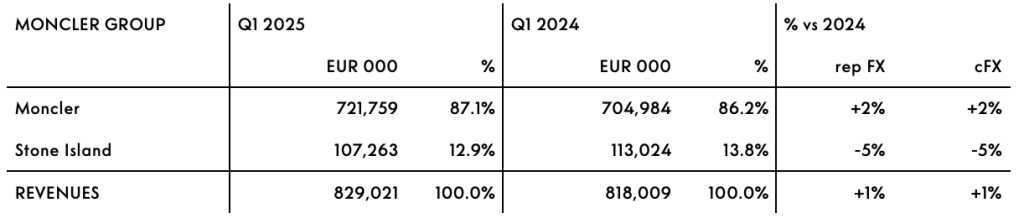

Moncler Group, parent of the Moncler and Stone Island luxury sportswear brands, reached consolidated revenues of €829.0 million in the 2025 first quarter, up 1 percent on a constant-currency basis compared with the 2024 first quarter. These results include Moncler brand revenues of €721.8 million and Stone Island brand revenues of €107.3 million.

All percentages are reported here in constant-currency terms.

Revenues by Brand

Moncler Brand

In the first quarter, Moncler brand revenues were €721.8 million, an increase of 2 percent compared with the 2024 first quarter, driven by 4 percent growth recorded in the DTC channel despite an “exceptionally high” comparable base.

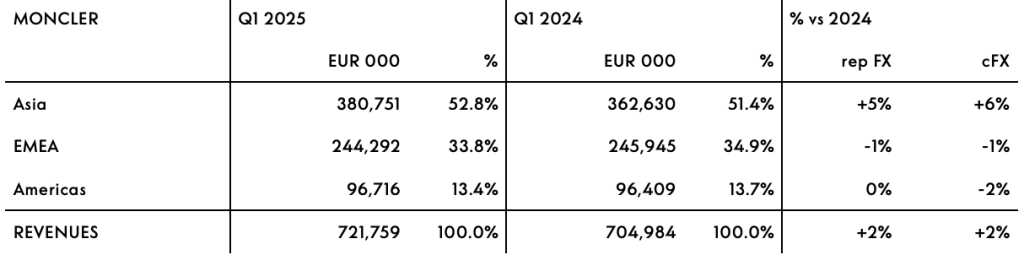

Moncler Brand by Region

In the first quarter, revenues in Asia (which includes APAC, Japan and Korea) were €380.8 million, up 6 percent compared with Q1 2024. The Chinese mainland continued to register positive growth, despite a very demanding comparable base and the ongoing shift of Chinese consumption abroad. Growth in Japan accelerated sequentially, mainly driven by tourist spending, while Korea showed softer trends compared to the previous quarter.

EMEA recorded revenues of €244.3 million in Q1, a decrease of 1 percent compared with Q1 2024, impacted by the negative performance of Wholesale. The DTC channel held steady versus the very strong Q1 in 2024, with both local and tourist consumption remaining positive in the quarter. The DTC performance continued to be penalized by difficult trends in the direct online channel.

Revenues in the Americas were down 2 percent to €96.7 million in the first quarter compared with Q1 2024, mainly impacted by the negative trend in the Wholesale channel, while the DTC performance held up year-on-year.

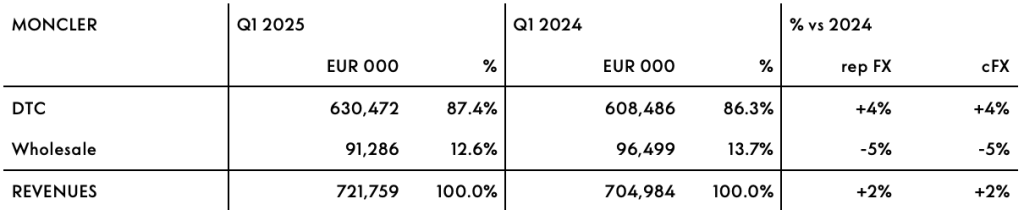

Moncler Brand by Channel

The direct-to-consumer (DTC) channel recorded revenues of €630.5 million in the first quarter, up 4 percent compared with the 2024 first quarter, despite ongoing market volatility and the exceptionally high comparable base in Q1 2024, which had recorded strong double-digit growth across all regions. The physical channel continued to outperform the online channel, whose trends remained weak in the quarter, particularly in EMEA, albeit improving sequentially.

The Wholesale channel recorded revenues of €91.3 million in the first quarter, a decline of 5 percent compared with the 2024 first quarter, mainly due to the ongoing efforts to upgrade the quality of the distribution through further network optimization.

