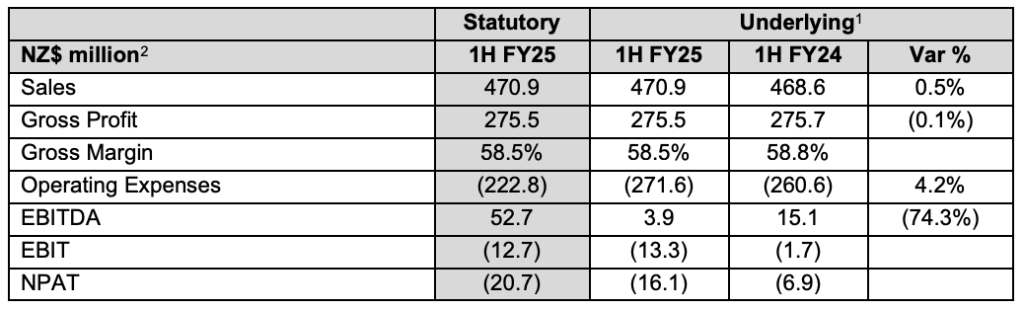

KMD Brands Limited, the parent of the Rip Curl, Oboz and Kathmandu brands, reported that Group sales for the fiscal 2025 first half ended January 31 inched up 0.3 percent to NZ$470.9 million.

KMD Brands Limited reports financials in New Zealand dollars (NZ$).

The sales result was reportedly supported by an improved trend in the direct-to-consumer (DTC) channel, including e-commerce (online) for all three brands. The company said Group online sales performance has been a highlight, with all three brands achieving double-digit sales growth y/y. Online reportedly remains a key growth priority for the Group.

The company said Wholesale sales are taking longer to recover, as wholesale accounts remain cautious on preseason commitments in a challenging market. Forward orders and in-season buying from key accounts reportedly support “an improving wholesale trend through 2025.”

Gross margin decreased 30 basis points year-over-year (y/y) to 58.5 percent of sales, said to be “remaining resilient despite increased promotional intensity for Kathmandu and clearance of inventory for Oboz.”

Underlying operating expenses, measured in constant-currency (cc) terms, were up 4.2 percent to NZ$271.6 million. All brands reportedly continue to actively manage operating expenses while facing global cost pressure.

Underlying EBITDA was NZ$3.9 million in H1, down 74.3 percent cc year-over-year.

Statutory NPAT (net profit after tax) loss amounted to NZ$20.7 million in H1. Underlying NPAT loss was NZ$16.1 million in constant-currency terms.

Balance Sheet and Cash Management Summary

Net Working Capital was NZ$192.6 million for the six-month period, down NZ$33.6 million year-over-year.

Net Debt was NZ$76.2 million at period-end, down NZ$20.0 million year-over-year.

No interim dividend declared as a result of H1 FY25 operating performance.

“In a challenging trading environment, net working capital efficiency is a key focus for the Group,” the company said in their report summary. Net working capital at period-end was NZ$33.6 million lower than January 31, 2024, with reduced inventory balances year-over-year.

2) H1 FY25 NZD/AUD conversion rate 0.909 (H1 FY24: 0.926), H1 FY25 NZD/USD conversion rate 0.595 (H1 FY24 0.604).

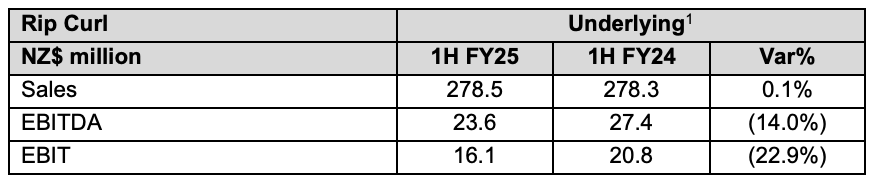

Rip Curl 2025 H1 Summary

Rip Curl brand total sales increased 0.1 percent y/y to NZ$278.5 million in the 2025 H1 period, improving from a 6.7 percent decline during Q1 to a 6.5 percent increase during Q2.

- DTC sales increased 4.1 percent, reflecting strong sales growth over the key Australasian summer and Christmas trading period. Also, stronger results were achieved in Europe and South America, supported by store openings. Online sales increased 13.9 percent to NZ$21.1 million, comprising 11.5 percent of DTC sales.

- Wholesale sales decreased 7.9 percent in a challenging global market. Forward orders support improving wholesale momentum for Q1 FY26.

Gross margin increased 0.2 percent of sales with channel and product mix offsetting the impact of increased promotional intensity in a tough trading environment.

Operating expenses continue to be tightly managed while facing global cost pressure.

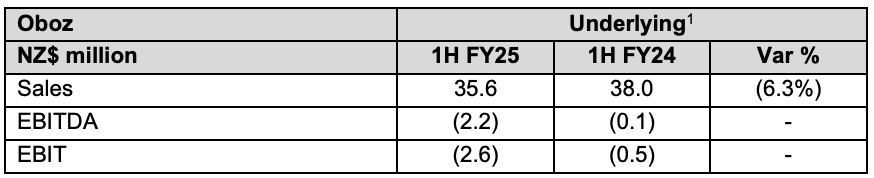

Oboz 2025 H1 Summary

Oboz brand total sales decreased 6.3 percent y/y to NZ$35.6 million in the 2025 first half, reportedly impacted by Wholesale customer caution.

