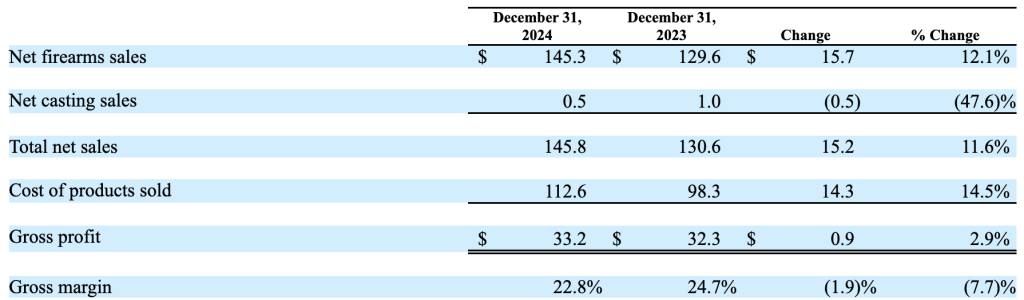

Sturm, Ruger & Company, Inc. (RGR) reported net sales of $145.8 million in the 2024 fourth quarter, an 11.6 percent increase compared to net sales of $130.6 million in the 2023 fourth quarter. Net firearms sales jumped 12.1 percent year-over-year in the fourth quarter to $145.3 million. Net casting sales fell 47.6 percent to $0.5 million. Gross margin declined 190 basis points year-over-year to 22.8 percent of sales in the fourth quarter.

Fourth quarter diluted earnings were 62 cents per share, compared to 58 cents per share in the corresponding period in 2023.

2024 Fourth Quarter Sales Summary

“Our fourth quarter results improved significantly from the third quarter as our production increased 10 percent, sales increased 19 percent, and our profitability more than doubled,” shared company President and CEO Christopher Killoy on a conference call with analysts.

“We were pleased with our sales growth and improved profitability in the fourth quarter, despite the apparent reduction in consumer demand, as adjusted NICS checks decreased 6 percent from the prior year,” offered Killoy. “Our disciplined approach, long-term focus on generating shareholder value, diverse product catalog and commitment to new product development allow us to succeed during the ebbs and flows of the firearms market. We enter 2025 with a strong, debt-free balance sheet, reduced inventories at our independent distributors, and a full pipeline of recently launched new products and many others still under development.”

Killoy also shared that the launch of the RXM pistol collab with Magpul had a significant impact in December.

“We had pre-planned the launch of the RXM for a while,” he said. “We had conducted a series of retailer summits, in what we called ‘meeting with key retailers throughout the U.S. over the course of 2024.’ At those summits, under an NDA, we introduced and unveiled the RXM to those key retailers and solicited pre-orders so that as we got closer to our actual launch date, we shipped both to those key big independent retailers, some of the key national accounts, as well as our distributors, so product was in place at both wholesale and retail prior to our public unveiling in December. That made for, I’ll say, [a] smooth launch at all levels.”

CEO Transition

Killoy will step down as president and CEO on March 1 and continue to serve as a special advisor through his planned retirement from the company in May 2025. Todd Seyfert will become president and CEO on March 1. Seyfert has been the president of Segment Land Vehicles Americas at Dometic Group AB since January 2024. Before that, he was the CEO of FeraDyne Outdoors, LLC, a manufacturer of archery and hunting products, from February 2016 through May 2023.

“Todd attended the SHOT Show last month and spent time with many of our employees and customers and a host of industry folks, many of whom he already knew from his past experience in the industry,” said Killoy. “I have been very impressed with Todd and know he and the rest of the team will continue to deliver innovative and exciting new products to our consumers, profitability to our independent distributors and retailers, and long-term value to our shareholders.”

