L.E.K. Consulting released its fourth annual Brand Heat Index, which outlines the brands that have gained in popularity, or increased brand “heat,” across the major product categories in women’s and men’s footwear and apparel.

L.E.K. said in its report that the intent from the insights provided by its Brand Heat Index brings a more nuanced view of brand trajectory and what drives it up, which should ultimately enhance retailer’s strategic decision-making.

“Our Brand Heat Index continues to demonstrate how material differences in brand momentum can exist below the surface and how quickly sentiment can change,“ the company said in its report summary. “Once again, generational differences in top brand rankings point to the importance of recognizing that consumers are not all the same and that deep understanding and tailored strategies are required to win.”

L.E.K. Consulting based its Brand Heat Index on a survey of nearly 5,000 U.S. consumers between the ages of 14 and 55. Within product categories and generational cohorts, each brand earns a heat score on a scale of 0 to 100 — the higher the score, the hotter the brand.

Notably, the Brand Heat Index identifies brands on the most significant upward trajectory with consumers, not necessarily the brands’ relative size or scale.

The survey gathers feedback on brands across four product categories: Athletic, Casual, Outdoor/Rugged and Dress. SGB Media focuses on the athletic, casual and outdoor/rugged categories for this review and write-up.

The brands with the most heat are not necessarily the biggest or fastest-growing; it’s about connection with the core consumer.

L.E.K. noted that relative to footwear, apparel categories are showing a greater drop-off in brand heat after the top brand in a given category this year, suggesting clear winners followed by meaningful differences across generations. At the same time, the survey data reveals that the greater number of apparel brands overall means that there are more brands that consumers are excited about and spending cash in an environment where consumers are playing it safe.

The data shows that women continue to prefer athleisure and fast fashion brands, though the specific brands in favor continue to shift. For example, Girlfriend Collective joined the Athletic Top 10, and Edikted replaced Princess Polly and Cider in casual clothing this year. Conversely, men are more drawn to work wear and athletic/technical apparel, suggesting a premium on form and function and a clear preference for the blue-collar look, regardless of whether working or living on a back street or Wall Street.

Similar to what was seen this year in the company’s Footwear Brand Heat report, dress apparel brands are gaining renewed traction, particularly among Gen Z, who are purchasing and engaging with this category more than last year. This may suggest a reemergence of this category after pandemic declines.

Athletic Clothing | Key L.E.K. Observations

Year-over-year, Athletic Clothing has a fair amount of consistency, with nine out of the Top 10 brands for each gender staying consistent. Further, the consulting firm said there is an increasing overlap between the leading brands across genders. Nike comes in as the top brand in both women’s and men’s athletic clothing, while seven of the Top 10 brands overlap on both lists.

As part of its thesis, L.E.K. mentioned brands, including Lululemon, which started off serving women exclusively, and Vuori, which initially catered to men exclusively, now each designed for women and men. As a result, both brands are showing strength across genders.

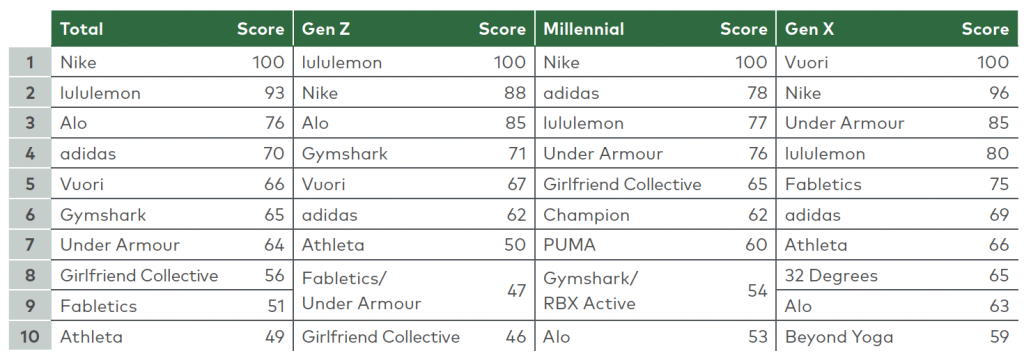

Women’s Athletic Clothing

- Nike, Lululemon, Alo, and Adidas retained the top four spots from 2024; however, the data is more interesting at the generational level. Lululemon and Alo provide stiff competition to Nike among Gen Z, with Lululemon taking the top spot and Alo coming in only three points behind Nike.

- While Vuori has long shown strength among the older generation and rose to the top spot in the Gen X rankings for 2025, it also climbed the chart to No. 4 among Gen Z.

- Girlfriend Collective is another gainer in the category, coming in at No. 8 overall and showing strength among younger generations, who appreciate the brand’s reputation and style.

