When Wolverine Worldwide entered into a joint venture (JV) agreement with Xtep International Holdings Limited, a leading Chinese sportswear retailer, to develop, market and distribute Merrell and Saucony products in mainland China, Hong Kong and Macau, it was probably not in the cards that some day Xtep would buy Wolverine out of the JV and turn the operations into wholly-owned subsidiaries of Xtep.

Wolverine Worldwide formed the joint venture with Xtep in March 2019 to launch the Merrell and Saucony brands in China. Xtep is described as a vertical player in the sportswear market, with over 8,200 stores in Asia-Pacific, North America, and EMEA, and a strong network of distributors and shopping mall operators.

Under the joint venture agreement, Xtep held the option to purchase a 40 percent minority ownership interest in the entity that owns the Saucony intellectual property in China if the business met certain financial targets. Due to the early success and profitability of Saucony in China, the company and Xtep agreed in December 2023 to accelerate the exercise of that purchase option.

The company and Xtep also agreed the company would sell its equity interest in the Merrell and Saucony joint venture entities to a wholly-owned subsidiary of Xtep, transitioning the business from a joint venture model to a license and distribution rights model under which Xtep will exclusively carry out the development, marketing and distribution of footwear, apparel, and accessories for the Saucony and Merrell brands in China.

This is where the brands stand today, and probably a good position to be in, considering the difficulties and technicalities of navigating the Greater China markets for most brands. While many brands are experiencing issues with a slow recovery, or a weakening outlook in the China market, other companies, including Amer Sports and its trio of key brands, Arc’teryx, Salomon and Wilson, are enjoying unprecedented growth and opportunity due to a partnership with their largest shareholder, Anta Sports, which also owns thousands of retail locations, both mono-brand and multi-brand, in the China market. It works.

The Wolverine Worldwide Transition

The MS (China) Sports Company Limited, a direct wholly-owned subsidiary of Xtep International Holdings Limited (Group), completed the acquisition of Wolverine Group’s interests in certain joint venture entities in Merrell and Saucony brands and their subsidiaries, which it completed on January 1, 2024:

Acquisition of 51 percent equity interests in Merrell Brand Operations Limited and Saucony Brand Operations Limited and their subsidiaries. The Group acquired these interests for a total cash consideration of $14.0 million (equivalent to RMB 99.4 million). Consequently, the associates above became wholly-owned subsidiaries of the Group.

Acquisition of 49 percent equity interests in Merrell Distribution Operations Limited and Saucony Distribution Operations Limited and their subsidiaries. This acquisition, made for a total cash consideration of $8.0 million (equivalent to RMB 56.3 million), resulted from the subsidiaries above becoming wholly owned subsidiaries of the Group.

As a result, the agreements constituting the joint ventures were terminated and the companies began operating under the new licensing and royalty agreements at the beginning of the year.

Consolidated First Half Results – Xtep International

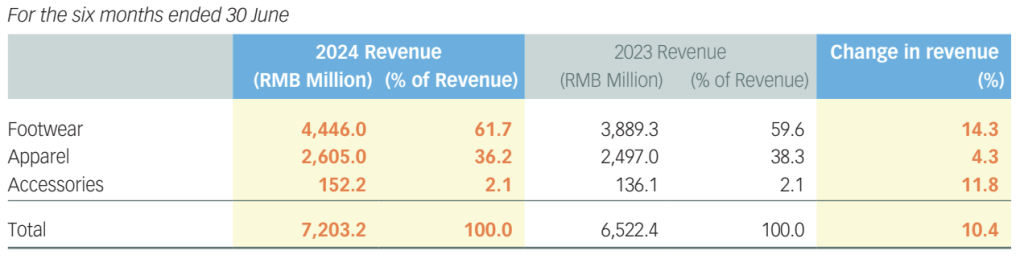

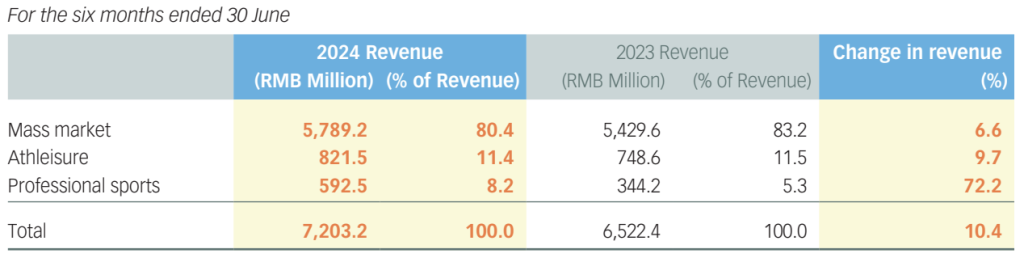

The Group’s consolidated first half (H1) revenue increased 10.4 percent to RMB 7.2 billion in 2024, compared to RMB 6.5 billion in the 2023 first half. Revenue of the core Xtep brand increased 6.6 percent year-over-year (y/y) to RMB 5.8 billion. Channel inventory turnover was around four months at the end of June.

