Shimano Inc. is reporting that the pace of global economic recovery was moderate during the first half of fiscal year despite some factors that continued to exert downward pressure on the current economic climate, including tight monetary policies adopted mainly in Europe and the U.S., geopolitical risks caused by rising tensions in Ukraine and the Middle East, and a stagnant Chinese economy.

The company noted that:

- In Europe, as the employment environment further improved, personal consumption recovered moderately, and business sentiment also started to show some signs of recovery.

- In the U.S., despite the ongoing tight monetary policies, Shimano said a favorable employment environment underpinned personal consumption, and the economy remained firm.

- In China, the economy was said to be lackluster due to the prolonged sluggishness in the real estate market and a slowdown in personal consumption.

- In Japan, the company said the economy recovered moderately as a pick up was seen in the employment environment, in addition to the implementation of incomes policies.

Shimano said that, in this environment, demand for bicycles and fishing tackle continued to be weak, according to the company’s H1 report as the company reported net sales decreased 17.6 percent year-over-year (YoY) to ¥216.89 billion for the first half of fiscal year 2024 versus the year-ago H1 period.

For comparison, net sales fell 20.2 percent in the 2024 first quarter so the second quarter was a moderation from that decline. Second quarter revenue was ¥116.33 billion, compared to ¥137.18 billion in the 2023 second quarter, a 15.2 percent decline year-over-year.

First half consolidated operating income decreased 42.6 percent YoY to ¥30.96 billion, ordinary income decreased 18.7 percent YoY to ¥55.63 billion, and net income attributable to owners of the parent decreased 13.2 percent YoY to ¥43.70 billion.

Second quarter operating income amounted to ¥17.53 billion, compared to ¥25.90 billion in Q2 2023.

Bicycle Components

Shimano noted that while the strong interest in bicycles continued as a long-term trend, supply and demand adjustments of completed bicycles continued, and global market inventories generally remained high.

In the European market, Shimano reported that retail sales were firm in its major markets, namely Germany and the Benelux countries. In other European countries, the company said sales were weak due to a delayed recovery in demand for completed bicycles, and market inventories remained high.

- In the North American market, although interest in bicycles was said to be “firm,” the company said retail sales of completed bicycles softened, and market inventories remained at a somewhat high level.

- In the Asian, Oceanian and Central and South American markets, retail sales of completed bicycles were said to be weak due to “sluggish personal consumption due to rising inflation and economic uncertainty.” Market inventories were reported at “a high level.”

- In the Chinese market, due to continued popularity of road bikes, retail sales of completed bicycles were said to be “favorable,” and market inventories remained at an appropriate level.

- In the Japanese market, retail sales were said to be sluggish, affected by the soaring price of completed bicycles due to yen depreciation, and market inventories remained somewhat high.

Under these market conditions, demand for Shimano 105 and other components for road bikes was said to be “firm.” In addition, the Shimano Group said it received a favorable reception for its products, including a gravel-specific component Shimano GRX.

As a result, net sales from the Bicycle Components segment decreased 20.7 percent YoY to ¥162.59 billion, and operating income decreased 42.2 percent to ¥24.33 billion.

For comparison, sales in the 2024 first quarter declined 22.6 percent YoY and operating income fell 52.7 percent YoY. Second quarter revenues were ¥86.51 billion in the second quarter, a decline of 18.9 percent from ¥106.89 billion in the year-ago Q2 period. Segment operating profit for the second quarter amounted to ¥13.86 billion, compared to ¥19.97 billion in the 2023 second quarter.

Fishing Tackle

As demand for fishing tackle that had been overly strong globally cooled down, sales remained weak. On the other hand, adjustments to market inventories started to show signs of progress.

- Japanese market sales were reported as “lackluster” due to an ongoing adjustment of market inventories.

- In the North American market, demand for saltwater tackle was said to be “firm.” Backed by favorable weather conditions, sales were described as “favorable,” and market inventories trended toward an appropriate level.

- European market, sales were reportedly weak due to an ongoing adjustment of market inventories.

- In the Asian market, market inventories reportedly remained high, and sales were said to be weak due to cooling consumer confidence as affected by a stagnant economy.

