XXL, said the be the largest sporting goods retailer in the Nordic region, reportedly delivered a growth of 7 percent in the 2025 first quarter, said to be driven by progress in its “Reset & Rethink” strategy.

XXL reports in the Norwegian krone (NOK)) currency.

Total operating revenue amounted to NOK 1.7 billion in the first quarter, compared to NOK 1.6 billion in the year-ago period as retailer said it continued to see sales recovery. All markets and sales channels reportedly contributed to the growth, despite muted winter conditions, as XXL said it managed to compensate reduced winter sales with growth in non-seasonal categories.

The general availability of products improved in the quarter, said to be driven by increased quantities of products on lower price points, especially within Private Label. The inventory was stable in value at quarter-end.

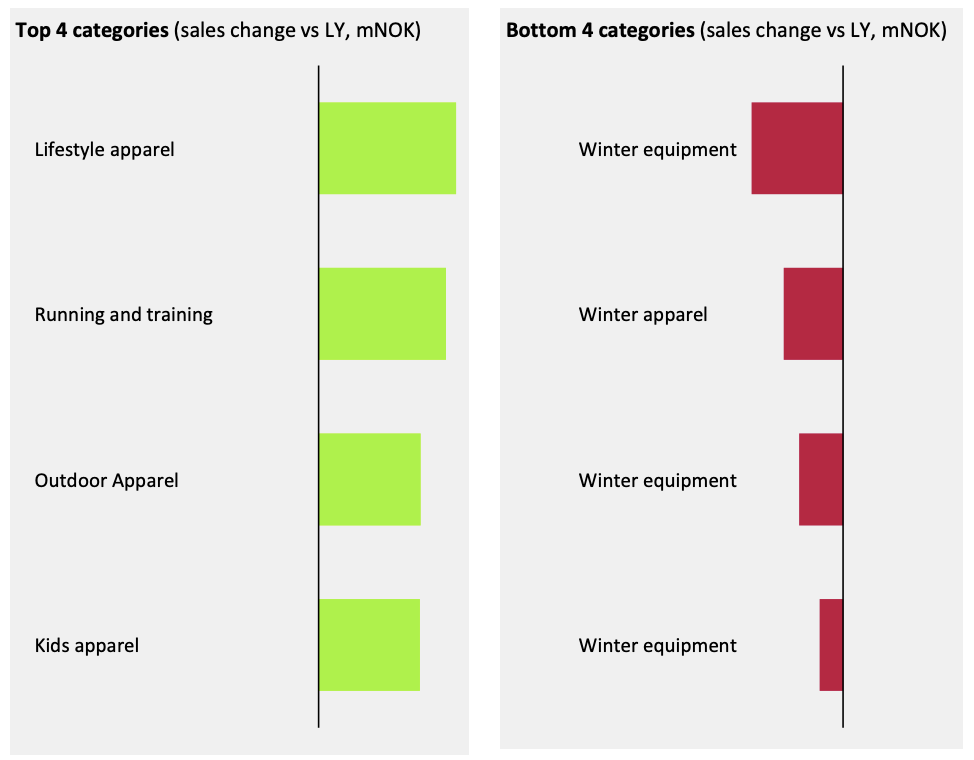

Category Performance

Increased sales resilience was said to be driven by strengthened campaign execution and activation of non-seasonal categories to compensate for lower sales of seasonal winter products.

“We are pleased to see that our renewed focus on delivering value for money and staying relevant to the mass market is driving growth across all our markets,” said company CEO Freddy Sobin in a first quarter report summary. “For the first time in two years, we are back to top-line growth, a clear sign that our Reset & Rethink strategy is gaining traction. Customers appreciate our updated offering, where improved product availability, competitive price points, and enhanced services in our workshops with repairs create real value. This, combined with strengthened partnerships with our brand partners and strict cost discipline, puts us in a solid position to continue growing – with profitability now in clear focus.”

EBITDA amounted to NOK 12 million (NOK 12 million).

In the quarter XXL closed its rights issue of NOK 600 million, and subsequently paid down a bridge loan facility of NOK 300 million, to support efforts in regaining top-line growth and continue to deliver on XXL’s “Reset & Rethink” plan.

Looking ahead, XXL said it will remain committed to execute on its turnaround agenda to restore profitability by utilizing all available measures to strengthen its position as the leading mass-market sports retailer in the Nordics.

Outlook

XXL said it is currently working on several short-term turnaround actions and a longer-term strategic plan, called “Reset & Rethink”, in order to improve sales and profitability. Five must win battles are identified and is currently in execution as part of the “Reset”:

- Reset category strategies

- Secure product availability

- Improve store sales strategies and operations

- Strengthen pricing processes

- Increase e-commerce profitability

XXL said the identified “must win” battles are expected to deliver an EBITDA run-rate uplift of NOK 500 million to NOK 750 million, conditional of sufficient availability of products in key seasonal categories and positive market development for sporting and outdoor goods in the Nordics. XXL has launched further ambitions to reduce cost and free up capital with a target of gross NOK 300 million by 2026.

XXL’s target and goal moving forward is to come back to sound profitability as well as over time gain market shares in all markets and regain growth in the E-commerce channel. XXL will continue to emphasize strict liquidity control and stock management by prioritizing sales volume over gross margin optimization, due to risk of material liquidity constraints.

XXL’s target and goal moving forward is to come back to sound profitability as well as over time gain market shares in all markets and regain growth in the E-commerce channel. XXL will continue to emphasize strict liquidity control and stock management by prioritizing sales volume over gross margin optimization, due to risk of material liquidity constraints.

In line with the existing strategy, XXL will continue to mainly invest in operational efficiency, store footprint optimization, customer experience enhancing projects in both stores and in the E-commerce platform, as well as in IT and tech. Total CAPEX for XXL Group in 2025 is expected to remain at around NOK 100 million.

XXL has one new store opening signed for 2025 as well as one store closure. Mid- to long-term XXL continues to expect the pace of the store roll-out to be 2-3 new stores per year including relocations of stores. At the same time XXL will be downsizing several existing stores. Short term the Group will continue to focus on optimizing the store portfolio, including evaluation of selective closures of low performing stores with limited turnaround abilities.

Image courtesy XXL ASA