A new survey from Stifel Financial found that the U.S. consumer view of the importance of brands operating sustainably has reached parity with Europe but also shows more significant consumer concerns about the economy and personal finances.

Following three years of near-record inflation, the data in Stifel’s survey indicates heightened price sensitivity as the holiday shopping season kicks into high gear.

Working with Morning Consult, Stifel polled 6,053 U.S. active/casual lifestyle brand consumers ages 18 to 55 to compile the results, suggesting that while a majority of consumers (80 percent) believe it’s important for brands to operate sustainably, only one-third of respondents “Highly Prioritize” sustainability when making purchasing decisions, compared “Good Value” and “Low Price” posting larger numbers and growing in importance to the consumer.

Amid persistent inflationary pressures, consumer prioritization of “Low Price” reflects the biggest gains year-over-year (up five points from 52 percent in 2022).

Roughly three out of five respondents (63 percent), however, remain willing to pay a premium for brands with sustainability practices.

“We know that many consumers regularly consider and value sustainability, especially in the active and casual lifestyle category,” said Jim Duffy, managing director and Sports and Lifestyle Brands Analyst at Stifel. “However, our survey found that 62 percent of consumers are more concerned about the state of the economy this year versus last year, and 56 percent are more worried about their personal finances, so pocketbook issues are having a greater impact on purchasing decisions.”

“We know that many consumers regularly consider and value sustainability, especially in the active and casual lifestyle category,” said Jim Duffy, managing director and Sports and Lifestyle Brands Analyst at Stifel. “However, our survey found that 62 percent of consumers are more concerned about the state of the economy this year versus last year, and 56 percent are more worried about their personal finances, so pocketbook issues are having a greater impact on purchasing decisions.”

Other key findings include:

- 56 percent (flat versus 2022) of respondents look for information about a brand’s sustainability practices when thinking about a purchase, 70 percent (down from 71 percent in 2022) consider sustainability factors when choosing between brands, and more than one-half of respondents (59 percent versus 58 percent in 2022) purchased a new product precisely because of sustainability reasons.

- More than three-quarters (78 percent) of respondents said they are trying to be more sustainable in their daily life (up from 75 percent in 2022), and 70 percent said they care more about the sustainability of products they buy than a year ago (versus 67 percent in 2022).

- Most (58 percent) respondents believe that ethical business practices are “Very Important” for brands to prioritize and rank giving workers fair pay and benefits, paying a fair share of taxes and promoting a healthy work/life balance as priorities.

- Two-thirds of U.S. category consumers (67 percent) reported they are aware of brands receiving negative attention on social media for a statement or action taken on a social issue.

- Three of five category respondents (60 percent) think it’s important for brands to take a stance on social issues, but three-quarters (74 percent) indicate a willingness to boycott a brand if the stance is contrary to their opinion.

“Operating sustainably is a consumer expectation, but brands weighing in on social issues is a high-wire act,” noted Duffy.

“Consumers want brands to support their issues, but the majority indicate they would boycott a brand that expresses views opposing their own. Deep understanding of the customer is essential to this risk-reward calculus,” noted Global Insights.

The survey also questioned 4,096 additional active/causal lifestyle brand consumers ages 18 to 55 across the UK, Italy, Germany, and France. Similar to findings among U.S. consumers, at least four of five category purchasers across all international markets believe it’s important for brands to operate sustainably, but the figures declined year-over-year.

Interestingly, while “Good Value” was still the most noted (68 percent) by respondents as a priority for purchasing, it lost one percentage point versus the last survey.

“Low Price” was the biggest gainer, jumping 5 points to 57 percent of respondents. “Reputation for Durability” was the response that lost the most ground versus the 2022 survey, falling 3 percentage points to 48 percent of respondents. “Style/Design Aesthetic” and “Innovation/New Technology” both last ground in Stifel’s 2023 survey, while the “Sustainability, Brand Is Unique/Different” and “Brand Is Trendy/In-Style” responses all gained a point or two in importance.

The core attributes of top-of-the-pyramid brands are losing their importance to price and low-end trend-right products that turn quickly. Unfortunately, cheap, quick-turn or fast-fashion product is some of the least sustainable product in the market, but the consumer does not understand that as they also cite sustainability as a key factor in purchasing.

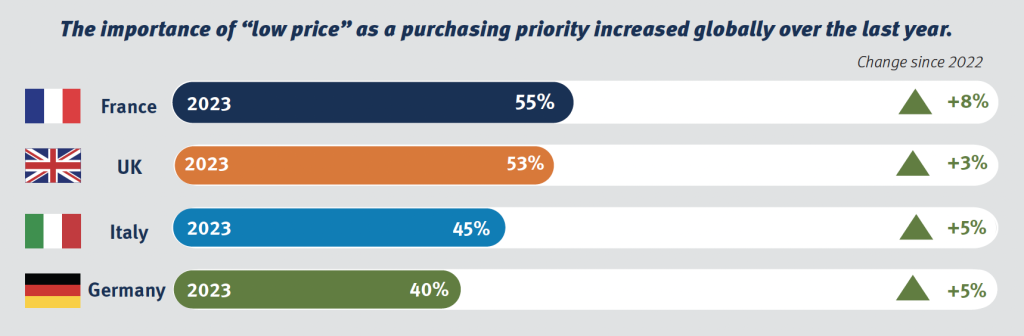

Like the U.S., value and price concerns outweigh sustainability practices as purchasing priorities across the pond. Findings include:

- Sustainability as a purchasing priority remained essentially flat compared to last year in the U.K. (35 percent) and Italy (40 percent) but declined year to year in France (52 percent versus 59 percent in 2022) and Germany (36 percent versus 39 percent in 2022).

- “Good Value” ranked as the top consideration when making purchasing decisions, with consumers in Italy (74 percent versus 75 percent in 2022), France (72 percent versus 70 percent in 2022), the U.K. (72 percent versus 69 percent in 2022), and Germany (71 percent flat versus 2022) versus 68 percent of U.S. consumers.

- The importance of “Low Price” as a purchasing priority increased over last year, with French (55 percent versus 47 percent in 2022), Italian (45 percent versus 40 percent in 2022), German (40 percent versus 35 percent in 2022), and U.K. consumers (53 percent versus 50 percent in 2022) listing it as a Top 3 purchasing priority versus 57 percent of U.S. consumers (up from 52 percent in 2022).

- Brand Environmental Efforts were less important year to year across each European market, including using less energy and water, using more renewable or recycled materials, reducing carbon emissions, and advocating for environmental causes publicly.

For more in-depth survey results, go to stifel.com or here.

Photo courtesy Instagram, Data courtesy Stifel Financial