Johnson Outdoors is expanding its expense-reduction efforts to counter a steep drop in profits in its fiscal third quarter, which was impacted by promotional pressures and sales declines across its business segments.

Helen Johnson-Leipold, chairman and CEO, told analysts that retailers remain “very conservative” in placing orders. “Continued tough marketplace conditions significantly impacted our results through the quarter,” said Johnson-Leipold on the quarterly call. “Consumer demand for outdoor recreation products remains depressed across all of our categories through the peak season. The down market and soft demand require us to significantly increase our investment in promotional activity as we continue to operate in this challenging environment.”

The CEO said the company believes the outdoor recreation marketplace “is resilient and attractive over the long term and that our brands will be well-positioned once conditions start to even out.” However, the company is evaluating all aspects of the business to improve its financial results and redeploying resources to enable future growth, improve profitability and strengthen business operations.

“We’ve been working hard to reduce inventory to more normal levels, although progress has been limited by the lower consumer demand,” said Johnson-Leipold. “We are expanding our cost savings actions and evaluating our cost structure for additional efficiency opportunities. While we have seen some progress from these efforts, we have a lot more work to do to boost our margins and improve our financial performance.”

When an analyst on the call asked about the health of inventory levels across the retail marketplace and replenishment opportunities, Johnson-Leipold said, “The retail inventory situation is getting better, but we still see our retailers being very conservative on the purchasing end of things and trying to maintain a pretty conservative level of inventory going forward.”

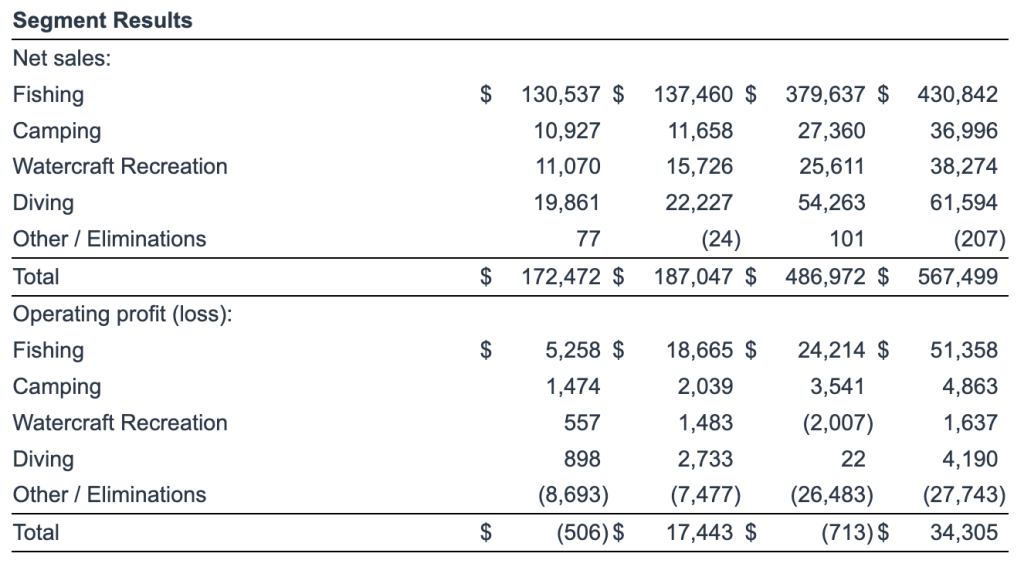

In the company’s fiscal third quarter ended June 28, net profits fell 89.2 percent to $1.6 million, or 16 cents a share, from $14.8 million, or $1.44, the prior year. Sales declined 7.8 percent to $172.5 million.

The company’s operating loss in the period came to $506,000 versus an operating profit of $17.4 million in the prior year’s third quarter.

Gross margin eroded 570 basis points to 35.8 percent, primarily reflecting sales deleverage and changes in the company’s product mix toward lower-margin products.

Operating expenses increased 3.6 percent to $62.3 million due to increased advertising and promotional spending. As a percent of sales, operating expenses grew to 36.1 percent from 32.1 percent.

Inventories ended the quarter at $223 million, down about $12 million from last year’s quarter and $26 million from its March 2024 quarter. Dave Johnson, VP and CFO, said, “We expect some inventory reductions in the balance of the fiscal year.”

Segment Highlights

Fishing segment (Minn Kota Cannon, Humminbird) sales slid 5.0 percent in the quarter to $130.5 million, while operating profits in the segment tumbled 71.8 percent to $5.3 million.

Camping segment (Jetboil, Eureka!), sales were down 6.3 percent to $10.9 million while operating profits declined 27.7 percent to $1.47 million.

Watercraft Recreation segment (Old Town, Carlisle) fell 29.6 percent to $11.1 million; operating income slumped 62.4 percent to $557,000.

Diving segment (ScubaPro), sales declined 10.6 percent to $19.9 million while operating earnings were down 67.1 percent to $898,000.

Johnson-Leipold did not provide further details on the analyst call on each segment’s sales trends. Looking ahead, she stated that beyond reducing costs and increasing efficiencies, enhancing its digital and e-commerce capability remained a “key priority.” She said, “Our online presence provides key consumer touch points for our brand, from product research to purchase and post-purchase support.”

“Profits remain impacted by lower sales volumes and our ongoing investment in promotional activity. Additionally, while we’ve been improving our inventory levels, progress has been slowed by the decreased demand,” said David W. Johnson, VP and CFO of Johnson Outdoors, Inc. “As we execute against both short-term and long-term cost savings opportunities for the Company, we remain confident in our ability and plans to create long-term value and consistently pay dividends to shareholders.”

Year-to-Date Highlights

- Fiscal 2024 year-to-date (YTD) net sales were $487.0 million, a 14 percent decrease year-over-year;

- Gross margin decreased 20 basis points to 36.2 percent in the YTD period;

- YTD operating expenses were $176.8 million, a decrease of $4.6 million year-over-year;

- The 2024 YTD operating loss was $0.7 million compared to a profit of $34.3 million in the 2023 YTD period;

- YTD Other income decreased by $3.5 million year-over-year due primarily to the sale of the company’s Military and Commercial Tents business;

- Profit before income taxes for the YTD period was $9.8 million versus $47.9 million in the prior YTD period; and

- Net income was $7.7 million, or 75 cents per diluted share, versus $35.5 million, or $3.47 per diluted share, in the prior YTD period.

Balance Sheet and Cash Management

- Cash and short-term investments were $148.4 million as of June 28, 2024.

- Depreciation and amortization were $14.8 million in the YTD period, compared to $11.8 million in the 2023 YTD period.

- Capital spending totaled $16.4 million in the YTD period, compared with $19.4 million in the prior YTD period.

The company is also continuing its investments, driving innovation to stimulate demand. Johnson-Leipold said innovation “has always been key to our success and continues to be imperative to winning in an outdoor recreation marketplace that has been changing at a rapid pace.”

The company has a pipeline of new product introductions planned across its brands.

“The whole area of innovation is going to keep being a focus, and it’s our lever to differentiate ourselves,” the CEO said. “I think the market has changed, and that’s a positive. I think the consumer has some different needs and different motivations, which opens up the door for innovation. So, all I can say is that’s been our key to leadership in the past, and it’s going to be our key going forward. And we feel good about the long term and feel good about our ability to understand the consumer and to be there with the right new products.”

Image courtesy Johnson Outdoors