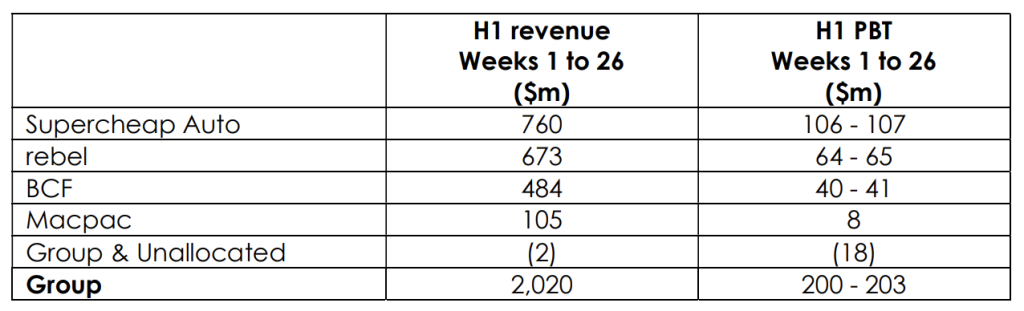

Super Retail Group (SRG), the Australia-based parent of Rebel Sports, BCF outdoor and Macpac outdoor retail chains, reported that sales for the first half of fiscal 2024 increased 3 percent and are expected to reach A$2.02 billion for the period ended December 30.

Comparable store sales were up 1 percent. Comp-store sales increased 11 percent in the year-ago corresponding period.

- Rebel Sports segment net sales declined 1 percent for the period, while comp sales declined 3 percent.

- BCF segment net sales increased 8 percent for the period, while comp sales rose 2 percent.

- Macpac segment net sales increased 4 percent for the period, while comp sales were flat.

“I am pleased to report that Super Retail Group has delivered another record first-half sales result,” said Group CEO and Managing Director Anthony Heraghty. “The Group has traded well over the cyber sales and Christmas holiday trading period. We maintained positive like-for-like sales growth in the first half; however, cost of living pressures on the consumer did lead to a more constrained retail trading environment at the end of the second quarter. Despite this, our customer proposition and the resilience of the lifestyle and leisure categories in which we operate underpin our performance in challenging economic conditions where consumers are sharpening their focus on value.”

Promotions during the peak end-of-year sales period delivered revenue growth that translated into strong first-half earnings.

The gross margin in H1 FY24 is expected to be higher than H1 FY23; however, the cost of doing business (CODB), as a percentage of sales, increased due to the impact of inflation on wages, rent, and electricity. Higher CODB impacted Rebel in particular, given its lease portfolio composition and higher employee-to-store ratio.

The Group’s first-half revenue is expected to be A$2.0 billion, and the first-half profit before tax (PBT) is expected to be between A$200 million and A$203 million. RSG reports in Australian dollars (A$).

Rebel’s first-half normalized PBT result includes the impact of a provision for deferred revenue as a result of loyalty credits issued to customers under the new customer loyalty program launched in October 2023. The provision is expected to be approximately A$5 million in fiscal H1 2024 and about A$8 million in total for the fiscal full-year 2024, in line with previous disclosure.

The Group had no drawn bank debt and a positive cash balance at the end of the first half.

Image/Data courtesy Super Retail Group