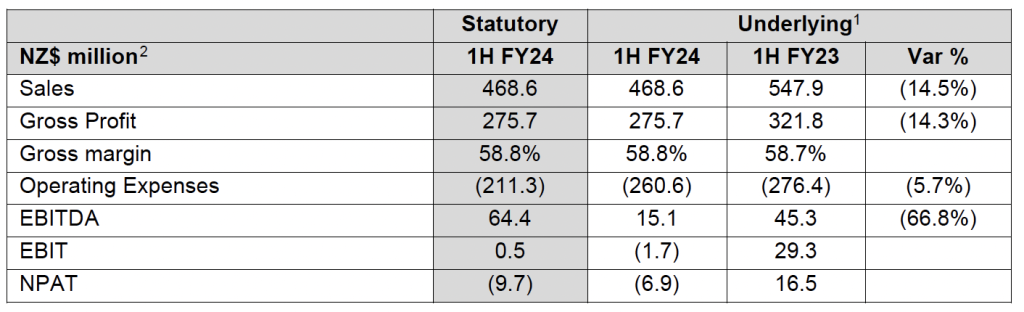

KMD Brands Ltd, the New Zealand-based parent of the Rip Curl, Oboz and Kathmandu brands, reported that total consolidated Group revenue in the first half of fiscal 2024 decreased 14.5 percent year-over-year (YoY) to NZ$468.6 million for the period ended December 31, 2023. Sales were down in all three of the company’s brands. KMD reports results in New Zealand Dollars (NZ$).

“Through the first half we continued to experience the effects of weakness in consumer sentiment,” said Group CEO & Managing Director Michael Dal. “Weaker consumer sentiment, the warmest winter on record in Australia and an over-reliance on winter weight product led to a disappointing first half for Kathmandu.”

Dal said Rip Curl and Oboz are cycling record sales last financial year, and while revenues from the direct-to-consumer channel are showing single digit declines, the wholesale channel has been more challenging for both brands as wholesale customers reduce inventory holdings.

Gross margin was said to have “remained resilient” for the period, increasing 10 basis points to 58.8 percent of sales despite the realized U.S. dollar hedged rate3 in H1 being down approximately 7 percent from the prior-year comparative period. These currency headwinds were reportedly offset by lower freight rates, improved channel mix, improved pricing, exiting low margin business, and new product introductions.

Operating costs were NZ$15.8 million, or down 5.7 percent YoY, despite continued inflation pressure. Operating expenses benefited from restructuring implemented in the prior year and lower variable costs associated with lower sales.

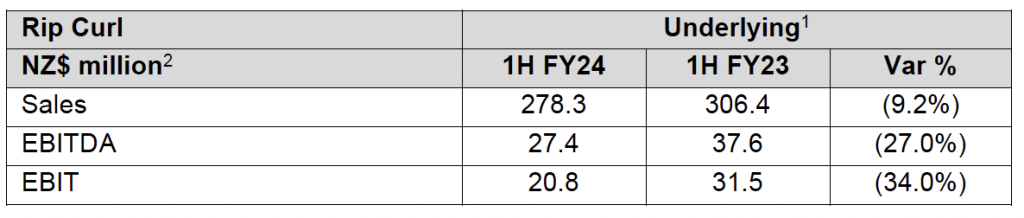

Rip Curl: Sales Impacted by Wholesale Customer Caution

Rip Curl total sales decreased 9.2 percent to NZ$278.3 million in the first half, cycling record sales in the prior year. Direct-to-consumer (DTC) sales, including online, decreased 5.0 percent YoY in H1, reflecting weakened consumer sentiment in key global markets, while noting stronger results in Europe, Asia and South America. Online sales reportedly increased 4.3 percent YoY in the first half and reportedly remains significantly above pre-COVID levels.

First half wholesale sales decreased 14.1 percent YoY, as attributed to wholesale accounts reducing their inventory holdings in response to the challenging consumer environment. The company said that in a challenging sales environment, gross margin and operating expenses were well controlled.

Rip Curl gross margin increased 90 basis points in the first half, reflecting improved pricing and freight rates, plus exiting low margin business in North America and Europe. Operating expenses were said to be tightly managed despite continued inflation pressure.