- Online sales increased 32.8 percent y/y in the period, “growing strongly” over the Black Friday and Christmas promotions, and “reinforcing the growth opportunity for the brand.”

- Wholesale sales decreased 10.6 percent as Wholesale accounts reportedly remain cautious on pre-season commitments in a challenging market, partly offset by improved in-season buying from key accounts. Forward orders and in-season buying from key accounts support an improving Wholesale trend through 2025.

Gross margin decreased 570 basis points y/y as clearance of excess inventory was said to contribute to lower gross margins. Gross margin on core styles and new launches remained “in line with historical margins.”

Operating expenses were tightly controlled during the period. The company said current levels of operating expense investment will be leveraged with future sales growth as the market recovers.

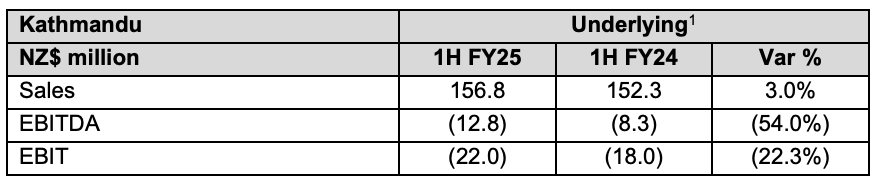

Kathmandu 2025 H1 Summary

Kathmandu brand total sales increased 3.0 percent y/y, improving from a 2.7 percent decline during Q1 to a 6.9 percent increase during Q2.

- Australia sales increased 3.8 percent, said to be supported by enhanced in-store execution and new products.

- New Zealand sales were down 2.0 percent year-over-year, with strong sales growth during the Christmas trading period. Excluding the clearance of end-of-line products in August in the prior year, New Zealand sales increased 4.8 percent for the remaining five months of H1 FY25.

- Online sales increased 26.6 percent to NZ$20.8 million, comprising 13.4 percent of DTC sales.

Gross margin decreased -0.4 percent of sales, with increased promotional intensity in a competitive trading environment.

Kathmandu operating expenses include approximately NZ$3 million incremental y/y to refresh brand advertising (increased first half weighting), increase product newness and innovation, and improve the consumer experience. Brand foundations are now in place, and sales momentum is building.

Balance Sheet and Cash Management Summary

At January 31, 2025 the Group had a net debt position of NZ$76.2 million, down NZ$20.0 million from NZ$96.2 million one year earlier, and with funding headroom of approximately NZ$215 million.

January inventory investment results in typically higher net debt levels at the January measurement point.

Net working capital was NZ$33.6 million lower than January 31, 2024, with reduced inventory balances y/y. Inventory positions reportedly continue to moderate back towards historical levels.

As previously communicated, the dividend policy remains aligned to earnings, with a target payout ratio of 50 percent to 70 percent of underlying NPAT. As a result of the H1 FY25 operating performance, the Directors have not declared an interim dividend.

Fiscal H2 Trading Update

DTC sales (including online) for the seven full weeks of the fiscal second half through March 16, said to be a seasonally non-significant trading period for both brands:

- Kathmandu DTC revenues increased 5.2 percent year-over-year.

- Gross margin is under pressure y/y due to increased promotional intensity in a competitive trading environment.

- Rip Curl global DTC sales for owned stores and websites inched up approximately 0.7 percent y/y.

- Gross margin remains resilient year-over-year.

Outlook

Commenting on the outlook for the Group, outgoing Group CEO Michael Daly said that DTC sales have improved for all three of the company’s brands, while the wholesale market is taking longer to recover. “Global monetary policy settings have been easing, but the return of consumer confidence will take time,” he suggested.

“We are seeing short-term gross margin pressure for all brands in a highly competitive global market. However, our focus remains on growing gross margin in the medium-term as markets improve,” Daly continued.“We are monitoring the impact of geopolitical uncertainty on consumer confidence and supply chains.”

Incoming Group CEO and Managing Director Brent Scrimshaw added, “I am excited to step into the KMD Brands Group CEO role and look forward to my transition with Michael over the next two weeks. I was pleased to announce earlier this week the appointment of Ashley Reade as the new CEO of Rip Curl and additionally, have also commenced a worldwide search for a Melbourne-based Group chief financial officer. Ben Washington will continue in his current role as interim Group CFO until a permanent appointment is made.”“We continue to focus on delivering positive sales growth, improving profitability, maximising cash flows, and reducing inventory.”

“We believe that with our portfolio of iconic global outdoor brands and leadership in sustainability, we remain a unique investment proposition and well-placed for the future,” Scrimshaw concluded.

Image courtesy Rip Curl/KMD Brands Limited

***

See below for other recent SGB Media coverage of the KMD business.

Rip Curl and Oboz Parent KMD Names Former Nike Europe CEO as New Group CEO

EXEC: KMD Saw Holiday Turnaround for Rip Curl; DTC Gives Lift to All Brands