Rapala VMC President and CEO Lars Ollberg said the fishing company strategically strengthened its business in a challenging year, focusing on brand value, customer relationships, and market positioning in North America and Europe.

“Despite initial commercial headwinds, we stabilized operations and created a robust foundation for future growth,” he shared. “Our targeted efforts successfully improved overall business performance.”

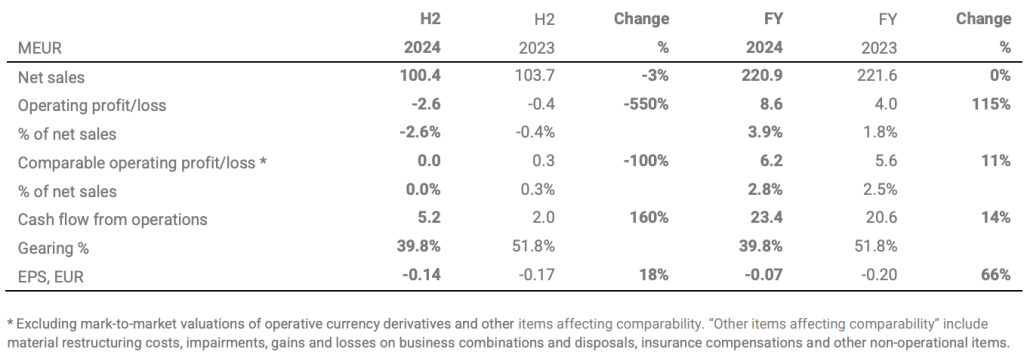

Total sales reportedly “remained steady” at €220.9 million, compared to €221.6 million in 2023, and comparable operating profit increased to €6.2 million in 2024 from €5.6 million in the prior year.

Profitability reportedly improved in both halves of the year, although H2 reported operating profit fell to negative €2.6 million compared to negative €0.4 million in H2 2023 due to one-off’s related to achieving lower operating expense level in the future.

Operational cash flow was €23.4 million versus €20.6 in the prior year, said to reflect improved net working capital and effective resource and operational management.

The CEO also noted the consolidation of lure and knife production to Estonia was yielding results. Inventories and lead times have significantly decreased, and he said the company has achieved substantial savings in operational costs. The implementation of a new logistics tool has also improved inventory quality and fill rates.

Inventory levels decreased to €84.2 million at year-end, compared to €87.5 million at 2023 year-end.

“Our delivery reliability is among the highest in the industry, and customer satisfaction has significantly improved,” offered Ollberg.

“The development of new products is progressing on schedule, and our product development organization’s collaboration across North America, Europe, and the APAC regions adheres to the ‘Think Global – Act Local’ strategy,” Ollberg explained. “An example of this is the global success of the Rapala CrushCity product family in the soft lure market, where it has quickly risen to become one of the best-selling products in its category on all continents.” He noted that nearly all of the company’s lures are designed in its product development center in Vääksy, Finland.

Ollberg called 2024 a year of stabilization for the company.

“We believe that our renewed strategy will provide added value to our customers and other stakeholders. We will continue to invest in growth and efficiency to strengthen our position as one of the leading companies in the fishing tackle market,” he shared.

Market Environment

In 2024, operating environment was said to be “reasonable throughout the year,” with eased inflation improving consumer sentiment and resulting in improved retail activity.

“Furthermore, favorable open water fishing conditions lasted long in Autumn which acted as a counterweight to political uncertainties that might otherwise have impacted consumer spending,” Ollberg said.

