Frasers Group PLC, parent company of Sports Direct and other retail nameplates, boasted “sustained profitable growth” in its fiscal year ended April 28, 2024 as earnings before taxes (EBT), while a year-over-year decline, came in at the top of the guidance for the year and are expected to continue for the current fiscal year.

“This has been a break-out year for building Frasers’ future growth,” commented Michael Murray, chief executive at Frasers Group. “As well as delivering a strong trading performance, particularly from Sports Direct, we made significant progress with our Elevation Strategy. We expanded our retail ecosystem and established valuable partnerships with new brands. Our brand relationships have never been stronger, giving us invaluable support as we continue the international expansion of our business.

“We invested in group-wide operational efficiencies in warehouse automation and digital infrastructure, which we expect to yield a tangible impact as early as FY25. And we generated new growth opportunities with the rollout of Frasers Plus, including recently signing our first third-party partner in THG,” continued Murray.

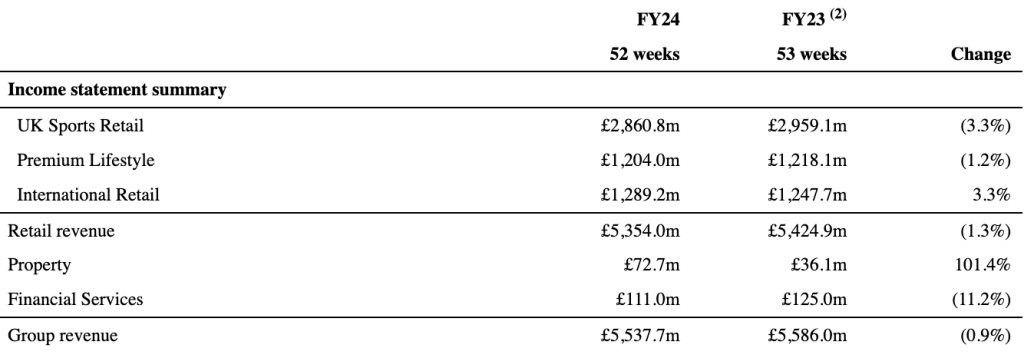

Group revenue dipped 0.9 percent to £5.54 billion for the 52-week fiscal 2024 period ended April 28, compared to £5.59 billion for the 53-week fiscal 2023 period. Excluding the impact of the 53rd week in fiscal 2023, Retail revenues increased by 0.6 percent year-over-year.

The company reported Retail revenue decreased by 1.3 percent year-over-year, with “strong trading performance” from the core Sports Direct business offsetting the majority of the planned sales declines in Game UK and Studio Retail, as well as the impact of House of Fraser store closures and a softer luxury market in Premium Lifestyle.

Group gross margin increased to 43.3 percent of revenue in fiscal 2024, a 40-basis-point improvement from 42.9 percent in fiscal 2023. Frasers said the growth was driven by “an increase in retail gross margin reflecting improvements in Sports Direct’s product mix as a result of strengthening brand relationships mitigated by the softer luxury market.”

The Group’s operating profit was down 2.7 percent to £520.6 million.

Reported EBT was down 20.5 percent to £507.0 million, or 86.8 pence per share, for the year, compared to £638.0 million, or 106.9 pence per share, in fiscal 2023.

Adjusted EBT was up 13.1 percent to £544.8 million, or 95.8 pence per share, in fiscal 2024, compared to £481.8 million, or 71.7 pence per share, in fiscal 2023.

