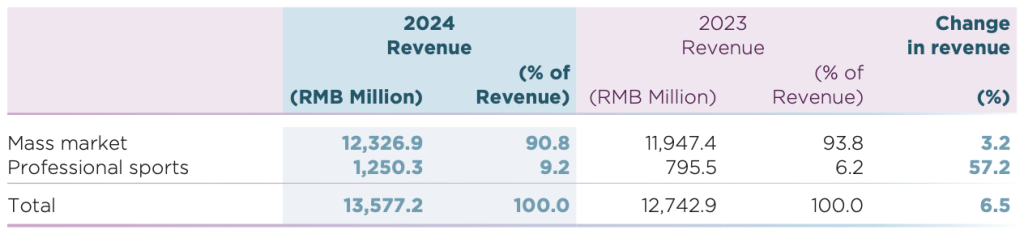

Xtep International Holdings, Ltd. (Group), the owner of the Xtep brand globally and the Saucony and Merrell brands in the Greater China market, reported in its 2024 Annual Report that revenue of the Group’s continuing operations increased by 6.5 percent to RMB13.6 billion in 2024, compared to RMB12.7 billion in 2023. The company said the increase was driven by the “steady performance” of the core Xtep brand and “robust growth” of the Professional Sports segment, comprised of the Saucony and Merrell brands.

The company divides its business into Mass Market and Premium Market consumers, with the core Xtep brand focused on the larger, more price-sensitive Mass Market and Saucony and Merrell (Professional Sports) focused on the Premium Market.

Revenue of the core Xtep brand increased 3.2 percent year-over-year (y/y) to RMB12.3 billion. Revenue of the Saucony and Merrell combined business (Professional Sports) segment saw year-over-year growth of 57.2 percent to RMB1.25 billion, compared to RMB795.5 million in 2023.

Group Revenue by Segment

Group Revenue by Category

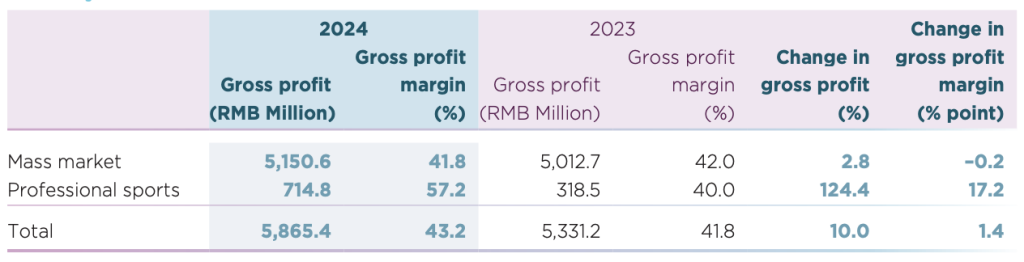

Group Gross Profit/Margin by Segment

Operating profit for the Group’s continuing operations increased 9.3 percent to RMB1.97 billion in 2024 from RMB1.80 billion in 2023. The increase was said to be driven by strong performance in both the Mass Market and Professional Sports segments. The overall operating profit margin improved to 14.5 percent of net revenue in 2024 from 14.1 percent in 2023.

Profit attributable to ordinary equity holders of the company hit an all-time high of RMB1.24 billion (2023: RMB1.03 billion), an increase of 20.2 percent y/y.

The Group proposed a final dividend of HK9.5 cents per share (2023: HK8.0 cents per share), with an option to receive scrip shares instead of cash. With the interim dividend of HK15.6 cents per share, the full-year dividend payout ratio was 50.0 percent. Additionally, with a special dividend of HK44.7 cents per share, the total dividend increased by 221.7 percent, resulting in a payout ratio of 138.2 percent (2023: 50.0 percent).

Following the strategic divestiture of K-Swiss and Palladium in November 2024, the Group has realigned its strategy to prioritize running and allocate resources effectively to optimize operations.

The company said the Group would enhance its direct-to-consumer (DTC) initiatives for the core Xtep brand, inspired by Saucony’s “remarkable success in retail network management“ to cultivate deeper, more personalized customer engagement, foster brand loyalty and boost retention rates.

