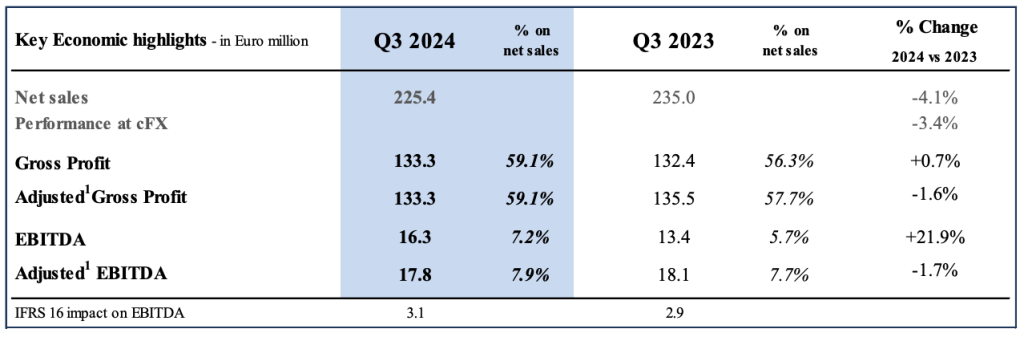

Safilo Group S.p.A., the owner of Smith Optics and Blenders, and licensee of the Under Armour, Fossil, Havaianas, Tommy Hilfiger, Levi’s, and Liz Claiborne brands for eyewear, among many others, said it improved its economic performance through the ongoing growth of the gross margin, driven by the structural efficiency of the new industrial set-up, and a favorable impact of the price/mix of sales.

At the operating level, the recovery was said to be partially offset by the effects of the unfavorable operating leverage stemming from a lower level of revenues. Although marketing expenses saw a slight decrease compared to the same period in 2023, the company said they remained significant to ensure the successful launch of the new collections.

Italy-based Safilo Group S.p.A. reports in EU euro (€) currency.

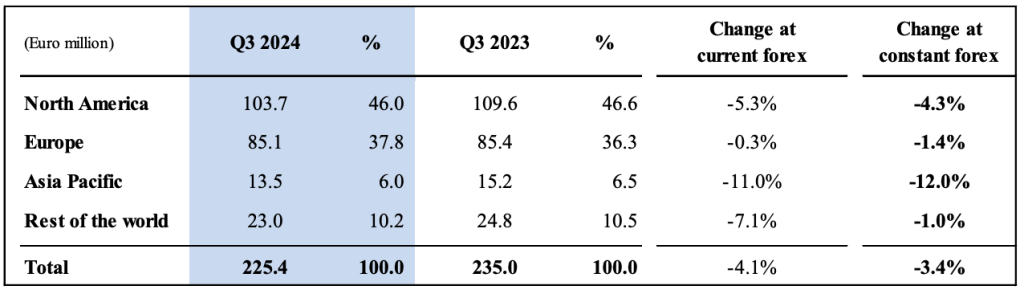

Safilo’s consolidated net sales amounted to C225.4 million in the third quarter, down 3.4 percent at constant-currency (cc) exchange rates and 4.1 percent at current exchange rates compared to €235.0 million recorded in Q3 2023.

After what the company said was a soft performance in May and June, third-quarter sales were said to be marked by a modest sun season in July and August, followed by a more promising start to the Fall/Winter order collection in September. Such business context did not allow the Group to counterbalance the exit of the Jimmy Choo brand.

The quarterly performance reportedly showed lingering soft trends in North America and Asia, while trends proved more resilient in Europe, despite the slowdown of the sunglasses business. Among brands, Carrera, David Beckham, Tommy Hilfiger, and Marc Jacobs experienced the most significant growth, while Polaroid and other brands were influenced by their higher exposure to sun products.

In the sport segment, Smith’s performance remained affected by a still cautious market environment.

Safilo closed the first 9 months of 2024 (YTD) with net sales of €757.4 million, down 2.7 percent in cc terms and down 3.5 percent in reported terms compared to €785.1 million recorded in the first 9 months of 2023. As in the third quarter, the decline in the YTD period was said to be entirely due to the exit of Jimmy Choo, net of which the sales performance was substantially stable compared to the same period of 2023.

Net Sales by Region

North America sales amounted to €103.7 million in Q3, down 4.3 percent cc and 5.3 percent in reported terms compared to Q3 2023. The performance of the area remained soft and volatile, with varying trends across product categories and distribution channels. In eyewear, wholesale revenues of prescription frames and sunglasses posted a good recovery, thanks to the growth achieved by Carrera, Boss, David Beckham, Tommy Hilfiger and Marc Jacobs. The market was instead subdued for sunglasses sales through online channels, and for the Sports business, where clients and consumers maintained a cautious approach to purchases, awaiting the start of the winter season.

Third quarter YTD sales in North America totaled €321.4 million, down 5.4 percent at constant exchange rates and 5.8 percent at current exchange rates compared to €341.1 million recorded in YTD 2023.

Europe sales amounted to €85.1 million in Q3, down 1.4 percent cc and 0.3 percent in reported terms, compared to Q3 2023. The company said, excluding the residual negative effect of the Jimmy Choo exit, the underlying performance of the region was slightly positive, marked, on one side, by the ongoing solidity of the prescription frames business, on the other by soft sunglasses sales.

Safilo said that in the current context of uncertainty, Europe remained the company’s most resilient market, particularly France, where the business with independent opticians and chains maintained good growth rates. The quarter was also positive in Germany, and in Eastern European markets.

Third quarter YTD sales in Europe totaled €324.2 million, up 2.2 percent cc and 1.0 percent in reported terms, compared to €321.1 million recorded in YTD 2023.

Asia Pacific sales amounted to €13.5 million in Q3, down 12.0 percent at constant exchange rates and 11.0 percent at current exchange rates compared to Q3 2023. The performance of the period was said to be primarily influenced by the slow down in China. Still, the company said the feedback on the new collections, gathered at the optical fair held in Beijing in the second week of September, proved to be promising.

Third quarter YTD sales in the Asia Pacific region totaled €40.0 million, down 7.8 percent cc and 8.7 percent in reported terms, compared to €43.8 million recorded in the YTD 2023 period.

Rest of the World region sales amounted to €23.0 million in Q3, down 1.0 percent cc and 7.1 percent in reported terms, compared to Q3 2023. Safilo said business trends in July and August in the different markets of the area remained soft, while September registered a good recovery, especially in India, the Middle Eastern and African markets.

Third quarter YTD sales in the Rest of the World totaled €71.8 million, down 8.1 percent cc and 9.3 percent in reported terms compared to €79.2 million recorded in the YTD 2023 period.

Consolidated Income Statement

Image courtesy Smith, data and tables courtesy Safilo Group S.p.A.