Segment Review

UK Sports

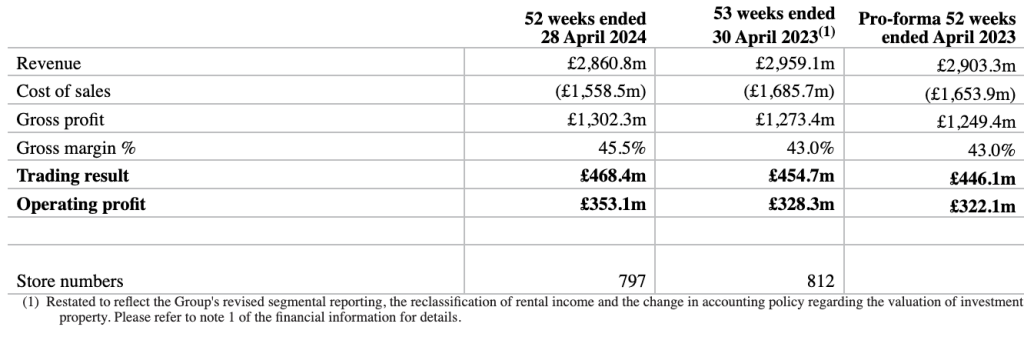

The UK Sports segment, which accounted for 51.7 percent of the Group’s revenue in fiscal 2024 and 53.0 percent of Group’s revenues in fiscal 2023, now includes the results of the Group’s core sports retail store operations in the UK, plus all the Group’s sports retail online business, other UK-based sports retail and wholesale operations, Game UK stores and online operations, retail store operations in Northern Ireland, Frasers Fitness, and the Group’s central operating functions, including the Shirebrook campus.

Segment revenue reportedly decreased by 3.3 percent, with Sports Direct largely mitigating planned declines in Game UK and Studio Retail. Excluding the impact of the 53rd week from the prior year, revenue decreased by 1.5 percent.

Gross profit reportedly increased by £28.9 million, and gross margin increased 250 bps to 45.5 percent of revenue, reflecting an improved product mix at Sports Direct due to strengthening brand relationships and reduced lower margin sales from Game UK and Studio Retail. The company said this contributed to a £13.7 million, or 3.0 percent, increase in the segment’s profit from trading.

Segment operating profit was £353.1 million in fiscal 2024, compared to £328.3 million in fiscal 2023. The 2024 results include impairment reversals of £8.4 million (FY23: impairments of £25.1 million), a result of the strong trading performance, and future forecasts outweighing the company’s downside impairment assumptions, and foreign exchange gains of £9.2 million (FY23: £35.8 million).

Store numbers decreased from 812 doors at FY 2023 year-end to 797 doors at FY 2024 year-end, which is said to be mainly driven by the replacement of stand-alone Game stores with Game concessions situated inside larger Sports Direct stores.

Premium Lifestyle

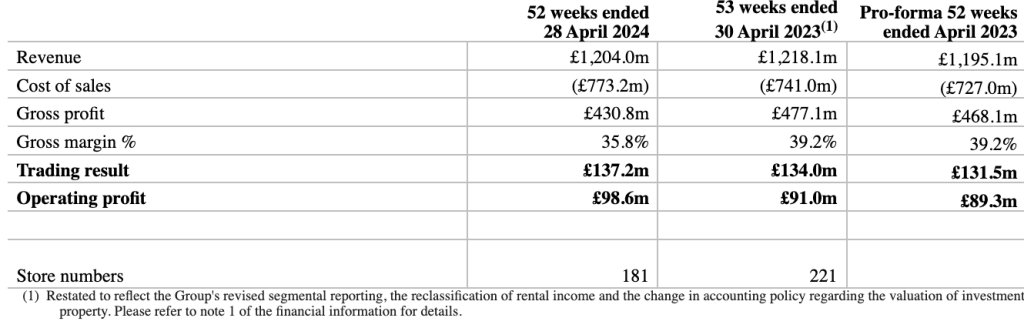

The Premium Lifestyle segment accounted for 21.7 percent of the Group’s revenue in fiscal 2024, down ten basis points from fiscal 2023. The segment includes the results of the Group’s premium and luxury retail businesses Flannels, Cruise, Van Mildert, Jack Wills, House of Fraser, Gieves, Hawkes, and Sofa.com, along with the related websites, the businesses acquired from JD Sports in fiscal 2023, as well as the results from the I Saw it First and Missguided websites until the disposal of the Missguided intellectual property in October 2023.

Segment revenue decreased 1.2 percent year-over-year in fiscal 2024 as the impact of planned House of Fraser store closures and a softer luxury market were partially offset by sales from the businesses acquired from JD Sports Fashion plc in the second half of fiscal 2023. Excluding the impact of the 53rd week from the prior year, revenue increased by 0.7 percent year-over-year.

