Genesco Inc. executives reported on a Q1 conference call with analysts on Wednesday, June 4 that Journeys’ 8 percent comp jump in the quarter was largely driven by strength in athletics, supported by low profile and 2000s era running inspired trends. Company Board Chair, President and CEO Mimi Vaughan, said bigger athletic inventory investments, including the reintroduction of Saucony and introduction of Hoka, also played a large part in the strong performance.

Journeys’ strong performance helped Genesco top analysts’ target from an earnings and sales perspective in the quarter. The company kept its earnings guidance for the year due to the uncertainty largely tied to tariffs.

Vaughan said on the call that Journeys continues to benefit from changes brought on by a new management team led by former Foot Locker executives, including Andy Gray, who took over as Journeys’ president at the start of 2024; and Chris Santaella, who became Journeys’ chief merchandising officer in February 2024.

Under the new team, Journeys is undergoing a transformation program that calls for an increased emphasis on the stylish teen girl and a broadening of assortments across athletic, casual, and fashion footwear, including more premium product, that Vaughan’s estimates is “six to seven times larger than the market we’ve historically served.”

Journeys has historically been known for casual, vulcanized, and canvas footwear. The big winner among expanded assortments has been a broader range of athletic styles. This new reality at Journeys cannot be good news at Vans, which has seen sales shrink for the last two years, dragging down overall performance at parent VF Corp.

“A major growth driver is expansion of our premium athletic assortment,” said Vaughan on the call. “In Q1, athletic grew well into the double digits over last year and now represents more than a third of Journeys footwear sales. At the same time, we continue to strengthen and expect growth from casual.”

Vaughan said Journeys’ comp gain was driven by many existing brands, but also “impactful newer brands,” citing the introduction of Hoka and re-introduction of Saucony.

She said of the two brands, “They’re really impactful in terms of our customers’ reaction to the new offerings. They help validate Journeys in these categories that we haven’t had historical strength in. Lifestyle running is a really good example of a category that’s important to our teen consumer.”

On Journeys’ website, brands with the largest selections included Adidas, Birkenstock, Converse, Dr. Martens, HeyDude, New Balance, Puma, Uggs and Vans.

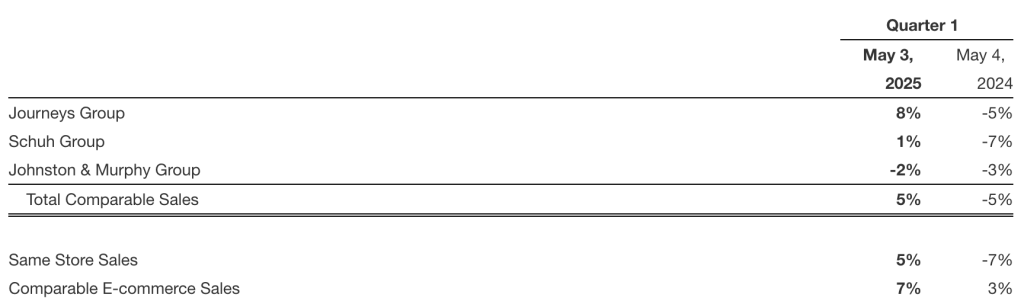

The 8 percent gain at Journeys in the first quarter followed double-digit comp increases seen in the back half of 2024.

“This comp strength was broad based, with seven brands across both athletic and casual posting double digit gains,” Vaughan said of Journeys’ comp performance in the first quarter. “Vulcanized or canvas footwear is still pressured, but with diversification and growth of these other brands and positive consumer reaction to trends like low profile and 2000s running inspired styles, these increases are driving healthy growth overall.”

Journeys’ comp strengthened through the months of the quarter. Gains in store conversion and transaction size more than offset softer traffic in the quarter that Vaughan attributed to a continued trend of shoppers pulling back from shopping “outside of peak periods” due to the uncertain economic climate.

Vaughan said of Journeys, “We expect the same brands and trends to drive Q2 growth and while not dependent on this to drive results, we are also excited about some new brands we have been introducing or reintroducing at Journeys as well.”

Journey’s Transformation Continues

Addressing other aspects of Journeys’ transformation effort, Vaughan said Journeys is bringing updated brand positioning to build awareness with the expanded group of teen customers.

Vaughan said, “You’ve already seen a change in our brand platform and imagery, with continuity across online and stores, and style vignettes online in the Journeys blog showcasing our fashion authority. We’re investing further in influencers, content and social, including TikTok and long form content.”

