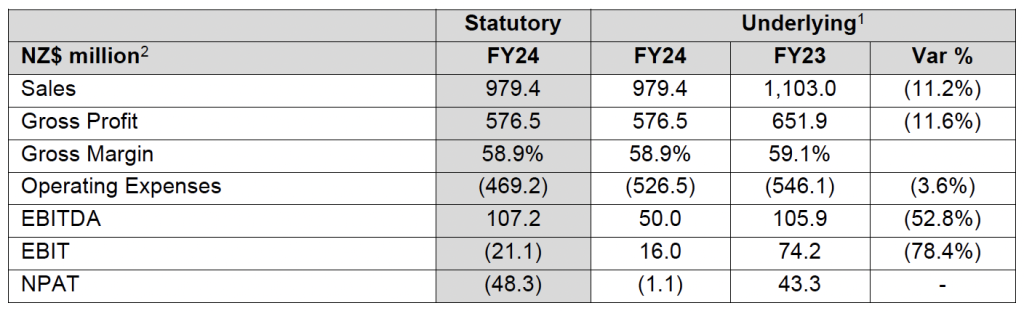

KMD Brands, parent of the Rip Curl, Oboz and Kathmandu brands, reported that sales for the fiscal full-year ended July 31 fell in double digits year-over-year (y/y).

“Rip Curl and Oboz cycled record sales last financial year, with DTC sales outperforming the Wholesale channel this year,” offered Michael Daly, CEO & managing director, KMD Brands. “The Wholesale channel has been more challenging for both brands as Wholesale accounts continued to reduce their inventory to manage risk in a challenging economic environment.”

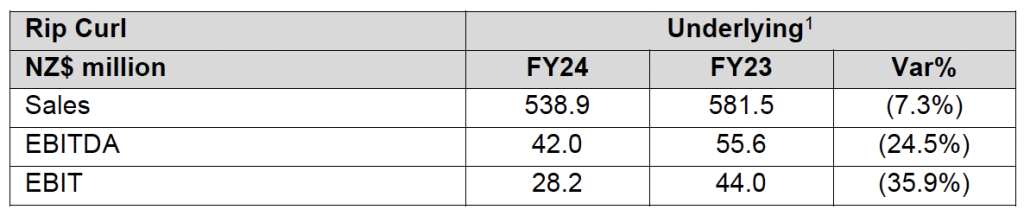

Rip Curl

Rip Curl total sales decreased 7.3 percent y/y to NZ$538.9 million. DTC sales, including online, outperformed the Wholesale channel this year.

DTC sales decreased 2.8 percent y/y for the full year, showing continued improvement on first half sales trends during the third and fourth quarters. Stronger results were recorded in Europe, Asia and South America, helped by new store openings in Europe and Brazil, helped by new store openings.

Online sales increased 8.6 percent to NZ$37.9 million, comprising 11.9 percent of DTC sales.

Rip Curl Wholesale sales decreased 13.0 percent y/y, as Wholesale accounts continued to reduce their inventory holdings. In a challenging sales environment, gross margin and operating expenses were well controlled. Gross margin increased +0.5 percent of sales reflecting channel mix, improved pricing, and exiting low margin business in North America and Europe.

Rip Curl operating expenses were said to be tightly managed despite continued inflation pressure.

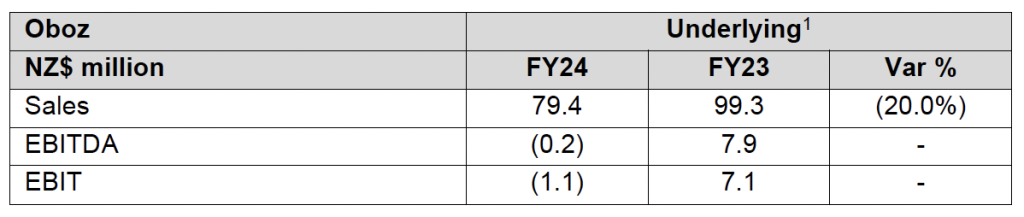

Oboz

Oboz Wholesale sales were said to be impacted by post-COVID industry challenges in the North American outdoor footwear category. KMD said the brand benefited from diversified sales channels, and strong online sales growth.

Total sales decreased 20.0 percent y/y to NZ$79.4 million. The company said Wholesale sales remained subdued through the year, as Wholesale accounts continued to reduce their inventory to manage risk in a challenging economic environment. Oboz has been impacted by post-COVID industry challenges in the North American outdoor footwear category.

KMD said participation levels and demand have now moderated, leaving the wider market with higher inventory levels and aggressive promotional behavior. The brand benefited from a commitment to diversified sales channels. Online sales grew 31.7 percent y/y, with increased traffic, conversion, and strategic promotional activity. In a challenging sales environment, gross margin and operating expenses were well controlled.

