Active lifestyle brands dominated the leaderboard in the latest annual resale report from ThredUp and doubled representation in the report’s Top 20 for Best Brandx for Resale.

Lululemon was named the Best Brand for Resale in 2023, supplanting Torrid, according to ThredUp’s 12th Annual Resale Report. LULU was in the No.2 position in the prior year.

Patagonia jumped four positions to No.2 in 2023 from its No.6 position for the previous year.

Vuori rounded out the Top 3 in the ThredUp report, rocketing from No.10 in the company’s spring 2023 report covering the 2022 sales year.

Other active lifestyle brands that made the Top 20 include Skims, new on the list at No.10; Dr. Martens, also new to the list at No.11; The North Face, which rose to the No.13 position from No.18 in the prior year; Converse, debuted in the Top 20 at No.15; and Smartwool made the list at No.18.

Last year’s report from ThredUp only featured four active lifestyle brands in the Top 20, half the number of the active lifestyle brands in this year’s report.

Several active lifestyle brands also made the reports Resale’s Rising Stars chart.

Outdoor Voices was the top active lifestyle brand on the Rising Stars chart at No.3. Vans is listed at No.8, and Prana came in at No.13. Footwear brand Toms took the No.15 spot.

Evaluating over 55,000 brands in its marketplace, ThredUp ranked Best Brands for Resale using an aggregate score based on sell-through and volume of sold items in its marketplace from January 1, 2023 through December 31, 2023 and ranked Resale’s Rising Stars using an aggregate score based on year-over-year increases in sell-through rates and volume of listed items in its marketplace from January 1, 2023 to December 31, 2023 compared to January 1, 2022 to December 31, 2022.

For brands that have engaged with consumers in the resale space, 87 percent cited the process as Advanced Sustainability Goals as the top benefit for doing so, up 5 points from last year’s report. Eighty percent of brands cited Generated More Revenue as the top benefit, up 7 points from the prior year. Acquired More Customers was cited by 67 percent of brands in this year’s report, up 22 points, or nearly one-third from last year’s report.

Interestingly, for brands still considering resale but not yet engaged in the practice, the same Top 3 reasons were mentioned, but in reverse order, with Acquire More Customers cited as the top reason for pursuing resale. Brands said the biggest challenge with resale is securing enough inventory of pre-owned products.

For brands not interested in resale, the top reasons given were: Resale is too complex (67 percent; need to know where to start (56 percent); and other higher priority initiatives (56 percent).

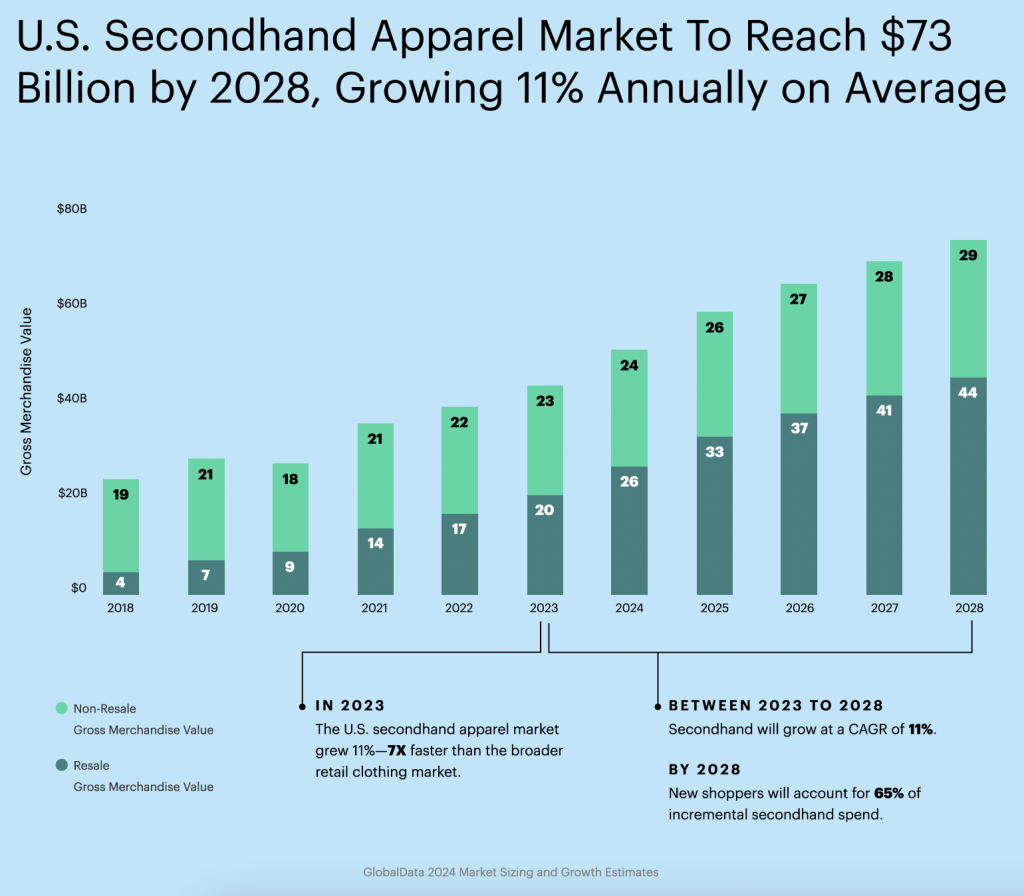

Third-party retail analytics firm GlobalData conducted ThredUp’s 2024 Resale Report. The 12th annual study measures the global secondhand market, with forward-looking projections through 2033. It also includes trends driving online resale growth, momentum in branded resale and the government’s role in reducing fashion’s impact and potential implications for the 2024 U.S. election.

ThredUp based the report’s findings on market size and growth estimates from GlobalData, a survey of 3,654 U.S. consumers over age 18, and a survey of 50 top U.S. fashion retailers and brands.

To access the full report and archival information, go here.

Image courtesy Lululemon/Chart ThredUp

***

For more SGB Media coverage on ThredUp’s latest report, see below.