Full Year 2024 Summary

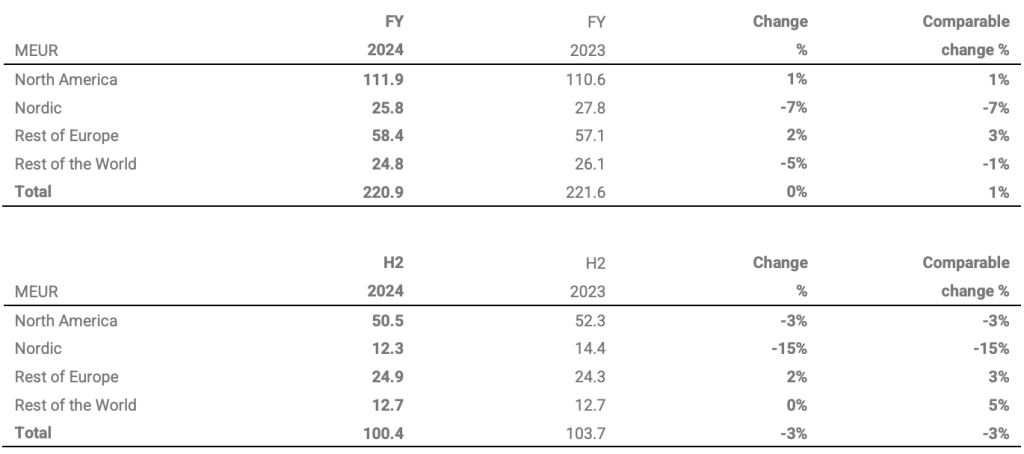

The Group’s net sales for 2024 were flattish to 2023 with reported translation exchange rates. Changes in translation exchange rates had a slight positive impact on the sales and with comparable translation exchange rates, net sales grew by 1 percent from the comparison period.

North America

Sales in North America increased by 1 percent from 2023 with reported translation exchange rates and increased by 1 percent with comparable translation exchange rates. Newly launched Rapala CrushCity soft plastic lures reportedly contributed significantly to the increase in sales. CrushCity also boosted the VMC jigging hook sales.

North America sales grew in almost all categories except for hard baits, which was impacted by the trend shift in fishing technique which favored soft plastics over hard baits. The company said favorable Autumn weather conditions prolonged replenishment sales season with big box retailers dominating the market. High retailer carryover inventory in the ice fishing categories resulted in lower pre-order shipments in the later part of the year.

Ollberg said North America remains the company’s largest market area, where its position remained strong.

“The launch of the new Rapala CrushCity product range has exceeded our expectations and has been one of the most successful market entries in recent years,” the CEO noted. “This new product line has opened up new consumer groups for us, particularly among younger enthusiasts, who represent a growing and significant customer segment.”

He said CrushCity has further strengthened the company’s relationships with the largest retailers in North America.

Ollberg also called out the successful integration of 13 Fishing with Rapala USA as another significant achievement in 2024.

“As a result of this initiative, 13 Fishing is now profitable, and the product range has been revamped in both summer and winter fishing products,” he noted. “Our customers have widely adopted the new collection into their assortments.”

Nordic

Sales in the Nordic market decreased by 7 percent in 2024 compared to 2023. With comparable translation exchange rates, sales were said to be down by 7 percent.

“Retailers’ inventories returned to healthy levels but general economic condition impacted sales negatively,” the company noted. “Demand for consumables improved and CrushCity soft plastic lures contributed positively to sales.”

The company said the focus on operational excellence continued throughout the year and as a result, sales of open water sales categories landed at the prior-year level. Strong focus was put on core brands such as Rapala, Sufix and Okuma. Improved availability of products improved sales in the second part of the year.

Winter fishing sales reportedly remained flattish to the prior-year level, while the ski business was said to be down due to retailer carryover inventory from the prior season. “As a weather-sensitive industry, the ski business was further impacted by unfavorable conditions, contributing to the decline in sales for the whole region,” the company said.

Rest of Europe

Sales in the Rest of Europe market increased by 2 percent in 2024 compared to 2023. With comparable translation exchange rates sales were up by 3 percent versus the prior year.

Market remained challenging but sales reportedly landed above prior-year levels, driven by successful new product introductions including CrushCity, a strong push on Dynamite Baits and a positive momentum on Okuma and VMC. Sales in France were supported by novelties and early seasonal order deliveries that compensated poor weather conditions and as a result, sales remained at the prior-year level. Growth in the region reportedly came from strong positive momentum and focus on operational excellence in the UK and Germany.

