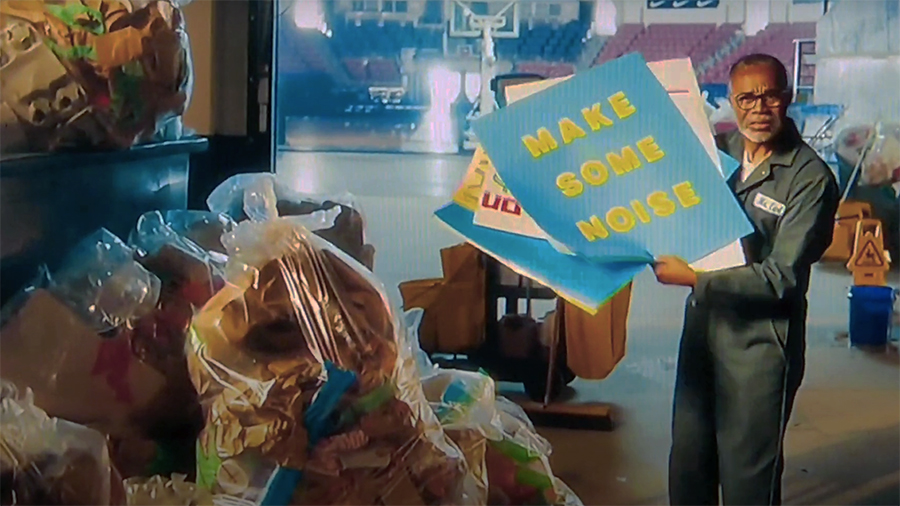

In perhaps the most anticipated conference call with analysts in recent company history, new Nike, Inc. CEO Elliott Hill did not ride in on a white horse or a chariot as a conquering hero but as a janitor, not unlike Mr. Earl, who realizes he has a big job to do but also has a clear mind on what must be done to clean up the place and get back to focusing on the company’s North Star.

“I know Nike inside and out, take pride in what the brand stands for and want to see the company succeed,” Hill stated at the beginning of his prepared comments on Thursday evening, December 19. “And, in a moment where our team, brand and business are being challenged, my singular focus is to help get us back on track to get back to winning.”

Nike’s challenge from the marketplace is cleaning up the market, cleaning up Nike Direct, and bringing innovation based on sport. From a Wall Street perspective, all will depend on analyst and investor buy-in on the long-term plan, which will require patience as the janitor cleans up the market while the innovator builds for the future. The time required is the biggest challenge as Hill rolled out plans that reflect a fiscal 2026/27 timeline rather than a real turnaround in the current fiscal year ended May 2025.

The assessment phase of the plan has resulted in meetings with Nike’s geographic team (GEOs), key customers, suppliers, company distribution centers, sports leagues/conferences, teams/clubs, and athletes to gain a complete perspective across the global landscape. What Hill possesses is what most new CEOs do not—relationships with each of them and the entities they own or represent.

“It was important to me that I spent my first 60 days personally collecting these deep and direct insights,” Hill said. “Across the board, our partners are energized. The people I talk with are rooting for a strong Nike. Because when Nike is at its best, we bring excitement. We invite consumers into the world of sport and sport culture. When we do that, we help grow the overall marketplace. That’s good for consumers, that’s good for our partners and that’s good for Nike.”

Hill said the consistent feedback he and his team heard was pretty simple: Let’s see more of Nike being Nike. The CEO said that starts with leveraging all the advantages that make the company great: Three of the world’s most iconic brands, a dominant roster of athletes, teams and leagues, unmatched patented innovation, a deep catalog of products at every price point, teams positioned to serve consumers across 190 countries, an integrated marketplace across multiple channels, strong longstanding relationships with leading suppliers and manufacturing partners and, most importantly, passionate, highly talented and committed teammates.

“Lately, we have not been maximizing these strengths,” Hill noted. “From everything I heard and observed, there are clear themes about the recent state of our business and where we need to go.”

He started with a high-level observation.

“We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision. The sharpness in each sport differentiates our brand and business and fuels our culture,” he shared. “Another observation is that relying on a handful of sportswear silhouettes is not who we are. We will get back to leveraging deep athlete insights to accelerate innovation, design, product creation, and storytelling. Sport is what authenticates our brand.”

Hill also noted that the company has shifted investments away from creating demand for the brand to capturing demand through performance marketing for its Digital business.

“We will reinvest in our brands to create stories that inspire and emotionally connect with our consumers during important sports moments and critical product launches,” Hill committed.

When visiting Nike teams worldwide, Hill said it was clear that centralization has impacted Nike’s resources in key countries and cities.

