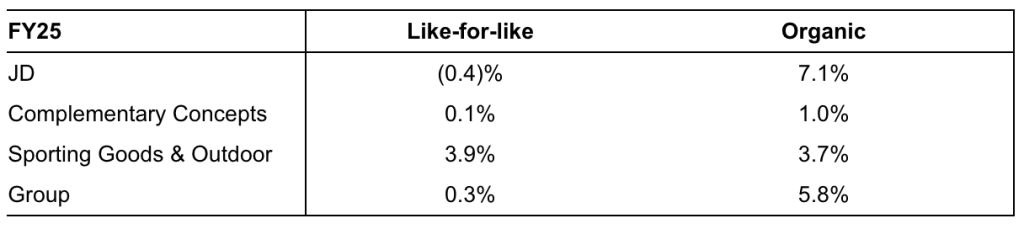

JD Sports Fashion Plc (Group), the global parent of the JD, Hibbett, Finish Line, DTLR and Shoe Palace retail brands in the U.S., reported 5.8 percent organic revenue growth for the 2025 fiscal year ended February 1.

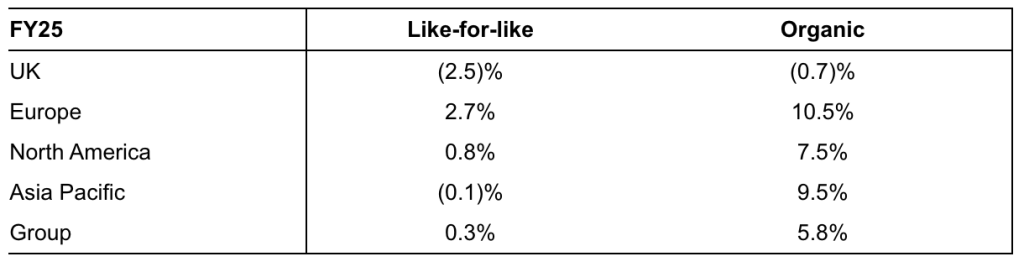

Full year like-for-like (LFL) revenue growth was 0.3 percent year-over-year, which was said to be in-line with the Group’s previous guidance of “broadly flat,” and organic growth of 5.8 percent, which was said to be “slightly ahead of previous guidance” and driven by strong growth from North America, Europe and Asia Pacific.

“Our recent acquisitions, Hibbett and Courir, traded in-line with our expectations in the period,” the company said in a media release.

Gross margin for the year was 47.8 percent of sales, 20 basis points below the prior year due to the impact from the acquisitions.

“As a result of the company’s performance for the year, JD expects Profit before tax and adjusting items for the 52 weeks to be in-line with its January guidance range of £915 million to £935 million.

The company ended the year with net cash before lease liabilities on the balance sheet.

The total number of stores at the year end was 4,850, up 1,533 from the start of the year, including 1,485 stores acquired through Hibbett and Courir.

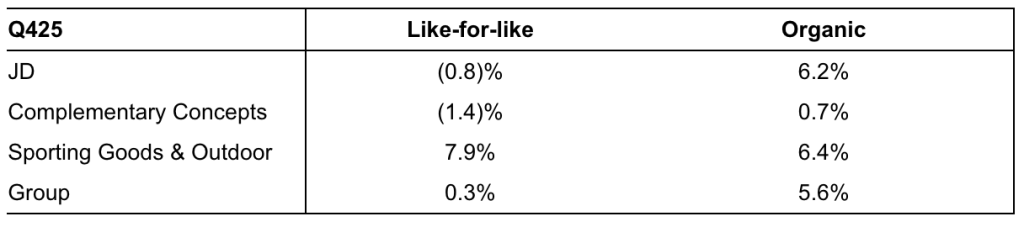

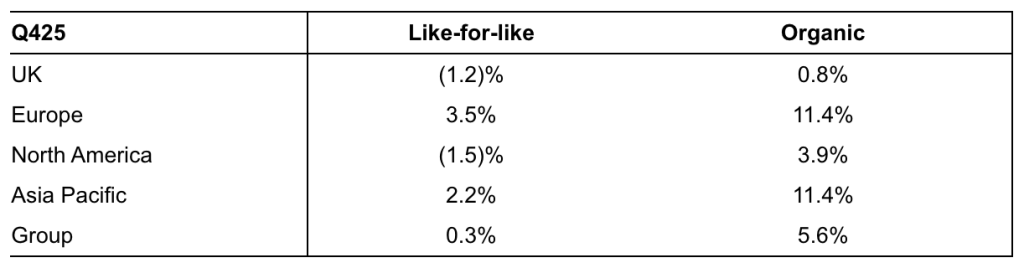

Fourth Quarter Summary

Fourth quarter LFL revenue growth was 0.3 percent year-over-year, with organic revenue growth of 5.6 percent, driven by a strong performance in Europe.

Fiscal 2026 Guidance

Looking at the 2026 first quarter, the retailer said revenues through the end of March have been in line with expectations for the fiscal 2026 period.

“While we currently expect Profit before tax and adjusting items to be in line with consensus expectations, our FY26 guidance excludes any potential impact from changes to tariffs,” the company said in a media release.

The company said it expects the trading environment in its key markets to be volatile throughout the year and they have started the year in line with expectations.

“We note the proposed changes to tariffs announced last week,” the company said. “At this stage, the outcome of these developments is uncertain. We are in regular dialogue with our brand partners but it is too early to comment on the potential sector impact.”

Total revenue in FY26 is expected to grow due to the impact of the acquisitions the company made during fiscal 2025, which will add ~10 percent in fiscal 2026, and through the contribution from new space of ~4 percent. JD anticipates ~150 new stores and ~100 conversions/relocations in the year. There will also be ~50 closures, mainly in Eastern Europe.

“We anticipate LFL revenues will be below FY25,” the company said.

The company noted that it will have additional operating expenses in the year, outside of normal inflationary increases, including UK labour costs and a higher proportion of IT investment falling into operating expenditure as opposed to capital expenditure. Offsetting these increases partially will be cost savings and scale efficiencies across key markets, and integration synergies in North America following the Hibbett acquisition.

“Accordingly, while we expect FY26 Profit before tax and adjusting items to be in line with current consensus expectations, our FY26 guidance excludes any potential impact from changes to tariffs,” the company said.

Capital expenditure are expected to be ~£500 million in fiscal 2026. JD said it anticipates net cash before lease liabilities on our balance sheet at the year end, including the intended £100 million share buyback program.

The company noted that the current consensus Profit before tax and adjusting items is £920 million with a range of £878 million to £982 million.

Assuming FX rates of USD:GBP 1.31, EUR:GBP 1.17. A one U.S. cent move impacts Profit before tax and adjusting items by £3 million and a one Euro cent move impacts Profit before tax and adjusting items by £2 million.

Image courtesy DTLR / JD Sports Fashion Plc