Xtep International trades and reports in China renminbi (RMB) or “Yuan” currency.

First Half Revenue by Category

The Group’s gross profit margin reached 46.0 percent of sales in the first half, compared to 42.9 percent in H1 2023. First half consolidated gross profit increased 18.5 percent y/y to RMB 3.3 billion.

Operating profit climbed 10.9 percent y/y to RMB 1.1 billion, compared to RMB 986.6 million for the corresponding H1 period in 2023. The increase was said to be driven by strong performances in the Mass Market and Professional Sports segments, partially offset by increased losses in the Athleisure segment.

The overall operating profit margin improved slightly to 15.2 percent of sales from 15.1 percent of sales in H1 2033.

Profit attributable to the company’s ordinary equity holders amounted to RMB 752.1 million, or RMB 29.7 cents per share, up 13.0 percent from RMB 665.4 million, or RMB 26.4 cents per share, in the year-ago first half.

Strategic Realignment

“Since the Group embarked on its journey to become a leading multi-brand sportswear company in 2019, we have seized new market opportunities but have also been presented with a myriad of challenges arising from the COVID-19 pandemic,” Group Chairman Ding Shui Po wrote in Xtep’s Interim (H1) Report.

Xtep strategically has now streamlined its business into three segments—Mass Market, Athleisure, and Professional Sports.

First Half Revenue by Updated Segment

Mass Market Features the Core Xtep Brand

“As a mass market brand, the core Xtep brand seamlessly taps into the growing demand for professional running products that represent good value for money,” said Po. “The success and popularity of our mass market running shoes have translated into the highest marathon wear rate in China, contributing to our success in achieving consistent expansion in our market share over the years.”

Athleisure Contains the K·Swiss and Palladium Brands

Following a thorough review of its business strategy and financial objectives, the Group, in May 2024, announced the proposed strategic divestiture of the K·Swiss and Palladium (KP) business. The decision to carve out the “constantly underperforming” segment from the Xtep portfolio is expected to eliminate the ongoing impact of KP’s loss on Xtep’s profitability and cash flows, allowing the company to concentrate resources on developing the highly profitable brands, the Group’s core Xtep brand, as well as Saucony and Merrell.

Professional Sports Houses the Saucony and Merrell Brands

By leveraging the synergies of the core Xtep brand in product innovation, marketing, and retail networks, the company said that Saucony would be able to convey its brand positioning to top runners and social elites by offering premium professional running products.

“Sophisticated consumers in higher-tier cities are becoming more discerning and seeking sportswear that is an alternative to the traditional big labels, fueling the emergence of up-and-coming international sportswear brands in China. Capitalizing on this evolving consumer demand, Saucony has caught on in the mainstream and become one of the fastest-growing sportswear brands in China,” the chairman added.

“We will continue to broaden our product offerings, increase marketing efforts and accelerate the opening of new-image Saucony stores in higher-tier cities,” the report said. “Merrell will expand its product line to support outdoor athletes who enjoy tackling various terrains and adopt a demand-driven supply approach to achieve sustainable business growth.”

A Strategic Focus on Running

Professional Sports

The Professional Sports segment, home to the Saucony and Merrell brands, saw significant H1 growth (+72.2 percent), with revenue rising to RMB 592.5 million and accounting for 8.2 percent of the Group’s revenue in the first half of 2024. This increase was said to be driven by higher product popularity and strong retail performance, highlighted by double-digit same-store growth and robust online sales performance.

The Professional Sports segment realized a dramatic increase in gross profit, up 132.6 percent to RMB 336.5 million from RMB 144.7 million in Q2 2023, with the gross profit margin rising to 56.8 percent from 42.0 percent in H1 2023. This significant improvement was mainly due to the acquisition of the entire Saucony and Merrell joint venture interests, which allowed the Group to capture the total gross profit margin.

The Professional Sports segment posted a significant increase in operating profit in the first half as well, increasing 75.5 percent y/y to RMB 23.3 million, with the operating profit margin remaining at 3.9 percent. This improvement was again said to be mainly due to the acquisition of the entire Saucony and Merrell joint venture interests, which allowed the Group to capture the full gross profit margin. However, the consolidation of marketing expenses, research and development expenses, and staff costs into the Group offset the increase in gross profit margin.

This Saucony and Merrell segment also recorded a net profit of RMB 31.8 million for the first half.

Saucony

As a leading global running brand, Saucony’s popularity among the Chinese running community has grown rapidly over the past few years.