At 2024 year-end, there were 6,382 Xtep Adult branded stores and 1,584 Xtep Kids stores in Mainland China and overseas, respectively. Saucony had 145 stores in Mainland China at year-end.

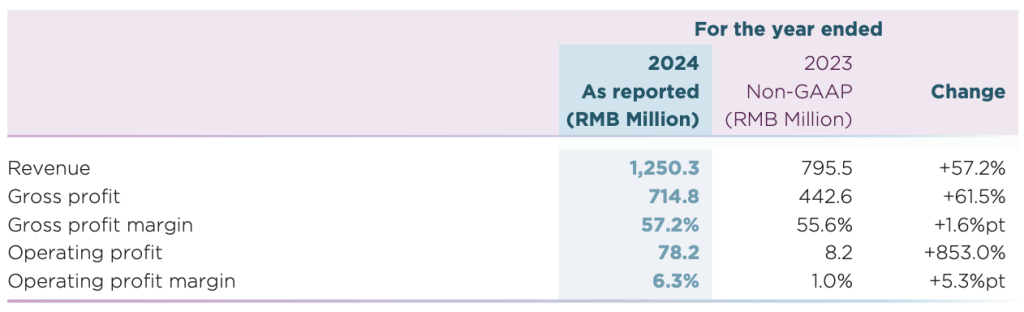

Professional Sports

In 2024, revenue from the Professional Sports segment realized a year-over-year growth of 57.2 percent to RMB1.25 billion, accounting for 9.2 percent of the Group’s total revenue. The segment also recorded an operating profit of RMB78.2 million, representing a “substantial increase” compared to the operating profit of RMB8.4 million in 2023.

The Professional Sports segment saw a significant increase in operating profit in 2024, rising by 829.5 percent to RMB78.2 million (2023: RMB8.4 million), with the operating profit margin increasing to 6.3 percent from 1.1 percent. This improvement was mainly due to acquiring all of Saucony and Merrell’s joint venture interests, which allowed the Group to capture the full gross profit margin. However, as expected, the consolidation of marketing expenses, research and development expenses, and staff costs into the Group offset certain increases in gross profit margin.

Non-GAAP Financial Measures for Professional Sports Segment

After completing the acquisition of Wolverine Group’s interests in certain joint venture entities associated with the Merrell and Saucony brands and their subsidiaries on January 1, 2024, all Merrell and Saucony operating entities in Greater China are now wholly owned by the Group. Consequently, the results of the Professional Sports Segment were fully consolidated into the Group’s financial results. The table below is a pro forma as if both brands were owned 100 percent for full year 2023.

Professional Sports Income Statement Summary

Saucony Brand

As the first new brand to achieve profitability in 2023, Saucony reportedly maintained a growth trajectory again in 2024, surpassing RMB1 billion in revenue.

The company said that Saucony has rapidly become the new favorite among runners in China, serving as the second growth driver for the Group. Ranked among the Top 3 brands in wear rates in the top Chinese marathons, its legacy as a century-old icon in the running world has been further solidified.

Since 2020, Saucony has primarily relied on the DTC model to expand its retail network in China. This DTC strategy has fueled the rapid growth of the Professional Sports segment over the past five years. The segment’s revenue achieved a compound annual growth rate of over 100 percent from 2020 to 2024, reaching breakeven in 2023 and demonstrating resilience in 2024.

As Saucony scales up its business operations in China, the company said it will further enhance its branding initiatives for Saucony and will continue efforts to launch new flagship and concept stores with elevated aesthetics in premium shopping malls, as well as an expanded range of apparel and lifestyle products designed to appeal to a broader audience and enhance the overall customer experience.

In September, Saucony unveiled its first concept store at The Mixc Shenzhen, marking a new chapter for the sports brand with a new visual space in Shenzhen. This new visual space design features a “fissioning moon” to showcase Saucony’s core running shoe technology and pay tribute to the historic moment in 1965 when astronauts made their first spacewalk wearing Saucony space shoes.