“We will rebalance resourcing and empower our teams on the ground to win with the everyday athletes and influencers,” he pledged.

“My last observation is that prioritizing Nike’s digital revenue has impacted the health of our marketplaces,” the CEO continued. “We will build back an integrated marketplace. Across Nike Direct and Wholesale, our marketplace will be consumer-led, putting our best product and presentation in the consumer’s path, wherever they choose to shop.”

Hill said that Nike will ultimately focus on the company’s North Star and reenergize its culture and identity.

“We believe we have one of the strongest mission statements of anyone, and that is to bring inspiration and innovation to every athlete in the world,” he added. “Inviting 8 billion athletes into sport is a pretty powerful purpose.”

The CEO of just 60 days also said he has grown “more confident” as he’s traveled around the world and seen Nike teams engaging with each other, with consumers and with partners.

“It’s also been great to see how much expertise we’ve added since I’ve been away. In spaces like supply chain, product creation, technology, materials, sports science, you name it, our talent is world-class,” Hill noted.

Looking at the product, the critical component central to re-accelerating growth, Hill said the team is getting sharper on specific sports.

“We’re shifting into sport-led teams segmented by men’s, women’s and kids’, and we call each of them Fields of Play,” he shared. “Throughout our history, we’ve utilized inflection points to further segment our businesses to unlock the next wave of growth. We will do this by empowering more nimble cross-functional teams to assess the needs of sport-specific athletes by gender. The approach enables the teams to identify new opportunities, fuel innovation and drive incremental growth by sport and gender.”

Hill called out breadth and depth and how the company orchestrates a complete product portfolio, which has always been the strength of Nike.

“We will return to the discipline of franchise management that I was a part of for so many years,” he added. “We’ve already started managing the inventory in our marketplaces and will move faster to return to a pull market for our largest Classic Footwear franchises. At the same time, the team has been planting the seeds of the next franchises that will fuel growth.”

In the second quarter, Hill noted that some of Nike’s most sought-after products are distinctly Nike franchises, including the Pegasus 41, Nike Shox, and the Kobe lineup.

“And we’re building anticipation for what’s ahead, unveiling the Vomero 18 and Pegasus Premium to passionate runners at The Running Event (TRE) in my hometown a few weeks ago,” he said. “There’s still work to do in rounding out the portfolio, but I’m encouraged by the innovation coming from our Fields of Play in the next several seasons, especially in the high volume areas like running, training, sportswear, core product, and the Jordan brand lineup.”

Hill also said Nike will continue to be aggressive in sports marketing.

“In just the last 60 days, we’ve announced the re-signing of the NBA and the WNBA, the Brazil Football Confederation, FC Barcelona and, last week, the NFL,” he noted.

“We drive growth through sports’ most iconic partners. Their athletes are the creative fuel for our brand—the power of our innovation agenda, our brand voice and our revenue. Inspiring the consumer includes being part of the active communities that run, train and compete locally. It’s about showing up and building relationships every day with athletes and influencers.”

Hill said Nike’s marketing team delivered moments this quarter that got the company back to owning the conversation in sport, from the Liberty’s WNBA championship to the Dodger’s World Series win to Saquon Barkley’s reverse hurdle, and to city takeovers at the Berlin, Shanghai, New York City, and Chicago marathons.

“My visits to the GEOs the past few weeks only reinforce my conviction that we need to get back to empowering our teams in key countries and key cities,” Hill stated. “I know from my years of working in our geographies that they’re the ones creating emotional consumer connections in their neighborhood. They’re the ones identifying the insights that inform our offense.”

Hill said the company will resource key country and city teams to create stronger consumer connections, build relationships with athletes, influencers and partners, and unlock incremental growth for the brand and business. Hill said he was optimistic about the actions already underway in product and brand, but he also said the company is still in the early innings of elevating the marketplace, both in Nike Direct and with its wholesale partners.

“I’ve seen traffic in Nike Direct—digital and physical—has softened because we’ve lacked newness in product, and we’re not delivering inspiring stories,” he noted. “We’ve become far too promotional. We’ve moved to a ‘push model.’ Entering the year, our digital platforms delivered roughly a 50/50 split of full price to promotional sales. The level of markdowns not only impacts our brand but also disrupts the overall marketplace and the profitability of our partners.”

Hill said the company will return Nike Direct’s digital and physical products to premium destinations that lead the sports industry.

“They’ll elevate the consumer experience and be the ultimate representation of the Nike brand,” he shared. “It’s where we’ll offer our most complete assortments, tell deep product stories and share our passion for sports.”