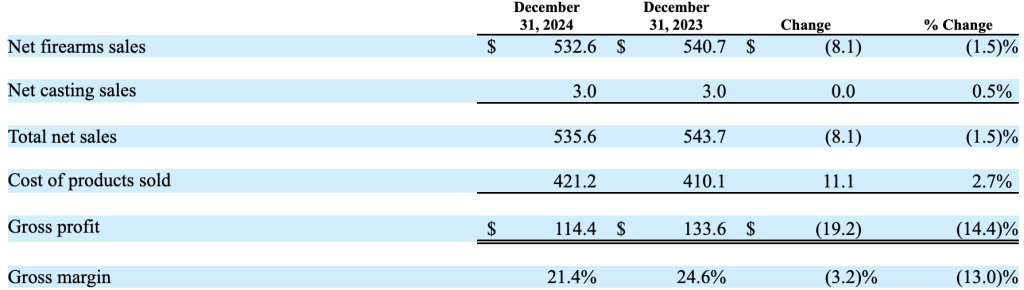

Full-Year 2024 Sales Summary

Full-year net sales declined 1.5 percent to $535.6 million in 2024, compared to $543.8 million in 2023. Firearms sales decreased 2 percent, and unit shipments increased 3 percent in 2024.

New products represented $159.3 million, or 32 percent, of firearms sales in 2024, an increase from $119.0 million, or 23 percent, of firearms sales in 2023. New product sales include only major new products the company introduced in the past two years.

In 2024, new products included the RXM pistol, American Centerfire Rifle Generation II, Marlin 1894 lever-action rifles, Security-380 pistol, Super Wrangler revolver, LC Carbine, Small-Frame Autoloading Rifle, and the Marlin 1895 lever-action rifles, which it only included for a portion of the year.

The estimated unit sell-through of the company’s products from independent distributors to retailers increased 5 percent in 2024 compared to 2023.

In 2024, NICS background checks, adjusted by the National Shooting Sports Foundation (NSSF), decreased by 4 percent from 2023. The increase in the sell-through of the company’s products despite the decrease in adjusted NICS background checks could be attributable to new product introductions, like the Ruger American Rifle Generation II bolt-action rifles and the Marlin lever-action rifles, which helped offset aggressive promotions, discounts, rebates, and the extension of payment terms offered by the company’s competitors.

Gross Profit

The decreased gross profit for the year ended December 31, 2024, was reportedly attributable to decreased sales, unfavorable deleveraging of fixed costs resulting from reduced production, and a product mix shift toward products with relatively lower margins that remain in stronger demand. These same factors, partially offset by increased pricing, contributed to the decrease in gross margin for the year.

Company CFO Tom Dineen said profitability declined in 2024 from 2023 as gross margin decreased from 25 percent to 21 percent of sales. The lower margin was said to be driven by unfavorable deleveraging of fixed costs resulting from reduced production and sales, inflationary cost pressures, and a product-mix shift toward products with relatively lower margins that remain in stronger demand.

Net Earnings

Full-year diluted EPS was $1.77 per share, compared with diluted earnings per share of $2.71 per share in 2023.

Inventories

In 2024, the company’s finished goods inventory decreased 28,300 units, and distributor inventories of its products decreased 63,500 units.

Cash Management Summary

Cash provided by operations during 2024 was $55.5 million. At year-end, cash and short-term investments totaled $105.5 million. The company’s current ratio is 4.2 to 1. It has no debt.

In 2024, capital expenditures totaled $20.8 million for new product introductions and upgrades to our manufacturing equipment and facilities. In 2025, the company expects capital expenditures to approximate $20 million.

In 2024, the company returned $46.2 million to its shareholders through:

- the payment of $11.8 million of dividends; and

- the repurchase of 835,060 shares of its common stock in the open market at an average price of $41.19 per share, for a total of $34.4 million.

At year-end, stockholders’ equity was $319.6 million, which equates to a book value of $19.03 per share, of which $6.28 per share was cash and short-term investments.

Dividend

The company also announced that its Board of Directors declared a 24-cent per share dividend for the fourth quarter for stockholders of record as of March 14, 2025, payable on March 28, 2025. This dividend varies every quarter because the company pays a percentage of earnings rather than a fixed amount per share. This dividend is approximately 40 percent of net income.

Image courtesy RangeHot.com