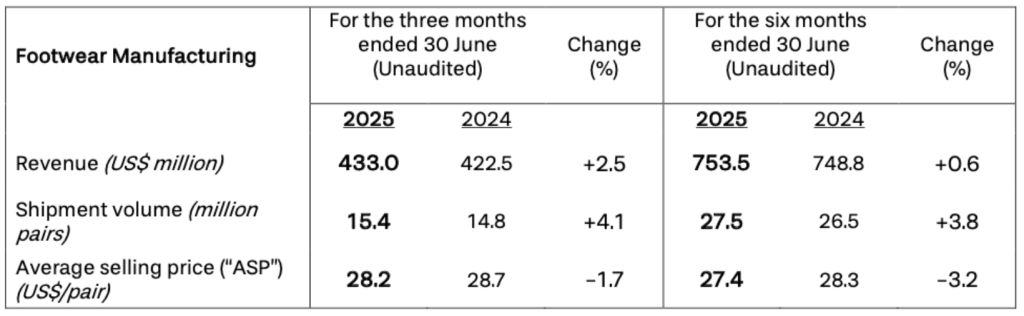

Stella International Holdings Limited (Group), the China-based the manufacturer of footwear for Nike, Saucony, Under Armour, Merrell, Timberland and Ugg reported that the Group’s unaudited consolidated revenue increased by approximately 2.9 percent to $444.0 million, compared to $431.6 million in Q2 2024.

For the six months ended June 30 (H1), the Group’s unaudited consolidated revenue increased by approximately 0.7 percent to $775.0 million, compared to $770.0 million in H1 2024.

Stella International Holdings reports in the U.S. dollar ($) currency.

Footwear Manufacturing shipment volumes in the second quarter rose 4.1 percent year-over-year and increased 3.8 percent year-over-year for the first half period, said to be mainly driven by the Sports segment. The average selling prices (ASPs) in both periods decreased due to the higher proportion of Sports product orders which have a lower ASPs.

“We are expanding and ramping up new production lines in Indonesia and the Philippines to catch up with increased customer demand,” said company CEO Chi Lo-Jen. “Worker utilisation and efficiency will slowly improve over the course of the year. We remain focused on partnering with our customers to navigate market challenges, capitalising on the strength and flexibility of our diversified production base.”

Having achieved an operating profit margin of approximately 11.9 percent in 2024, the Group said it is ahead of schedule in meeting the targets of its Three-Year Plan (2023-2025), which are to achieve an operating margin of 10 percent and a low-teens compound annualized growth rate on profit after tax by the end of 2025.

“We expect to continue meeting these Three-Year Plan targets, despite temporary margin headwinds associated with the ramp-up of our expanded production capacities in Indonesia and the Philippines, and broader macroeconomic uncertainties this year,” the company said in its Q2 report.

Stella said it also remains committed to returning additional cash up to $60 million per year to shareholders in 2025 and 2026, through a combination of share repurchases and special dividends, on top of paying regular dividends with a payout ratio of approximately 70 percent (comprising final dividends and interim dividends).

“Despite ongoing macroeconomic headwinds and trade pact uncertainties, we are partnering with our customers to optimise our production operations and further strengthen our strategic ties for the future,” noted Lawrence Chen, chairman of the Group.

Image courtesy Stella International Holdings Ltd