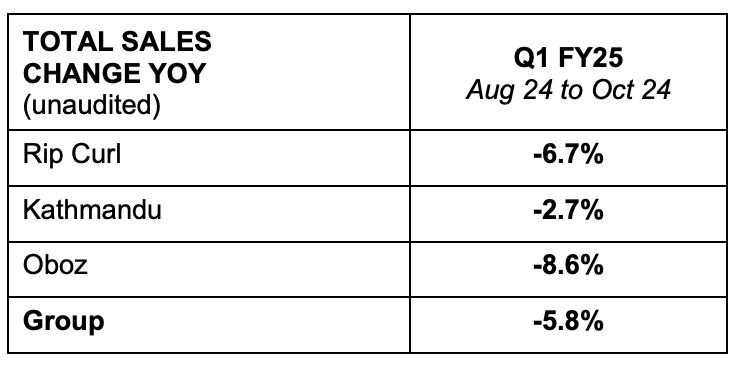

KMD Brands Limited, parent of the Rip Curl, Oboz, and Kathmandu brands, has provided an update on sales performance for the first quarter of the fiscal 2025 ending July 31, 2025. Company CEO and Managing Director Michale Daly said that the company’s first half results are dependent on the key Black Friday and Christmas retail trading periods to come.

“We remain cautious on consumer sentiment, given the challenging global macroeconomic environment,” he shared.

The company said that, since its last trading update near the end of September, direct-to-consumer (DTC) sales results have improved for both Rip Curl and Kathmandu for the fiscal first quarter ended October 31.

The company said that, since its last trading update near the end of September, direct-to-consumer (DTC) sales results have improved for both Rip Curl and Kathmandu for the fiscal first quarter ended October 31.

Rip Curl DTC sales continued to outperform the wholesale channel. Rip Curl global DTC sales for Q1 FY25 were down 3.4 percent compared to the fiscal Q1 period last year.

“We are also encouraged that the Rip Curl direct-to-consumer results are outperforming the Wholesale channel,” Daly said. “We remain optimistic that wholesale results will start to improve as the wholesale customer inventory reduction cycle ends.”

Kathmandu first quarter DTC sales trends continued to improve, with Kathmandu Australia fiscal Q1 total sales up 4.3 percent versus the year-ago Q1 period. New Zealand total sales decreased 15.4 percent year-over-year, cycling strong end of line clearance sales in August last year. While Kathmandu total sales for Q1 FY25 were down 2.7 percent from Q1 last year, gross profit dollars were said to be up 3.6 percent above Q1 last year.

“We are encouraged that Kathmandu has continued to show an improving sales trend through the first quarter of the new financial year,” offered Daly. “Refreshed authentic outdoor brand advertising has outperformed previous campaigns in Kathmandu’s largest market, Australia. Brand awareness has improved, and we expect the new campaign will have a positive impact on building key long-term brand associations.”

KMD said Wholesale accounts remain cautious on pre-season commitments for Rip Curl and Oboz.

Rip Curl Wholesale sales decreased by 11.2 percent year-over-year, with forward orders indicating improving wholesale

trends in the second half.

Oboz wholesale sales were down 8.5 percent from the first quarter of last year. The company said that sell-in for the second half is not yet complete.

Consolidated gross margin for Q1 was said to be up year-over-year, and all brands are continuing to actively manage costs while facing global inflation pressure.

“Kathmandu will continue to leverage its elevated brand positioning, sustainability credentials, and innovative new products moving forward,” Daly added.

Daly said Kathmandu has increased product newness and innovation for the spring summer season, resulting in a positive consumer response in key categories.

“Our strategy remains unchanged. For FY25, we remain focused on returning to sales growth, improving profitability, and reducing inventory,” the CEO noted.

Image courtesy