Termination of Third Party distributorships had a minor negative impact to the sales of this region.

“Although there have been challenges in the European markets due to consumer caution, we have succeeded in improving and streamlining our operations,” added Ollberg. “Our profitability in the region has improved during 2024. The enhancement of operational efficiency is evident in shorter delivery times and increased customer satisfaction. Our European sales focus specifically on the sales and marketing of Rapala products as well as Okuma rods and reels.”

Rest of the World

Sales in the Rest of the World market decreased 5 percent year-over-year in reported terms. With comparable translation exchange rates, sales decreased by 1 percent compared to the previous year. Sales were reportedly down in most of the markets following the macroeconomic headwind and low discretionary spending. Asian markets apparently suffered from weak currencies which favored locally produced products over imported goods. This hit the sales of Sufix fishing lines, in particular. A successful Okuma launch in Korea provided incremental growth in addition to strong boost from CrushCity, especially in Australia. In Latin American markets, sales landed close to prior-year levels, supported by good momentum and focus on Okuma.

“In the Asian markets, we have also seen growth in sales and profitability,” Ollberg noted. “We have started selling Okuma products in Thailand and Korea. The winter sports business has been challenging, but we have implemented several measures to support sales.”

Financial Results and Profitability

Comparable (excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability) operating profit increased by 0.6 million from the comparison period. Reported operating profit increased by 4.6 million from the previous year and the items affecting comparability had a positive impact of 2.4 million (-1.6) on reported operating profit.

Comparable operating profit margin was 2.8 percent (2.5) for the year. Profitability was pressured by lower sales and lower sales margin.

This decline was fully offset by savings in operating expenses. Sales margin decrease is a result of strong actions taken to clear out slow-moving items and improving inventory composition. The 6 million savings program was concluded during the year. Among the measures was bringing decision making closer to the local markets and defining clear accountabilities. Following this, the size of the Global Management Team was reduced to eight members.

Reported operating profit margin was 3.9 percent (1.8) for the year. Reported operating profit included impact of mark-to-market valuation of operative currency derivatives of -0.7 million (0.2). Net gain of other items affecting comparability included in the reported operating profit were 3.1 million (-1.9). This amount includes gain from the sale and lease back transaction of the Canadian real estate. Majority of the expenses relate to the restructuring of the Global Management Team and other restructuring expenses arising from the 6 million savings program.

Total financial (net) expenses were 8.1 million (10.7) for the year. Net interest and other financing expenses were €8.8 million and (net) foreign exchange expenses were €0.7 million .

Net profit for the year increased by €7.6 million and was €0.4 million in 2024, compared to a net loss of €7.3 million in 2023. Earnings (loss) per share was a loss of €0.07 in 2024 versus a loss of €0.20 in 2023.

Short-term Outlook and Risks

The year 2024 has been a year of stabilization for us. We believe that our renewed strategy will provide added value to our customers and other stakeholders. We will continue to invest in growth and efficiency to strengthen our position as one of the leading companies in the fishing tackle market.

U.S. consumer demand has remained robust despite rising uncertainties in the global trade environment. The ongoing tariff situation continues to create challenges, but management is actively monitoring developments and taking necessary actions to mitigate potential impacts. European markets are indicating stable consumer spending despite recent economic and political developments. Our improved operational efficiency is expected to yield improved results in open water fishing categories. Favorable ice fishing conditions in North America are expected to result in improved order book for season 2025/2026. In Nordics, ice and snow conditions have been suboptimal, and the market is expected to remain tough in season 2025/2026.

Guidance reflects current market conditions but remains subject to potential trade-related disruptions, including tariffs and regulatory changes, which may impact demand and cost structures.

Consequently, the Group expects 2025 full year comparable operating profit (excluding mark-to-market valuations of operative currency derivatives and other items affecting comparability) to increase from 2024. Short-term risks and uncertainties and seasonality of the business are described in more detail at the end of this report.

Image courtesy Rapala VMC