The off-price retailer sector is finally showing the growth the market expected when inventory started piling up in retailer and vendor distribution centers. While the industry headlines have talked about inventory overhang, liquidations, higher promotions, and even coined the term “de-stocking,” the floors at TJ Maxx, Marshall’s and Ross Stores did not swell to the expected levels many thought would happen. That wait is now apparently over, and it’s global.

A recent report from Investopedia said that “inflation-cautious consumers have begun to make fewer discretionary purchases at more expensive stores but continue to seek out deals on high-quality items at off-price retailers.” The report quoted the International Council of Shopping Centers CEO Tom McGee suggesting there is “price sensitivity on the part of consumers, but they continue to spend” when they can find discounts and promotions.

The results?

Ross Stores turned the frown upside down for the second quarter, reporting a 5 percent growth in comps and partially reversing the trend from the year-ago second quarter when comps were off 7 percent. The company reported 19 percent year-over-year EPS growth and a 7 percent total revenue increase for the second quarter. The better-than-expected sales and earnings for the second quarter prompted Ross Stores to raise guidance for the remainder of the year, as price-conscious consumers increasingly look for deals at discount retailers.

Ross management said that, along with easing inflationary pressures, customers responded well to improved value offerings throughout their stores.

TJX, parent to TJ Maxx, Marshalls and Sierra, joined Ross Stores in offering an even wider assortment of big-name brands as high-end and mid-tier retailers struggled with bloated inventories. Second quarter comp store sales increased 6 percent for TJX, driven by customer traffic, and EPS jumped 23 percent in the quarter as TJX topped its guidance. Marmaxx, including the TJ Maxx, Marshalls and Sierra nameplates but excluding HomeSource and International, saw comps rise 8 percent for the quarter, exceeding its 2 percent to 3 percent guidance. Marmaxx’s apparel and home categories both saw high-single-digit comp store sales increases.

The company said comp store sales and traffic increases accelerated monthly throughout the quarter. Comp sales were also strong across each of Marmaxx’s regions. TJX said it also saw consistent performance across low-, mid- and high-income store demographics.

On a recent conference call with analysts, TJX President and CEO Ernie Herrman said they see multiple opportunities to keep driving sales and traffic in the second half of the year.

“First, as I said earlier, we are seeing phenomenal product availability across all categories and a wide range of brands,” he shared in his prepared remarks. “This gives us great confidence that we can bring consumers the right assortment at the right values throughout the fall and holiday season.”

Herrman also said the retailer had attracted a disproportionate number of new Gen Z and Millennial shoppers, which is what they look at in terms of future growth because that’s the higher spend.

Marmaxx’s second quarter segment profit margin was 13.7 percent of sales, up 80 basis points versus last year, primarily driven by a benefit from lower freight costs and the expense leverage on the strong sales and strong markup.

TJX International comp store sales increased 3 percent, and customer traffic was also “up.” Hermann said seeing comp sales and traffic increase at its European and Australian businesses was great.

The trend to discounted goods has taken hold in China, too, at least in the online world. Vipshop Holdings Limited, an online discount retailer for brands in China, including many U.S. active lifestyle brands, reported total net revenues for the second quarter increased by 13.6 percent year-over-year, primarily attributable to the growth in active customers and spending driven by the recovery in consumption of discretionary categories. Read SGB Executive coverage here.