Journeys is also focused on “elevating the customer experience,” with the most promising initiative being its 4.0 store redesign that features an elevated setting and more premium product. The new store concept has driven more than a 25 percent sales lift versus pre-remodeled stores. Vaughan said, “Our focus is on making the most productive stores even more productive. These stores have meaningfully better traffic, higher conversion and higher average selling prices and have been attracting a larger share of new customers.”

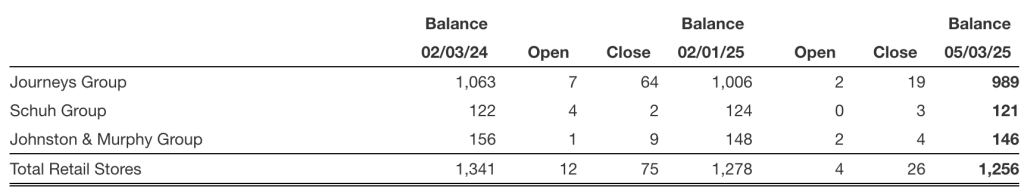

Journeys currently has 39 stores in the 4.0 format and expects to reach 75, or more than 10 percent of the chain’s portfolio, by year end. Vaughan said, “We think we can get close to 50 percent of our portfolio done over the next three or so years. The results there have been fantastic.”

Finally, Journeys is also moving to “double down on selecting and training” its in-store staff as part of the plan that Journeys’ team believes has contributed to improved store conversion.

Vaughan said, “We’re in early innings in this strategic transformation with several waves of planned growth to broaden and deepen Journeys’ consumer appeal.”

Genesco’s Q1 Results Top Analyst Targets

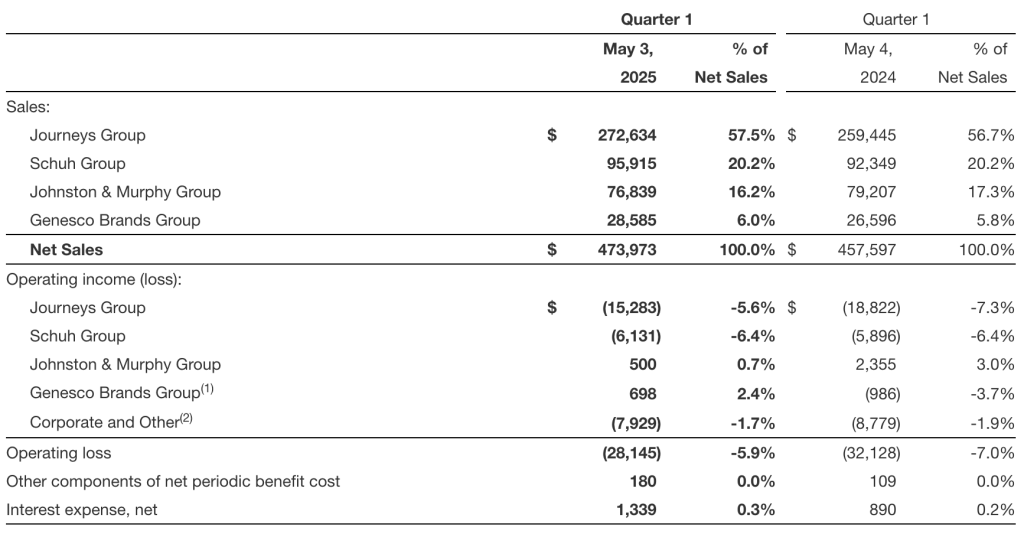

Companywide, Genesco’s sales of $474 million increased 4 percent compared to Q1 last year.

Sales topped analysts’ consensus target of $463.9 million.

The gains were driven by increases of 5 percent at Journeys, 4 percent at Schuh and 7 percent at Genesco Brands that offset by a decrease of 3 percent at Johnston & Murphy. On a constant currency basis, Schuh sales were up 1 percent for the first quarter this year.

Genesco Brands is the company’s wholesale segment that includes Levi’s shoes for men, Dockers, Starter, and Pony.

