JD Sports Fashion Plc (Group), the parent of the JD, Hibbett, Finish Line, DTLR, and Shoe Palace retail brands in the U.S. and JD and others worldwide, reported an update on sales performance for the 13-week period ended November 2, noting that the retailer had a strong back-to-school period but saw much softer consumer demand and trading toward the end of the 13-week period. The measured period roughly mirrors the retail fiscal Q3 period in the U.S.

CEO Régis Schultz of JD Sports Fashion, Plc, said the softer trend line reflected elevated promotional activity, unseasonable weather and a cautious consumer, with evidence supporting suppressed demand in the U.S. ahead of the election.

“After a good start to the period, helped by strong back-to-school sales, we saw increased trading volatility in October, particularly in North America and the UK, reflecting elevated promotional activity and mild weather.”

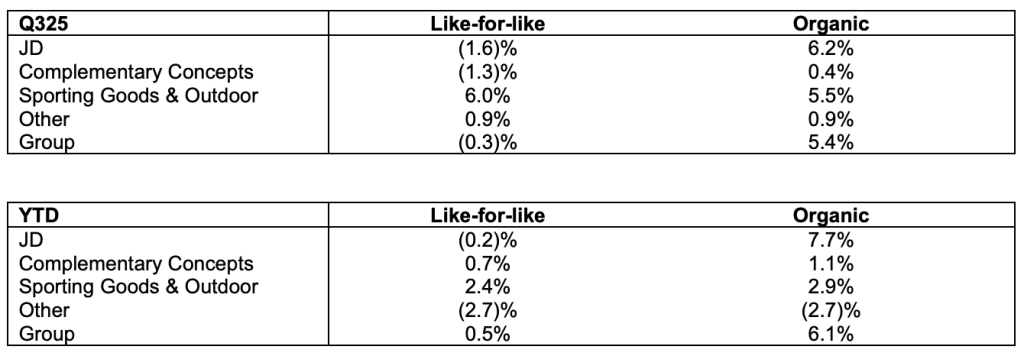

Schultz said the company delivered 5.4 percent organic sales growth for the period, driven by a successful store rollout program. Year-to-date organic sales growth through November 3 was 6.1 percent.

The more volatile environment was said to be reflected in like-for-like (LFL), or comp, sales for the period, which was down 0.3 percent with a good August and September offset by a softer October.

Segment Summary

All segments reportedly achieved organic sales growth during the period, driven by new space growth in JD and Complementary Concepts and by LFL sales growth in Sporting Goods & Outdoor.

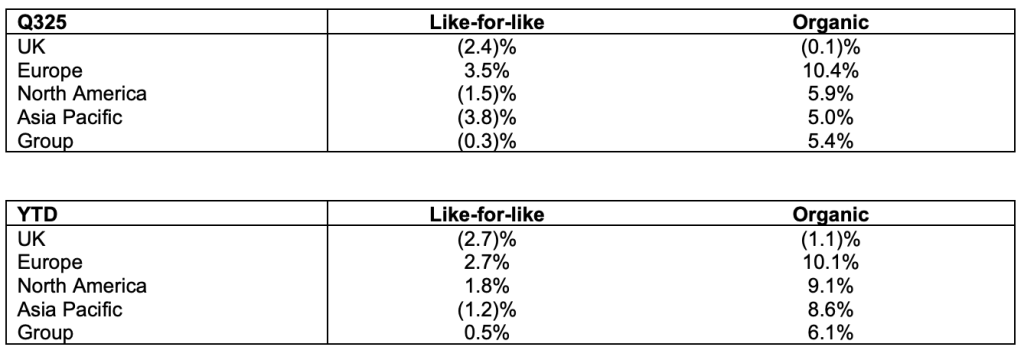

Region Summary

Regionally, Europe performed well, delivering both LFL sales growth and organic sales growth, with softer sales performance seen elsewhere in the period.

At the end of the period, year-to-date LFL sales growth was 0.5 percent. On a LFL basis, stores reportedly continued to outperform online and footwear continued to outperform apparel in the period.

“Against this backdrop, we maintained our operating discipline to deliver on our long-term commercial strategy rather than a short-term sales focus,” Schultz noted. “As a result, gross margin for the Group in the period increased 0.3 percentage points to 48.1 percent [of sales] with the year-to-date gross margin for the Group now at 48.2 percent [of sales], in line with the corresponding period.”

He said the company has performed well in the key trading events this year and they are well positioned for the upcoming peak holiday season.

“The trading environment remains volatile though and, following October trading, we now anticipate full year profit to be at the lower end of our guidance ranges,” Schultz offered.

In the 13-week period, the Group opened 79 new JD stores, taking the total number of openings by the end of Q3 to 181. The total number of stores at the period end was 4,541, up 1,224 from the start of the year, including 1,179 stores acquired with Hibbett.

“We have also made good progress on the process to complete the acquisition of Courir,” Schultz noted. “Following the satisfaction of all regulatory conditions, we now anticipate this transaction will complete shortly, adding a strong and growing, female-orientated fascia to complement our global portfolio.”

Due to what the company calls a volatile trading environment, and following October trading, JD now expects Profit before tax and adjusting items (PBT) to be at the lower end of its original guidance range of £955 million to £1,035 million. Within this full year guidance, the company still expects Hibbett to contribute around £25 million to PBT and, at current exchange rates, for currency to reduce PBT by £15 million, compared to the rates used in setting the original guidance.

The £955 million to £1,035 million guidance range was based on £1.25 for the U.S. Dollar and £1.15 against the euro. Average rates to the end of Q3 were £1.29 for the U.S. Dollar and £1.19 for the euro. Current rates used for Q4 are £1.26 for the U.S. dollar and £1.20 for the euro.

Image courtesy JD Sports