Oboz gross margin increased 210 basis points year-over-year, with improved channel mix, improved pricing, and new product introductions accounting for the improvement.

The company reported that Oboz continued to invest in brand, product, and online to support long-term growth objectives, including international expansion. Oboz expects the operating expense investment to be leveraged with future sales growth opportunities as the market recovers and international expansion continues.

Oboz goodwill has been impaired by NZ$40.3 million, driven by a conservative view of near-term U.S. Wholesale market conditions. The company said this one-off non-cash item does not impact the day-to-day operations of the business. This impairment has been excluded from underlying1 results.

Oboz continued to focus on efforts to reduce reliance on US Wholesale customers. ‘Shop-in-shops’ in ANZ were established in six key Kathmandu stores including Tower Junction in Christchurch and Frankston in Victoria. The strategic placement of the brand within the vast Kathmandu ANZ store network boosted sell-through and illustrates the power of KMD integration through simple and streamlined execution. The North American team also activated 15 shop-in-shops across U.S. retailers, elevating the brand’s visual experience for customers in its most important market.

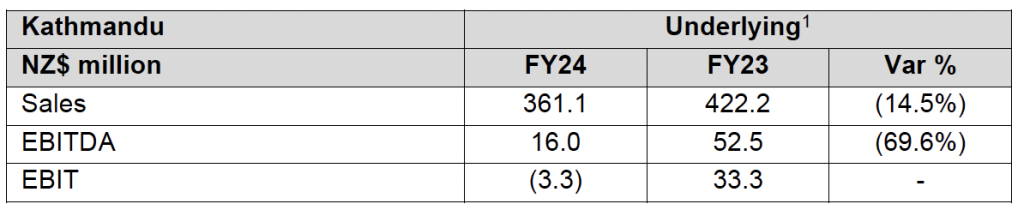

Kathmandu

The Kathmandu brand reportedly had a disappointing first half, with a combination of weaker consumer sentiment, the warmest winter on record in Australia, and reliance on winter weight product, all contributing to lower sales. Sales trends reportedly improved in Kathmandu’s largest market, Australia, in the third and fourth quarters, supported by strategic airport and DFO store openings, enhanced in-store execution and the launch of new products.

The company said economic settings in New Zealand have resulted in a more challenging consumer environment.

Kathmandu total sales decreased 14.5 percent, cycling strong sales growth last year, with declines in both Australia (-13.9 percent) and New Zealand (-15.2 percent).

Following a disappointing first half, sales trends improved in Kathmandu’s largest market, Australia, in the third and fourth quarters, supported by strategic store openings, enhanced in-store execution and the launch of new products. Economic settings in New Zealand have resulted in a more challenging consumer environment.

Online sales decreased 18.9 percent to NZ$47.7 million, in line with pre-COVID levels, comprising 13.3 percent of DTC sales. Online sales trends, relative to FY23, improved each quarter to end up down 1.5 percent y/y in the fourth quarter. Search engine optimization and new payment methods online have improved conversion and the consumer experience.

Kathmandu gross margin decreased 220 basis points year-over-year, driven by clearance of end of line products in August 2023, increased promotional intensity through the fourth quarter, and currency headwinds. Excluding August 2023, gross margin for the period was -1.4 percent of sales lower y/y. Operating expenses were more than NZ$10 million lower y/y.

Balance Sheet

- At year-end KMD had a net debt position of NZ$59.7 million, with funding headroom of approximately NZ$230 million.

- Net working capital was NZ$21.4 million lower than 31 July 2023 despite lower sales, with a significant reduction in inventory.

- Rip Curl and Oboz inventory positions continue to moderate back towards historical levels, with further moderation expected in the second half of fiscal 2025.

- As previously communicated, the dividend policy remains aligned to earnings, with a target payout ratio of 50 percent to 70 percent of underlying NPAT.

- As a result of the Fiscal 2024 operating performance and challenging market conditions, the Directors have not declared a final dividend.

Outlook

Fiscal 2025 trading update for the first 8 full weeks through September 22:

- Kathmandu Australia DTC sales were up 2.1 percent y/y and New Zealand DTC sales were down 23.2 percent y/y, cycling strong end of line clearance sales last year.

- Kathmandu gross profit dollars were up 5.1 percent y/y for the first eight full weeks of fiscal 2025.

- Rip Curl global DTC sales declined approximately 5 percent y/y in a “seasonally non-significant” trading period.

- Wholesale forward orders are moderating from double-digit declines in FY24 to single-digit declines for the first half of FY25.

“We are seeing order book growth year-over-year for some regions in 2H FY25, noting that sell-in is not yet complete. Wholesale accounts continue to remain cautious on pre-season commitments,” the company said.

Image courtesy Rip Curl