March 31, 2025, the network of Moncler mono-brand boutiques counted 284 directly operated stores (DOS), a net decrease of 2 units compared with December 31, 2024, including the opening of Shanghai Grand Gateway, and the closures of Shanghai The Reel, San Francisco Bloomingdale’s and Seoul Incheon Airport. The Moncler brand also operated 55 Wholesale shop-in-shops (SiS), a net decrease of 1 unit compared with December 31, 2024.

Moncler Mono-Brand Stores by Region

Stone Island Brand

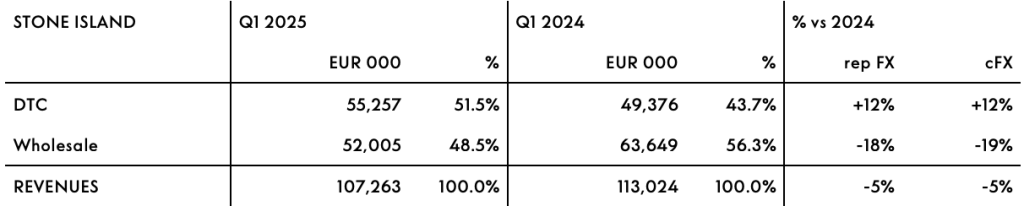

Stone Island brand revenues reached €107.3 million in the first quarter, a decrease of 5 percent compared with the 2024 first quarter, with continued solid double-digit growth in the DTC channel partially offsetting the decline in the Wholesale channel in its largest quarter of the year.

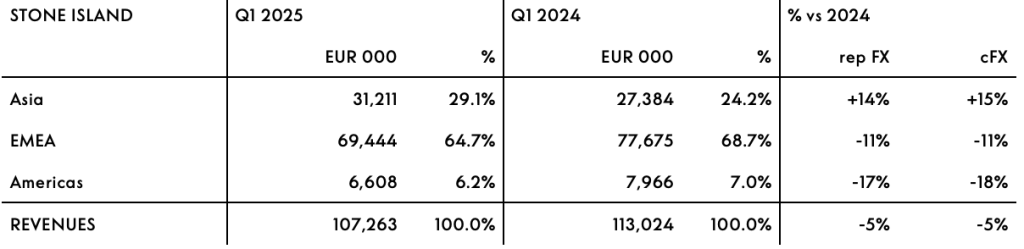

Stone Island Brand by Region

In the first quarter, revenues in Asia (which includes APAC, Japan and Korea) reached €31.2 million, growing 15 percent compared with the 2024 first quarter, mainly driven by a strong performance of Japan and the Chinese mainland. Korea improved sequentially, although underperforming the rest of the region.

EMEA recorded revenues of €69.4 million, a decrease of 11 percent compared with Q1 2024, with the positive performance of the DTC channel more than offset by the decline in the Wholesale channel. France and the UK outperformed the rest of the EMEA region.

Revenues in the Americas were down 18 percent compared with Q1 2024, mainly due to the double-digit negative performance in the Wholesale channel. The DTC channel, instead, recorded positive growth, improving sequentially.

Stone Island Brand by Channel

In the first quarter, the DTC channel grew by 12 percent compared with the 2024 first quarter to €55.3 million, driven by positive growth in all regions, with Asia outperforming. The physical channel continued to outperform the online channel across all regions.

The Wholesale channel recorded revenues of €52.0 million in the first quarter, down 19 percent compared with Q1 2024. In its largest quarter of the year, performance in this channel was impacted by a different timing of deliveries in Q1 vs Q2 and by continued efforts to improve the quality of the distribution network.

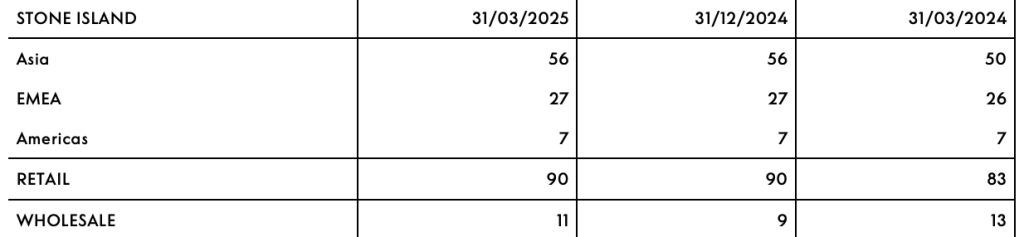

As of March 31, 2025, the network of Stone Island mono-brand stores comprised 90 directly operated stores (DOS), unchanged compared with 31 December 2024. During the quarter, a notable development was the relocation of the flagship store in Paris. The Stone Island brand also operated 11 mono-brand Wholesale stores, a net increase of 2 units compared with December 31, 2024.

Stone Island Mono-Brand Stores by Region

Image courtesy Moncler Group