“The success of its strategic brand positioning, targeting the running and social elites in China’s higher-tier cities, has been reflected in rapid sales growth, a top-three ranking in terms of wear rates in international and domestic marathons, and an increase in market share,” the Xtep report said.

“As the first new brand in the Group to achieve profitability, Saucony has manifested an impressive growth trajectory in recent years, driven by its strategic brand positioning to focus on running and social elites in China,” Po said. “The brand has received an enthusiastic response from China’s professional running community, as evidenced by its remarkable wear rates in domestic and international marathons. As we continue to focus our efforts on expanding Saucony’s business scale in China, we will broaden localized designs and lifestyle offerings without compromising on product quality while accelerating the opening of new-look image stores in higher-tier cities.”

Saucony reportedly intensified its branding efforts during the first half to drive growth, including spokesperson engagement, product innovation, channel enhancement, and event sponsorship.

In July 2024, Saucony appointed Chinese actor Eddie Peng as its brand spokesperson. Peng will promote Saucony’s complete product line, including the newly launched Triumph 22, Endorphin Pro 4 and Endorphin Speed 4 series. The brand also sponsored the “Hood to Coast China Relay” for the fourth year and worn by 25,000 elite runners as they the course.

To sustain Saucony’s future growth and expand its target market, the brand will open more new image stores in higher-tier cities in Mainland China. At the end of June, there were 128 Saucony stores in Mainland China.

Merrell

Chairman Po also said China’s rapidly expanding outdoor sports sector represents a promising opportunity for Merrell to gain market share.

“By creating demands for various outdoor scenarios, we offer thoughtfully designed products with cutting-edge performance and versatility to high-end consumers,” noted Po. “Leveraging its effective omni-channel sales strategy and strong brand image, Merrell has further explored growth opportunities in the e-commerce channel and achieved encouraging results.”

In its H1 report, Merrell said it has embraced an “unwavering commitment to providing consumers with the best possible outdoor experience. ”

In March 2024, Merrell introduced the Hydro Next Gen Moc Venom 3.0 shoe. In addition to increased cushioning, the new design reportedly eliminates the rear heel strap design for improved comfort and features an enhanced outsole with rubber patches that improve grip and traction, enabling runners to transition between terrains.

Recognizing the growing popularity of urban outdoor activities among the younger generation, the brand collaborated with Palladium to add a stylish element to the shoe. The crossover collection has gained widespread attention from outdoor enthusiasts.

Athleisure

Revenue in the Athleisure segment grew by 9.7 percent to RMB 821.5 million, accounting for 11.4 percent of the Group’s revenue. This growth was primarily driven by the China market, which experienced over 80 percent y/y growth. However, this was said to be partially offset by a decrease in international business outside of China. Revenue from Mainland China grew rapidly (+85.7 percent), representing 39.2 percent of revenue contribution.

Still, sluggish demand due to high inflation and economic uncertainty has reportedly dampened overseas growth for the K·Swiss and Palladium brands. Meanwhile, the company noted that growth in Mainland China reportedly continued to accelerate, driven by “meticulously executed rebranding efforts” that increased store productivity and the customer base.

Palladium’s solid growth in retail productivity in Mainland China was said to be a testament to its success in optimizing the product portfolio and enhancing the brand image. In the first half of 2024, the brand continued to roll out new image stores “infused with a trendy French aesthetic” and a comprehensive selection of the brand’s core and star product lines to cater to high-end consumers.

Gross profit in the Athleisure segment rose “significantly” by 39.6 percent to RMB 438.8 million in the first half, with the gross profit margin increasing to 53.4 percent of sales from 42.0 percent of sales in the prior-year H1 period. This improvement was said to be largely due to a higher contribution from the China market, where the direct-to-consumer (DTC) model, which has a much higher gross margin, is prevalent. There was also less stock clearance compared to the previous year and a lower contribution from the international business, which operates on a wholesale model with lower margins.

The Athleisure segment recorded an operating loss of RMB 99.2 million in the first half, compared to a loss of RMB 66.3 million in 2023. The operating margin increased to negative 12.1 percent of sales in H1, from negative 8.9 percent of sales in the H1 2023 period. The increased loss was reportedly due to higher expenses associated with the DTC model in China, including retail staff salaries, rental expenses, and store decoration costs, which affected profitability. Additionally, the lower revenue from the international business, which primarily incurs fixed SG&A expenses, could not cover these costs, further impacting the segment’s financial performance.

At June 30, there were 105 K·Swiss stores and 114 Palladium stores in Asia-Pacific, including Mainland China.

Mass Market

Revenue from the mass market segment increased by 6.6 percent to RMB 5.8 billion. This company attributed the growth mainly to the strong performance of its online channels, which saw substantial increases in consumer engagement and sales.