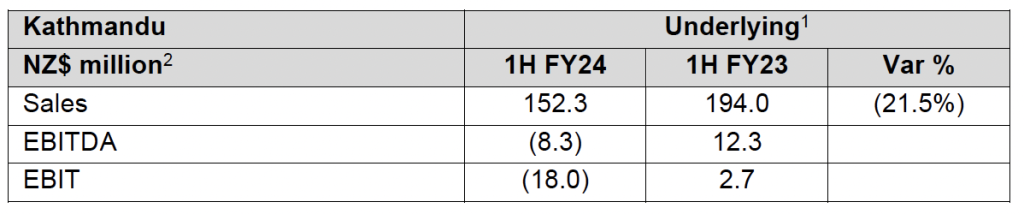

Kathmandu: Sales Reflect Ongoing Weakness in Consumer Sentiment

Kathmandu total sales decreased 21.5 percent YoY to NZ$152.3 million in the first half, cycling strong sales growth in the prior-year first half, with declines in both Australia (-22.9 percent) and New Zealand (-15.9 percent).

Online sales decreased 36.9 percent YoY to NZ$16.4 million in H1, as consumers reportedly returned to shopping in stores. Online penetration was at 10.9 percent of DTC sales and remained above pre-COVID levels. Improvement to online sales performance was said to be a priority.

Gross margin decreased 240 basis points in H1, reportedly driven by clearance of end of line products in August. Excluding August, gross margin for the period was 50 basis points lower YoY despite currency headwinds.

Operating expenses were said to be tightly managed despite continued inflation pressure.

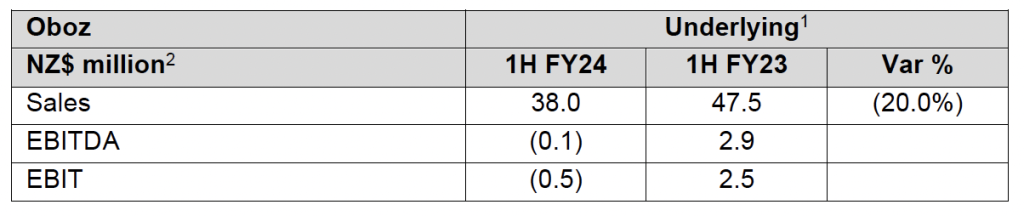

Oboz: Sales Impacted by Wholesale Customer Caution

Total Oboz sales decreased 20.0 percent YoY to NZ$38.0 million, cycling record sales in the prior-year first half.

Wholesale sales decreased 23.5 percent YoY as wholesale customers reportedly reduced their inventory holdings in response to the challenging consumer environment.

Online sales grew strongly (+34.2 percent YoY), benefiting from strategic promotional activity. In a challenging sales environment, Oboz said gross margin and operating expenses were well controlled.

Gross margin increased 450 basis points YoY, reflecting lower freight rates, improved channel mix, improved pricing and new product introductions. Oboz said it continued to invest in brand, online and product to support long-term growth objectives, including international expansion. While the North American wholesale operating margin remained below historic levels, Oboz said it expects the operating expense investment to be leveraged with future sales growth opportunities.

Balance Sheet

The Group had a net debt position of NZ$96.2 million at January 31, with funding headroom of approximately NZ$190 million.

Inventory was said to be well positioned at the end of the half, sitting NZ$5 million below January 2023, and net working capital was NZ$18 million below January 2023 despite lower sales. The inventory balance at July 2024 is expected to be below July 2023. The unwind of inventory is expected to underpin traditionally strong operating cashflow generation in the second half year.

As previously communicated in the fiscal 2023 results, the balance between interim and final dividend will be adjusted to better reflect the profitability of each half year. As a result of this change, and due to the first half performance, the Board of Directors have not declared an interim dividend.

Outlook

KMD said sales trends have improved for all three brands as they begin the second half year. Group sales for February 2024 were 3.5 percent below the prior-year comparative period, but also the company also noted that February is not a significant trading month.

“In the second half the Group will be cycling less challenging sales performance last year, particularly Kathmandu in the fourth quarter,” commented Daly.

“Improving Kathmandu sales performance is our immediate priority as we approach the key winter trading period. We expect to see progress in the second half and into FY25 as we launch new innovative products, quick to market programmes, elevated visual merchandising, increased personalisation through the recently released “Out There Rewards” and an expanded third-party brand strategy.” “We expect the wholesale customer inventory reduction cycle to end this financial year, giving us a more positive FY25 outlook in the wholesale channel for both Rip Curl and Oboz.”

“We believe that with our portfolio of iconic global outdoor brands and leadership in sustainability, we remain a unique investment proposition and well-placed for the future.”

Image courtesy Rip Curl