Hill said being premium also means full price. “We’ll focus promotions during traditional retail moments, not at the consistent levels we are today, and we will leverage Nike Value Stores to profitably move through any excess inventory,” he committed.

Hill left a big piece of the puzzle for last, suggesting the final action the company will prioritize is building back and earning the trust of key wholesale (retailer) partners.

“Some partners and channels feel we’ve turned our back on them, and we stopped engaging consistently. I’ve connected with many of them directly,” he said, rattling off a list of key retailers and leadership to make his point. “They’re all encouraged by our commitment to delivering new innovative product, telling emotional and inspiring stories and elevating Nike Direct. Their confidence is building in our product pipeline, and they welcome the closer collaboration as we invest more in their business.”

Hill continued, “We know our sales teams will have to earn every open-to-buy dollar, but we’re investing to make sure our partners feel supported. We’ll give them access to our best products and the breadth and depth they need, educate their teams on the latest Nike innovation and provide them with marketing support both in-store and out of home. We’ll do more than just sell-in our products. We’ll actively support mutually profitable sell-through. Simply put, we will win what our partners win.”

In an answer to an analyst question, Hill laid out the balancing act between the Nike Direct and Wholesale to Retail businesses.

“We are absolutely committed to getting back to leading and growing a consumer-led marketplace,” Hill said. “And, I think, there are a couple of keywords there, obviously, key being consumer-led. The bottom line is there are consumers that want to shop Nike Direct, consumers that want to shop wholesale, and there are consumers that want to shop digital and physical, and we have to show up with the best representation of the Nike brand wherever that is, and we will do exactly that.”

The new CEO closed his prepared statement by saying the company recognizes that some of the actions he articulated will have a negative impact on near-term results.

“But we’re taking a long-term view here,” he closed. “We’re making the decisions that are best for the health of our brand and business, decisions that will drive shareholder value. I strongly believe Nike’s path to sustainable, profitable growth will be through sport.”

Company CFO Matt Friend jumped in on the call to walk through the company’s financial outlook, reminding participants that the company intends to continue providing quarterly guidance during this transition period. He noted that while some of the actions outlined by CEO Hill have been in motion and are accelerating the pace, others are new. Friend was apparently tasked with delivering the vinegar, so to speak.

“More specifically, we are shifting Nike Digital to a full-price model and reducing the percentage of our business driven by promotional activity,” Friend confirmed. “We are also reducing investment in performance marketing, which will reduce paid traffic. This will require short-term liquidation of excess inventory through less profitable channels. We are creating capacity in the marketplace to sell in seasonal newness and innovation for fall and holiday 2025.”

Friend said this requires additional investment in marketplace returns, higher wholesale discounts to liquidate excess inventory and win back shelf space as well as higher promotions to accelerate volume through Nike factory stores.

“We are targeting a significant reduction in weeks of supply of our Classic Footwear franchises over the next few seasons, with timelines varying by franchise, channel, market, and geography,” he said. “As a result, summer order books will be down versus the prior year.”

Friend said the company is increasing brand marketing activity to support key product launches and upcoming sports moments. Investment in sports marketing has also increased with the recent long-term partnership extensions. The CFO said the company is investing in rebuilding its key city offense, sport by consumer Field of Play, and commercial teams to serve retail partners.

“We believe the strategic actions that Elliott has outlined are the right moves for Nike to create better balance in our business and to reignite growth with our wholesale partners in an integrated marketplace,” Friend stated. “But, over the near-term, the net effect of these actions will result in lower revenue, additional gross margin pressure and higher demand creation expenses, with a greater headwind to the fourth quarter compared to the third quarter.”

Regarding the company’s fiscal third quarter outlook, Friend said Nike, Inc. expects Q3 revenues to be down in low double-digits. The CFO said this reflects initial steps on the outlined actions and worsening foreign exchange headwinds, partially offset by a timing benefit from Cyber Week shifting into the company’s fiscal third quarter.

“We expect Q3 gross margins to be down approximately 300 basis points to 350 basis points, including restructuring charges during the same period in the prior year,” the CFO detailed. “This reflects the actions described earlier to clean and reset the marketplace. We expect Q3 SG&A dollars to be slightly down year-over-year, including restructuring charges in the prior year. We will continue to tightly manage expenses while we strategically increase investment, as mentioned earlier. We expect other income and expense, including net interest income, to be $30 million to $40 million for Q3.”

Images and video courtesy Nike, Inc.

See below for more SGB Media coverage of Nike’s Q2 results:

EXEC: Nike’s NA Q2 Footwear Down 14 Percent; Reduces Classics Share of Business