L.E.K. Consulting has released its Fourth Annual Brand Heat Index, again measuring and announcing the brands that have gained in popularity across major product categories in footwear and apparel.

L.E.K. said the intent from the insights provided by the Brand Heat Index brings a more nuanced view of brand trajectory and what drives it up, which should ultimately enhance retailer’s strategic decision-making.

“Our Brand Heat Index continues to demonstrate how material differences in brand momentum can exist below the surface and how quickly sentiment can change,” the company said in its report summary. “Once again, generational differences in top brand rankings point to the importance of recognizing that consumers are not all the same and that deep understanding and tailored strategies are required to win.”

L.E.K. Consulting based its Brand Heat Index on a survey of nearly 5,000 U.S. consumers between the ages of 14 and 55. Within product categories and generational cohorts, each brand earns a heat score expressed on a scale of 0 to 100 — the higher the score, the hotter the brand.

Notably, the Brand Heat Index identifies brands on the most significant upward trajectory with consumers, not necessarily the brands’ relative size or scale.

The survey gathers feedback on brands across four product categories: Athletic, Casual, Outdoor/Rugged and Dress. SGB Media focuses on the athletic, casual, outdoor/rugged categories for this review and write-up.

The brands with the most heat are not necessarily the biggest or fastest-growing; it’s about connection with the core consumer.

“In 2025, competition in the footwear space remains intense, with brand heat scores tightly clustered among the top three brands across categories,” L.E.K. wrote. “Consumers continue to be driven by iconic silhouettes and a blend of form and function, as demonstrated by the popularity of athletic brands and comfort-driven brands (e.g., Crocs, HeyDude, Ugg) in casual footwear,” the company wrote.

L.E.K. noted that athletic footwear brands tend to engender the most excitement from consumers overall, and other surveys and analyses over the last year have seen even more excitement as Nike stumbled and left the door open for other brands to innovate and build on their brand heat. Adidas and New Balance have been the primary beneficiaries of this opening.

L.E.K. said the leading footwear brands are more consistent across genders than apparel brands, with around 24 brands showing up in its Top 10 for Women’s and Men’s footwear in their respective categories.

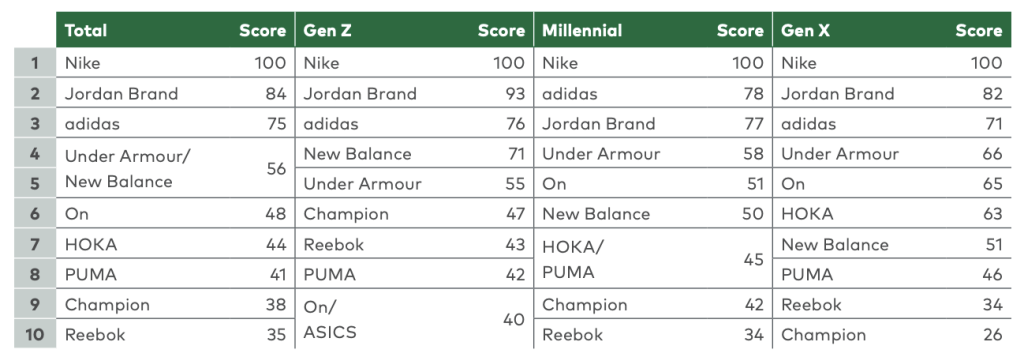

Athletic Footwear: Key L.E.K. Observations

- While the Top 10 brands in athletic footwear remain fairly consistent year over year and across genders, the competition within the Top 10 is increasingly fierce as top competitors trade spots and relative heat scores narrow.

- Nike has managed to stave off competitors and maintain its leadership position this year for many generational cohorts, but the margin is thin, particularly among women, with On and Hoka surpassing the industry behemoth in key generations. In general, legacy brands perform more strongly with men than with women.

- Even beyond On and Hoka, running heritage brands are seeing growing success, with New Balance, Brooks and Asics increasing their heat scores year over year.

Women’s Athletic Footwear

- Nike has reclaimed the top spot from On, but these two brands and Hoka all sit within three points of one another in the overall rankings. From a generational perspective, On takes the top spot among Gen Z, Nike among millennials and Hoka among Generation X.

- While Adidas remains at the same ranking as last year (No. 5 overall), the brand’s heat score has improved across all generations, likely due to the popularity of its Samba model and other key fashion styles.

- New Balance (No. 6 overall) has similarly increased its score across all generations of women. Under Armour and Reebok, on the other hand, have dropped spots, with Reebok falling out of the top 10 entirely.