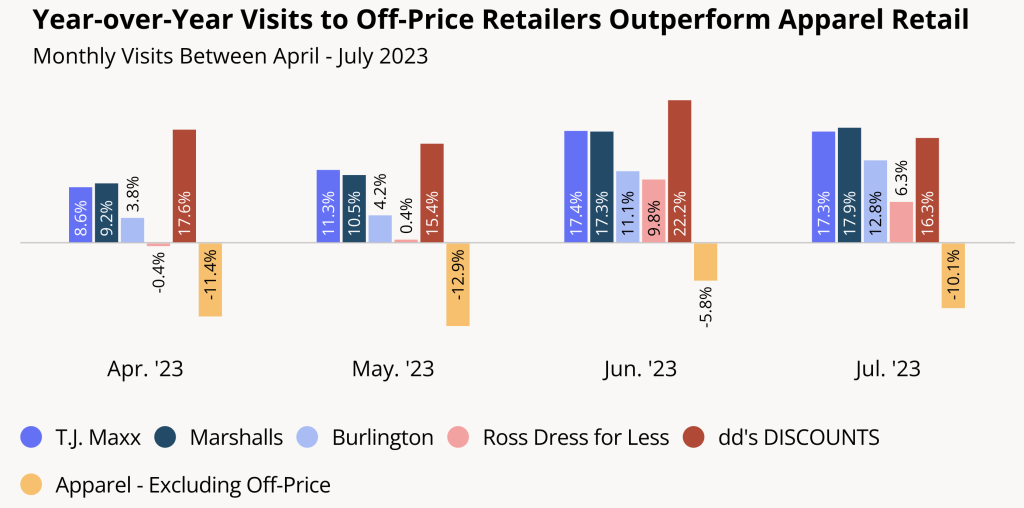

In a recent blog post from Placer.ai, the company, which analyzes trends in retail traffic, said, “Off-price apparel has been among the best-performing brick-and-mortar apparel segments over the past few years, offering shoppers budget-friendly options along with the thrill of the bargain hunt.”

Placer.ai indicated in its report that the Off-Price category had been outperforming the wider apparel segment, with leading off-price retailers seeing regular visit growth even relative to their already strong 2022 performance, and the ongoing back-to-school season appears to be driving an even bigger boost.

TJ Maxx and Marshalls showed strong year-over-year (YoY) growth every month analyzed, with June and July visits elevated as back-to-school shoppers drove traffic, Placer.ai reported. Burlington and Ross also reportedly enjoyed steady visit growth throughout the analyzed period, with the YoY increases picking up in June and July.

But even within this highly successful category, the company said one brand stood out from the pack in traffic growth—Ross-owned DD’s Discounts, known for its moderately priced product assortment. DD’s reportedly outperformed the other four off-price chains in April, May and June in traffic volume. The chain’s visit growth is likely partially driven by parent company Ross’ aggressive expansion plan, which includes opening 25 new DD’s Discount locations in fiscal 2023. DD’s opened nine locations in Q2 alone.

Still, as Ross Stores adds more doors to the DD’s side of the business, there are hints that not all traffic is equal regarding sales growth as the lower-end consumer remains squeezed in discretionary spending.

On its recent conference call with analysts, Ross Stores Group President and COO Michael Hartshorn shared that DD’s sales trends continued to trail the Ross trends.

“As a reminder, the DD’s average household income is more impacted by inflation, especially on necessities,” he explained. “The average household income is $40,000 to $45,000 [for DD’s] compared to $60,000 to $65,000 for Ross. Our strategy here is very similar. We are very focused on offering strong values, which is very important to DD’s customer today.”

TJX, on the other hand, sees the opportunities coming from product availability at great prices that build sales and margins.

“The third quarter is off to a very strong start, and we are seeing tremendous off-price buying opportunities in the marketplace, Herrman said in a company release. “We are in an outstanding position to continue shipping fresh and compelling merchandise to our stores and online throughout the fall and holiday selling seasons. Going forward, we continue to see excellent opportunities to grow sales and customer traffic, capture market share, and drive the profitability of our company.”

TJX believes that despite the proliferation of brand direct-to-consumer and support for specialty and mid-tier discounting, it is in control of the supply chain of available inventory as the company sees more coming through the end of the year—so much so it is pulling back on using all open-to-buy pre-season knowing that bigger deals and fresher product are in the pipeline.

“Right now, our [garbled] mission, as always, is to pace ourselves on buying the in-season closeouts because the market is so loaded,” Hermann said, responding to a question during the Q&A session. He said they would pull back even more on any purchases they tend to buy earlier or upfront because all indicators are there that there will be a continued additional supply, at least over the next 6-to-12 months of in-season closeout opportunities.

TJX reported consolidated inventories on a per-store basis at quarter-end, including distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were down 6 percent on both a reported and constant-currency basis. So they have room.

The Off-Price retail market may be entering a perfect storm, with high vendor inventories feeding better goods at lower prices to off-price retailers just as inflation modifies and worker pay rises.

The market can expect this trend to continue until so-called full-price retailers and vendors flush inventories to a more manageable level. But with most brands, with few exceptions, still reporting heavier inventory levels at the end of the second quarter and almost all reporting continued retail de-stocking efforts impacting bookings, the future of the Off-Price sector should look bright through year-end.

Photo courtesy Reviewed, traffic data and infographic courtesy Placer.ai