Stella International Holdings Limited, the Hong Kong-based developer, manufacturer and retailer of footwear and leather goods, reported that third quarter unaudited consolidated revenue increased by approximately 0.6 percent to $389.7 million, compared to $387.2 million in the 2023 Q3 period.

For the nine months ended September 30 (YTD), the company’s unaudited consolidated revenue increased by approximately 5.1 percent to $1.16 billion, compared to $1.10 billion in the prior-year nine-month period.

Stella International Holdings reports in U.S. dollars ($).

“The ramp-up of our new factory in Solo, Indonesia, along with the buildout of an additional production facility in Bangladesh, is progressing as planned,” offered Chi Lo-Jen, CEO, Stella International Holdings Limited. “Our enhanced manufacturing footprint will help us optimally serve new Sports customers in the upcoming year, while freeing up more of our existing capacity to produce higher-margin products for our growing number of high-end Fashion and Luxury customers.”

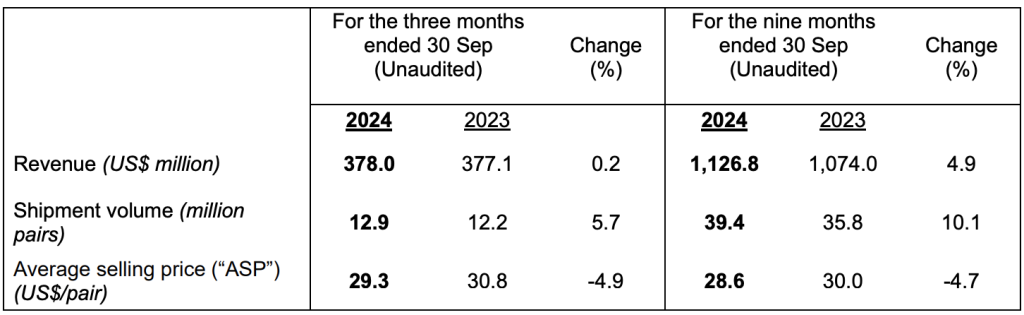

The financial and operational highlights of the company’s footwear manufacturing business is shown in the table below:

Shipment volumes in the third quarter increased by approximately 5.7 percent and jumped 10.1 percent year-over-year for the YTD period, mainly driven by the Sports category. The decrease of ASP in both periods was due to the higher proportion of Sports products orders, which have a lower ASP, as well as raw material price deflation.

Stella said the growth in revenue and shipment volume for the third quarter moderated, as anticipated, following shipments of approximately 1 million pairs of footwear to certain customers during the quarter, which was said to be earlier than the original shipment plan.

“We are ahead of schedule in meeting the targets of our Three-Year Plan (2023-2025), which are to achieve an operating margin of 10 percent and a low-teens compound annualized growth rate on profit after tax by the end of 2025,” the company said in its Q2 report. “We are confident about meeting these targets, having not only met but also surpassed the above operating profit margin target in both 2023 and in the six months ended 30 June 2024.”

In addition, as per previously announced, Stella said its remains committed to returning additional cash of up to $60 million per year for the next three years (2024-2026) to company shareholders, but not exceeding $180 million in total, through a combination of share repurchases and special dividends. This would come on top of the payment of regular dividends (including final dividends and interim dividends) at the normal payout ratio of 70 percent.

“We remain on track to meet our goals for this year, including enhancing our customer and product mix and strengthening our operational efficiency, which will enable us to continue meeting the profit targets set out under our Three-Year Plan (2023-2025),” concluded Lawrence Chen, chairman, Stella International Holdings Limited.

Image courtesy Stella International Holdings