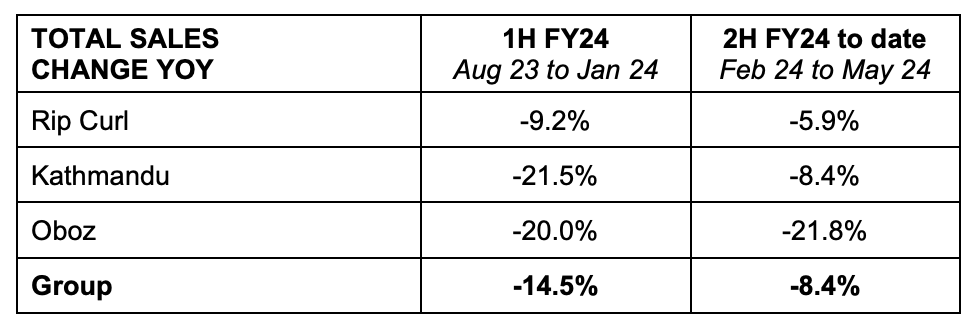

KMD Brands Limited, the parent company to the Rip Curl, Oboz, and Kathmandu brands, provided an updated outlook on its sales and margins for the fiscal year that ended July 31, indicating that it remains focused on optimizing its Kathmandu winter and Rip Curl’s Northern Hemisphere summer results in a challenging consumer environment.

“We are seeing a prolonged impact of cost-of-living pressures on consumer sentiment globally but particularly in New Zealand, and we continue to respond tactically to competitive market dynamics,” said KMD Brands CEO & Managing Director Michael Daly in a media release. “Alongside immediate trading priorities, our focus remains on tightly controlling operating costs, moderating working capital, and maximizing cash flows.”

At the end of the first half, Daly was more bullish in the second half, expecting year-over-year improvement as the company cycled a “less challenging [H2] sales performance last year, particularly Kathmandu in the fourth quarter.”

KMD Brands reports in New Zealand dollars (NZ$).

For the 10-month year-to-date (YTD) period through May 2024, the company reported consolidated KMD gross margins to remain resilient, with operating costs tightly controlled.

Rip Curl and Kathmandu sales improved on first-half sales trends during the first four months of the second half. KMD said it had not seen the continued improvement expected at the start of Kathmandu’s key winter selling period.

Kathmandu has reportedly experienced a slower-than-expected start to the key winter promotional period. The first three weeks of the winter sale season were down 11.5 percent compared to last year and below the improving second-half trend. Through the first three weeks of its winter sale, Australian sales were in with the Here 2 trend, but the New Zealand business remained challenging. Australian sales have reportedly improved weekly as the winter season progresses.

Other Brand Notes

Rip Curl has started its peak summer trade in the Northern Hemisphere and direct-to-consumer sales for the U.S. and Europe are showing positive single-digit growth above last year. The company noted that the peak weeks are still to come.

- Rip Curl and Oboz wholesale customers continue to reduce their inventory holdings in response to the challenging consumer environment.

- Oboz online sales continue to deliver strong year-over-year growth (+28.9 percent) for the 10-month YTD period, said to be benefiting from strategic promotional activity and new product innovation.

- The company noted it has six weeks of peak Kathmandu winter trade and Rip Curl Northern Hemisphere summer trade still to come.

Revised Outlook

The company now expects underlying EBITDA to be approximately $50 million for the full year, based on the most recent sales trends across all brands.

KMD has taken pre-emptive action with the support of its banking Group to lower the FCCR covenant ratio for the next three measurement points. Available funding at year-end is expected to be approximately NZ$200 million.

Image courtesy Rip Curl