “only” decreased by 3.3 percent in the second quarter. The CEO said the acquired Quad Lock business continued to perform well.

“Thule has once again proven that growth is possible even in a tough market,” Ankarberg stated.

The CEO reiterated that Thule recently launched a new organization in North America.

“The structure was streamlined and North America as a region has been given more focus in terms of both product development and sales. In June, we increased prices to offset the effect of the U.S. tariffs,” he noted.

Thule chose to accelerate the closure of its Longmont, Colorado facility, resulting in SEK 31 million in additional costs for premises and personnel. The costs were recognized as administrative expenses in the company’s consolidated income statement.

Ankarberg shared that the company launched a number of bike carriers specifically designed for the U.S. market.

“The result has been very good and makes the difference between the weak sales development in the first quarter and the clearly better trend in the second,” he said. “Demand was so strong that our Connecticut factory has had to work hard to rapidly increase production capacity. The ability to launch in-demand products in an otherwise weak market shows the strength of Thule’s product development capability”

He said a renewed focus on pickup trucks will also come to market later this year, a category in which Thule has not launched any new products for many years.

“This winter we will launch Thule Xscape, an easy-to-assemble premium product enabling safe transportation of skis, surfboards, rooftop tents, and other equipment on pickup trucks,” Ankarberg described. “While the North American market will take time to recover, a sharpened product portfolio and a more focused sales organization mean we are well on our way to building a stronger North America.”

Ankarberg said he was struck by how the success in U.S. bike carriers is a clear example of how Thule is implementing its strategy.

“We call our strategy ‘Big in pockets, united by the Thule brand,'” Ankarberg shared. ”We want to be market leaders – big – in small niches. The niches, or pockets, must be a good fit with our brand and our capabilities, and the products must appeal to enthusiasts who are willing to pay for premium products.”

He added that when they then add the ingredient of innovation, the results come quickly.

“Many opportunities remain in the categories where we are already market leaders, and therefore we have every opportunity to shape our own future,” the CEO said.

Rest of World

Net sales in Region Rest of World amounted to SEK 206 million, up 58.5 percent from SEK 130 million in Q2 last year. Organically, sales declined 6.9 percent.

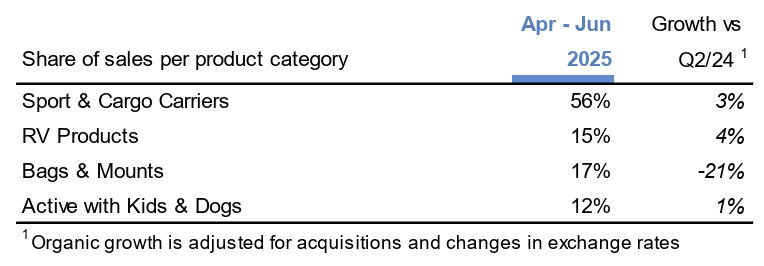

New Products and Categories Fuel Growth

Ankarberg said 2025 is one of the company’s most intensive product launch years to date.

“We completed several important product launches in the first quarter, and continued in the second quarter with launches, such as Thule Outpace, a lightweight and compact bike carrier that uses little space when not in use, and an updated version of Thule Glide, our award-winning jogging stroller,” he began. “New products clearly generate growth, particularly in areas where we hold strong market positions and our brand has high recognition.”