- In the Australian market, due to stable weather conditions, people apparently were said to be fishing “actively.” As a result, market inventories remained at an “appropriate level,” and sales were described as “strong.”

The company said that under these market conditions, order-taking was reportedly brisk for the new baitcasting reels Metanium DC, the new spinning reels Twinpower and the new rods Poison Adrena.

As a result, net sales from the Fishing Tackle segment decreased 6.8 percent YoY to ¥54.07 billion, and operating income decreased 43.8 percent to ¥6.65 billion.

For comparison, the first quarter decline in sales was 5.4 percent. Second quarter Fishing Tackle sales were ¥29.70 billion, a 2.2 percent decrease from ¥30.36 billion in the year-ago quarter.

Fishing Tackle H1 operating income decrease was a moderation from the 49.8 percent decline in the first quarter, with second quarter operating profit amounting to ¥3.69 billion, compared to ¥5.95 billion in the year-ago period.

Others Segment

Net sales from the Others segment decreased 5.6 percent YoY to ¥222 million and operating loss for the first half amounted to ¥24 million, following an operating loss of ¥28 million for the comparable period last year.

Balance Sheet Review

Total assets at the end of the first half of fiscal year 2024 amounted to ¥961.48 billion, an increase of

¥89.75 billion compared to the previous fiscal year-end. The principal factors included an increase of ¥55.05 billion in cash and time deposits, an increase of ¥12.33 billion in construction in progress, an increase of ¥10.09 billion in notes and accounts receivable-trade, an increase of ¥4.02 billion in investment securities, and an increase of ¥4.01 billion in buildings and structures.

Total liabilities amounted to ¥78.89 million at half-end, an increase of ¥9.56 million compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥4.82 billion in income taxes payable, an increase of ¥4.72 billion in accounts payable-trade, and a decrease of ¥1.55 billion in provision for product warranties.

Net assets amounted to ¥882.59 billion at half-end, an increase of ¥80.19 billion compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥62.83 billion in foreign currency translation adjustments, an increase of ¥26.66 billion in retained earnings, and a decrease of ¥11.73 billion due to acquisition of treasury stock.

Outlook

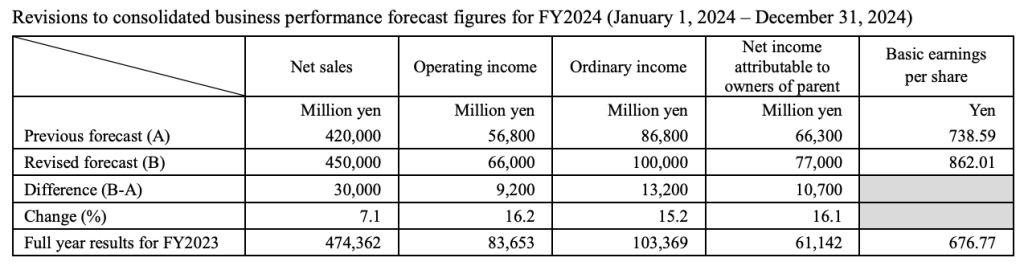

Forecast for the Fiscal Year Ending December 31, 2024

The consolidated business performance forecasts for fiscal year 2024 have been revised in light of the following factors. Sales were favorable in the Chinese market, where the popularity of sport bikes continued, especially for road bikes. As a result, the consolidated business performance for the first half of fiscal year 2024 exceeded the previous forecast. On the other hand, the outlook will remain uncertain mainly due to market inventories remaining at a high level and delays expected in resolving the remaining market inventories partly due to unfavorable weather conditions during the spring selling season in the European market.

The company considers the return of earnings to shareholders to be one of the most important issues for management. The company’s basic policy is to continue providing stable returns reflecting overall business performance and strategy.

With an eye to increasing shareholder returns further and in light of the company’s financial standing and the business performance forecasts for the full year, the company decided to pay out cash dividends of 154.50 yen per share at the end of the second quarter of fiscal year 2024, an increase of ¥12 per share from the previous forecast. In addition, the year-end cash dividends will also be ¥154.50 per share, an increase of ¥12 per share, which will make cash dividends forecast for the full year of fiscal year 2024 amount to ¥309 per share, an increase of ¥24 per share from the previous forecast.

Image and data courtesy Shimano, Inc.