Gross profit for the mass market segment grew by 8.6 percent to RMB 2,539.0 million (2023: RMB 2,338.2 million), with the gross profit margin improving to 43.9 percent from 43.1 percent. This growth was primarily driven by a higher contribution from e-commerce, which has a higher gross margin than wholesale business and an increase in the e-commerce gross margin.

The operating profit for the Mass Market segment grew by 7.6 percent to RMB 1.2 billion, with the operating profit margin slightly increasing to 20.6 percent of sales in H1 from 20.4 percent in H1 last year. This growth was said to be primarily driven by a higher contribution from the e-commerce channel, which has higher margins compared to wholesale. The increase in revenue and gross profit outpaced the rise in SG&A expenses, demonstrating operational leverage of the segment operation.

The H1 report said that Xtep is “the most recognized running brand in China,” having “demonstrated excellence in product development and performance” through the 408 marathon championships and national records achieved by the brand’s sponsored athletes in China.

“The endorsement of our professional running products by top athletes has reinforced the association between the brand and its expertise in running, successfully increasing the popularity of our mass market running shoes and securing the highest marathon wear rate in China,” the Group said.

As consumers returned to online shopping in 2024, the revenue of its e-commerce business reportedly recorded “robust growth” of over 20 percent in the first half of 2024, accounting for over 30 percent of the revenue of the core Xtep brand. Among e-commerce platforms, livestreaming and social e-commerce platforms have reportedly gained significant traction to become the fastest-growing retail channels. Retail sales from Douyin, DeWu and WeChat Channels surged over 80 percent y/y.

“Owing to our reputation and specialization in running, our running products have contributed substantially to the robust retail sales growth for the e-commerce business,” the Group wrote. “During the 618 Shopping Festival, the online gross merchandise value of the Group and the core Xtep brand increased by over 50 percent and 40 percent, respectively.”

At June 30, there were 6,578 Xtep Adult branded stores mainly operated by authorized distributors in Mainland China and overseas, a net increase of seven stores since January 1, 2024.

The Group said its intensified efforts to cultivate young sports talent have yielded “fruitful results.”

“By collaborating with sports experts to provide professional sportswear for Chinese children and encouraging them to participate in sports, the Kids business enjoyed remarkable success and continued to fuel the growth of the core Xtep brand in the first half of 2024,“ the Group noted.

At June 30, there were 1,706 Xtep Kids stores in Mainland China, a net gain of three stores since January 1 predominantly operated by the Group’s authorized distributors.

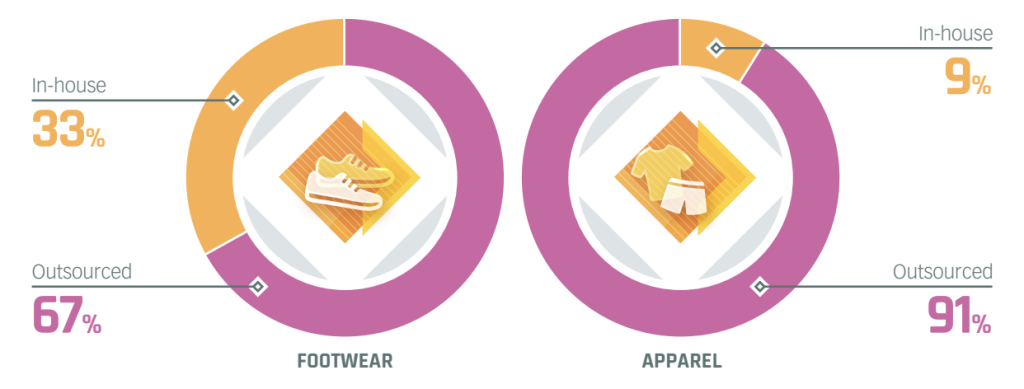

The construction of the second phase of the in-house production facility in Shishi, Fujian Province, is said to be well underway. This facility will reportedly feature state-of-the-art footwear assembly lines to satisfy the increasing demand, with a total planned gross floor area of approximately 170,000 square meters, of which 30,000 square meters is expected to be completed in October 2024.

The new industrial park in Bengbu, Anhui Province, which commenced operations in May 2023, comprises a footwear production facility of approximately 48,000 square meters and an apparel production facility of 25,000 square meters, effectively supporting the ever-expanding business.

Meanwhile, the logistics park in Jinjiang, Fujian Province, is under construction. With a planned gross floor area of approximately 240,000 square meters, the logistic park is expected to serve as a central warehouse to effectively facilitate the delivery of finished goods directly to brand retail stores and maximize our operational efficiency.

Image courtesy Xtep, Changsha, Hunan Province, Mainland China

See below for additional SGB Media coverage of the evolution of the joint venture program:

Wolverine Transforming Saucony and Merrell Model in China; Sells Asia Leathers Business