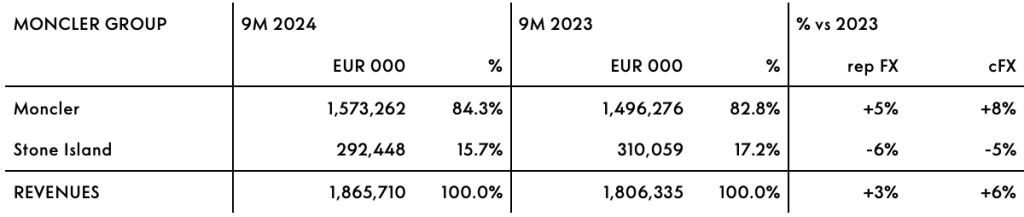

Moncler S.p.A. has reported Group consolidated revenues reached €1,865.7 million in the first nine months of 2024 (YTD), an increase of 6 percent at constant exchange rates, or 3 percent at current exchange rates, compared to €1,806.3 million in the first nine months of 2023.

Group Revenues by Brand

“Our industry is facing a period of continuous volatility, characterized by a more difficult global macroeconomic context, which has been impacting consumer confidence in several markets,” offered Remo Ruffini, chairman and CEO, Moncler S.p.A. “In light of these ongoing uncertainties, we remain focused on what we do best: building long-lasting connections with our customers, and – most importantly – creating energy and emotions around our brands.

Ruffini said the brand’s recent event in Shanghai, The City of Genius, was a testament to this: “a powerful brand experience celebrating creativity and innovation, with an extraordinary echo effect among communities all around the globe.”

In the third quarter, Group revenues were €635.5 million, down 3 percent constant-currency compared to the same period of 2023. The Moncler brand recorded €532.0 million in revenue in the quarter, while the Stone Island brand produced €103.6 million in revenues in the third quarter.

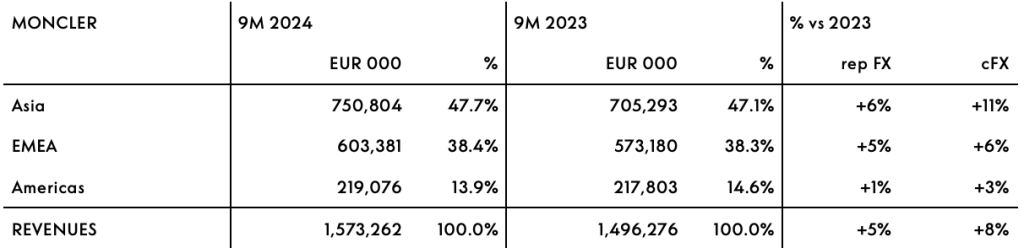

Moncler Brand

In the 2024 YTD period, Moncler brand revenues were €1,573.3 million, an increase of 5 percent (+8 percent cc) compared to €1,496.3 million in the YTD period in 2023.

In the third quarter, revenues for the brand amounted to €532.0 million, down 3 percent y/y in constant-currency terms, said to be mostly due to a 9 percent constant-currency y/y decrease in the Wholesale channel during its most significant quarter of the year. The decline was said to be due to “challenging market trends and the ongoing efforts to upgrade the quality of the distribution network.”

In Asia (which includes APAC, Japan and Korea) 9M revenues were €750.8 million, up 11 percent cc, compared to YTD 2023. In the third quarter, revenues in the region were down 2 percent constant-currency y/y, reportedly due to more challenging macroeconomic conditions affecting consumer confidence, as well as a normalization of tourist flows into Japan.

EMEA recorded revenues of €603.4 million in YTD 2024, +6 percent constant-currency compared to YTD 2023. In the third quarter, EMEA revenues decreased by 3 percent constant-currency y/y, mainly due to a decline in the Wholesale channel. DTC was said to be impacted by a deceleration in tourist inflows and by the deterioration in the performance of the direct online channel.