Men’s Athletic Footwear

- Legacy brands maintain greater dominance among men, with Nike, Jordan Brand and Adidas forming the Top 3 overall and across generations. The Adidas scores have generally improved year-over-year, though less so than on the women’s side.

- New Balance is showing increasing strength among men, having moved up from No. 7 to No. 5 (with particular strength among Gen Z), while On and Hoka have each dropped a position.

- Asics, meanwhile, has capitalized on the popularity of sportstyle running styles to crack the Top 10 among Gen Z (in both women’s and men’s athletic footwear).

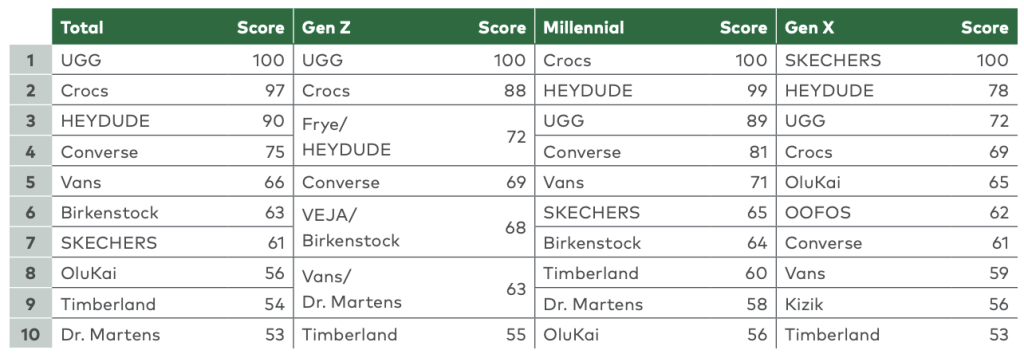

Casual Footwear: Key L.E.K. Observations

- Brands with distinctive, iconic silhouettes remain on top in casual footwear for both women and men, as Crocs, HeyDude, Ugg and Timberland reshuffle across the Top 3 spots.

- Converse and Vans, while also visually distinctive, are in a second tier in terms of brand heat.

- Consumer demand for comfort is evident across leading brands and is further supported by Skechers rising in the ranks, not just among Gen X but in the Top 10 overall across both genders.

Women’s Casual Footwear

- Ugg takes the No. 1 spot overall this year, with Crocs coming in a close second (only three points behind). HeyDude has slipped from No. 1 to No. 3 but is still very close to the top with an overall score of 90. Across generations, Ugg shows differential strength with Gen Z, while Crocs and HeyDude perform more strongly with millennials.

- The largest gains were shown by Skechers, which entered the Top 10 overall and rose to No. 1 among Gen X.

- Frye shows the continued strength of the Western trend, rising to No. 3 among Gen Z on the back of a TikTok-driven renaissance, while Dr. Martens continues to slip in the ranks across age cohorts, having previously capitalized on the 1990s fashion revival.

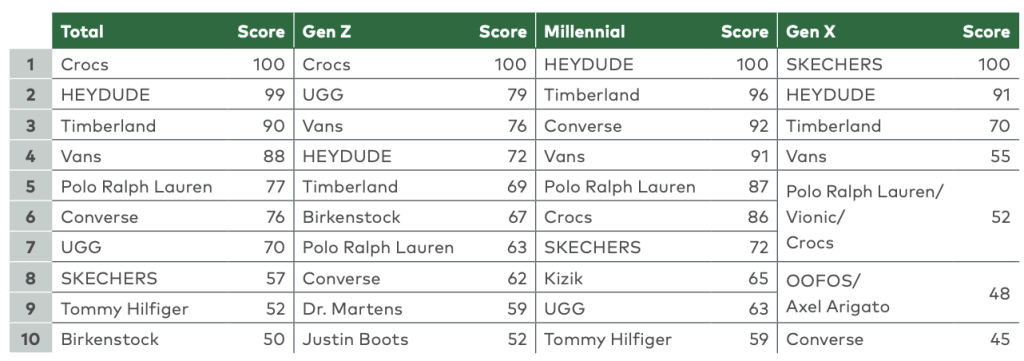

Men’s Casual Footwear

- The men’s casual footwear rankings have a fair amount of consistency with last year, with nine out of the Top 10 brands remaining the same.

- Crocs, HeyDude and Timberland again make up the Top 3, but Crocs has retaken the top spot from its sister brand. HeyDude has gained among millennials but lost ground to its peers among Gen Z.