Segment profit from trading was said to be “broadly flat” year-over-year at £137.2 million, with the planned clearance of surplus inventory from businesses acquired from JD Sports Fashion plc and the impact of continuing closures of legacy House of Fraser stores leading to a 340 basis-point reduction in gross margin to 35.8 percent of segment revenue, reportedly offset by overhead savings that came from the closure of House of Fraser stores and integrated the acquired businesses into the Group.

Segment operating profit result was £98.6 million (FY23: £91.0 million), which includes impairments of £2.5 million versus fiscal 2023 impairments of £56.9 million, including £20.5 million concerning writing down intangibles recognized on the acquisition of Missguided and I Saw it First.

“We have invested in a unique proposition in our luxury business and are well positioned for the future,” the company wrote in its performance overview for the segment. “Our long-term ambitions for this business remain unchanged, although it is likely that progress will remain subdued for the short to medium term in the face of a softer market. However, we view this as an opportunity for continued consolidation in order to further strengthen our position.”

Store numbers decreased from 221 doors at fiscal 2023 year-end to 181 doors at fiscal 2024 year-end as the company said it “continued to rationalize the House of Frasers store estate and close unprofitable stores in the businesses acquired from JD Sports Fashion plc in the second half of fiscal 2023.”

International Retail

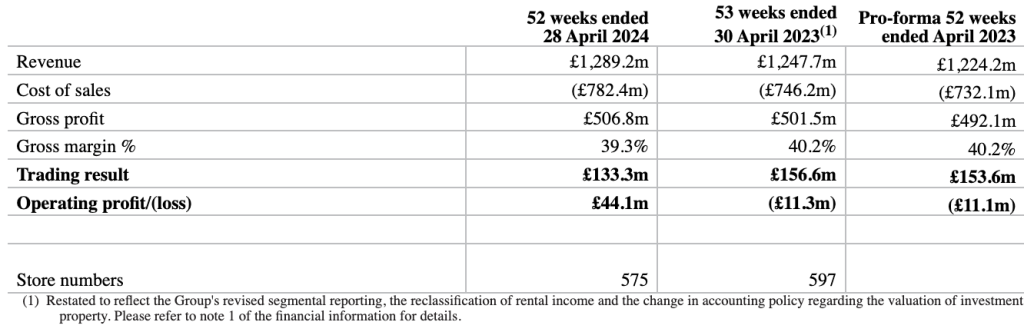

The International Retail segment accounted for 23.3 percent of the Group’s revenue in fiscal 2024, 100 basis points more than in fiscal 2023. The segment includes the results of all of the Group’s sports retail stores, management and operating functions in Europe, Asia, and the rest of the world, including the Group’s European Distribution Centers in Belgium and Austria, Game Spain stores and e-commerce offerings, the Baltics and Asia e-commerce offerings, the MySale business in Australia, the Group’s U.S. retail operations, until they were disposed of in 2022, and all non-UK based wholesale and licensing activities related to brands, including Everlast, Karrimor and Slazenger.

Segment revenue increased 3.3 percent, reportedly due to growth from the Sports Direct International business and the acquisition of the MySale business in Australia in mid-fiscal 2023. Excluding the impact of the 53rd week from the prior year, revenue increased by 5.3 percent year-over-year.

Segment profit from trading decreased by £23.3 million, or 14.9 percent, year-over-year as gross profit growth (achieved at a lower margin percent due to Game Spain (console sales and MySale) was more than offset by the one-off costs associated with integrating acquired businesses such as Sportmaster in Denmark, and inflation-linked operating cost increases.

Segment operating profit was £44.1 million for fiscal 2024, compared to a segment operating loss of £11.3 million in fiscal 2023. Fiscal 2024 includes impairments of £12.5 million versus fiscal 2023 impairments of £133.8 million, including £87.9 million concerning intangible assets allocated to the Everlast CGU, and foreign exchange gains of £0.3 million in fiscal 2024 versus foreign exchange losses of £4.7 million.

“We continue to explore opportunities for growth, having invested in our Indonesian joint venture, and expect to complete the purchase of Netherlands retailer Twinsport post-year-end,” the company said in its year-end report.

International store numbers decreased from 597 doors at fiscal year-end 2023 to 575 doors at fiscal 2024 year-end as Frasers said it continued to evaluate its stores at lease expiries and breaks to rationalize the store’s international store portfolio.

Image courtesy Sports Direct