Revenues in the Americas increased by 3 percent constant-currency y/y in the first nine months of 2024 to €219.1 million. In the third quarter, revenues in the region declined by 6 percent constant-currency y/y, impacted by the decrease in the Wholesale channel, while trends in the DTC channel remained stable

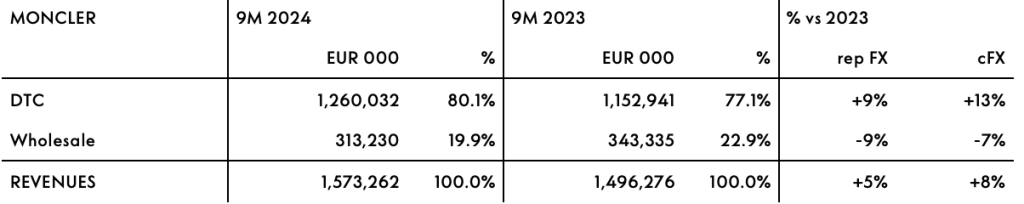

In the 2024 YTD period, the DTC channel recorded revenues of €1,260.0 million, up 13 percent constant-currency compared to the first nine months of 2023.

Revenues in the third quarter of 2024 were flat year-over-year at constant exchange rates, impacted by more difficult macroeconomic conditions affecting consumer confidence as well as by the weak performance of the direct online channel across all regions.

The Wholesale channel recorded revenues of €313.2 million in the first nine months of 2024, a decline of 7 percent constant-currency compared to YTD 2023.

In the third quarter – the most significant quarter of the year for this channel – Wholesale revenues declined by 9 percent constant-currency y/y, reportedly impacted by challenging market trends and by the ongoing efforts to upgrade the quality of the distribution network.

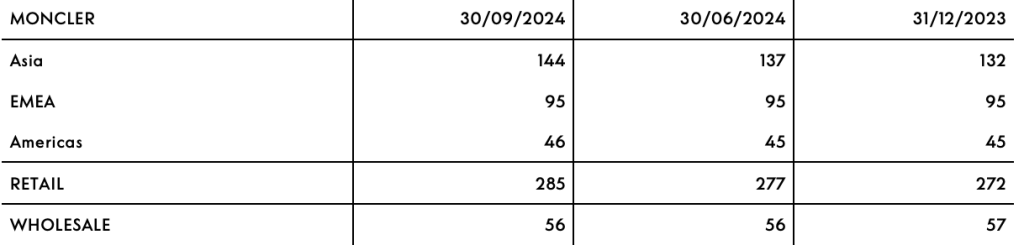

As of 30 September 2024, the network of Moncler mono-brand boutiques comprised 285 directly operated stores (DOS), a net increase of eight units compared to June 30, 2024, including the opening of Wuhan SKP and Suzhou Matro in China and the relocation of Royal Hawaiian store in Honolulu.

The Moncler brand also operated 56 Wholesale shop-in-shops (SiS)

Stone Island Brand

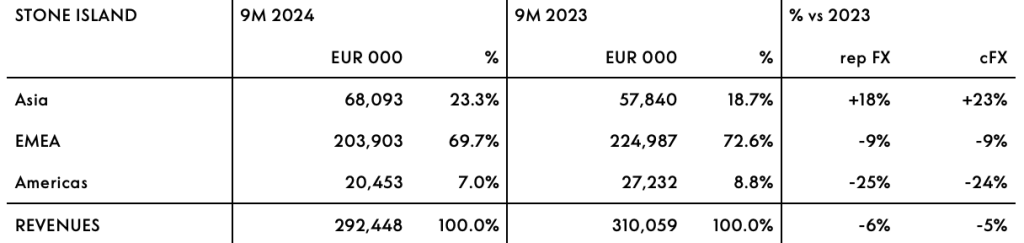

In the first nine months of 2024, Stone Island brand revenues reached €292.4 million, a decrease of

6 percent (-5 percent cc) compared to €310.1 million in the nine-month YTD period in 2023.

