You can always tell bad news is coming when a company announces two hours before a conference call that the players have changed, the CEO has left and they have appointed a new guy to lead the company. And then a separate release arrives with the bad news about reporting results from the most recent quarter and a diminished outlook ahead and a realization that their hopes for recovery fall into the next year.

No, not a Netflix movie, it’s just another morning in the active lifestyle market.

Wolverine Worldwide awakened the footwear community with the news Thursday that company CEO Brendan Hoffman had exited stage right and had been replaced with company president Chris Hufnagel. Hufnagel had just recently picked up the president title and was seen by many, if not most, as the heir apparent. (See SGB Media coverage here) With a 15-year career in the Wolverine Worldwide business across a variety of brands, disciplines and responsibilities, it would seem he will hit the ground running – if he hasn’t already.

It was left to Hufnagel to open the quarterly analyst conference call the same morning but he was not a new name or face to many that attended. It became clear that the decision on the change at the top was not quick and it was not hasty – it was (well) planned for some time and the players were now prepared.

“Since joining Wolverine, I have developed an intimate knowledge of the company, our brands, our processes, our people, our partners, and the industry,” Hufnagel shared. “I understand both the challenges and opportunities facing Wolverine today, and ready to move with pace to strengthen our footing and ultimately deliver better results for our shareholders.

“Drawing on my experiences, and more importantly, levering our talented teams, I firmly believe we have the playbook and capabilities that can get this company back on track,” he continued. “I have hit the ground running, and am excited about the work ahead. From my very first call with you, let me start with what matters most on our journey to create shareholder value: Brands. Wolverine Worldwide must transform to become a great builder of brands. I believe great brands do three things extraordinarily well day in and day out.

“First, they build awesome products, innovative, trend-right, priced right, covetable products informed by deep insights that solve for consumers’ wants and needs.

“Second, great brands tell amazing stories; differentiated, meaningful stories and experiences that meet their consumers when and where they want to be met. Modern brands must also engage in an ongoing push-pull relationship with their consumers.

“Third, and finally, great brands have great teams driving the business each and every day, a constant and relentless pursuit to build and protect their brand, and to be better tomorrow than today. This is the new brand-building model for Wolverine Worldwide, a model and playbook we’ve put into practice at Cat Footwear and Merrell, which drove those brands to new heights. And we’ll now implement this playbook across the portfolio, leading to a repeatable pattern of success.”

The new CEO said that while he is excited about the future, the company’s financial update that same morning is “well short of expectations.” He said they have seen softness in the marketplace and headwinds impacting the business that they now expect to continue to the second half of the year.

“We expect these headwinds to abate over the coming quarters as consumers move past current economic uncertainties, inventories become cleaner at retail, post-COVID trends normalize, and we lapse tough comparisons,” he offered. “Despite the current situation and the near-term outlook, I believe we have a strong foundation in place at Wolverine today, with industry-leading authentic brands loved around the world, yet I know they have yet to reach their full potential.”

Hufnagel got down to business quickly and set out to highlight current actions in motion.

“We’re effectively getting our inventories back in line,” he said. “I’m pleased to report that at the end of the quarter we’re $25 million lower [in inventory] than we expected to be, and are on track to achieve a $225 million reduction in inventory versus 2022 by year-end. Our Profit Improvement Office, designed to free capacity for increased investments in our brands, is on track to deliver its goals for 2023, along with our targeted full-year savings in 2024. Critical enterprise-wide tools and process initiatives, specifically end-to-end planning and product line management are on schedule, and will allow us to be both more accurate and more agile in managing our business.”

He noted on the brand front that several of Merrell’s new launches into hike and trail running are seeing positive traction and that Merrell is gaining market share in the hike category for each of the past 10 months. He said Saucony is seeing early signs of strong product acceptance for recent introductions, specifically the Triumph 21, and Savior also seeing a halo effect for other styles within the assortment. He noted that Sweaty Betty performed better than expected in the most recent quarter, and saw a positive response to the new product introductions. He said they have also accelerated their integration for the brand, and that work is yielding both better synergies and cost efficiencies.

“Finally, we have new leaders in our three key growth brands; Merrell, Saucony, and Sweaty Betty, all consumer-centric thought leaders. I’m excited about working together with these new leaders,” he said.

He also noted the company has initiated other critical efforts to transform its portfolio in global operations to have a more focused approach, targeting its biggest opportunities while streamlining the organization to be more agile and efficient.

“Key steps we’ve taken include the sale of Keds, the licensing of Hush Puppies in North America, and the decision to pursue a strategic alternative for Sperry and the Wolverine Leathers Group – a more strategic, integrated, and efficient approach to managing our business,” he shared.

Hufnagel said they are consolidating the WWW U.S. offices, including the closure of the company’s Boston campus at year-end.

