Spartoo is signaling that it will continue offering a wide range of footwear, ready-to-wear, bags, and accessories throughout 2024, even as it manages its online inventory more tightly.

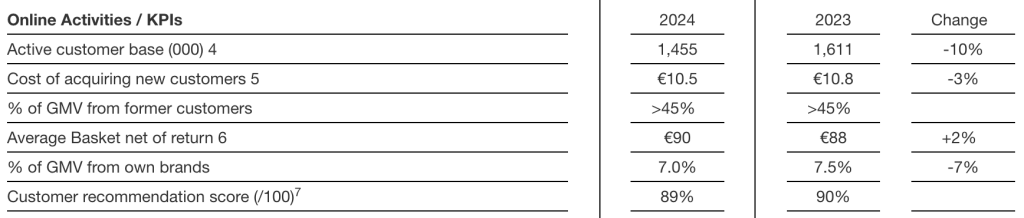

The company, which boasts one of the leading online retailers for fashion items in Europe with over 1.6 million unique references, reported that the average basket increased by 2 percent in 2024 due to higher unit selling prices.

Key Performance Indicators

The Grenoble, France-based company said its omni-channel approach remains firmly at the center of the Group’s priorities through an asset-light strategy focused on the network of affiliates and the creation of corners. As of December 31, 2024, Spartoo had 36 points of sale, including 21 corners in department stores.

As announced on February 19, 2025, a judicial liquidation procedure for the subsidiary Toostores R1 was initiated by Spartoo at the Commercial Court of Grenoble, involving the immediate cessation of activity at 22 points of sale, including 10 owned stores. This procedure directly results from the significant increase in the rent index and inflation on the Group’s fixed costs in the context of contracting demand.

The company reported further progress in acquiring new customers for TooPost despite the contraction in demand. The Group’s transport agent activity records the acquisition of 28 new e-retailers in 2024. The Gross Merchandise Value was €18.2 million, down 10.0 percent compared with the 2023 financial year.

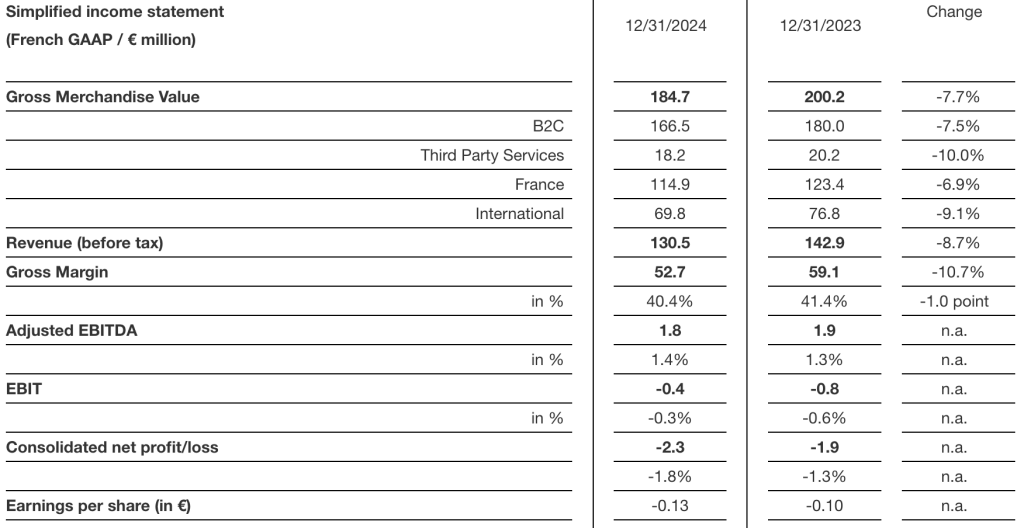

Simplified Income Statement

Income Statement Summary

Full-year revenue amounted to €130.5 million in 2024, down 8.7 percent from €142.9 million in 2023.

- “Brands acquired by the Group, such as JB Martin, Christian Pellet, GBB, and Easy Peasy, have shown good resilience with a revenue close to that of the previous year and an optimized cost structure,” the company said in a media release.

- The Adult division continues to “grow strongly” while the Children’s division is “suffering from a difficult market.”

Gross profit stood at €52.7 million over the 2024 period, or 40.4 percent of revenue, compared with 41.4 percent in 2023.

Despite strong cost pressure in 2024 (transport, minimum wage, raw materials, etc.), the Group’s adjusted EBITDA remains at €1.8 million, compared with €1.9 million for the 2023 financial year, said to demonstrate the effectiveness of the Group’s proactive cost control policy, including allocation of marketing investments according to their profitability with the cost of acquiring new customers down 3 percent, to €10.5 compared with €10.8 for 2023, closure of a warehouse and a general reduction in fixed costs.

The consolidated net loss was €2.3 million in 2024, compared with a net loss of €1.9 million at the end of 2023.

Boris Saragaglia, co-founder, chairman and CEO of Spartoo, said, “Spartoo remained true to its commitments in 2024, increasing its free cash flow to more than €6 million by optimizing its investments and costs and reducing its inventory. This strategy, which had already demonstrated its relevance in 2023, continues to pay off in 2024. Despite a still deteriorated market environment, we thus managed to maintain a positive adjusted EBITDA, almost stable compared to 2023, by reducing our net debt by more than half over the period. Our recent decision to focus offline activity on the creation of corners and affiliation should also have a favorable impact on our profitability in the 2025 financial year.”

Operating Cash Flow

The Group achieved a positive operating cash flow of €6.6 million, excluding significant non-recurring items (+€0.2 million), up from €2.0 million in 2023, excluding significant non-recurring items (+€2.5 million). The €4.6 million decrease in inventory over the period reduced the working capital requirement and thus had a positive impact on cash flow.

Operating cash flow improved by €4.6 million compared with 2023

The amount of investments remains limited over the period and reaches €0.4 million.

Balance Sheet Summary

As of December 31, 2024, the Group’s cash position amounted to €15.3 million, compared to €14.3 million as of December 31, 2023.

The Group’s net debt ratio, or gearing, remains perfectly under control, showing a decrease over the period with a level of 19 percent at the end of 2024 compared with 37 percent at the end of 2023.

Meanwhile, the Group’s net debt decreased sharply over the period, reaching €5.5 million compared with €11.7 million as of December 31, 2023.

In addition to its cash position, the Group has short-term credit lines granted by its banks of more than €8.5 million, unused as of December 31, 2024.

Spartoo reported that the Group’s inventory optimization policy has resulted in a 7.7 percent decrease in gross value compared to December 2023, contributing to the control of free cash flow while preserving its quality, as evidenced by the maintenance of a low depreciation rate (8.1 percent as of December 31, 2024, excluding André products). The company reduced its inventory dedicated to online activity by 5.1 percent in gross value and 10.6 percent in quantity.

Image courtesy Sportoo