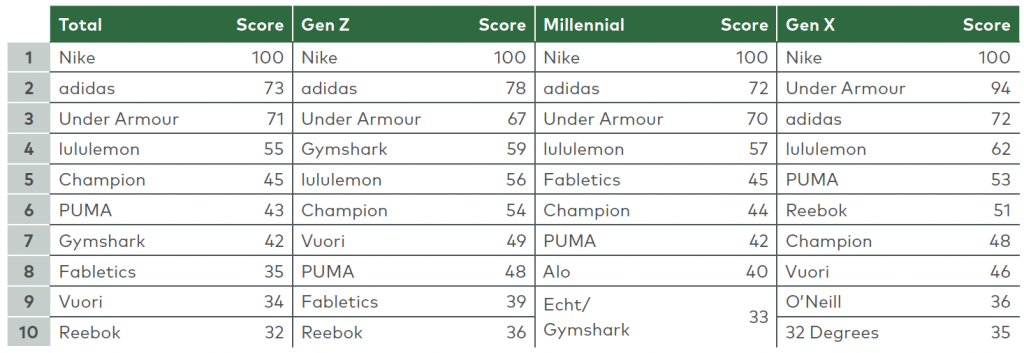

Men’s Athletic Clothing

- Nike remains the clear leader across all generations, followed somewhat distantly by Adidas and Under Armour, which perform differentially among Gen X.

- Lululemon climbed to No. 4 overall, reflecting the brand’s continued success as a dual-gender brand.

- Vuori declined slightly since 2024, dropping to No. 9 overall and falling out of the Top 10 for Millennials.

- Younger generations show relatively more appetite for direct-to-consumer (DTC) brands, with Gymshark, Vuori, Fabletics, and Alo on their Top 10 lists, while Gen X men continue to demonstrate a preference for legacy athletic brands, including Puma, Reebok and Champion.

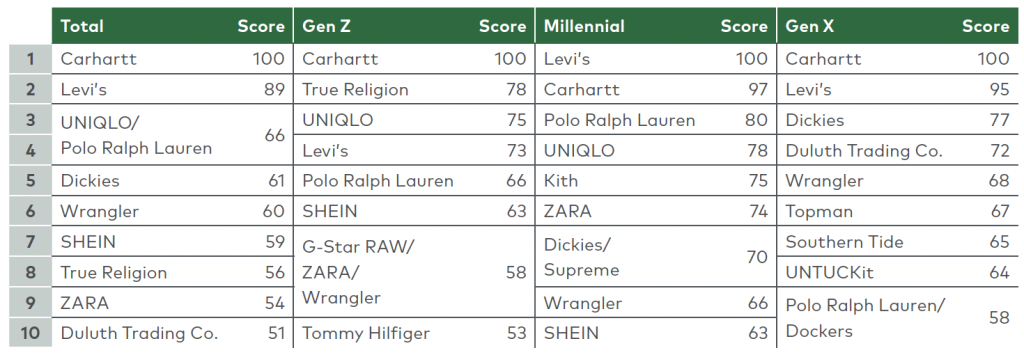

Casual Clothing | Key L.E.K. Observations

Casual Clothing has less overlap across genders than other categories like Athletic Clothing, with only five brands appearing on the Top 10 lists for both genders. Top women’s Casual Clothing brands indicate a strong preference for fast fashion, while workwear players once again dominate men’s Casual Clothing.

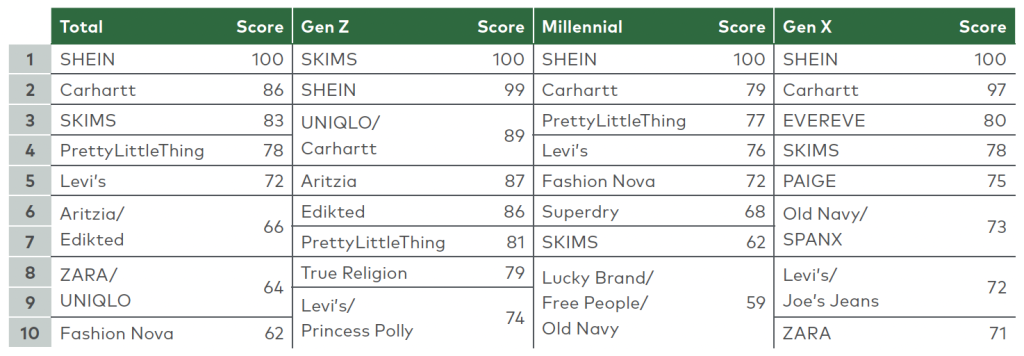

Women’s Casual Clothing

- Leaders are consistent relative to 2024, with Shein, Skims and Carhartt retaining the No. 1, No. 2 and No. 3 positions, respectively.

- While fast fashion shines overall, the brands that are top-of-mind for consumers continue to shift.

- PrettyLittleThing and Zara have risen in the rankings relative to 2024 and are joined in the Top 10 by Edikted, reflecting its growing popularity among social media-driven Gen Z.

- At the same time, Fashion Nova and Princess Polly have fallen out of the Top 10, though they remain strong with certain age cohorts.