“This decision will drive increased collaboration across our teams and accelerate the sharing of best practices across the organization, including the implementation of the brand-building playbook,” Hufnagel explained. “I’m excited to have all our footwear brands under one roof in the near future.”

On the operations front, the company is actioning a more strategic, long-term approach to its global supply chain, working with the “best partners to drive improved reliability, costing, efficiency, transparency, and agility,” ultimately making the supply chain a competitive advantage for other brands and partners.

“I would like to make it clear that we’re not starting over,” he stressed. “We have a good, sound strategy in place. We have a proven scalable playbook, authentic brands, and amazing talent. The recent challenges have only made it clear that we need to move faster and be bolder to achieve our fullest potential. As we navigate the current challenges, our focus must be to stabilize the financial footing of the company, which we are making progress on each day while also finding capacity to reinvest in our brands. And ultimately, reallocate resources to realign our competencies to become better brand builders. Focus on consumer obsession, product innovation, and modern demand creation.”

Chris uttered a bit of a Coach Tomlin-ism when he stated, “Gradual Improvement Will Not be Sufficient.”

“We have an actionable pragmatic in place to advance strategic priorities, deleverage the balance sheet, and maintain the capacity to invest in building our key growth brands while accounting for the challenges we face. We look forward to sharing more updates with you on our progress in the coming months,” he closed in his opening remarks.

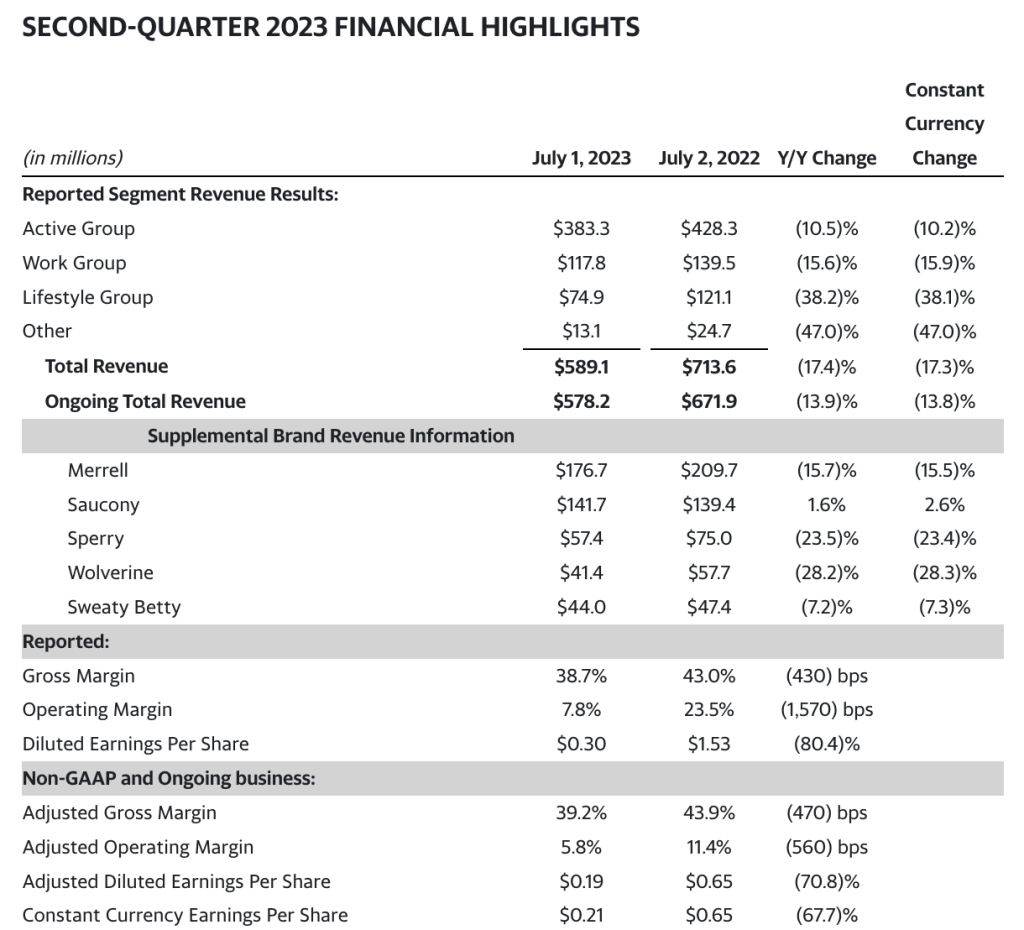

Wolverine World Wide, Inc. reported revenue for the second quarter ended July 1 declined 17.4 percent (-17.3 percent constant-currency) to $589.1 million, compared to $713.6 million in the year-ago quarter. Revenue from the ongoing business was $578.2 million and declined 13.8 percent on a constant-currency basis.

The company’s international revenue from the ongoing business was down 6.2 percent (-17.3 percent constant-currency) to $260.9 million.Direct-to-Consumer revenue was down 20.3 percent year-over-year to $132.4 million. Revenue was down 16.4 percent for the ongoing business compared to the prior-year period.