In November, Saucony expanded its footprint, launching its first urban store at the Hopson One Mall in Beijing. The store continues the moon concept at its entrance and incorporates iconic Beijing running routes, celebrating the city’s culture and Saucony’s commitment to the running community. As of December 31, 2024, there were 145 Saucony stores in Mainland China.

Product Innovation and Marketing

In addition to providing elite runners with top-tier performance gear, including the newly launched Triumph 22, Endorphin Pro 4, Endorphin Speed 4 and Hurricane 24 series, the company said Saucony is “poised to expand its apparel and lifestyle offerings to cater to the diverse needs of Chinese consumers.”

In 2024, the Saucony brand introduced a series of co-branded collections that garnered attention in the market. It partnered with designer Jae Tips to launch the ProGrid Omni 9 series, bringing a fashion perspective to the Omni shoe with Jae Tip’s design concept. In addition, Saucony collaborated with Lamfo to release the FW2024 co-branded series, the second collaboration between the two brands featuring the Triumph 22 model. The shoes are adorned with insoles in gold, red and white, “symbolizing victory and effectively conveying strength and glory.”

Merrell Brand

In 2024, the brand organized outdoor events to allow athletes to experience its product line. During the fall season, Merrell partnered with women’s brand Seniq to host a hiking experience in Bend, OR, to encourage more women to connect with nature while wearing Merrell’s wind and waterproof Moab Speed 2 GTX hiking shoes. Additionally, Merrell assembled a team of 30 trail running enthusiasts to participate in the 2024 Torx CHN100 Shenzhen Mountain Running Race in December, “empowering them” with MLT Long Sky 2 Matryx footwear.

Through these activities, the company said Merrell not only “celebrates the passion for outdoor sports, but also strengthens its commitment to inspiring people to seize every opportunity to explore and connect with the natural world.”

Significant Investments and Material Acquisitions and Disposals of Subsidiaries

The acquisition of the Wolverine Group’s interest in the 2019 joint venture entities: On January 1, 2024, MS (China) Sports Company Limited, a direct wholly-owned subsidiary of the company, completed the acquisition of Wolverine Group’s interests in certain joint venture entities to carry out the development, marketing and distribution of products under the Saucony and Merrell brands, which included:

- The acquisition of 51 percent equity interests in Merrell Brand Operations Limited, Saucony Brand Operations Limited and its subsidiaries for a total cash consideration of US$14.0 million (equivalent to RMB99.4 million). Consequently, the aforementioned associates have become wholly-owned subsidiaries of the company, and

- The acquisition of 49 percent equity interests in Merrell Distribution Operations Limited and Saucony.

Additionally, the acquisition of Distribution Operations Limited and its subsidiaries resulted in a total cash consideration of US$8.0 million (equivalent to RMB56.3 million). As a result, the aforementioned subsidiaries became wholly owned subsidiaries of the company.

The company said the consolidation of ownership and management of the joint venture entities has allowed the Group to maximize the synergies in product innovation, marketing and distribution channels between the core Xtep brand and the Saucony and Merrell brands and to enhance control over the brand’s strategic direction and operational efficiency.

Disposal of KP Global Group

On May 9, 2024, the company entered into a share purchase agreement with Ding Shun Investment Limited, owned 67 percent, 21 percent and 12 percent by Mr. Ding Shui Po, Ms. Ding Mei Qing and Mr. Ding Ming Zhong, respectively, under which the company agreed to sell. Ding Shun Investment Limited agreed to acquire all the issued share capital of KP Global, the company that owns K-Swiss and Palladium brands, at the consideration of US$151,000,000. As part of the transaction, KP Global issued US$154 million in convertible bonds to offset its debt to the company. The KP Disposal was completed on November 30, 2024.

The KP Disposal allowed the Group to eliminate the ongoing impact on its profitability and cash flow due to the continuous losses incurred by the business of the K-Swiss and Palladium brands. The KP Disposal was expected to significantly reduce losses for the Group, with an improvement in profitability over the next two years and beyond.

After completing the KP Disposal, the Group streamlined its business structure. The Group will continue concentrating its resources on developing profitable brands, including Xtep, Saucony and Merrell.

Image and data tables courtesy Xtep International Holdings Ltd. and Saucony