Comparable sales increased 5 percent, with stores up 5 percent and e-commerce climbing 7 percent. E-commerce sales represented 23 percent of retail sales

Among its other banners, Schuh Group delivered a 1 percent comp sales gain in the quarter. The UK-based shoe chain had returned to positive comp growth in the fourth quarter and is benefiting from investments in brand and product elevation and improved access to top brands and styles. Vaughan said, “Like the U.S., the UK consumer remains very selective, putting pressure on the footwear category and purchases in the quarter overall. Key brands and must-have styles drove conversion with the same brands as Journeys driving the business.”

Vaughan said with the support of Journeys’ merchant partnerships, Schuh has secured “significant further improved product access with Nike and New Balance with exciting new styles and iconic franchises arriving this quarter.”

Johnston & Murphy Group’s same-store sales declined 2 percent. The dressier chain is coming off two consecutive years of record sales attributed to a repositioning to a more casual and more comfortable lifestyle brand.

Segment Performance (in $ thousands)

Profitability & Expenses

Genesco’s GAAP operating loss for the first quarter was $28.1 million, down from an operating loss of $32.1 million a year ago. Excluding non-recurring items in both periods, the operating loss shrunk to $27.9 million from $30.0 million last year.

Beyond the top-line growth, the reduced operating loss on an adjusted basis reflects a reduction in selling and administrative expenses by 170 basis points to 52.5 percent, primarily reflecting decreased occupancy and performance-based compensation expenses as well as other cost savings initiatives.

Gross margins in the quarter on an adjusted basis eroded 90 basis points to 46.7 percent due primarily to changes in brand mix at Journeys and Schuh, promotional activity at Schuh and lower margins at Genesco Brands related to liquidation of product for sunsetting licenses.

The GAAP loss from continuing operations was $21.2 million, or $2.02 a share, compared to a loss of $24.3 million, or $2.23, in the first quarter last year. Excluding extraordinary items, the loss from continuing operations was $21.5 million, or a loss of $2.05 per share, compared to a loss of $22.9 million, or a loss of $2.10 per share, in the first quarter last year.

Wall Street was expecting, on average, a loss of $2.14 per share.

Tariff Update

Vaughan said that at current rates, the reciprocal tariffs in its branded business, including Johnston and Murphy and Genesco Brands Group, would result in unmitigated cost increases of roughly $15 million this fiscal year. Overall, for Genesco, including the retail business of Journeys and Schuh, a little over 10 percent of its products are subject to China tariffs, with branded representing about half.

Vaughan noted that retail is the largest portion of Genesco’s business at more than 80 percent of sales. She said Journeys’ top vendors employ diversified sourcing, but to date a limited number of partners have notified Journeys of immediate price increases in response to reciprocal tariffs.

“We do expect price increases over time, but know our brands are working to mitigate tariff cost pressure and ensure key franchises remain stable,” said Vaughan. “Brands with momentum as usual have more ability to take price, and we anticipate that our partners like us will remain flexible and respond accordingly to any changes in tariff rates versus current levels.”

Genesco is not planning to absorb gross margin reductions and Vaughan remarked that the “biggest unknown” is how consumers will respond to higher footwear prices and inflationary pressure in general. Vaughan said, “We will be in constant communication with our brand partners to relay and react to this dynamic. Our experience shows that customers continue to engage and shop with us when we offer the best brands and the highly coveted footwear they desire, positioning us well to manage through this impact.”

Outlook

Looking ahead, Genesco reiterated its earnings guidance for the year despite the outperformance in the first quarter due to greater uncertainty in the external consumer environment. Sales guidance was slightly lowered.

“The consumer environment remains choppy, and with recent first quarter events this choppiness has become more pronounced,” Vaughan shared. “Consumers show a willingness to shop when there’s a reason like we saw over Valentine’s Day and Easter and retreat when there’s not. And they remain quite selective.”

In the second quarter so far, Journeys and Johnston & Murphy comps have been tracking at a similar pace to Q1, while Schuh has had an offset in timing of a sale period versus last year.

Overall, the outlook for the current year continues to call for:

- Adjusted EPS in the range of $1.30 to $1.70 per share, including the impact of tariffs currently in place

- Total sales to be up 1 percent to 2 percent versus prior expectations of flat to up 1 percent, due to the impact of favorable foreign exchange, with comparable sales range narrowed to up 2 percent to 3 percent versus prior range of up 2 percent to 4 percent

Vaughan said, “We’re optimistic about our ability to drive our business forward, especially in the second half during back to school and holiday when there are more reasons to shop.”

Photo courtesy Journeys/Genesco, Inc.