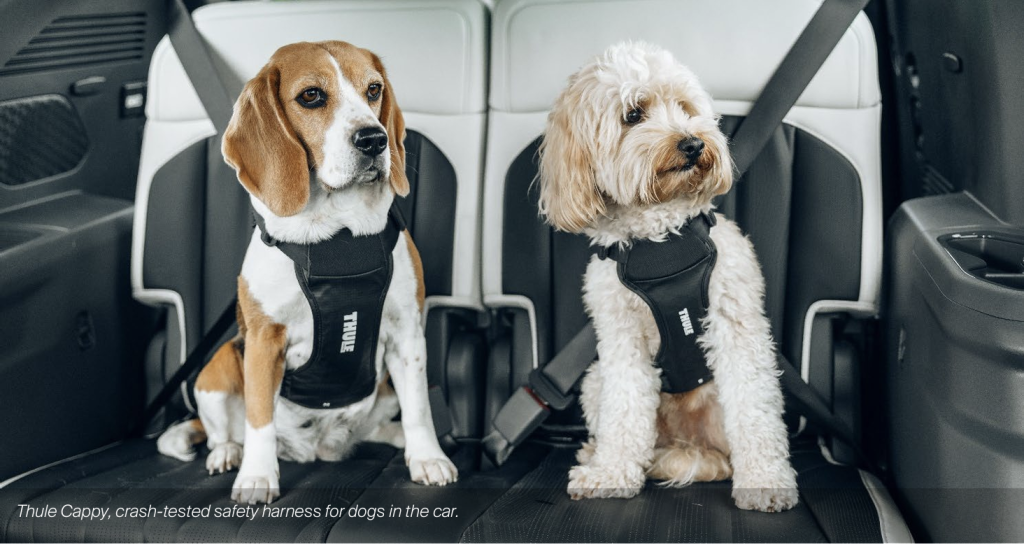

Beyond initiatives to strengthen existing market positions, Ankarberg shared that Thule is also further developing new categories of dog transportation and child car seats.

“The dog transportation category made an excellent start last year and growth remained strong in the first half of the year,” he said. “Thule Cappy, a crash-tested dog car harness, was launched in June to a warm reception.”

“In the car seat category, we will launch Thule Palm later this year, a high back booster seat with back and neck support for slightly older children,” Ankarberg said. He said the launch of Thule Palm means the company will have a range of car seats to fit all ages.

“Toward the end of last year, we added an additional category through the acquisition of Quad Lock, the global market leader in performance phone mounts for cyclists, motorcyclists and other adventurers,” he said. “Quad Lock has performed strongly in its first seven months as part of Thule with organic sales growth of more than 15 percent in the second quarter and with many further growth opportunities to address.”

Profitability and Expenses

Gross margin for the second quarter improved to 46.3 percent of net sales, compared to 44.4 percent in the 2024 second quarter. The increase was attributable to the acquired Quad Lock business, which has a higher gross margin.

“As previously communicated, more products are being launched earlier this year, resulting in higher product development costs for the first half of the year,” Ankarberg explained. “The aim is to benefit from sales over the full high season, as the positive sales figures clearly show.”

Adjusted operating income amounted to SEK 734 million, or 21.6 percent of sales, compared to SEK 732 million, or 23.6 percent of sales, in Q2 2024. More products were launched earlier in the year, which reportedly resulted in higher costs in the quarter. Second quarter operating income totaled SEK 703 million and was said to be charged with non-recurring items relating to the restructuring of the North American operations. The result compares to SEK 732 operating income in the year-ago quarter.

With the product investments phased earlier in the year, adjusted EBIT amounted to SEK 734 million, or 21.6 percent of sales, in Q2, compared to SEK 732 million, or 23.6 percent of sales, in the year-ago quarter.

“In addition to our financial targets; we also have ambitious sustainability targets,” Ankarberg added. “Agreements signed by Thule with our banks during the quarter now clearly link these sustainability targets to the terms in our financing, thereby providing an additional incentive to pursue forward-looking sustainability work in all areas.”

Enhanced Supply Chain Efficiency

Ankarberg said the company is continuously improving the efficiency of its supply chain, freeing up SEK 1.2 billion in inventory over the last two years and helping to finance growth initiatives.

“Our next major improvement is to expand and automate the existing logistics facility in Huta, Poland,” Ankarberg shared. “The facility will have three times as many pallet spaces in a highly automated warehouse. Increasing capacity in Huta means that we can end our collaboration with two external logistics providers.”

The investment, which is expected to lead to annual savings of ~ SEK 100 million before depreciation, amounts to ~ SEK 450 million.

“This investment is part of our investment program, which is planned, over time, to correspond to about 2.5 to 3 percent of sales,” the CEO noted. “The facility is expected to be in operation in 2027 and will provide us with increased flexibility, control and significant savings over the long term.”

Outlook

“In the short term, we expect the market to remain challenging, particularly in North America,” Ankarberg shared. “While growth costs a little more in a challenging market, it remains the most effective strategy to generate results. Moreover, with more successful products and categories, we will have an even greater upside once the market recovers.”

The CEO said Thule is continuing to invest long-term in areas that create value for Thule:

- product development;

- success in more product categories;

- increased consumer visibility; and

- increased efficiency in the supply chain.

Images/Charts courtesy Thule