Men’s Casual Clothing

- This category, once again, is dominated by workwear brands, including Carhartt, Levi’s, Dickies, Wrangler, and Duluth Trading Co. all showing up in the Top 10.

- Fast fashion brand Shein dropped from No. 3 to No. 7 overall, with consumers directly commenting on the pending lawsuits and poor quality products impacting its reputation.

- Further, several new brands entered the Top 10 for the first time in 2025. Zara rose from No. 19 in 2024, and True Religion rose from No. 14 in 2024.

- From a generational perspective, streetwear brands like Kith and Supreme have strengthened their position with Millennials, while Gen X prefers more traditional-styled brands, including Southern Tide and Untuckit.

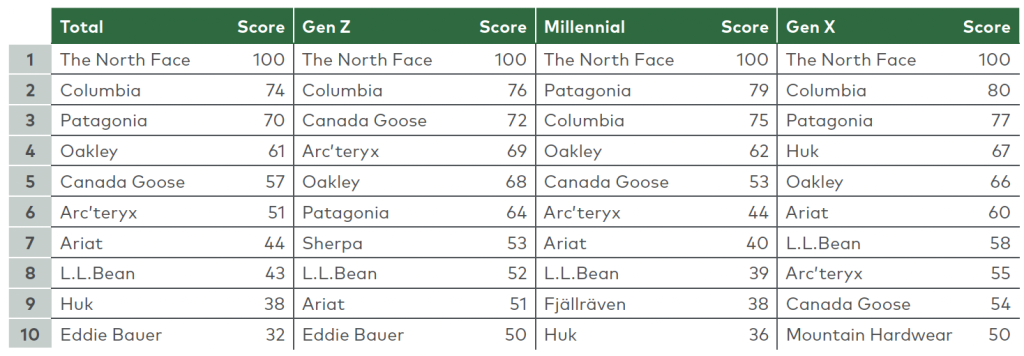

Outdoor/Rugged Apparel | Key L.E.K. Observations

Once again, industry stalwart brands The North Face, Columbia and Patagonia take the Top 3 spots for men’s and women’s Outdoor/Rugged Apparel and across two of three generations, highlighting the brands’ broad appeal; however, Patagonia slipped to tNo. 3 this year. Outdoor/Rugged Apparel had a higher turnover and shift in the Top 10 year-over-year, with three to four new brands on the overall list for each gender.

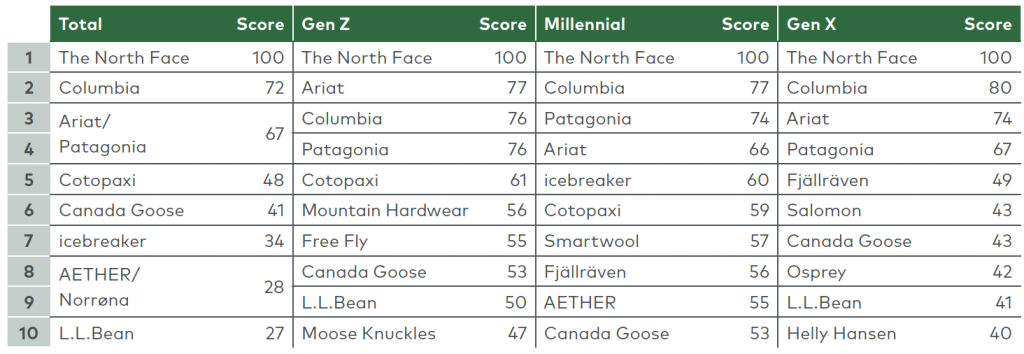

Women’s Outdoor & Rugged Apparel

- The North Face retained its No. 1 spot across all generations in the Women’s Outdoor/Rugged Apparel list.

- After the top tier of The North Face, Columbia and Patagonia; however, meaningful movement suggests that consumers are looking for new inspiration.

- Ariat and Cotopaxi are notable climbers, rising to No. 3 (tied with Patagonia) and No. 5 overall, respectively, with Ariat achieving solid performance across generations.

- Canada Goose replaces other premium outerwear players (Mackage and Moose Knuckles) on the Top 10 list, while emerging brand Norrøna entered the Top 10 for the first time.

Men’s Outdoor & Rugged Apparel

- For men, The North Face, Columbia and Patagonia are again at the top and consistent across generations, with Patagonia holding the No. 2 spot with Millennials.

- Canada Goose and Arc’teryx come in at No. 5 and No. 6, respectively, with strength among Gen Z.

- More activity-specific brands like Ariat and Huk round out the Top 10 and perform differentially well with older generations.

- The relative consistency of brands across generations within men’s Outdoor/Rugged Apparel suggests a similar set of needs and a focus on technical products across cohorts.

Go here to download the full L.E.K. Brand Heat Index Report.

Image courtesy Adidas, data and tables courtesy L.E.K. Consulting