Stella International Holdings Limited, the Hong Kong-based developer, manufacturer and retailer of footwear and leather goods, reported that 2024 fourth-quarter production revenues decreased 1.1 percent year-over-year to $385.4 million, compared to $389.5 million in the prior-year Q4 period. The sneaker maker posted a 13.5 percent increase in the 2023 Q4 period after a down year through the first three quarters of 2023.

Stella International Holdings Limited reports in U.S. dollar ($) currency.

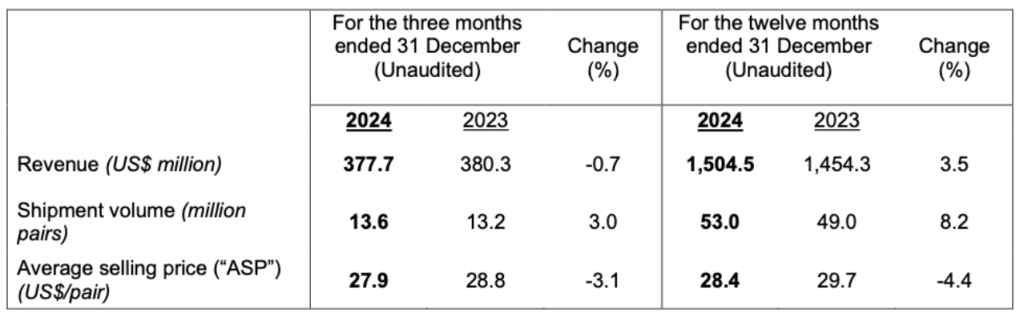

For the 2024 full year, the developer, manufacturer and retailer of footwear and leather goods said that unaudited consolidated revenue increased by ~ 3.5 percent to $1.55 billion, cycling an 8.5 percent increase in 2023.

Shipment volumes for the fourth quarter increased by approximately 3.0 percent year-over-year (y/y) to 13.6 million pairs despite “a high base effect and adjustments to seasonal shipment patterns by some customers in response to the 2024 Paris Olympics.”

Average selling prices (ASPs) were $27.90 per pair in Q4, compared to $28.80 in the prior-year Q4 period.

Shipment volumes in the twelve months ended December 31, 2024 increased by approximately 8.2 percent, which was said to be mainly driven by the Sports and Fashion categories. The decrease of ASP in both periods was due to the higher proportion of Sports product orders, which have a lower ASP, as well as raw material price deflation.

Full-year ASPs were down 4.4 percent to $28.40 per pair, compared to $29.7 per pair in 2023.

Stella said in its report that the company is ahead of schedule in meeting the targets of its Three-Year Plan (2023-2025), which are to achieve an operating margin of 10 percent and a low-teens compounded annualized growth rate on after-tax profit by the end of 2025.

“We are confident about meeting these targets, having not only met but also surpassed the above operating profit margin target in both 2023 and in the six months ended June 30, 2024,” the company said in its report.

The company reiterated that it remains committed to returning additional cash of up to $60 million per year for the three-year period (2024/26) to shareholders, not exceeding $180 million in total, through a combination of share repurchases and payment of special dividends, on top of the payment of regular dividends (including final dividends and interim dividends) at the normal payout ratio of 70 percent.

“We look set to exceed our margin expansion goals for this year as we continue to benefit from our diverse customer portfolio with increased orders from customers in higher-margin categories,” offered Chi Lo-Jen, CEO of Stella International Holdings Limited. “We believe this trend will continue into 2025 as we onboard more of these customers, commence production at our new production facility in Bangladesh and continue ramping up production capacity in Indonesia in 2025.”

Lawrence Chen, chairman of the Group, added, “We expect the looming changes to global trade tariffs will not have a material impact on our order book. This resilience is largely due to our diversified production base and the proactive measures taken earlier by most footwear brands to mitigate the impact of previous tariff hikes. We remain confident in our ability to achieve the targets outlined in our Three-Year Plan (2023-2025).”