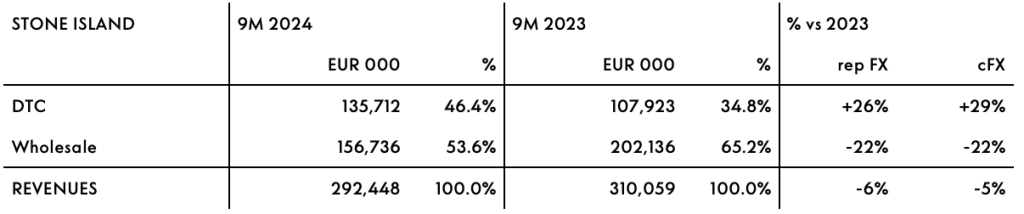

In the third quarter, revenues for the brand amounted to €103.6 million, down 4 percent constant-currency y/y, with a continued strong double-digit growth in the DTC channel almost entirely offsetting a 19 percent constant-currency decline in the Wholesale channel.

Asia (which includes APAC, Japan and Korea) reached €68.1 million revenues in YTD 2024, growing 23 percent cc compared to YTD 2023.

In the third quarter, the region grew by 17 percent cc year-over-year, mainly driven by a continued strong performance of Japan. Trends in Korea remained soft, although improving compared to the previous quarter. China and the rest of APAC slowed down sequentially due to a more difficult macroeconomic backdrop, affecting local consumer sentiment.

The EMEA region – which continues to be the most important region for the brand – recorded revenues

of €203.9 million in the nine-month YTD period, a decrease of 9 percent cc compared to YTD 2023.

In the third quarter, revenues were down 6 percent constant-currency y/y, with the continued double-digit performance of the DTC channel almost offsetting the decline in the Wholesale channel.

Americas revenues were down 24 percent cc in the YTD 2024 period, compared to the YTD period in 2023.

In the third quarter, the region saw a decline of 28 percent constant-currency y/y. The positive performance of the DTC channel in the quarter, which accelerated compared to the previous quarter, was more than offset by the ongoing decline in the Wholesale channel. This decline continued to be driven by

challenging trends mostly among department stores, as well as by the ongoing efforts in upgrading the

quality of the channel.

DTC channel revenues reached €135.7 million in the first nine months of 2024, up 29 percent cc compared

to YTD 2023, representing 46 percent of total 9M 2024 revenues. In the third quarter, revenues in this channel were up 28 percent cc year-over-year, thanks to a positive double-digit contribution from all regions, with Asia said to be outperforming.

The Wholesale channel recorded revenues of €156.7 million in the 2024 YTD period, down 22 percent cc compared to YTD 2023.

In the third quarter, revenues declined by 19 percent constant-currency y/y, impacted by challenging market trends in this distribution channel as well as by the strict volume control adopted to continuously improve the quality of the network.

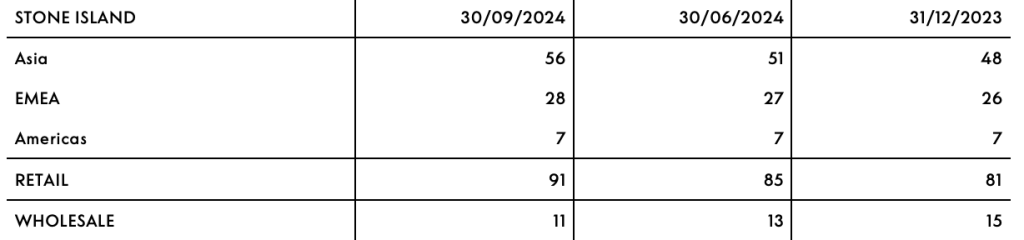

At quarter-end, the network of Stone Island mono-brand stores comprised 91 directly operated stores (DOS), a net increase of six units compared to June 30, 2024, including the opening of the Shanghai Taikoo Li QianTan and Macau Galaxy stores in China.

The Stone Island brand also operated 11 mono-brand Wholesale stores, a net decrease of two units compared to June 30.

“As we head into the final part of the year with a number of exciting initiatives planned for both Moncler and Stone Island, we remain committed to our brand-first, long-term oriented strategy, which I believe will position us well to navigate these challenging times,” Ruffini concluded.

Image courtesy Moncler