- Vans maintains its No. 4 position overall, while Converse has slipped to No. 6.

- Comfort appears to be king, particularly with older generations (millennials and Gen X), where Skechers, Kizik, Vionic and Oofos are climbing up the Top 10 lists.

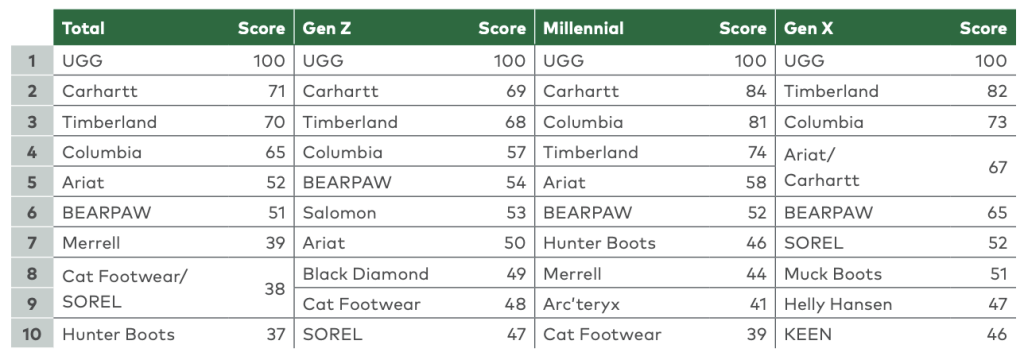

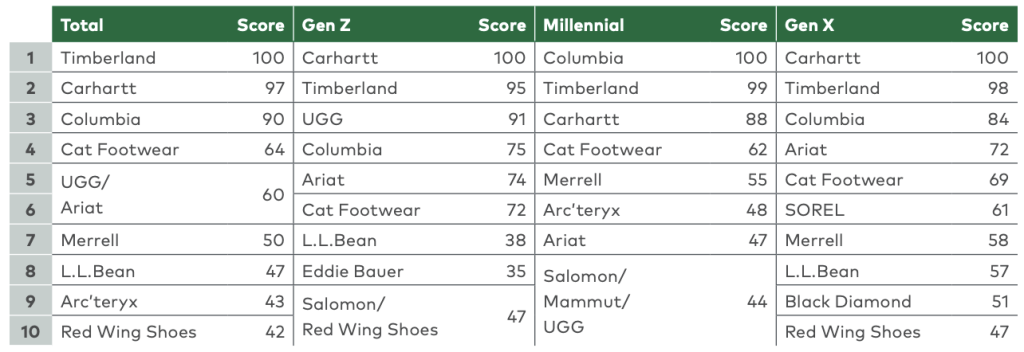

Outdoor/Rugged Footwear: Key L.E.K. Observations

- In 2025, outdoor/rUgged footwear rankings demonstrate the strength of heritage brands in the space — both traditional outdoor/rUgged and Western and work — with Timberland, Columbia, Ariat and Merrell in the Top 10 across genders.

- While traditionally an apparel-driven brand, Carhartt has made a push intofootwear and comes in at No. 2 across both rankings.

- The women’s rankings take a slightly more fashion-driven approach to the category, with Ugg topping the list, while men’s rankings skew more outdoor/rugged.

Women’s Outdoor/Rugged Footwear

- Ugg continues its dominance across all generations, often leading over the No. 2 brand by 20-plus points.

- Carhartt, Timberland and Columbia make up the next tier of brands, taking the second to fourth spots in some variation.

- After these consistent leaders, however, there is some notable variance across generations and key year-over-year movements:

- Ariat has ascended in the rankings across generations, though it still performs most strongly among Gen X.

- Salomon is spiking with Gen Z and Arc’teryx is spiking with millennials, while Sorel has lost a step, particularly among millennials, where it fell out of the Top 10.

Men’s Outdoor/Rugged Footwear

- Men’s Outdoor/Rugged footwear has greater competition at the top, with Timberland, Carhartt and Columbia trading the top spot overall and across generations.

- Work brands tend to dominate this category, with Ariat, Cat Footwear and Red Wing Shoes rounding out the top 10.

- Among hiking/trail brands, Salomon shows strength with Gen Z and millennials, while Merrell’s strength is with millennials and Gen X.

Go here to download the full L.E.K., Brand Heat Index report.

Image courtesy Skechers/Norman Powell; Data and tables courtesy L.E.K. Consulting

***

For additional SGB Media coverage of L.E.K.’s 2024 Footwear Brand Heat Index, click on the headline below.