Consolidated gross margin was down 430 basis points versus the prior-year quarter, reflecting “the sale of higher-cost inventory due to transitory supply chain costs from 2022, the acceleration of end-of-life inventory liquidation, and increased promotions.”

“In the second of the quarter, we saw a decline in full-price sales to our U.S. wholesale customers as they cautiously tightened their open-to-buy to manage inventory,” explained CFO Mike Stornant. “These full-price sales were replaced with lower gross margin shipments to international distributors.”

He continued, “In addition, we accelerated the liquidation of end-of-life inventory at lower than planned prices which negatively impacted gross margin, but helped us to drive inventory levels down by $25 million more than planned. Recall that Q2 gross margin includes the negative impact of $20 million of transitory supply chain cost. These costs will decline in the back half of the year and will not recur in 2024.”

SG&A expenses were $181.7 million, or 30.8 percent of adjusted revenue. Adjusted SG&A expenses of $192.8 million or 33.3 percent of adjusted revenue, were 80 basis points higher than the prior-year quarter.

Adjusted operating margin was 5.8 percent of sales for the quarter. Stornant said the strong cost management offsetting the shortfall in gross profit reported operating margin was 7.8 percent.

Adjusted diluted earnings per share for the quarter were 19 cents a share, in line with guidance. The reported diluted earnings per share was 30 cents.

Inventory for the ongoing business at the end of the quarter was $647.9 million, up 7 percent compared to the quarter-end 2022 and down approximately $97.3 million sequentially from the fourth quarter of fiscal 2022.

WWW ended the quarter with net debt of $930 million, liquidity of $370 million, and a bank-defined leverage ratio of 3.5 times.

Outlook

“The trading environment is challenging, especially in global wholesale channels where order demand has slowed as retailers manage their businesses more cautiously,” said Stornant. “As a result, we have reduced our revenue and earnings outlook for the back half of the year.”

For the full year, Wolverine Worldwide expects:

- Revenue from the ongoing business is expected to be in the range of $2.26 billion to $2.28 billion, representing a decline of approximately 10.7 percent to 10.0 percent versus full-year 2022.

- Gross margin is expected to be approximately 39.4 percent and adjusted gross margin is expected to be approximately 40.0 percent of sales.

- Operating margin is expected to be approximately 4.8 percent of sales, and the adjusted operating margin is expected to be approximately 5.0 percent.

- The effective tax rate is expected to be approximately 18.2 percent.

- Diluted earnings per share are expected to be between 43 cents and 53 cents a share and adjusted diluted earnings per share are expected to be between 45 cents and 55 cents a share. These full-year EPS expectations include an approximate 11 cents negative impact from foreign currency exchange rate fluctuations.

- Diluted weighted average shares are expected to be approximately 79.4 million.

“We remain focused on improving our balance sheet metrics while driving further profit improvement benefits,” Stornant continued, “We now expect the Profit Improvement Office to deliver at least $70 million in savings for 2023. We are on track to deliver our year-end inventory target of $520 million, which will set the business up for new product and cleaner trading in 2024. In order to accelerate debt pay down, we have plans to sell at least $50 million of non-core assets over the coming months.”

Net Debt at year-end is expected to be approximately $850 million resulting in bank-defined leverage of approximately 3x.

“Our second half outlook, as reflected in our updated annual guidance, is disappointing but we are confident that the work we are undertaking will drive significant profit improvement in 2024 and quickly set a strong growth foundation for the company,” said Chris Hufnagel, the newly minted CEO for Wolverine Worldwide. “The current adversity has not only deepened our conviction that our strategic direction is more correct than ever, but that we must execute it with greater boldness and speed.”

Last year, Wolverine unveiled a new corporate strategy and began to redesign the business to focus its portfolio on its biggest opportunities, while creating cost savings for reinvestment in its priority brands. As part of the redesign, in May the company announced the evaluation of strategic alternatives for the Sperry brand, which allows the company to now focus on its Active and Work Groups.

Wolverine also outlined new important elements of the company’s transformation, including the consolidation of its U.S. offices and streamlining the organization in line with the new focus. These efforts come in addition to previously announced profit improvements already underway.

Financial results and guidance for 2023, and comparable results from 2022 for the company’s ongoing business exclude the impact of Keds, which was sold in February 2023, and Wolverine Leathers, which is the subject of a sale process, and reflect an adjustment for the transition of its Hush Puppies North America business to a licensing model in the second half of 2023. The results and guidance include Sperry. Since May, Sperry’s revenue outlook has declined $55 million and operating profit has declined nearly $25 million.

“Like many other companies in our industry, we continue to see softness in our U.S. and European footwear wholesale businesses as retailers remain cautious,” Stornant concluded.

Photo courtesy Wolverine World Wide, Inc.